- Taiwan

- /

- Semiconductors

- /

- TPEX:5483

3 Dividend Stocks With Up To 9.8% Yield For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, including mixed performance in major stock indices and unexpected shifts in manufacturing data, investors are keenly observing opportunities to bolster their portfolios. In this context, dividend stocks offer an appealing option for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

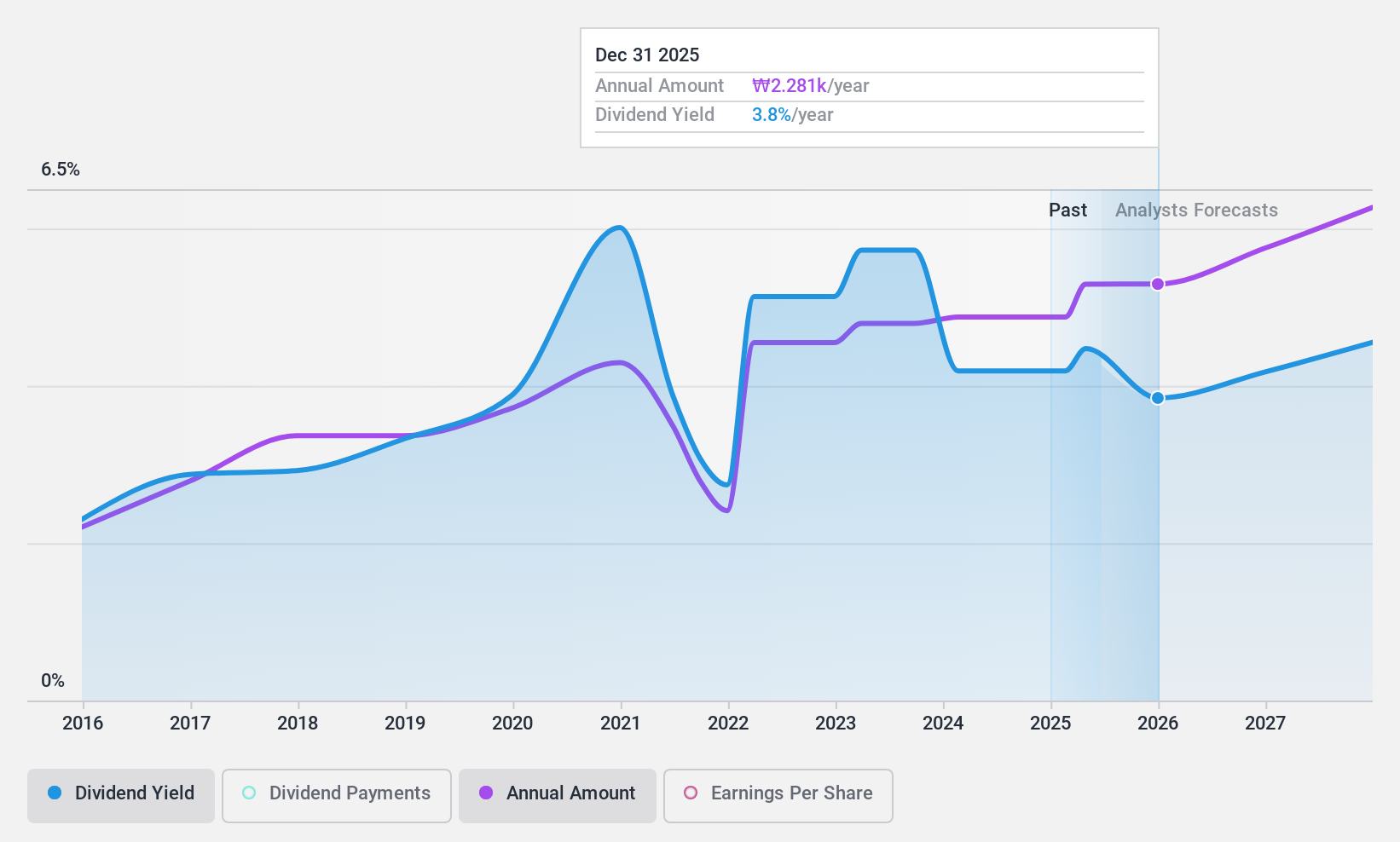

Shinhan Financial Group (KOSE:A055550)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinhan Financial Group Co., Ltd. offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩24.27 trillion.

Operations: Shinhan Financial Group Co., Ltd. generates revenue primarily from its banking segment (₩9.17 trillion), followed by credit card services (₩2.13 trillion) and securities (₩830.17 billion).

Dividend Yield: 4.3%

Shinhan Financial Group's dividend payments are well covered by earnings, with a low payout ratio of 24.7%, and forecasted to remain sustainable at 27.9% in three years. Despite past volatility, dividends have grown over the last decade and currently offer a competitive yield of 4.31%. Recent share buybacks totaling KRW 300 billion aim to enhance shareholder value, alongside quarterly cash dividends amounting to KRW 271.86 billion announced for distribution.

- Unlock comprehensive insights into our analysis of Shinhan Financial Group stock in this dividend report.

- Upon reviewing our latest valuation report, Shinhan Financial Group's share price might be too pessimistic.

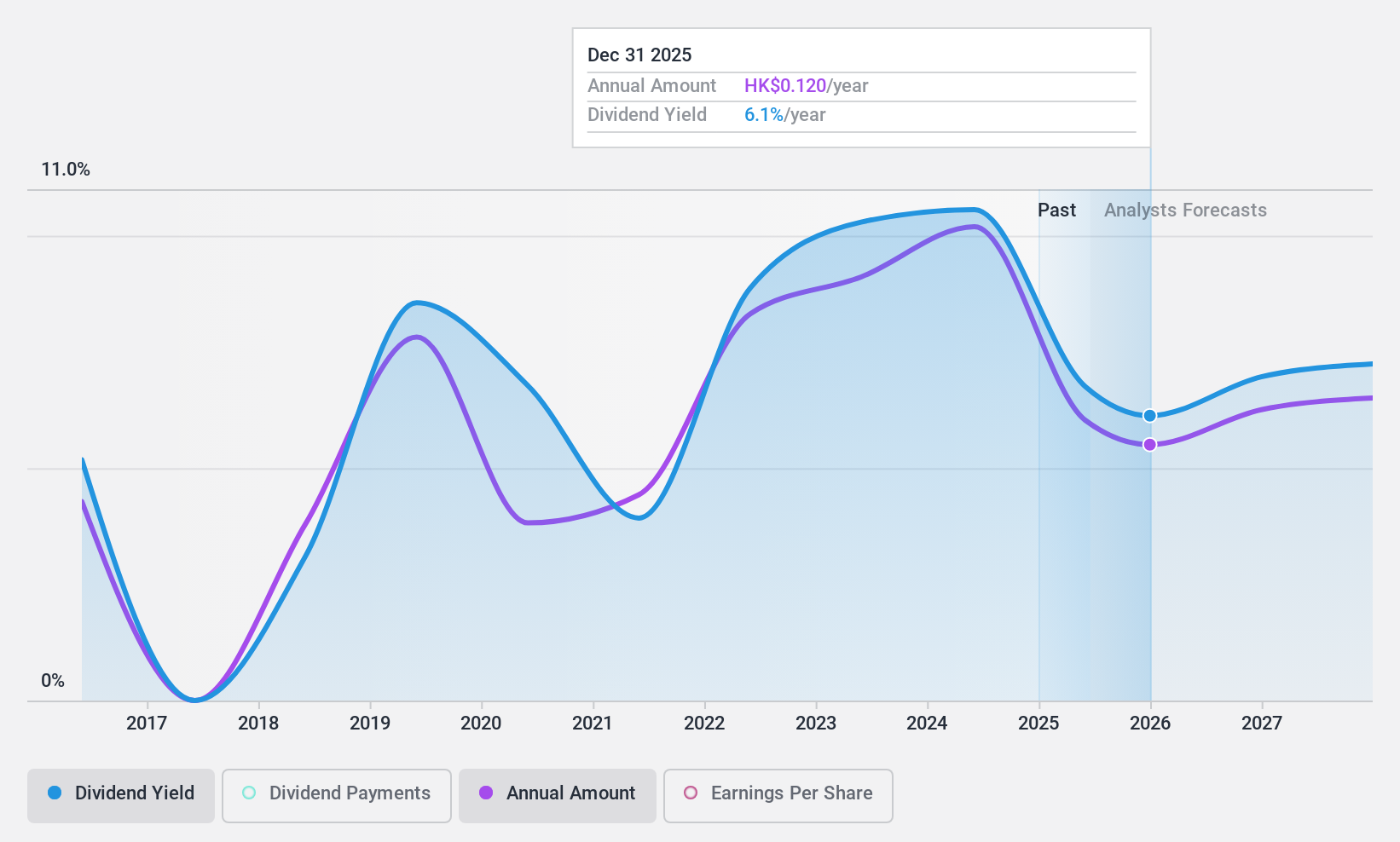

China BlueChemical (SEHK:3983)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China BlueChemical Ltd. and its subsidiaries develop, produce, and sell mineral fertilizers and chemical products both in the People’s Republic of China and internationally, with a market cap of HK$9.96 billion.

Operations: China BlueChemical Ltd. generates revenue through its key segments: Urea (CN¥4.26 billion), Methanol (CN¥3.11 billion), and Phosphorus and Compound Fertiliser (CN¥2.85 billion).

Dividend Yield: 9.8%

China BlueChemical's dividends are supported by earnings and cash flows, with payout ratios of 70.5% and 65.3%, respectively. The dividend yield is among the top 25% in Hong Kong at 9.8%, though past payments have been volatile and unreliable. Recent board changes include Ms. He Qunhui's appointment as an executive director, while auditor transitions saw Mazars ZSZH replacing BDO due to fee disagreements, reflecting ongoing corporate adjustments.

- Navigate through the intricacies of China BlueChemical with our comprehensive dividend report here.

- Our expertly prepared valuation report China BlueChemical implies its share price may be lower than expected.

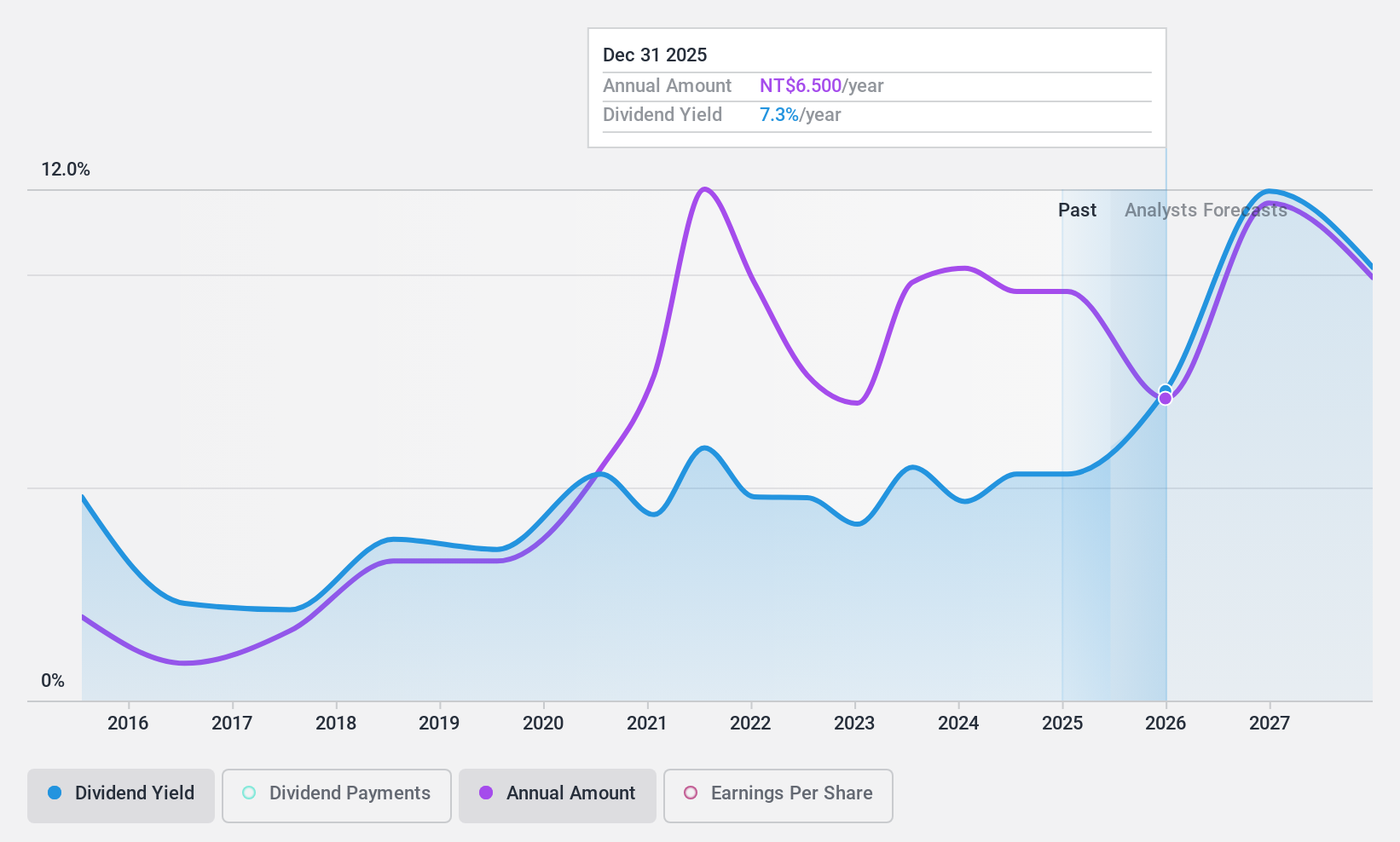

Sino-American Silicon Products (TPEX:5483)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sino-American Silicon Products Inc. is involved in the R&D, design, production, and sale of semiconductor silicon materials and components, rheostats, and optical and communications wafer materials with a market cap of NT$83.53 billion.

Operations: Sino-American Silicon Products Inc. generates revenue primarily from its Semiconductor Business Group, which contributes NT$68.46 billion, and its Renewable Energy Division, which adds NT$7.27 billion.

Dividend Yield: 6.4%

Sino-American Silicon Products faces challenges with its dividend sustainability, as recent payouts are not covered by free cash flows despite a low payout ratio of 41.7%. The company announced a TWD 1.92 billion dividend for early 2025, yet earnings have declined significantly year-on-year. While trading at a good value compared to peers and boasting dividends in the top tier of Taiwan's market, past volatility and shareholder dilution raise concerns about reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Sino-American Silicon Products.

- Our valuation report unveils the possibility Sino-American Silicon Products' shares may be trading at a discount.

Next Steps

- Explore the 1979 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5483

Sino-American Silicon Products

Engages in the research and development, design, manufacturing, and sale of semiconductor silicon materials and related components, varistors, optoelectronics, and communication wafer materials.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives