Santander's Interim Dividend Plan: What Does It Reveal About Capital Allocation at BME:SAN?

Reviewed by Sasha Jovanovic

- Banco Santander announced that its board approved an interim cash dividend of €0.115 per share, representing about 25% of the Group's underlying profit in the first half of 2025, with the payment set for 3 November 2025 and key trading dates specified for eligible shareholders.

- This move reflects Santander's ongoing commitment to its policy of returning approximately half of its underlying earnings to shareholders through dividends and share buybacks.

- To understand how the newly announced interim dividend payment shapes the outlook, we'll consider its effects on Santander's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Banco Santander Investment Narrative Recap

For long-term shareholders in Banco Santander, the investment story centers on steady operational progress across diversified markets and the realization of benefits from Santander’s digital and cost transformation efforts. The recent interim dividend announcement aligns with management’s established capital return policy and does not appear to materially alter the company’s biggest near-term catalyst, successful execution of digital platform integration and cost savings under the ONE Transformation program. The primary risk remains persistent challenges with loan quality in key emerging markets, which could place pressure on margins and net income if not contained.

Among other recent developments, Santander’s ongoing share buyback program stands out as especially relevant to the dividend decision, since both initiatives are core to the company’s stated aim of returning about half of underlying profits to shareholders. While buybacks can enhance returns, their impact hinges on the bank’s ability to sustain earnings and capitalize on cost efficiencies that underpin future capital distributions.

In contrast, investors should also keep an eye on the elevated loan loss provisions in Brazil and how they might affect...

Read the full narrative on Banco Santander (it's free!)

Banco Santander's narrative projects €63.8 billion revenue and €13.2 billion earnings by 2028. This requires 8.4% yearly revenue growth and a €0.6 billion earnings increase from €12.6 billion.

Uncover how Banco Santander's forecasts yield a €8.65 fair value, in line with its current price.

Exploring Other Perspectives

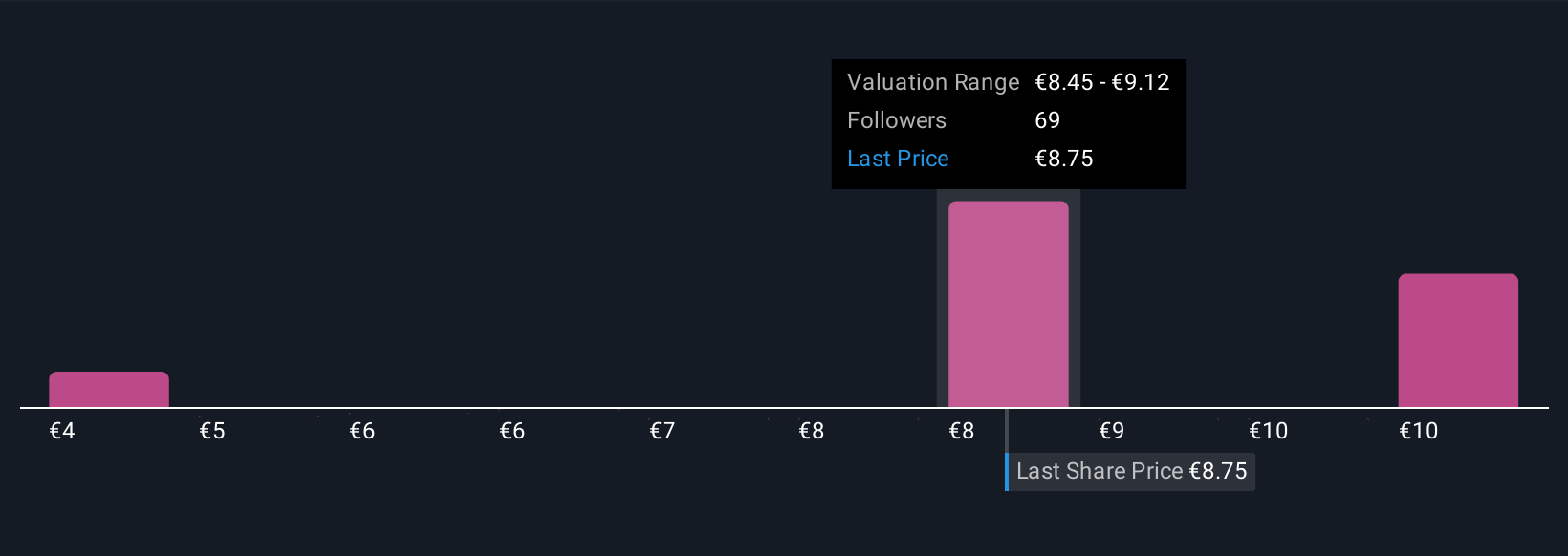

Eleven fair value estimates from the Simply Wall St Community span €4.43 to €11.17 per share, reflecting sharply differing views ahead of recent dividend news. With loan quality challenges in markets like Brazil still front of mind, this is a good time to compare these varied outlooks for Santander’s future performance.

Explore 11 other fair value estimates on Banco Santander - why the stock might be worth 49% less than the current price!

Build Your Own Banco Santander Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Banco Santander research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Santander's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives