- France

- /

- Professional Services

- /

- ENXTPA:TEP

Top European Dividend Stocks To Consider

Reviewed by Simply Wall St

As European markets continue their longest streak of weekly gains since 2012, buoyed by encouraging company results and a strong performance in defense stocks, investors are increasingly looking towards dividend stocks as a reliable source of income amid mixed economic signals. In this environment, selecting stocks with consistent dividend payouts and solid financial health can provide stability and potential growth opportunities for those seeking to navigate the current market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 5.02% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.22% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.14% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.88% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.59% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.21% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.34% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 7.10% | ★★★★★☆ |

Click here to see the full list of 219 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Teleperformance (ENXTPA:TEP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teleperformance SE, along with its subsidiaries, provides customer consultancy services both in France and internationally, with a market cap of approximately €6.37 billion.

Operations: Teleperformance SE generates revenue through its Specialized Services segment (€1.49 billion), Core Services & D.I.B.S - Americas (€4.18 billion), and Core Services & D.I.B.S - Europe, Middle East & Africa (EMEA) & APAC (€4.61 billion).

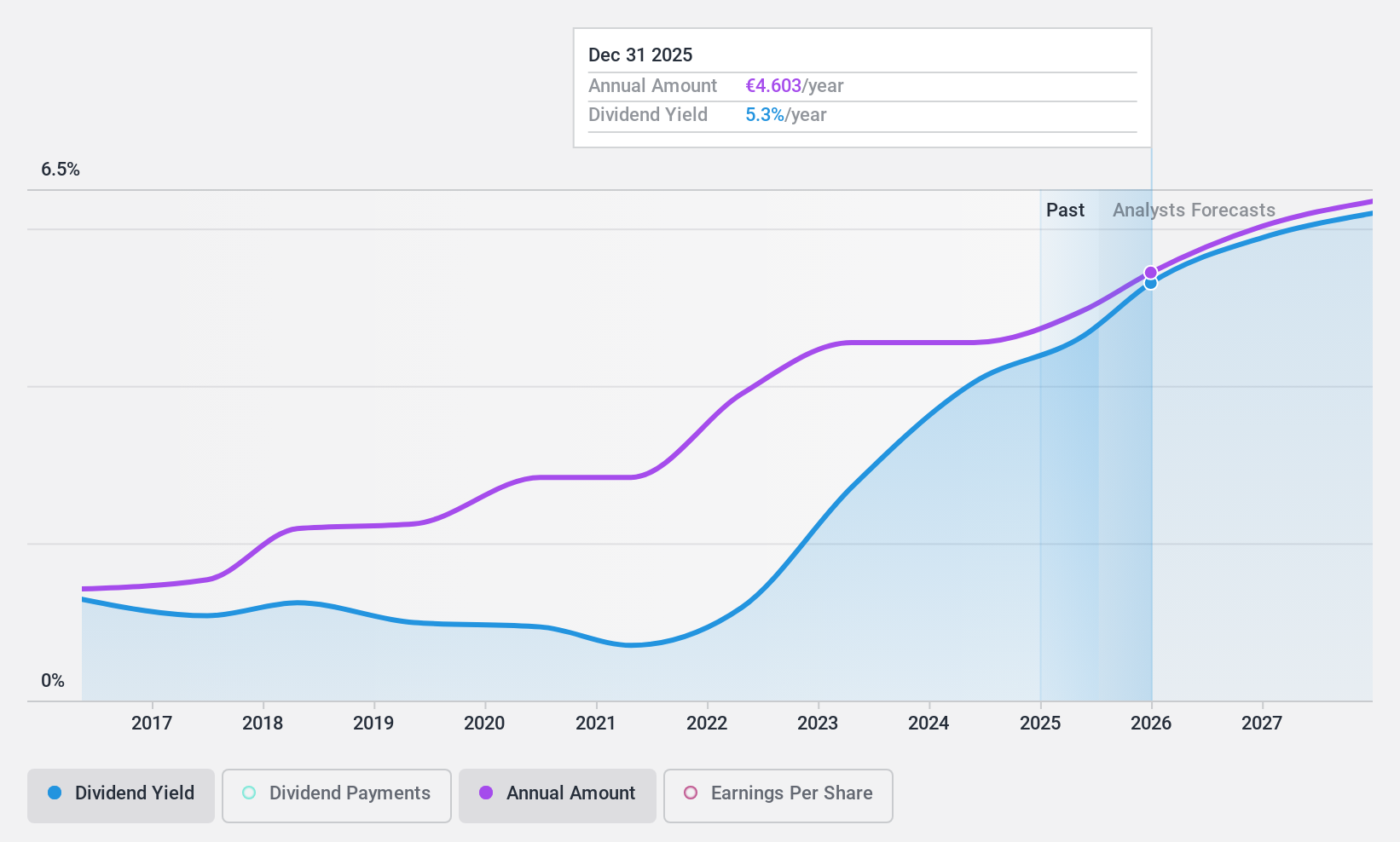

Dividend Yield: 3.9%

