- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

NEXTIN Leads These 3 Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

In a year marked by mixed market performances and economic uncertainties, the S&P 500 Index managed to close with impressive gains despite a late-year slump, while small-cap indices like the Russell 2000 showed resilience with notable increases. Amid this backdrop, investors are increasingly seeking stocks with robust fundamentals that can weather economic fluctuations, making companies like NEXTIN and other undiscovered gems particularly appealing for their potential stability and growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Beijing Foyou PharmaLTD | 1.88% | 7.27% | 17.56% | ★★★★★★ |

| Anapass | 7.88% | 5.06% | 41.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 36.20% | 2.98% | 3.98% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

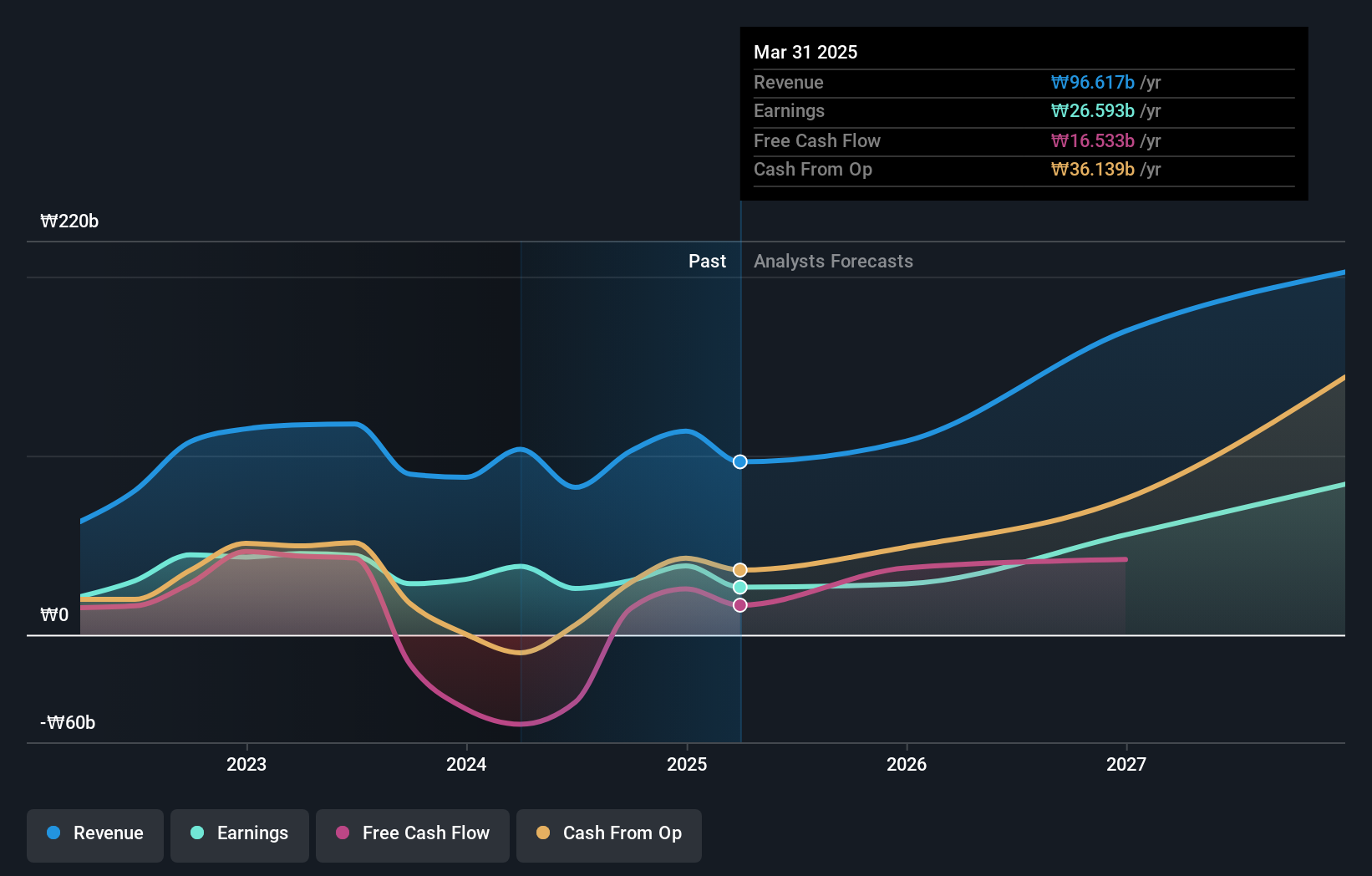

NEXTIN (KOSDAQ:A348210)

Simply Wall St Value Rating: ★★★★★★

Overview: NEXTIN, Inc. specializes in producing defect inspection and metrology systems for the semiconductor and display industries in South Korea, with a market cap of ₩550.94 billion.

Operations: The primary revenue stream for the company is its semiconductor equipment and services segment, generating ₩101.98 billion.

NEXTIN has been making strategic moves, including a recent share repurchase of 87,532 shares for KRW 4.99 billion, which might indicate confidence in its valuation. The company's earnings have shown resilience with a net income of KRW 9.13 billion in the third quarter compared to KRW 4.76 billion last year, despite negligible sales figures suggesting operational challenges or transitions. Its basic earnings per share increased to KRW 887 from KRW 471 year-on-year, reflecting improved profitability metrics amidst industry dynamics. Additionally, Advanced Process Systems Corporation's acquisition of a stake for KRW 27.8 billion highlights potential interest and value recognition within the market context.

- Delve into the full analysis health report here for a deeper understanding of NEXTIN.

Review our historical performance report to gain insights into NEXTIN's's past performance.

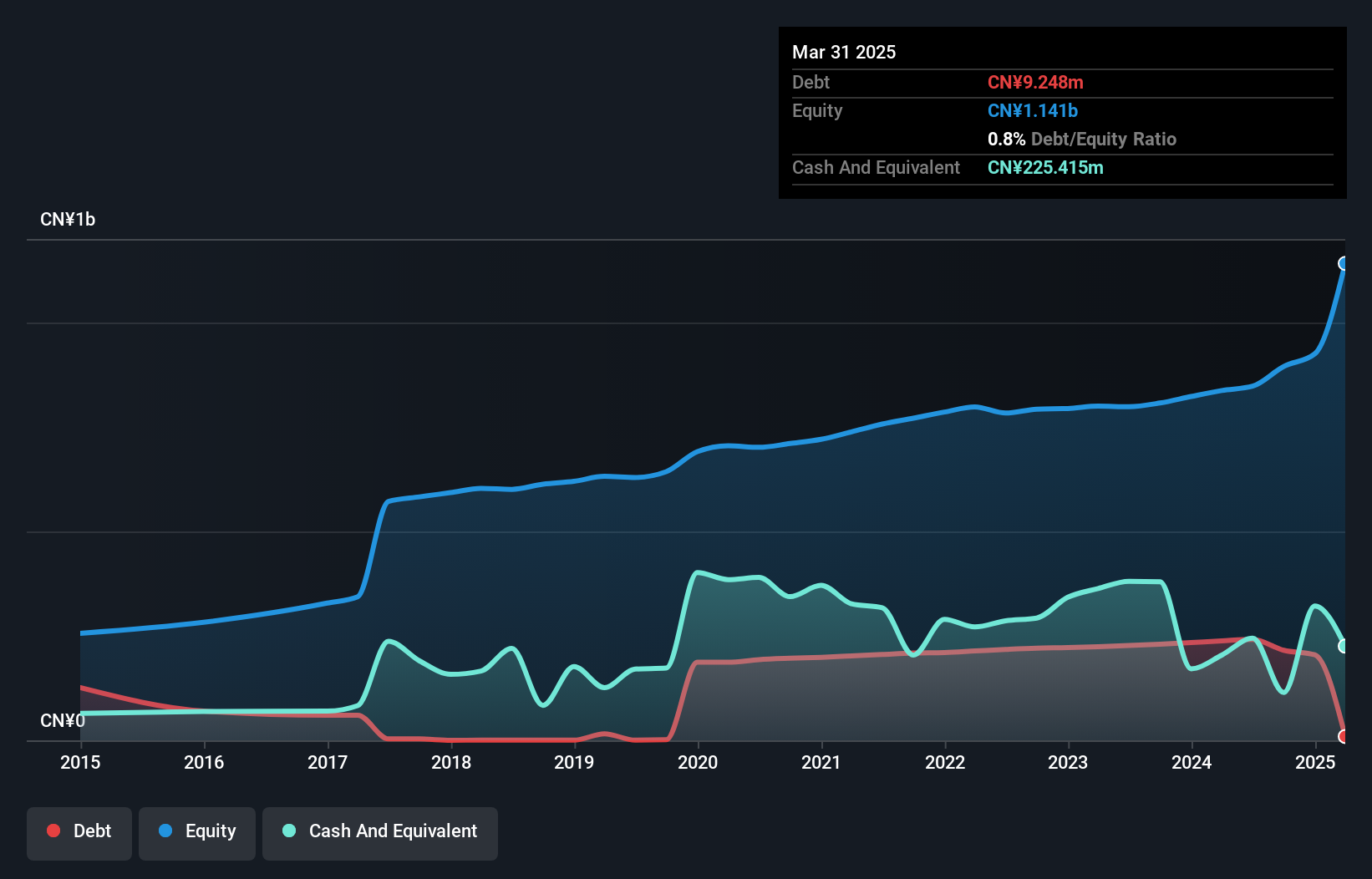

ZHEJIANG DIBAY ELECTRICLtd (SHSE:603320)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZHEJIANG DIBAY ELECTRIC CO., Ltd. focuses on the research, development, manufacture, and sale of sealed motors for household and commercial compressors in China, with a market cap of CN¥2.02 billion.

Operations: Dibay Electric generates revenue primarily from the sale of sealed motors for compressors. The company has a market capitalization of CN¥2.02 billion.

Zhejiang Dibay Electric, a smaller player in the machinery sector, showcases impressive growth with earnings rising 191.9% over the past year, outpacing the industry's -0.06%. Its price-to-earnings ratio of 29.9x remains attractive compared to the CN market's 32.8x, suggesting potential value for investors. The company's debt-to-equity ratio has climbed from 0.2% to 24.1% over five years but maintains a satisfactory net debt level at 11.3%. Recent financials reveal sales of CNY779 million and net income of CNY56 million for nine months ending September 2024, reflecting strong operational performance and profitability with positive free cash flow trends noted recently.

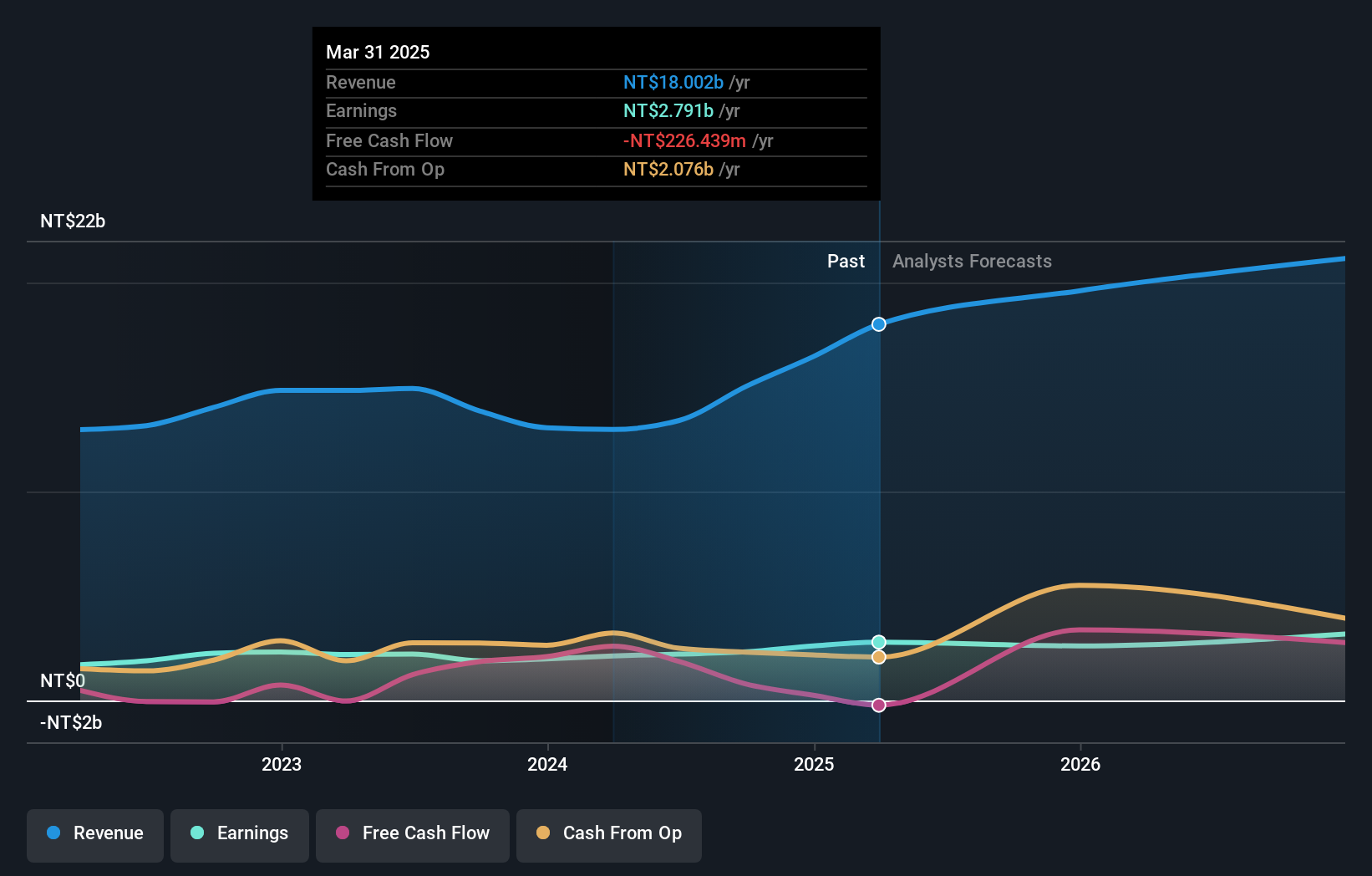

Foxsemicon Integrated Technology (TWSE:3413)

Simply Wall St Value Rating: ★★★★★★

Overview: Foxsemicon Integrated Technology Inc. specializes in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration across Taiwan, the United States, China, and other international markets with a market cap of NT$31.77 billion.

Operations: Foxsemicon generates revenue primarily from its semiconductor equipment and services segment, amounting to NT$15.03 billion. The company's financial performance is influenced by its cost structure and market presence across various regions.

Foxsemicon Integrated Technology, a player in the semiconductor industry, has shown robust performance with earnings growth of 22.4% over the past year, surpassing the industry's 5.9%. The company reported third-quarter sales of TWD 4.61 billion and net income of TWD 581.88 million, reflecting a solid increase from last year's figures. Despite shareholder dilution in the past year, it trades at an attractive valuation—26.7% below its estimated fair value—and boasts high-quality earnings with substantial non-cash components. Additionally, Foxsemicon's debt-to-equity ratio has improved from 29.2% to 16.7% over five years, indicating prudent financial management.

- Unlock comprehensive insights into our analysis of Foxsemicon Integrated Technology stock in this health report.

Understand Foxsemicon Integrated Technology's track record by examining our Past report.

Make It Happen

- Gain an insight into the universe of 4665 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives