- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LBIRD

The Returns At Lumibird (EPA:LBIRD) Provide Us With Signs Of What's To Come

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Having said that, from a first glance at Lumibird (EPA:LBIRD) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Lumibird is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.05 = €12m ÷ (€296m - €47m) (Based on the trailing twelve months to June 2020).

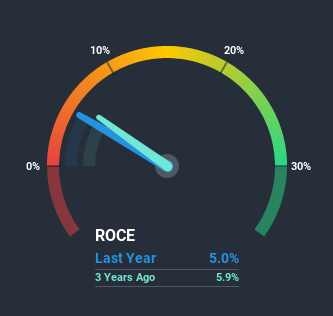

So, Lumibird has an ROCE of 5.0%. On its own that's a low return on capital but it's in line with the industry's average returns of 4.9%.

See our latest analysis for Lumibird

In the above chart we have measured Lumibird's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Lumibird here for free.

What Does the ROCE Trend For Lumibird Tell Us?

In terms of Lumibird's historical ROCE trend, it doesn't exactly demand attention. The company has employed 359% more capital in the last three years, and the returns on that capital have remained stable at 5.0%. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

Our Take On Lumibird's ROCE

As we've seen above, Lumibird's returns on capital haven't increased but it is reinvesting in the business. Although the market must be expecting these trends to improve because the stock has gained 70% over the last year. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

If you'd like to know about the risks facing Lumibird, we've discovered 5 warning signs that you should be aware of.

While Lumibird isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Lumibird, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:LBIRD

Lumibird

Designs, manufactures, and sells various lasers for scientific, industrial, and medical applications.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026