Last Update04 Sep 25

Banco Santander’s consensus price target was maintained at €8.00, as a marginally higher future P/E multiple offset steady revenue growth projections.

What's in the News

- Banco Santander is one of two main contenders to acquire Banco de Sabadell’s UK unit, TSB, alongside Barclays, with both banks in the final bidding stages.

- The potential TSB sale by Sabadell is seen as a defensive move amid BBVA's hostile takeover attempt, although Sabadell's CEO denies it's a "poison pill" tactic.

- Analyst/Investor Day and board meetings have been scheduled to discuss interim financials for H1 2025, 2024 consolidated annual accounts, and consideration of a complementary dividend.

Valuation Changes

Summary of Valuation Changes for Banco Santander

- The Consensus Analyst Price Target remained effectively unchanged, at €8.00.

- The Future P/E for Banco Santander has risen slightly from 12.01x to 12.27x.

- The Consensus Revenue Growth forecasts for Banco Santander remained effectively unchanged, at 8.4% per annum.

Key Takeaways

- Expansion in digital banking, operational efficiency, and focus on high-growth markets strengthen Santander's earnings stability and long-term revenue prospects.

- Diversified multinational presence and technology transformation drive fee growth, cost reduction, and improved profitability amid changing global financial trends.

- Ongoing economic, regulatory, and technological pressures across core and emerging markets could constrain loan quality, profitability, and sustainable revenue growth.

Catalysts

About Banco Santander- Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

- The expanding global middle class and increasing urbanization, particularly in Latin America, are expected to drive demand for retail and consumer banking services, directly supporting new customer acquisition and deposit growth, which should fuel higher revenues and fee income over the long term.

- Accelerated deployment of digital banking platforms (e.g., Openbank expansion, PagoNxt payments, AI-driven CRM), alongside cloud migration and automation, positions Santander to benefit from global digitization trends, lowering operating costs and improving net margins as digital usage and process efficiencies scale further.

- Greater global mobility and capital flows between Europe and Latin America will help Santander leverage its diversified, multinational business model, thereby enabling more stable earnings and a lower earnings volatility profile-especially as cross-border trade and client flows increase, supporting both revenue and fee growth.

- Ongoing transformation and cost reduction programs (ONE Transformation) are delivering structural operational leverage, with significant potential remaining as legacy systems are phased out; this supports a sustainable improvement in cost/income ratio and operating profits even in more muted economic environments.

- Strategic focus on high-growth markets (especially Brazil, Mexico, and the U.S.) and business lines such as payments and wealth management enhances top-line growth outlook and non-interest income, underpinning future earnings expansion as higher-yielding, fee-driven products gain increased penetration.

Banco Santander Future Earnings and Revenue Growth

Assumptions

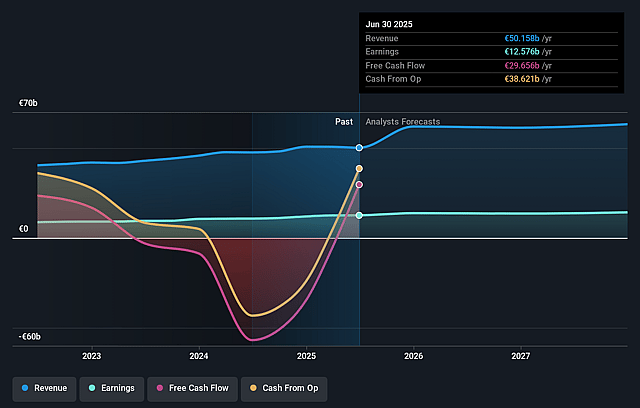

How have these above catalysts been quantified?- Analysts are assuming Banco Santander's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.1% today to 20.7% in 3 years time.

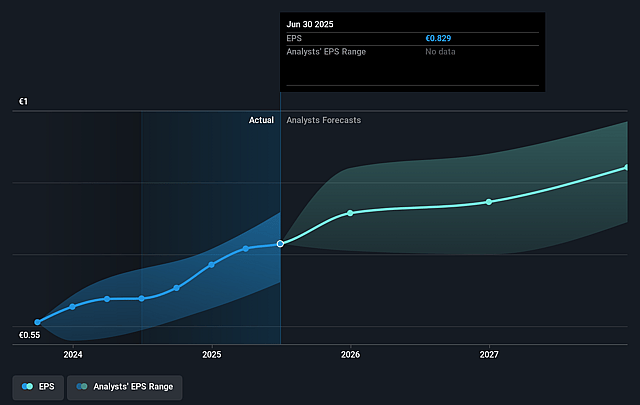

- Analysts expect earnings to reach €13.2 billion (and earnings per share of €0.99) by about September 2028, up from €12.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €15.5 billion in earnings, and the most bearish expecting €10.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from 9.5x today. This future PE is greater than the current PE for the GB Banks industry at 9.6x.

- Analysts expect the number of shares outstanding to decline by 1.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

Banco Santander Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent challenges in core geographies such as Brazil-where high interest rates, currency depreciation, and rising corporate bankruptcies are pressuring loan quality-could result in elevated loan loss provisions and higher cost of risk, putting downward pressure on net earnings and margins over time.

- Significant reliance on technology-led transformation (ONE Transformation) remains in a transitional stage, with parallel systems and up-front investment costs still weighing on the group's cost base; failure to realize anticipated cost reductions or operational efficiencies could limit future margin expansion and profitability improvements.

- Heightened regulatory scrutiny and ongoing or potential future litigation risks (e.g., temporary levies in Spain, ongoing legal matters with AXA in the UK, and antitrust investigations in Mexico) may lead to increased compliance costs, legal settlements, or capital charges-directly impacting net profit and capital ratios.

- The ongoing secular threat of digital disintermediation, including aggressive competition from fintech and digital-only banks-especially in mature markets-could erode Santander's customer base, compress fee and interest income, and challenge revenue growth over the long term.

- Ongoing exposure to macroeconomic and FX volatility in key emerging markets (e.g., Brazil and Mexico) could continue to dilute earnings growth in reported (current euro) terms, hinder revenue translation, and create uncertainty in consistent profit and return generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €7.997 for Banco Santander based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €9.5, and the most bearish reporting a price target of just €5.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €63.8 billion, earnings will come to €13.2 billion, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 12.2%.

- Given the current share price of €8.08, the analyst price target of €8.0 is 1.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.