As we step into January 2025, global markets are reflecting a mixed economic landscape, with major indices experiencing moderate gains amid declining consumer confidence and fluctuating manufacturing data. Despite these uncertainties, dividend stocks continue to attract investors seeking stability and income, especially in an environment where consistent cash flow remains a priority.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

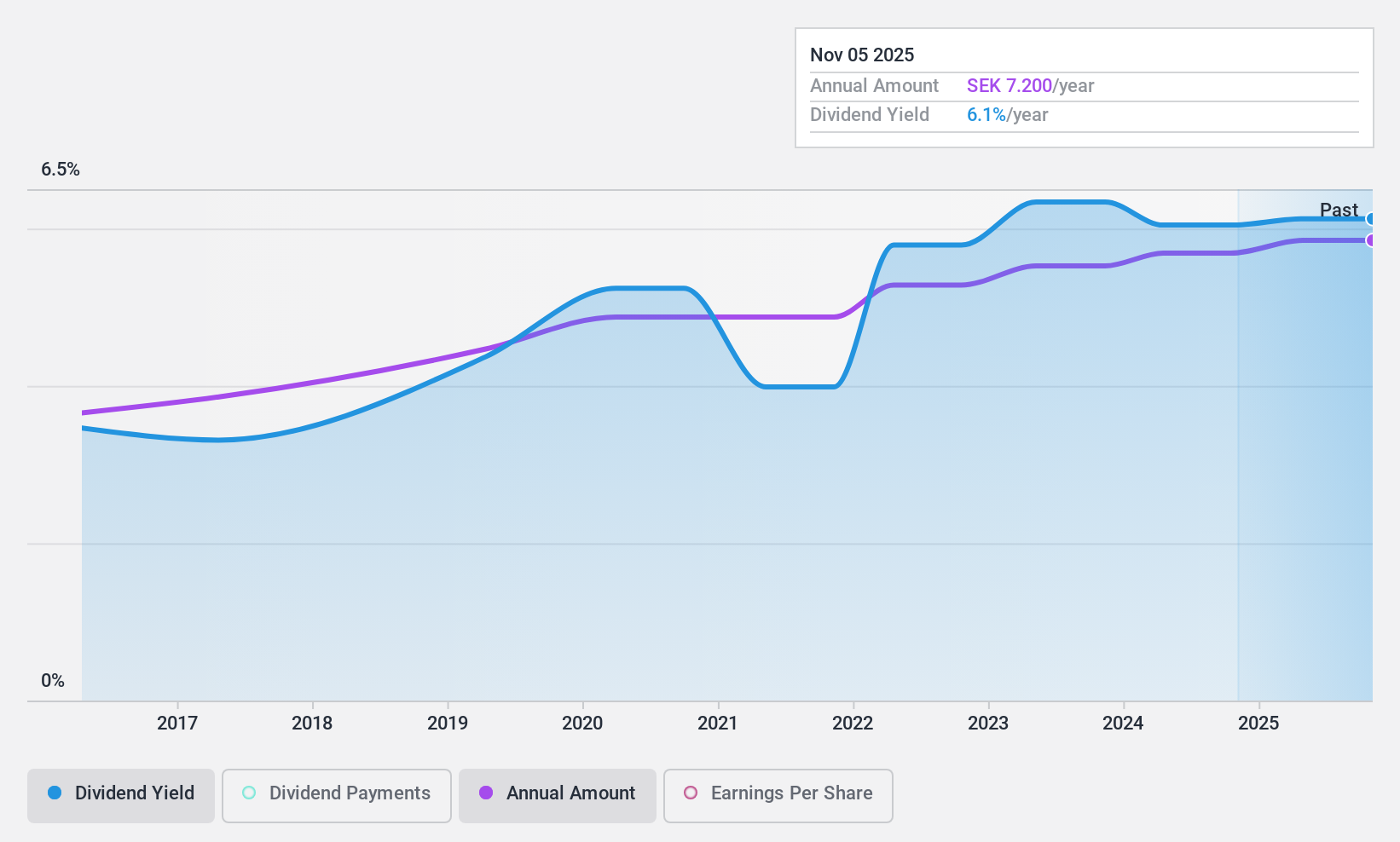

Investment AB Öresund (OM:ORES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Investment AB Öresund (publ) is a Swedish investment company focused on asset management, with a market cap of SEK4.81 billion.

Operations: Investment AB Öresund generates revenue from its asset management activities, with SEK920.77 million attributed to unclassified services.

Dividend Yield: 6.2%

Investment AB Öresund's dividend yield of 6.24% ranks in the top 25% of Swedish dividend payers, yet its dividends have been unreliable and volatile over the past decade. Despite a low payout ratio of 33.2%, indicating coverage by earnings, cash flow coverage is weak with a high cash payout ratio of 183.9%. Recent financials show improved profitability, but third-quarter results revealed negative revenue and a net loss, highlighting potential risks for dividend sustainability.

- Unlock comprehensive insights into our analysis of Investment AB Öresund stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Investment AB Öresund shares in the market.

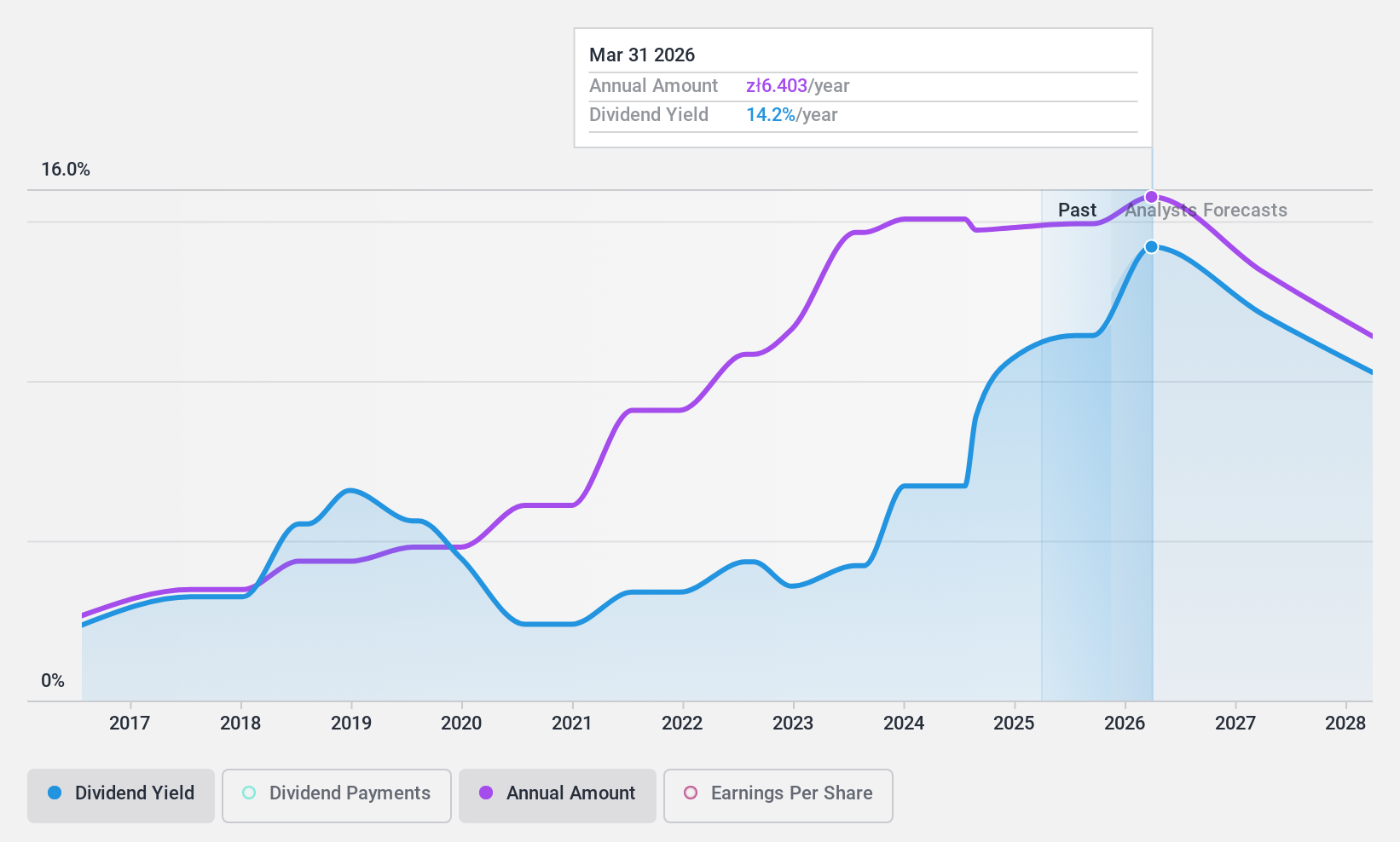

Text (WSE:TXT)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Text S.A. develops and distributes online text communication software for businesses worldwide, with a market cap of PLN1.69 billion.

Operations: Text S.A.'s revenue segment includes Live Chat, generating PLN348.93 million.

Dividend Yield: 8.5%

Text S.A. offers a high dividend yield of 8.49%, though it is not well-covered by earnings or cash flows, with a payout ratio of 92% and a cash payout ratio of 102.5%. Despite stable and growing dividends over the past decade, the company's earnings are expected to decline slightly in coming years. Recent financials showed improved net income, but share price volatility adds risk for dividend investors seeking stability in the Polish market.

- Delve into the full analysis dividend report here for a deeper understanding of Text.

- Our valuation report unveils the possibility Text's shares may be trading at a discount.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market cap of €186.82 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily through its Management Services segment, which accounts for €33.91 million, and its Transaction Services segment, contributing €6.90 million.

Dividend Yield: 4.9%

MPC Münchmeyer Petersen Capital's dividend is supported by a low cash payout ratio of 28.7%, indicating strong coverage by free cash flow. Despite only three years of dividend history, payments have been stable and growing. The recent acquisition by Castor Maritime Inc., completed on December 16, 2024, for €182.8 million, could influence future dividend stability and strategic direction as new supervisory board members are appointed following the transaction's closure.

- Click to explore a detailed breakdown of our findings in MPC Münchmeyer Petersen Capital's dividend report.

- Our valuation report here indicates MPC Münchmeyer Petersen Capital may be undervalued.

Seize The Opportunity

- Investigate our full lineup of 1958 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Text might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:TXT

Text

Develops and distributes online text communication software for businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)