- Taiwan

- /

- Semiconductors

- /

- TPEX:3227

Discovering 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape of geopolitical tensions and economic indicators, small-cap stocks have surged into record territory, with the Russell 2000 Index recently hitting an all-time high. This environment presents a unique opportunity to explore lesser-known stocks that possess strong fundamentals and potential for growth, making them worthy contenders in the pursuit of undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China with a market cap of CN¥9.74 billion.

Operations: Suzhou TZTEK Technology generates revenue primarily from the industrial vision equipment sector. The company has reported a gross profit margin of 41.5% in its latest financial period, reflecting its pricing and cost management strategies.

Suzhou TZTEK, a smaller player in the tech scene, reported CNY 851.09 million in sales for the first nine months of 2024, down from CNY 878.74 million last year. The company faced a net loss of CNY 13.67 million compared to a net income of CNY 41.05 million previously, reflecting challenges amidst industry volatility and negative earnings growth over the past year at -1.8%. Despite these hurdles, TZTEK's debt-to-equity ratio stands at a satisfactory 19.9%, indicating manageable financial leverage as they navigate market conditions with high-quality earnings and potential future growth forecasted at over 60% annually.

- Click to explore a detailed breakdown of our findings in Suzhou TZTEK Technology's health report.

Evaluate Suzhou TZTEK Technology's historical performance by accessing our past performance report.

PixArt Imaging (TPEX:3227)

Simply Wall St Value Rating: ★★★★★★

Overview: PixArt Imaging Inc., with a market cap of approximately NT$34.31 billion, is engaged in the research, design, production, and sale of CMOS image sensors and related integrated circuits across Taiwan, Hong Kong, China, Japan, and other international markets.

Operations: The company generates revenue primarily from the sale of CMOS image sensors and related ICs, amounting to NT$7.83 billion.

PixArt Imaging, a dynamic player in the semiconductor space, has showcased impressive growth with earnings surging by 234.7% over the past year, far outpacing industry norms. The company's recent introduction of the PAC9001 Smart Pixel Optical Sensing Device highlights its innovative edge, promising enhanced privacy and efficiency across various sectors. Financially robust with a debt to equity ratio reduced from 1.5% to 0.4% over five years and trading at an attractive value below fair estimates, PixArt's net income for Q3 reached TWD 478.97 million compared to TWD 298.98 million last year, reflecting strong operational performance despite shareholder dilution concerns.

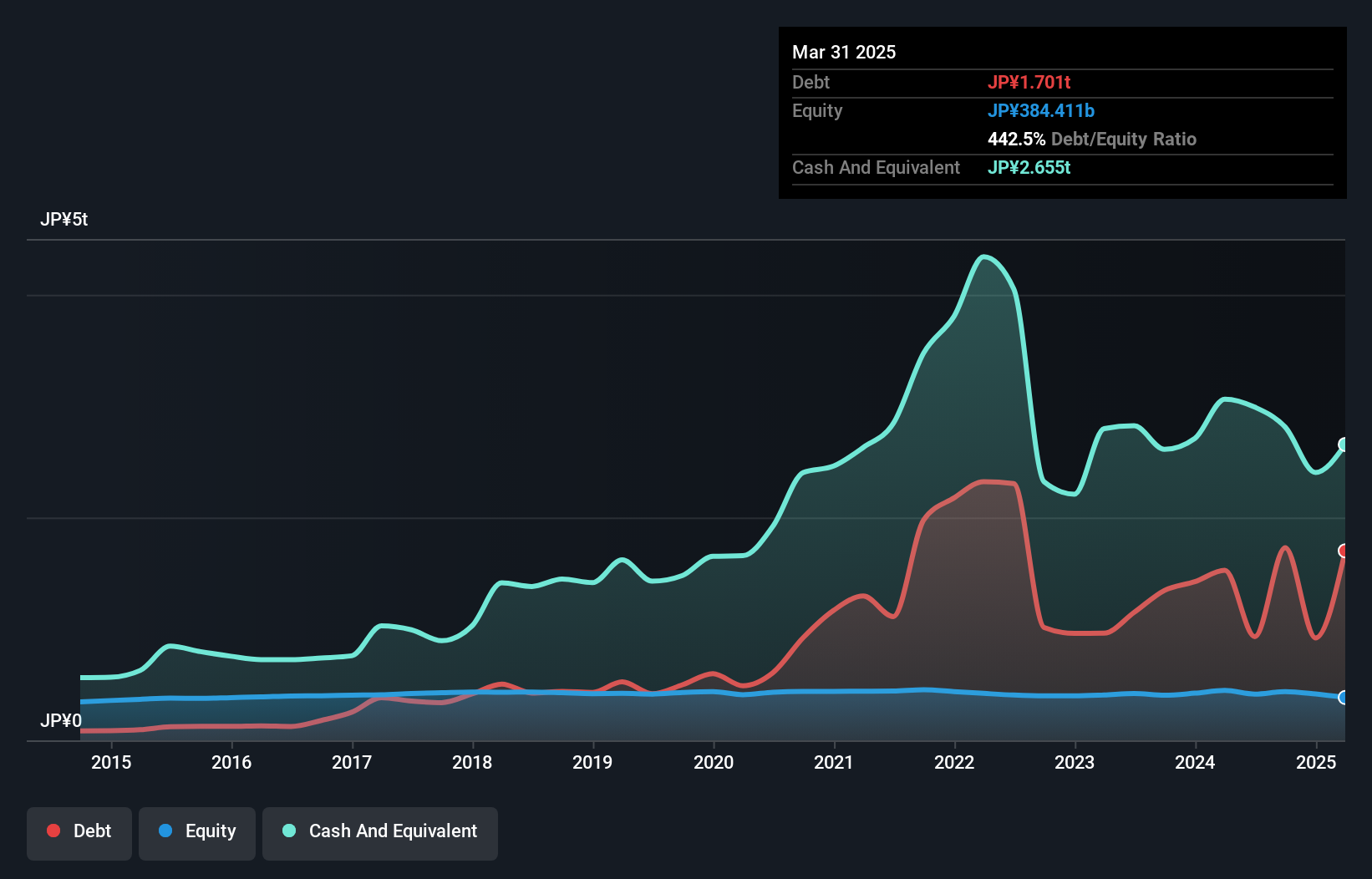

North Pacific BankLtd (TSE:8524)

Simply Wall St Value Rating: ★★★★☆☆

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market capitalization of ¥175.28 billion.

Operations: North Pacific Bank, Ltd. generates revenue primarily from its banking segment, amounting to ¥112.17 billion, followed by its leasing business at ¥23.99 billion. The company's cost structure and profitability are influenced by these segments' performance and market conditions in Japan.

North Pacific Bank, with assets totaling ¥13,245.8 billion and equity of ¥437.5 billion, stands out in the banking sector for its robust earnings growth of 66.6% over the past year, surpassing industry averages significantly. The bank's total deposits amount to ¥10,890.3 billion against loans of ¥7,483.2 billion, indicating a strong deposit base that forms 85% of low-risk funding sources. Despite an appropriate level of bad loans at 1.2%, there is a low allowance for bad loans at 48%, which may require attention moving forward as it trades below its estimated fair value by 20%.

- Navigate through the intricacies of North Pacific BankLtd with our comprehensive health report here.

Taking Advantage

- Unlock our comprehensive list of 4638 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3227

PixArt Imaging

Researches, designs, produces, and sells CMOS image sensors and related ICs in Taiwan, Hong Kong, China, Japan, and internationally.

Flawless balance sheet, undervalued and pays a dividend.