- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

3 Stocks Estimated To Be Priced Below Intrinsic Value In February 2025

Reviewed by Simply Wall St

Amidst geopolitical tensions and concerns over consumer spending, global markets have experienced a volatile week, with major U.S. indexes finishing lower despite early gains. As investors navigate these uncertain times, identifying stocks that are potentially undervalued can offer opportunities to capitalize on market inefficiencies and align with long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.26 | CN¥52.18 | 49.7% |

| Hibino (TSE:2469) | ¥2795.00 | ¥5546.91 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK270.00 | SEK535.44 | 49.6% |

| Nuvoton Technology (TWSE:4919) | NT$95.80 | NT$191.46 | 50% |

| América Móvil. de (BMV:AMX B) | MX$14.89 | MX$29.71 | 49.9% |

| Neosem (KOSDAQ:A253590) | ₩12050.00 | ₩23935.35 | 49.7% |

| CD Projekt (WSE:CDR) | PLN221.70 | PLN441.47 | 49.8% |

| Siam Wellness Group (SET:SPA) | THB5.35 | THB10.69 | 49.9% |

| Sandfire Resources (ASX:SFR) | A$10.53 | A$20.98 | 49.8% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.77 | 49.9% |

Here's a peek at a few of the choices from the screener.

Thales (ENXTPA:HO)

Overview: Thales S.A. is a global company offering solutions in defence and security, aerospace and space, digital identity and security, and transport markets, with a market cap of €38.14 billion.

Operations: The company's revenue is derived from segments including Aerospace (€5.49 billion), Digital Identity & Security (€3.69 billion), and Defence & Security excluding Digital I&S (€10.56 billion).

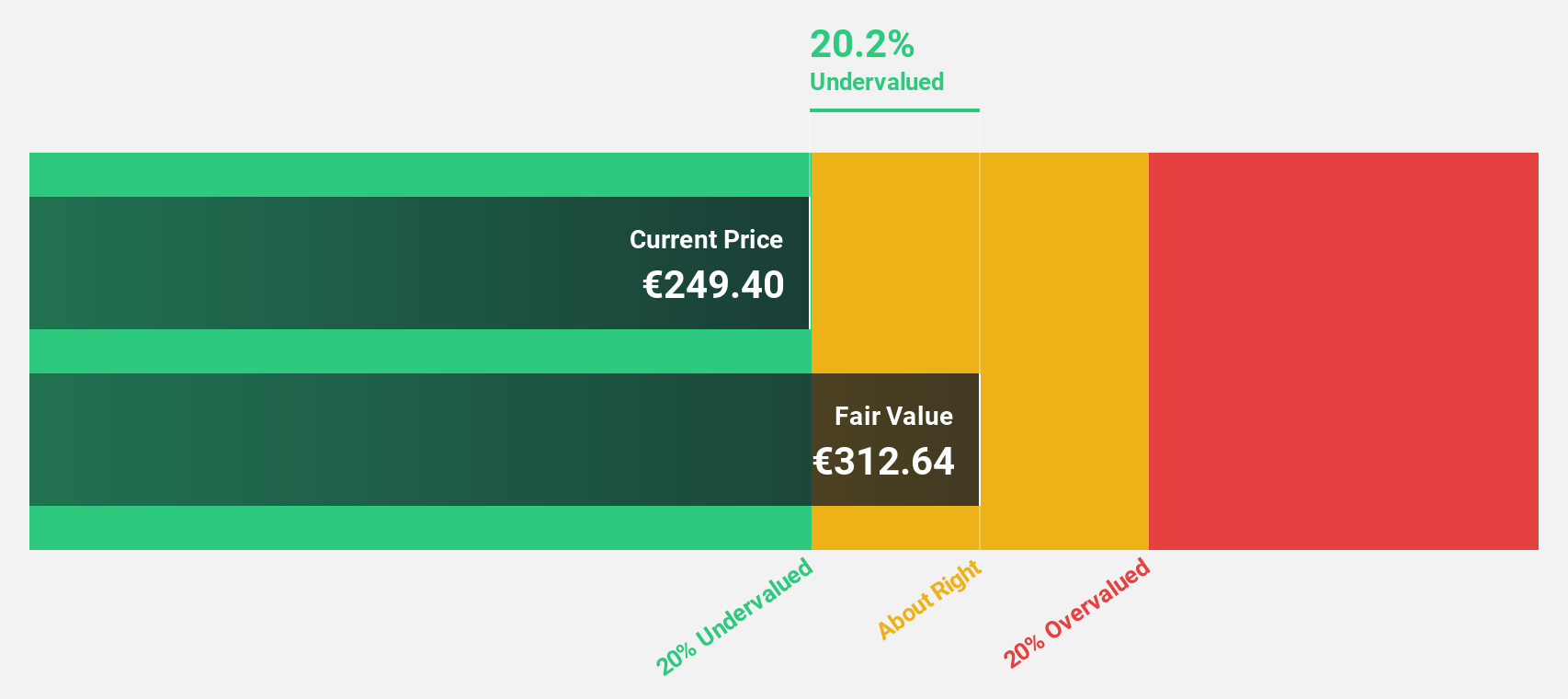

Estimated Discount To Fair Value: 24.8%

Thales is trading at €185.7, significantly below its estimated fair value of €246.96, indicating potential undervaluation based on discounted cash flow analysis. Despite a high debt level, its earnings are projected to grow at 16.5% annually, outpacing the French market's 12.7%. Recent product launches and strategic collaborations in cybersecurity and AI enhance Thales's growth prospects while maintaining a strong position in innovative technology solutions for large organizations and governmental bodies.

- Insights from our recent growth report point to a promising forecast for Thales' business outlook.

- Unlock comprehensive insights into our analysis of Thales stock in this financial health report.

Tikehau Capital (ENXTPA:TKO)

Overview: Tikehau Capital is an alternative asset management group with €46.1 billion in assets under management and a market capitalization of approximately €3.75 billion.

Operations: Tikehau Capital generates revenue through its alternative asset management operations, managing €46.1 billion in assets with a market capitalization of approximately €3.75 billion.

Estimated Discount To Fair Value: 32.9%

Tikehau Capital, trading at €21.8, is significantly below its estimated fair value of €32.48, suggesting it may be undervalued based on discounted cash flow analysis. Despite a dividend yield of 3.67% that isn't well covered by free cash flows and low forecasted return on equity (10.1%), the company anticipates robust revenue growth (20.4% annually) and substantial earnings growth (30.6% annually), surpassing the French market's average expectations.

- Our expertly prepared growth report on Tikehau Capital implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Tikehau Capital.

Spin Master (TSX:TOY)

Overview: Spin Master Corp. is a children's entertainment company involved in creating, designing, manufacturing, licensing, and marketing toys, entertainment products, and digital games globally with a market cap of CA$3.19 billion.

Operations: The company's revenue is derived from three main segments: Toys ($1.79 billion), Digital Games ($159 million), and Entertainment ($172.50 million).

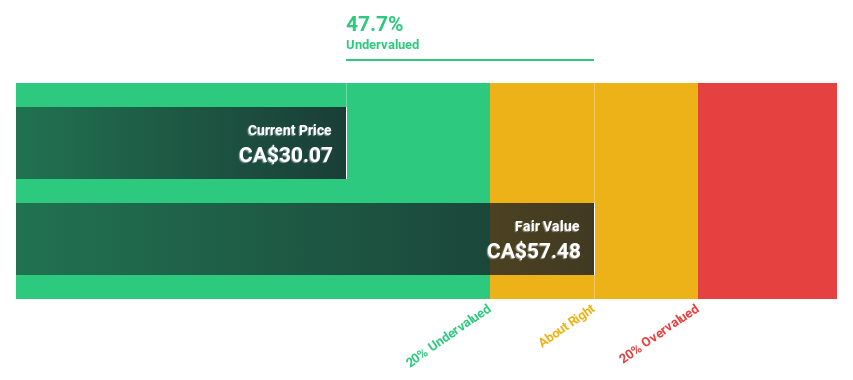

Estimated Discount To Fair Value: 47.5%

Spin Master, trading at CA$31.29, is considerably below its estimated fair value of CA$59.56 according to discounted cash flow analysis. Analysts expect earnings to grow significantly at 22.8% annually, outpacing the Canadian market's average growth rate of 16.5%. However, recent financial results have been impacted by large one-off items and profit margins have declined from 9% to 1.5%, indicating potential volatility in earnings quality.

- Our comprehensive growth report raises the possibility that Spin Master is poised for substantial financial growth.

- Click here to discover the nuances of Spin Master with our detailed financial health report.

Seize The Opportunity

- Click here to access our complete index of 916 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives