Valneva (ENXTPA:VLA): Rethinking Valuation After Fresh Results and Pipeline Progress

Reviewed by Kshitija Bhandaru

See our latest analysis for Valneva.

Valneva’s share price has shown some renewed energy lately, posting a modest gain over the past month as the company’s story continues to evolve alongside recent sector news. While short-term price momentum appears to be building, the long-term picture is more muted. The one-year total shareholder return is just under 1%, and losses have extended over a three- and five-year horizon for investors who have stayed the course.

If you’re interested in discovering more companies with breakout growth stories and strong insider backing, broaden your search with our fast growing stocks with high insider ownership.

With shares still trading at a notable discount to analyst targets, and impressive revenue and net income growth in recent results, the question now is whether Valneva represents a rare undervalued biotech opportunity or if future prospects are already fully priced in.

Most Popular Narrative: 23.6% Undervalued

The most widely followed valuation narrative sees significant upside for Valneva, with its fair value estimate coming in noticeably above the last closing price. The difference highlights bullish analyst sentiment and sets the stage for debate over whether Valneva's pipeline can deliver on these high expectations.

The robust pipeline beyond Lyme, with advancing Shigella and Zika programs targeting high-burden unmet needs and supported by non-dilutive funding (such as the CEPI grant), positions Valneva to leverage secular trends in preventative healthcare and global vaccine innovation. This drives longer-term revenue diversification and presents multiple future catalysts.

Curious why analysts are projecting a transformation in Valneva’s financial trajectory? Their forecast includes ambitious shifts in future earnings and margins, which hints at big surprises beneath the surface. Find out which key assumptions could be driving this high conviction valuation in the full narrative.

Result: Fair Value of $6.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in the Lyme vaccine’s approval process or ongoing safety concerns for IXCHIQ could quickly challenge even the most optimistic outlooks.

Find out about the key risks to this Valneva narrative.

Another View: A Different Take Using Our DCF Model

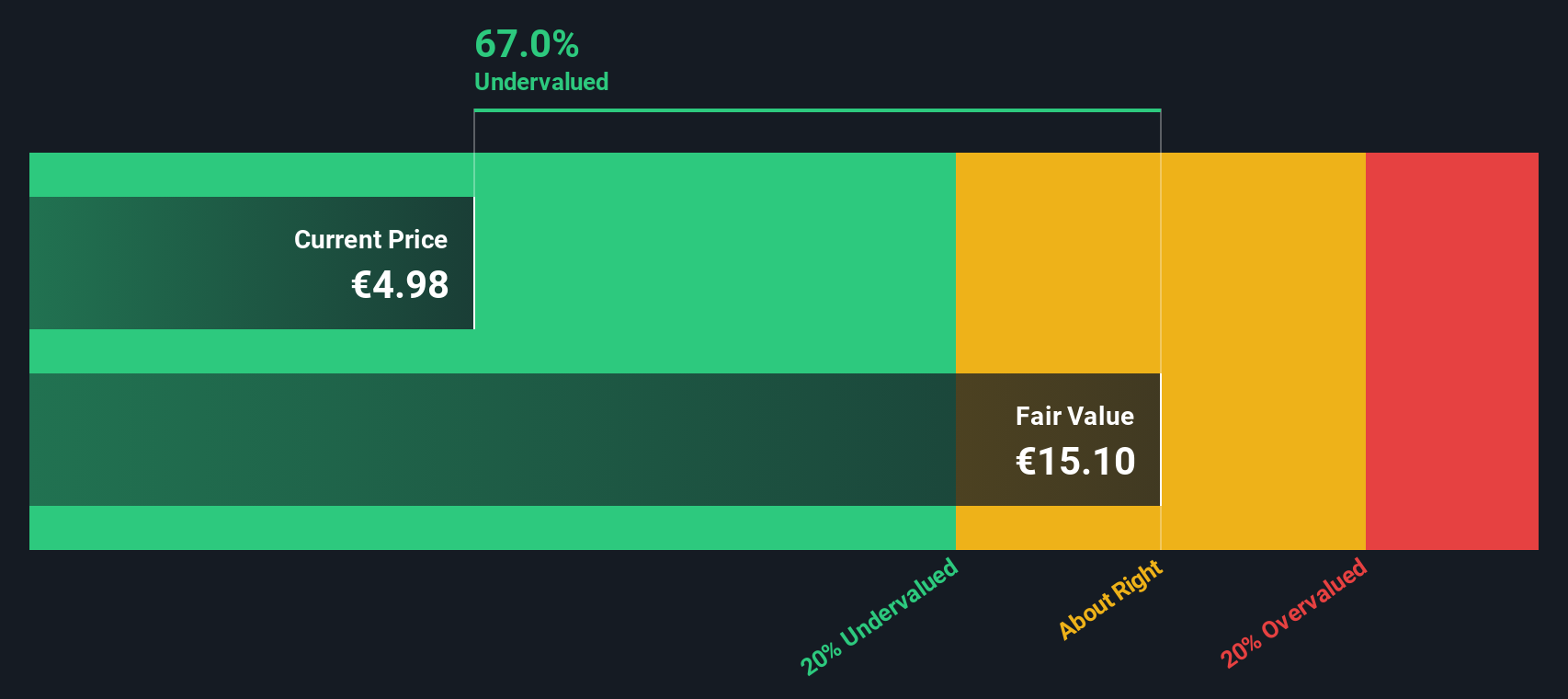

While analyst price targets suggest Valneva is undervalued based on market multiples, our SWS DCF model paints an even more optimistic picture. It calculates a fair value of €15.10 per share, which is much higher than the current price. This sharp difference raises an important question: is the market underestimating Valneva’s long-term earnings power, or are these growth projections too aggressive?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valneva Narrative

If your perspective differs from the dominant narratives or you want to shape your own opinion, you can quickly dig into the data and create a personalized analysis in just a few minutes. Do it your way.

A great starting point for your Valneva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t watch opportunity pass you by. Set yourself up for smarter investment decisions by tapping into fresh stock ideas and strategies that go beyond the obvious picks.

- Unlock cash-flow bargains by reviewing these 904 undervalued stocks based on cash flows, where strong fundamentals meet attractive prices for savvy investors.

- Find income standouts with these 19 dividend stocks with yields > 3%, offering stocks that deliver consistent yields above 3% to power your portfolio’s growth.

- Spot the next wave of disruptive innovation with these 26 quantum computing stocks, featuring companies at the frontier of quantum computing and tomorrow’s technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VLA

Valneva

A specialty vaccine company, develops, manufactures, and commercializes prophylactic vaccines for infectious diseases with unmet needs.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)