Teleperformance offers a stable dividend with a 3.9% yield, supported by a low payout ratio of 47.9% and cash payout ratio of 15.6%, indicating strong coverage by earnings and cash flows. Despite its high debt level, the company trades at good value, significantly below estimated fair value, and has announced an increased annual dividend of €4.20 per share for May 2025 payment. Recent earnings showed increased sales but decreased net income year-over-year to €523 million from €592 million.

- Unlock comprehensive insights into our analysis of Teleperformance stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Teleperformance shares in the market.

Palfinger (WBAG:PAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Palfinger AG is a global producer and seller of crane and lifting solutions, with a market cap of €902.20 million.

Operations: Palfinger AG generates its revenue from various segments, including the production and sale of crane and lifting solutions globally.

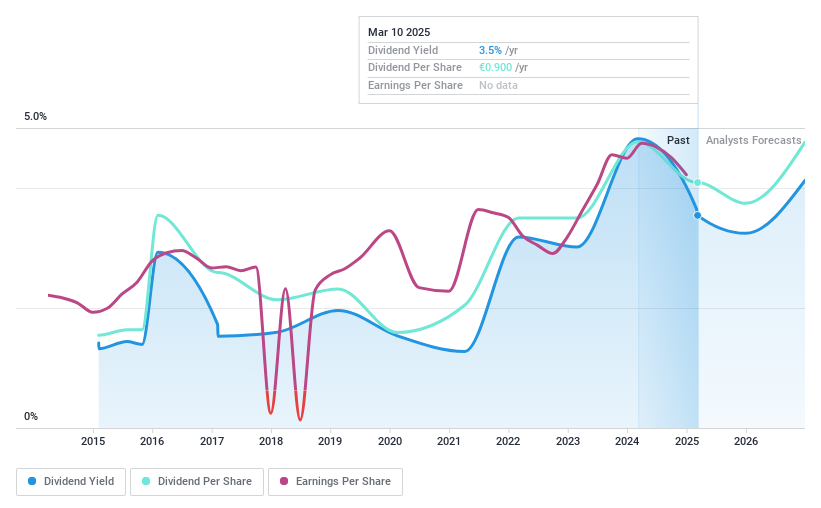

Dividend Yield: 4%

Palfinger's dividend payments have been volatile over the past decade, with a recent decrease to €0.90 per share for April 2025. Despite this, dividends are well covered by earnings and cash flows, with payout ratios of 32.3% and 47.9%, respectively. The stock trades at a significant discount to its fair value and is competitively priced against peers. Recent earnings showed decreased sales of €2.36 billion and net income of €100 million year-over-year amidst challenging market conditions.

- Dive into the specifics of Palfinger here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Palfinger is trading behind its estimated value.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions both in Germany and internationally, with a market cap of €892.13 million.

Operations: Mensch und Maschine Software SE's revenue is derived from two main segments: M+M Software, which contributes €107.95 million, and M+M Digitization, accounting for €242.22 million.

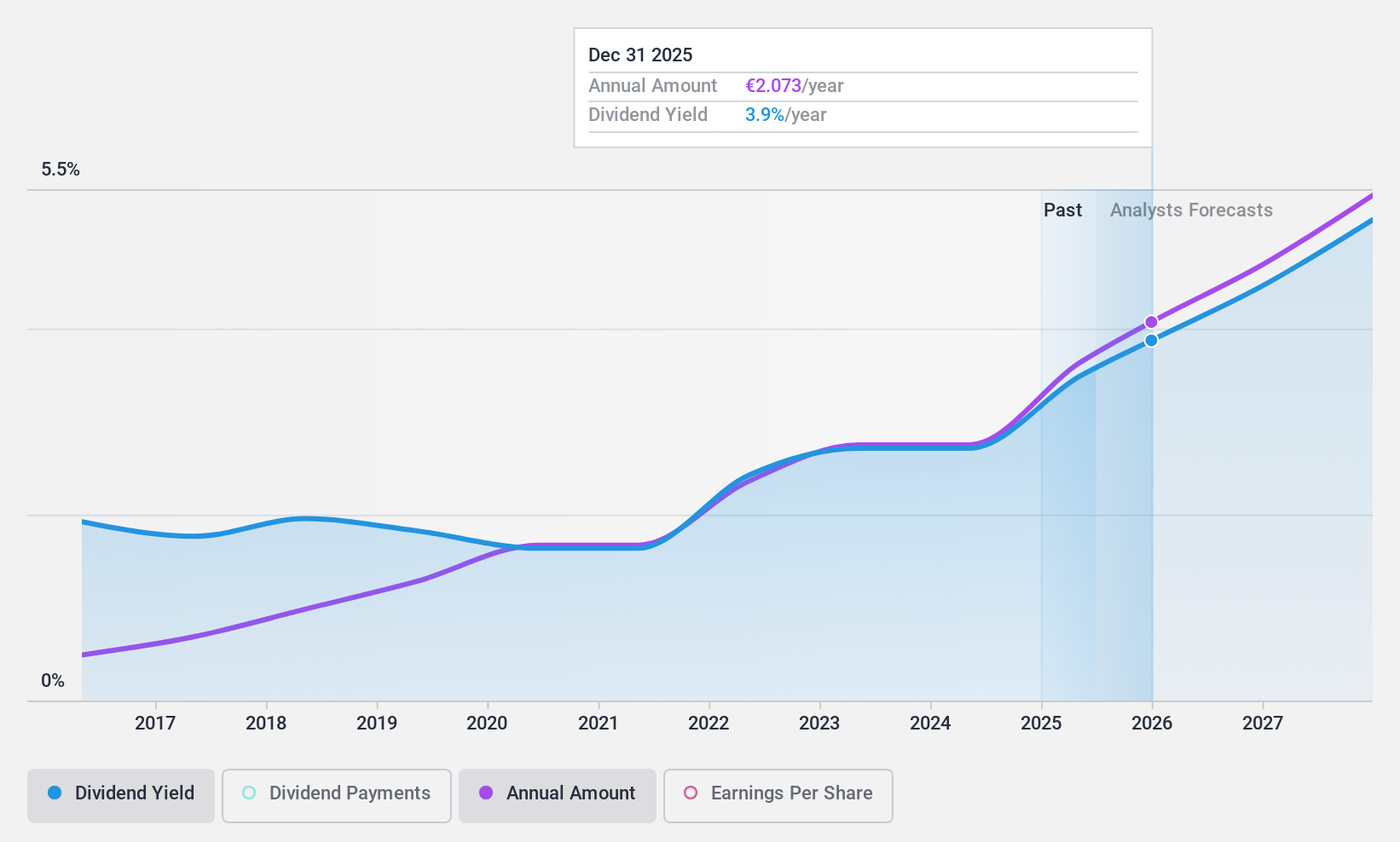

Dividend Yield: 3.1%

Mensch und Maschine Software offers a reliable dividend yield of 3.14%, though below the top tier in Germany, with stable growth over the past decade. Dividends are well-covered by earnings and cash flows, with payout ratios of 87.2% and 60.8%, respectively. The stock is trading at a discount to its estimated fair value, suggesting potential upside. Recent guidance indicates expected EBIT/EPS growth between 9%-18% for 2025 and stronger growth for 2026.

- Navigate through the intricacies of Mensch und Maschine Software with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Mensch und Maschine Software's share price might be too pessimistic.

Next Steps

- Navigate through the entire inventory of 219 Top European Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teleperformance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TEP

Teleperformance

Operates as a digital business services company in France and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives