BBVA (BME:BBVA) Valuation Check After Strong Multi-Year Share Price Rally

Reviewed by Simply Wall St

Banco Bilbao Vizcaya Argentaria (BME:BBVA) has quietly extended its rally, with shares up about 17% over the past 3 months and more than doubling year to date. This performance is putting valuation firmly in focus.

See our latest analysis for Banco Bilbao Vizcaya Argentaria.

At a share price of $19.205, that 90 day share price return of 17.39% sits on top of a five year total shareholder return of 500.11%. This suggests momentum is still very much on BBVA’s side as investors reassess its earnings resilience and growth profile.

If BBVA’s run has you thinking more broadly about financials and cyclicals, it could be worth scanning other banks and lenders via our solid balance sheet and fundamentals stocks screener (None results).

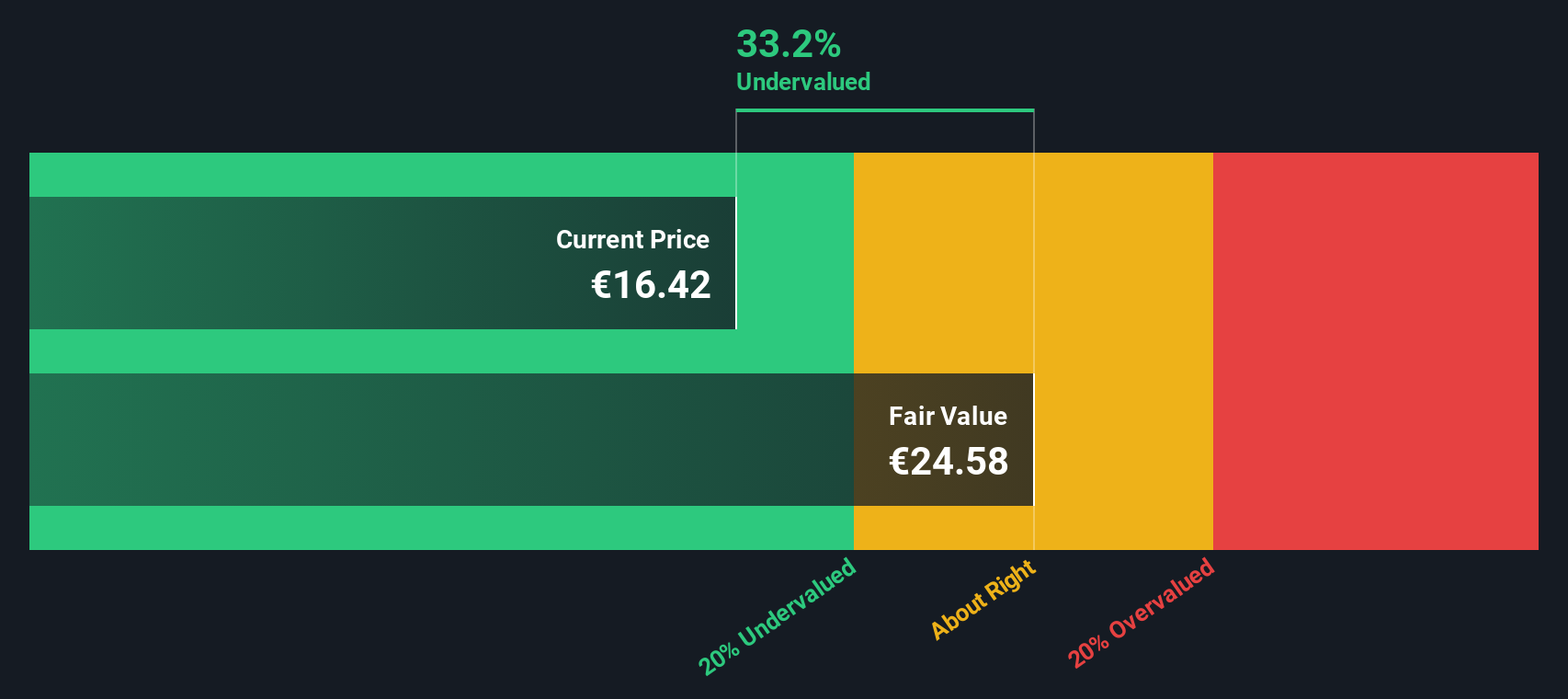

Yet with the share price now nudging past analyst targets but still trading at a sizeable discount to intrinsic value estimates, the key question is simple: is BBVA still attractive, or is future growth already priced in?

Most Popular Narrative: 3% Overvalued

Compared with Banco Bilbao Vizcaya Argentaria's recent close, the most followed narrative points to a slightly lower fair value, yet still assumes solid earnings power ahead.

The analysts have a consensus price target of €16.003 for Banco Bilbao Vizcaya Argentaria based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €11.7.

Want to see what keeps this valuation afloat despite moderating margins and only mid single digit growth assumptions? The narrative leans on surprisingly optimistic profit durability and a richer future earnings multiple. Curious how those ingredients combine into its fair value math? Dive in to unpack the full story behind the projections.

Result: Fair Value of €18.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook could quickly wobble if emerging market volatility deepens or if lower-for-longer interest rates squeeze margins more than expected.

Find out about the key risks to this Banco Bilbao Vizcaya Argentaria narrative.

Another Lens On Value

Our DCF model paints a very different picture, suggesting BBVA is trading about 28% below its estimated fair value at roughly €26.72. If cash flows really are that strong, is the market underpricing long term earnings power, or are the risks louder than the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Banco Bilbao Vizcaya Argentaria Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can shape a fresh perspective in minutes: Do it your way.

A great starting point for your Banco Bilbao Vizcaya Argentaria research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before markets shift again, put your research to work and use the Simply Wall St Screener to uncover fresh stock ideas that match your strategy and risk appetite.

- Capture early-stage growth by scanning these 3611 penny stocks with strong financials that already show stronger balance sheets and financial discipline than typical speculative names.

- Position ahead of the next tech wave by targeting these 26 AI penny stocks at the intersection of machine learning, automation, and scalable business models.

- Lock in potential value upside by focusing on these 908 undervalued stocks based on cash flows that markets may be overlooking despite solid cash flow support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)