European Stocks Estimated To Be 13.9% To 39.2% Below Intrinsic Value

Reviewed by Simply Wall St

As the European market reaches new heights, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are keenly observing opportunities for undervalued stocks amidst this optimistic climate. In such an environment, identifying stocks that are estimated to be trading below their intrinsic value becomes crucial for investors seeking potential growth while navigating the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xplora Technologies (OB:XPLRA) | NOK43.50 | NOK85.09 | 48.9% |

| Vimi Fasteners (BIT:VIM) | €1.19 | €2.32 | 48.8% |

| SBO (WBAG:SBO) | €27.35 | €53.33 | 48.7% |

| Robit Oyj (HLSE:ROBIT) | €1.14 | €2.19 | 48.1% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK122.68 | 48.3% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.11 | 48.7% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.40 | €12.59 | 49.1% |

| E-Globe (BIT:EGB) | €0.65 | €1.26 | 48.5% |

| Atea (OB:ATEA) | NOK142.20 | NOK280.38 | 49.3% |

| Allegro.eu (WSE:ALE) | PLN33.615 | PLN66.29 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

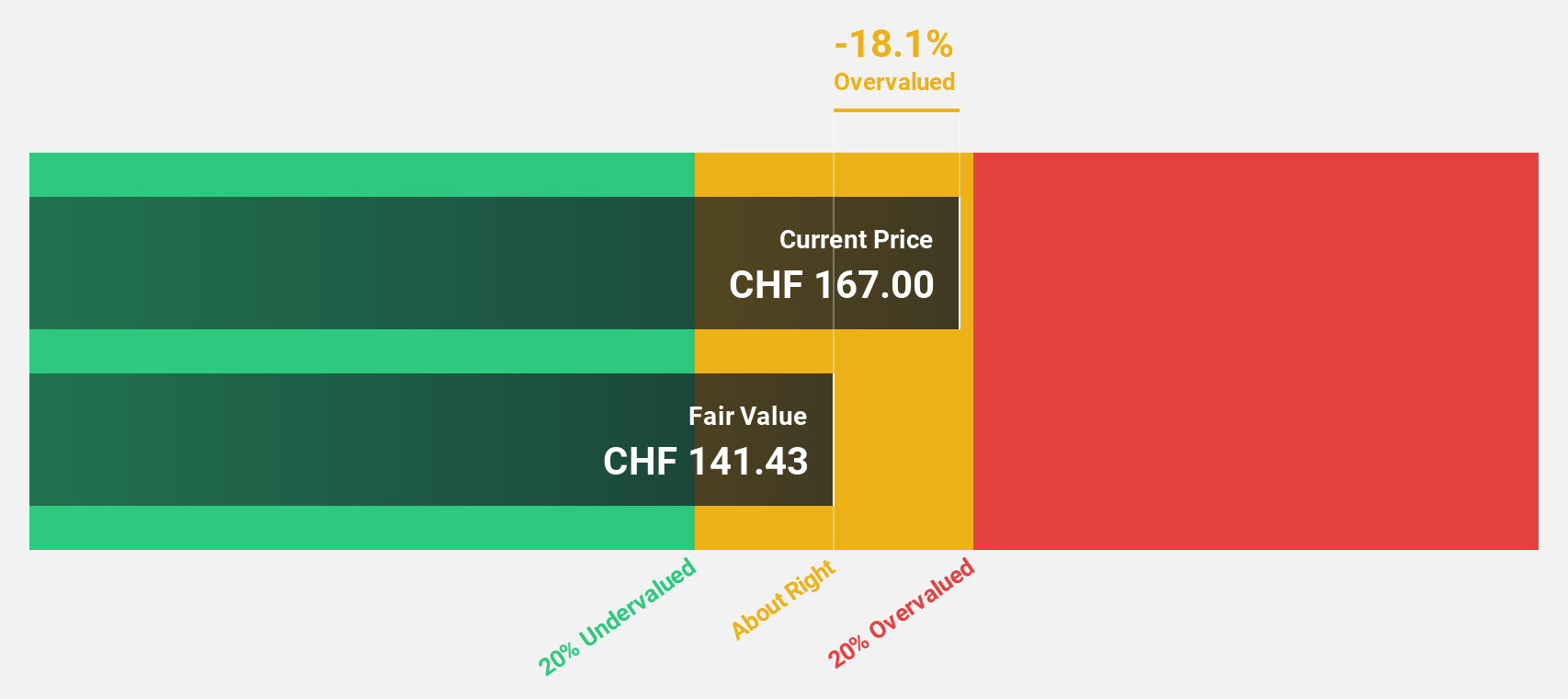

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., along with its subsidiaries, develops and manufactures electronic components, devices, and systems globally, with a market cap of CHF885.30 million.

Operations: The company's revenue is primarily derived from its Electronic Manufacturing Services (EMS) Division, which contributes CHF492.60 million, and the Advanced Substrates (AS) Division, which adds CHF40.70 million.

Estimated Discount To Fair Value: 18.8%

Cicor Technologies, recently added to the S&P Global BMI Index, is trading at CHF203, below its estimated fair value of CHF250.12. Despite a volatile share price and high debt levels, earnings are forecast to grow significantly at 36.4% annually over the next three years, outpacing Swiss market expectations. A recent aerospace order highlights its market leadership in advanced substrates. However, past shareholder dilution and lower net income remain concerns for potential investors.

- Our earnings growth report unveils the potential for significant increases in Cicor Technologies' future results.

- Navigate through the intricacies of Cicor Technologies with our comprehensive financial health report here.

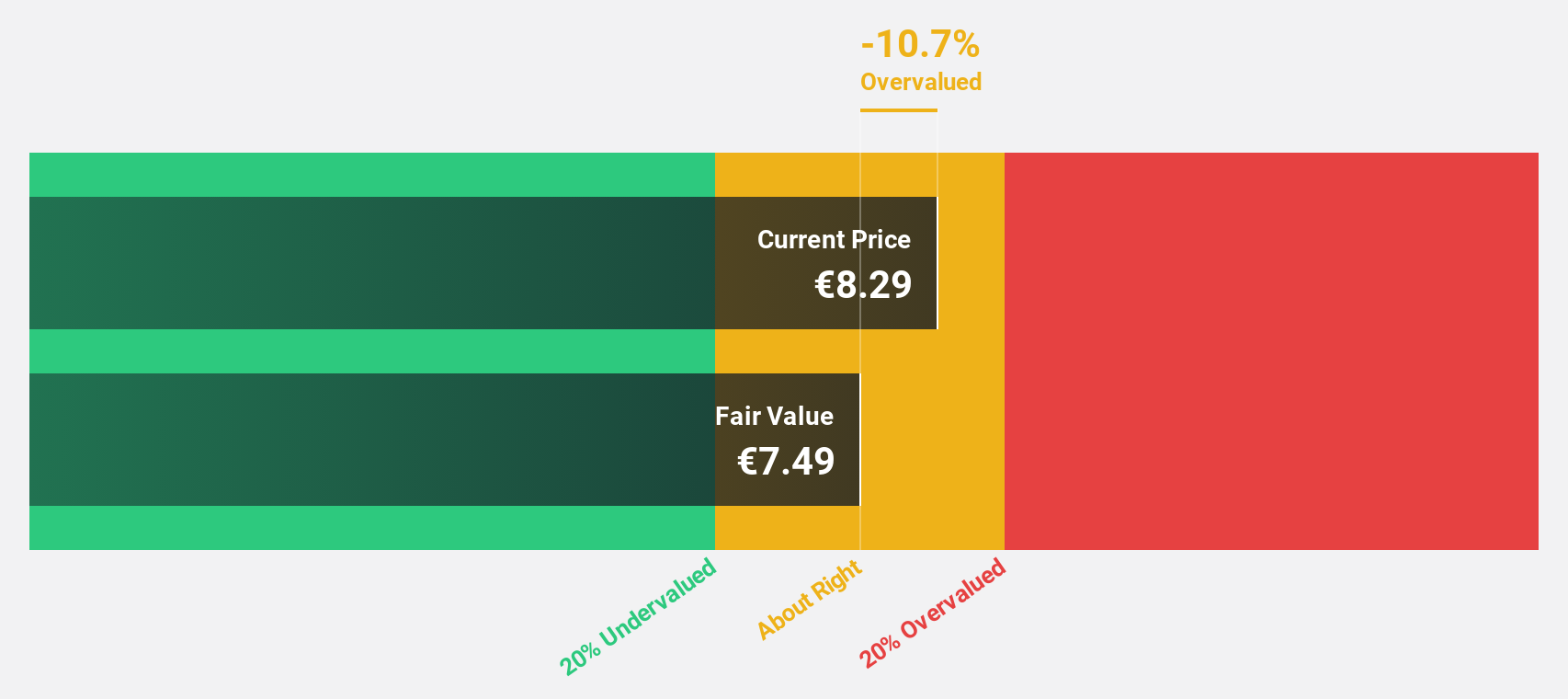

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users both in Germany and internationally, with a market cap of €568.83 million.

Operations: The company's revenue is primarily derived from its camera segment, which generated €202.37 million.

Estimated Discount To Fair Value: 13.9%

Basler Aktiengesellschaft, despite recent removal from the S&P Global BMI Index, shows promise with a significant earnings turnaround, reporting €6.46 million in net income for the first half of 2025 compared to a loss last year. The company increased its annual revenue guidance to €215 million and is trading at €18.5, below its estimated fair value of €21.48. However, Basler's share price has been highly volatile recently and its forecasted return on equity remains modest at 11.4%.

- In light of our recent growth report, it seems possible that Basler's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Basler.

DEUTZ (XTRA:DEZ)

Overview: DEUTZ Aktiengesellschaft is a company that develops, manufactures, and sells diesel and gas engines across several regions including Germany, Europe, the Middle East, Africa, the Asia Pacific, and the United States with a market cap of €1.41 billion.

Operations: The company's revenue segments comprise €1.88 billion from Solutions and €66.60 million from Engines & Services.

Estimated Discount To Fair Value: 39.2%

DEUTZ Aktiengesellschaft is significantly undervalued, trading at €9.23 compared to a fair value estimate of €15.18, and offers good value based on discounted cash flow analysis. Despite recent challenges with profit margins dropping from 4.1% to 1.2%, the company's earnings are forecasted to grow substantially at 59.9% annually over the next three years, outpacing the German market average of 16.5%. Recent equity offerings raised €131 million, supporting potential M&A activities and growth initiatives in Europe and beyond.

- The analysis detailed in our DEUTZ growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of DEUTZ stock in this financial health report.

Next Steps

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 205 more companies for you to explore.Click here to unveil our expertly curated list of 208 Undervalued European Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Basler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BSL

Basler

Engages in the development, manufacture, and sale of digital cameras for professional users in Germany and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)