- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

3 Stocks That Could Be Undervalued By Up To 34.9%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices showing varied performance and economic indicators presenting both challenges and opportunities, investors are increasingly on the lookout for potential value plays. In this environment, identifying undervalued stocks becomes crucial as they may offer attractive entry points for those seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | US$30.89 | US$61.61 | 49.9% |

| Avant Group (TSE:3836) | ¥1877.00 | ¥3746.18 | 49.9% |

| Tourmaline Oil (TSX:TOU) | CA$66.79 | CA$133.01 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.69 | CN¥100.80 | 49.7% |

| Camden National (NasdaqGS:CAC) | US$42.08 | US$83.90 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$35.85 | US$71.62 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥41.99 | 49.9% |

| Constellium (NYSE:CSTM) | US$10.52 | US$20.92 | 49.7% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

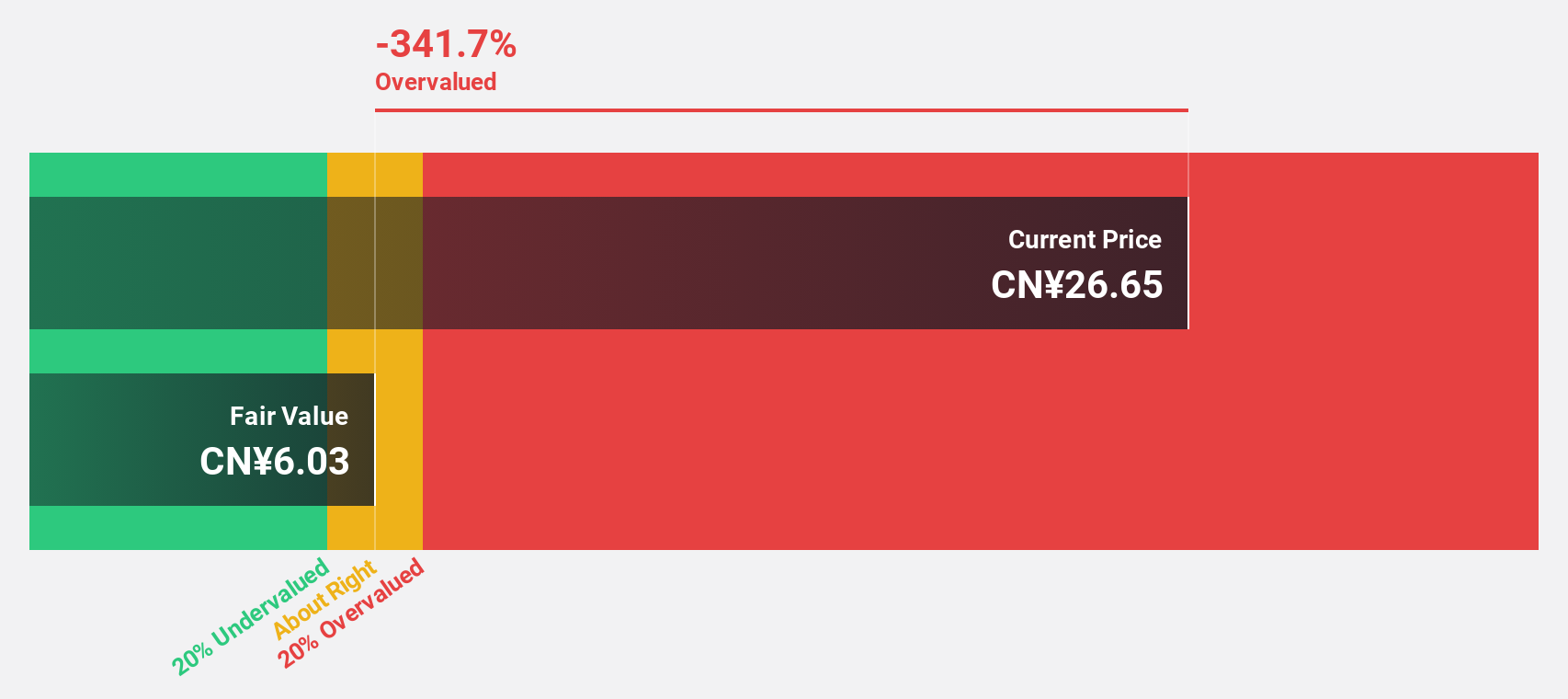

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the R&D, production, and sales of automotive wiring harness assemblies both in China and globally, with a market cap of CN¥13.88 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue through the development, manufacturing, and distribution of high and low voltage wiring harness assemblies for the automotive industry in domestic and international markets.

Estimated Discount To Fair Value: 29.4%

Kunshan Huguang Auto Harness Ltd. has shown a remarkable turnaround with net income reaching CNY 438.42 million for the nine months ending September 2024, compared to a net loss the previous year. The stock is trading at approximately 29.4% below its estimated fair value of CNY 46.87, highlighting potential undervaluation based on cash flows despite high debt levels. Revenue and earnings are forecasted to grow significantly, outpacing market averages in China.

- Our earnings growth report unveils the potential for significant increases in Kunshan Huguang Auto HarnessLtd's future results.

- Delve into the full analysis health report here for a deeper understanding of Kunshan Huguang Auto HarnessLtd.

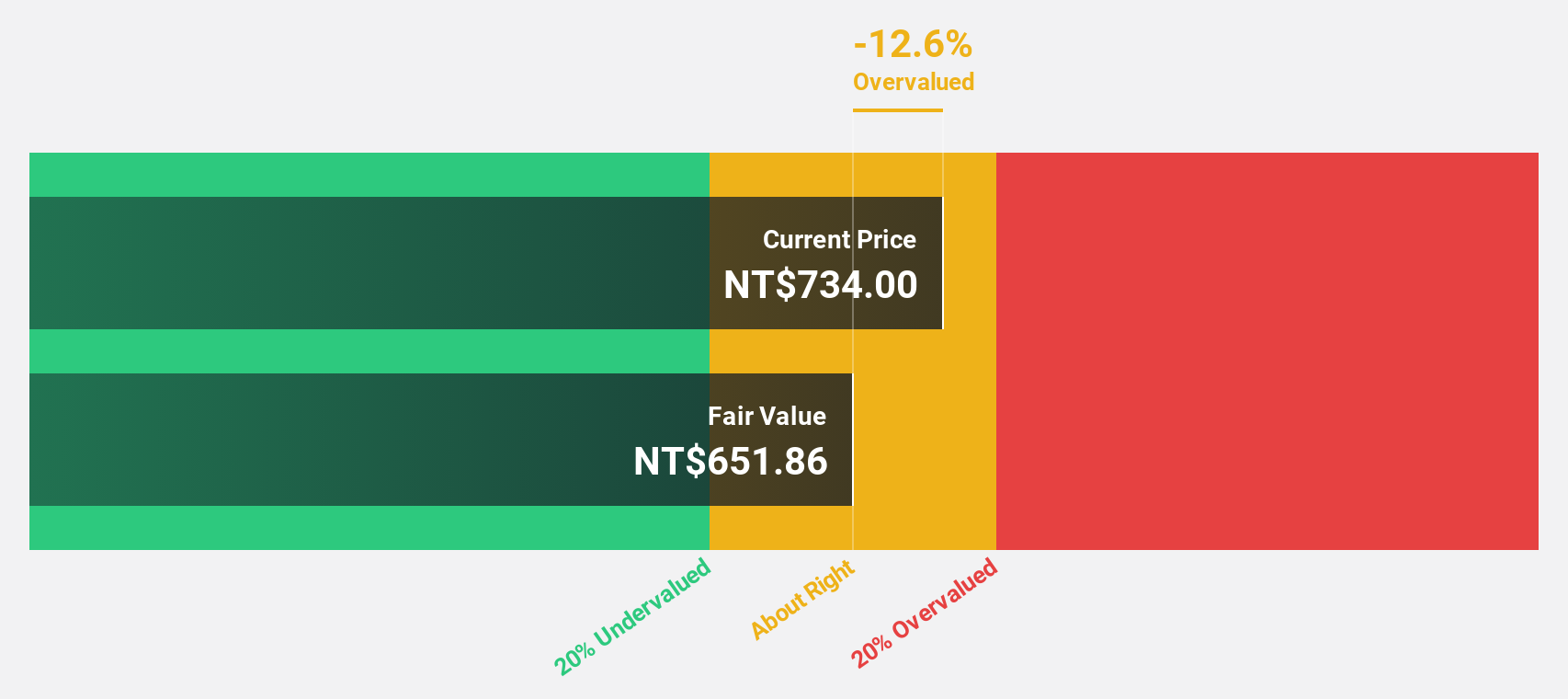

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. specializes in providing thermal solutions globally and has a market capitalization of NT$239.19 billion.

Operations: The company's revenue is derived from its Overseas Operating Department, which contributes NT$72.11 billion, and its Integrated Management Division, which generates NT$51.58 billion.

Estimated Discount To Fair Value: 34.9%

Asia Vital Components reported strong financial performance with net income for the third quarter reaching TWD 2.32 billion, up from TWD 1.43 billion a year ago. The stock is trading at approximately 34.9% below its estimated fair value of NT$964.34, indicating potential undervaluation based on cash flows. Earnings and revenue are expected to grow significantly at rates of 30.6% and 25.4% per year, respectively, outpacing the Taiwan market averages.

- The analysis detailed in our Asia Vital Components growth report hints at robust future financial performance.

- Take a closer look at Asia Vital Components' balance sheet health here in our report.

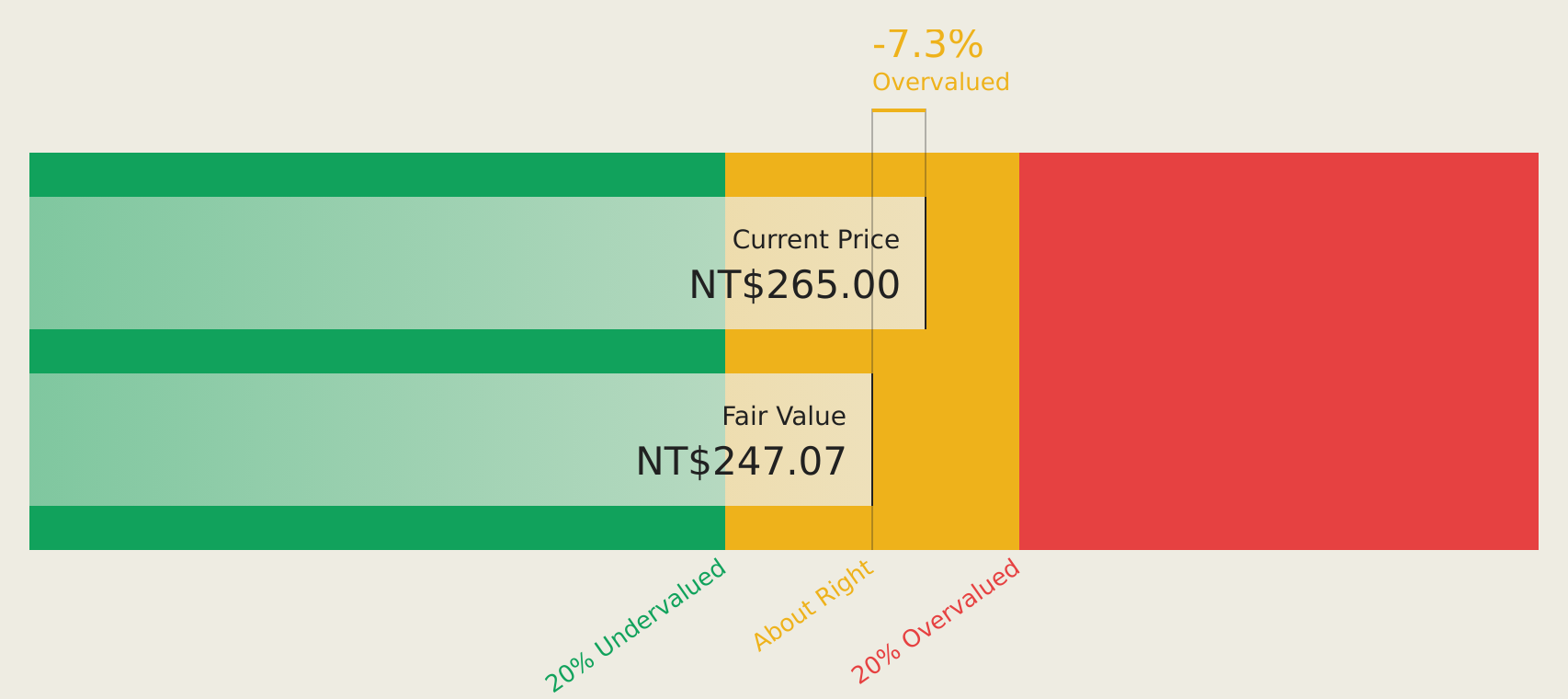

Ennoconn (TWSE:6414)

Overview: Ennoconn Corporation, along with its subsidiaries, engages in the research, design, development, manufacturing, and sale of data storage and processing equipment as well as industrial motherboards and network communication products across Taiwan, China, Europe, and other international markets; it has a market cap of approximately NT$39.84 billion.

Operations: The company's revenue segments include NT$54.61 billion from the Information Systems Department, NT$4.16 billion from the Network Communications Production and Sales Department, NT$26.93 billion from the Industrial Computer Software and Hardware Sales Department, and NT$60.85 billion from the Factory System and Electromechanical System Service Business Department.

Estimated Discount To Fair Value: 18.1%

Ennoconn's recent earnings report shows third-quarter sales increased to TWD 37.71 billion from TWD 29.96 billion, but net income declined to TWD 690.67 million from TWD 762.63 million a year ago, reflecting challenges despite revenue growth. The stock trades at approximately NT$294.5, about 18% below its fair value estimate of NT$359.37, suggesting undervaluation based on cash flows. Forecasts indicate significant annual profit growth of over 20%, though revenue growth is moderate at 14.1%.

- In light of our recent growth report, it seems possible that Ennoconn's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Ennoconn stock in this financial health report.

Turning Ideas Into Actions

- Reveal the 894 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with outstanding track record.