- Switzerland

- /

- Capital Markets

- /

- SWX:LEON

European Stocks Possibly Trading Below Estimated Value In December 2025

Reviewed by Simply Wall St

As the European market navigates mixed performances, with Germany's DAX seeing gains while France's CAC 40 and the UK's FTSE 100 experienced declines, investors are keenly observing economic indicators and central bank policies for cues on future movements. In this climate, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.016 | €5.96 | 49.4% |

| Straumann Holding (SWX:STMN) | CHF95.76 | CHF187.84 | 49% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.65 | €138.89 | 49.9% |

| Kitron (OB:KIT) | NOK67.70 | NOK135.14 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.2% |

| Exail Technologies (ENXTPA:EXA) | €86.70 | €170.21 | 49.1% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.14 | 49.2% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.57 | €5.07 | 49.3% |

| Cyber_Folks (WSE:CBF) | PLN205.00 | PLN408.69 | 49.8% |

| CCC (WSE:CCC) | PLN126.15 | PLN250.26 | 49.6% |

Let's dive into some prime choices out of the screener.

Gofore Oyj (HLSE:GOFORE)

Overview: Gofore Oyj offers digital transformation consultancy services to both private and public sectors in Finland and internationally, with a market cap of €212.87 million.

Operations: The company generates revenue of €182.19 million from its computer services segment, focusing on digital transformation consultancy for various sectors.

Estimated Discount To Fair Value: 28.2%

Gofore Oyj is trading at €13.36, below its estimated fair value of €18.59, making it undervalued based on discounted cash flow analysis. Despite a decline in net income and profit margins over the past year, Gofore's earnings are forecast to grow significantly at 26.6% annually, outpacing the Finnish market's growth rate of 16.9%. However, its return on equity is projected to remain low at 15.8%, and dividend coverage appears insufficient given current earnings levels.

- Our comprehensive growth report raises the possibility that Gofore Oyj is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Gofore Oyj.

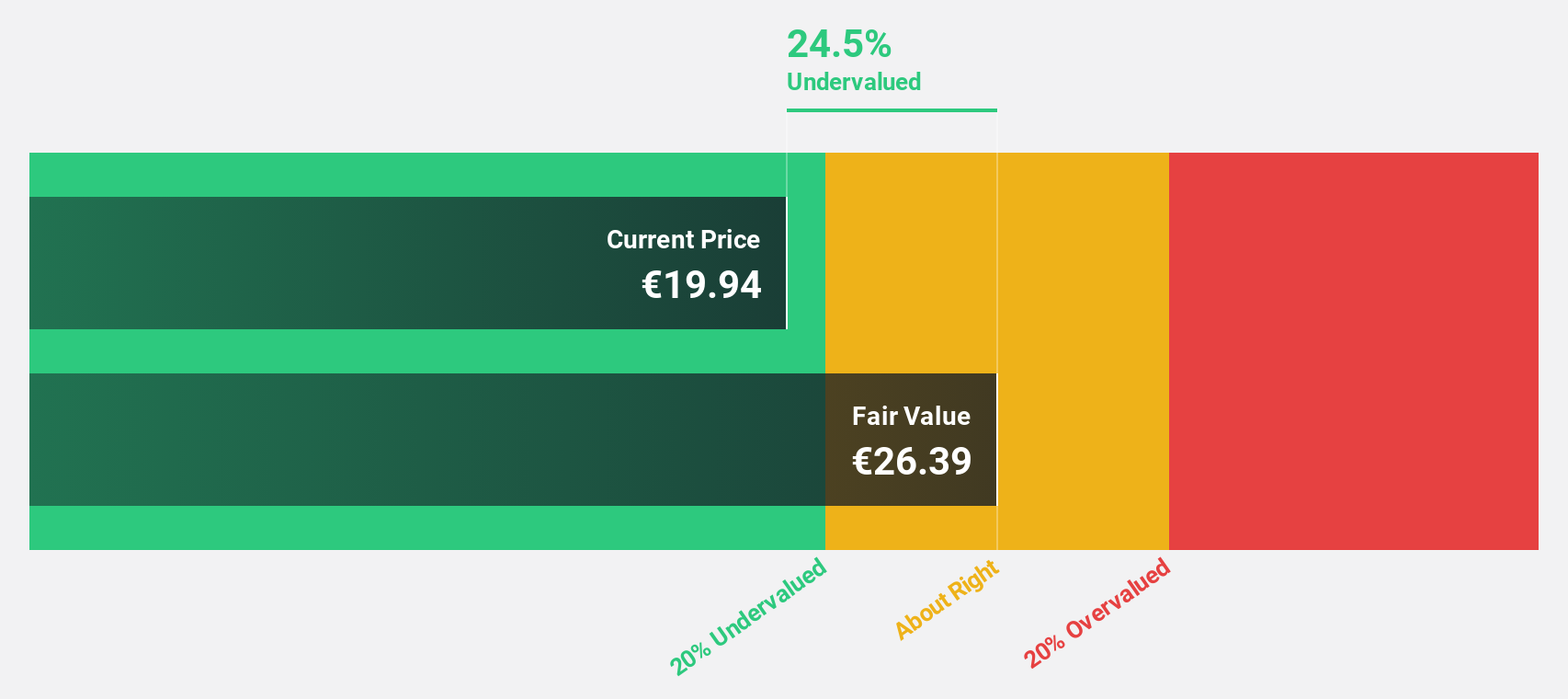

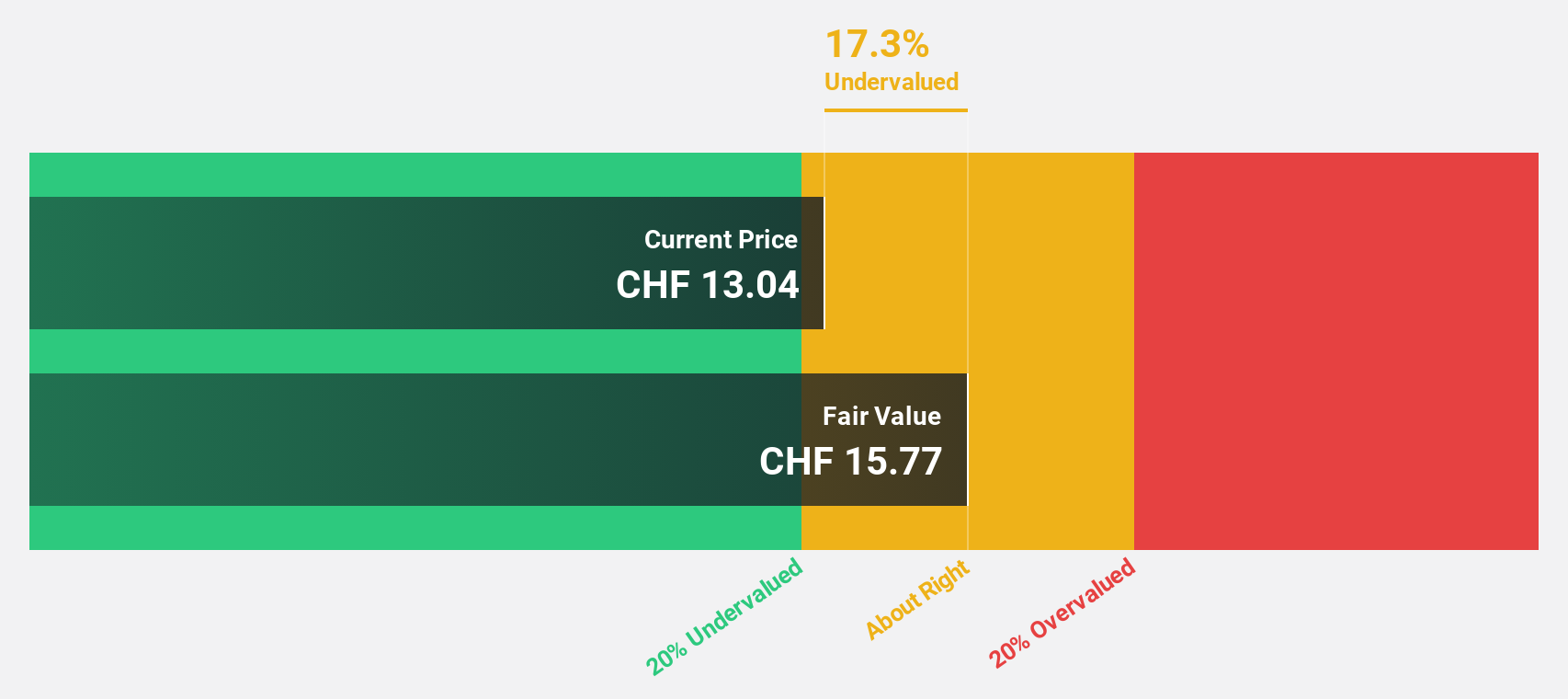

Leonteq (SWX:LEON)

Overview: Leonteq AG is a company that offers derivative investment products and services across Switzerland, Europe, Asia, and internationally, with a market cap of CHF236.54 million.

Operations: Leonteq's revenue segment includes brokerage services, generating CHF227.96 million.

Estimated Discount To Fair Value: 14.7%

Leonteq AG, trading at CHF13.4, is undervalued relative to its estimated fair value of CHF15.71, based on discounted cash flow analysis. The company is expected to achieve above-average market profit growth over the next three years despite low forecasted return on equity of 7.7%. However, its dividend yield of 22.39% lacks coverage by earnings or free cash flows. Recent strategic advancements include transitioning to SA-FRTB with a CET1 ratio above 15%.

- According our earnings growth report, there's an indication that Leonteq might be ready to expand.

- Get an in-depth perspective on Leonteq's balance sheet by reading our health report here.

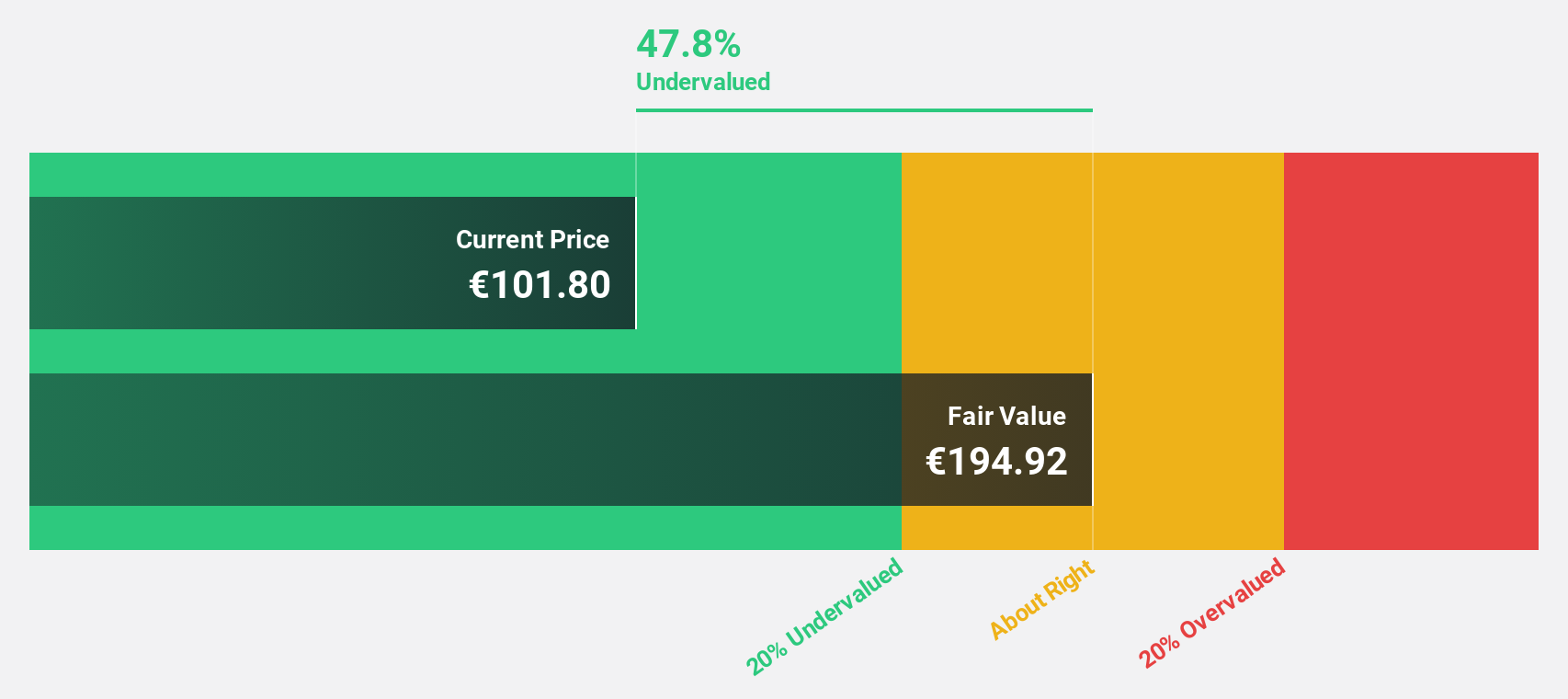

innoscripta (XTRA:1INN)

Overview: Innoscripta SE offers software-as-a-service solutions for managing R&D tax incentives and project management consulting in Germany, with a market cap of €942 million.

Operations: The company generates its revenue from the Internet Software & Services segment, amounting to €96.19 million.

Estimated Discount To Fair Value: 28.1%

innoscripta SE, trading at €94.2, is significantly undervalued compared to its estimated fair value of €131.06, according to discounted cash flow analysis. The company reported impressive earnings growth of 82.2% over the past year and forecasts suggest revenue will grow at 24.7% annually, outpacing the German market's 6.3%. Additionally, innoscripta's projected earnings growth of 27.2% per year surpasses the broader market expectations and indicates strong future profitability potential.

- The growth report we've compiled suggests that innoscripta's future prospects could be on the up.

- Dive into the specifics of innoscripta here with our thorough financial health report.

Taking Advantage

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 195 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEON

Leonteq

Provides derivative investment products and services in Switzerland, Europe, and Asia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)