Capgemini (ENXTPA:CAP) Deepens EU Cyber Mandate: What Does This Signal About Its Security Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Capgemini announced it had been selected by the European Commission’s Directorate‑General for Digital Services, alongside Airbus Protect, PwC and NVISO, to deliver multi‑million Euro cybersecurity services over four years to 71 EU institutions, bodies and agencies under the MC17 FREIA Cyber Framework Contract.

- This wide‑ranging mandate deepens Capgemini’s role in supporting EU cyber resilience and digital sovereignty, spanning incident response, governance, risk management, and specialized training aligned with NIS2, DORA, the EU Cybersecurity Act and the Cyber Resilience Act.

- We’ll now explore how this major EU cyber mandate might influence Capgemini’s investment narrative, particularly its positioning in high‑value security services.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Capgemini Investment Narrative Recap

To own Capgemini, you need to believe it can return to steady growth while protecting margins in a price‑competitive IT and consulting market. The new EU-wide cybersecurity mandate looks supportive for near term sentiment, but on its own does not fundamentally change the key catalyst, which is an eventual inflection in European demand, nor does it remove the central risk around pricing pressure and consolidation in large technology deals.

Among recent announcements, Capgemini’s expanded Sovereign Technology Partnership with SAP feels most connected to this EU cybersecurity win, as both underscore the group’s push into higher value work around digital sovereignty and regulated workloads. For investors, these moves speak directly to the core catalyst: shifting the mix toward complex, regulation‑driven engagements that can better defend pricing, even if broader macro and sector headwinds still weigh on growth and margins.

Yet against these promising contracts, investors should still be aware of the risk that intense pricing competition in large technology deals could...

Read the full narrative on Capgemini (it's free!)

Capgemini's narrative projects €24.5 billion revenue and €2.0 billion earnings by 2028. This requires 3.6% yearly revenue growth and about a €0.4 billion earnings increase from €1.6 billion today.

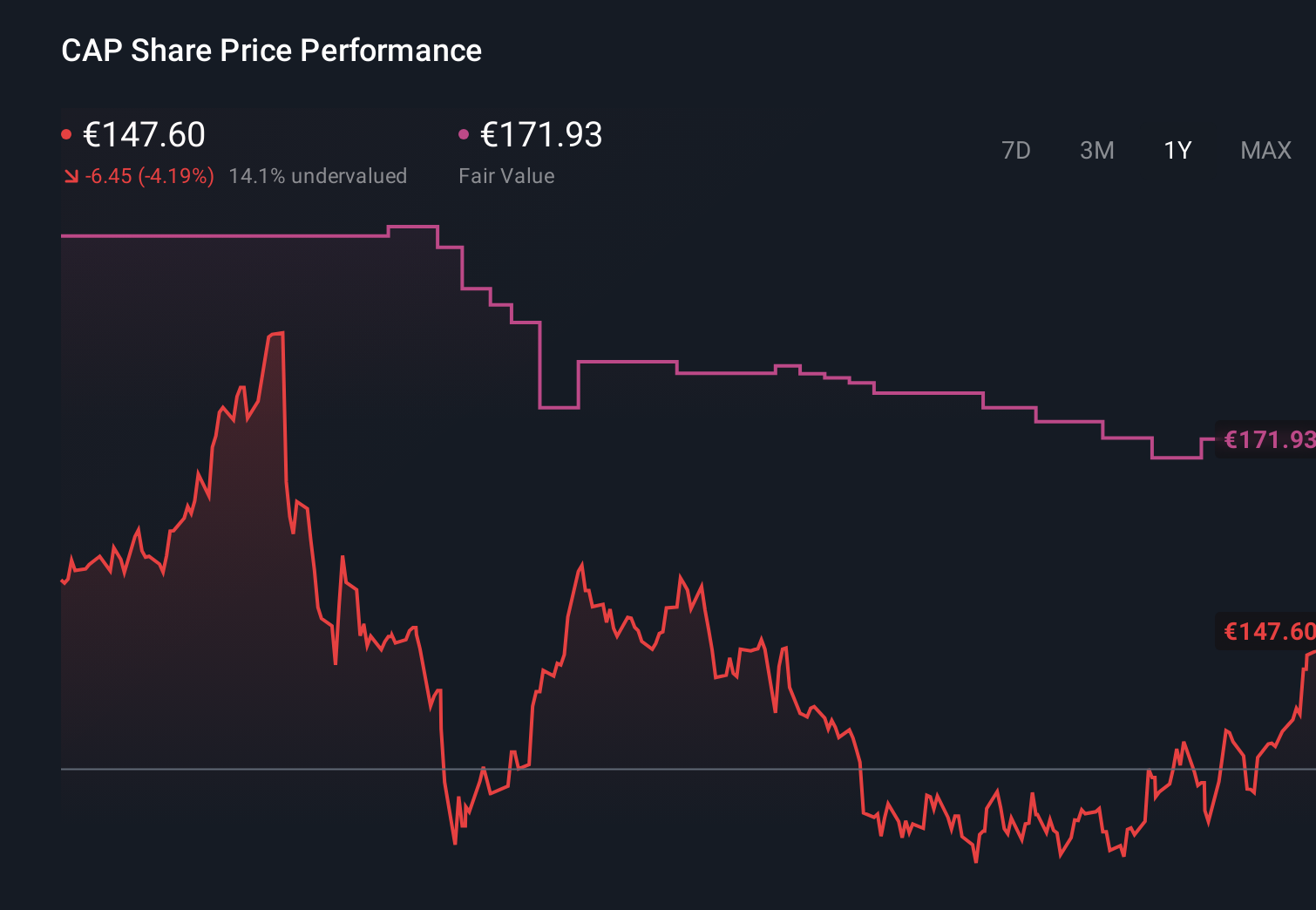

Uncover how Capgemini's forecasts yield a €171.93 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly €150 to €209 per share, showing just how far opinions can stretch. When you set that against concerns about ongoing pricing pressure and consolidation in big tech contracts, it underlines why many investors may want to compare several viewpoints before deciding how Capgemini fits into their portfolio.

Explore 8 other fair value estimates on Capgemini - why the stock might be worth just €150.00!

Build Your Own Capgemini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capgemini research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capgemini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capgemini's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026