- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices reflecting both gains and contractions, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts for signs of stability. Amidst these fluctuations, identifying stocks that may be undervalued becomes crucial as they present potential opportunities for growth when market sentiments stabilize. In this context, a good stock is one whose intrinsic value appears greater than its current market price, offering potential upside if broader economic conditions improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | US$30.89 | US$61.61 | 49.9% |

| Avant Group (TSE:3836) | ¥1877.00 | ¥3746.18 | 49.9% |

| Tourmaline Oil (TSX:TOU) | CA$66.79 | CA$133.01 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.69 | CN¥100.80 | 49.7% |

| Camden National (NasdaqGS:CAC) | US$42.08 | US$83.90 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$35.85 | US$71.62 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥41.99 | 49.9% |

| Constellium (NYSE:CSTM) | US$10.52 | US$20.92 | 49.7% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

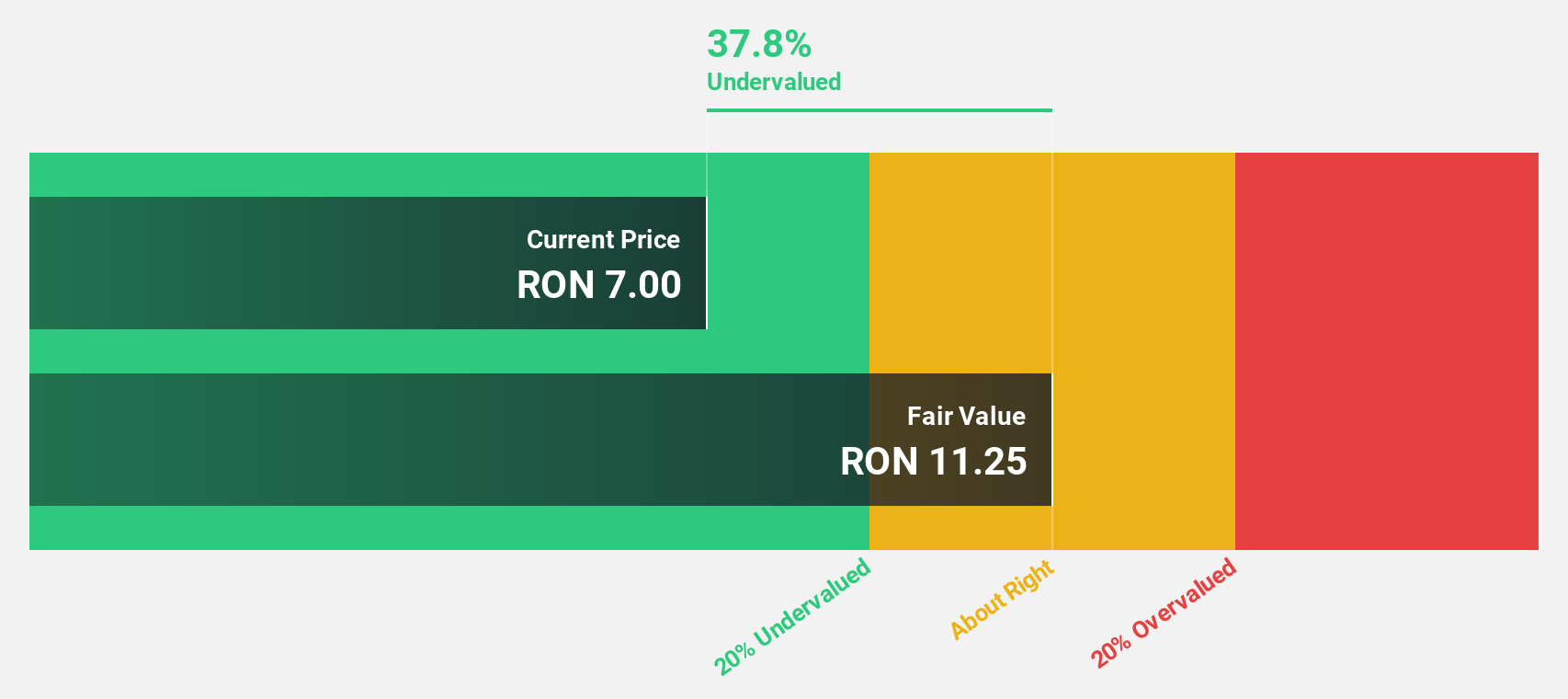

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is a Romanian company engaged in the exploration, production, and supply of natural gas, with a market cap of RON20 billion.

Operations: The company's revenue segments include Production at RON7.29 billion, Storage at RON552.61 million, and Electricity at RON588.62 million.

Estimated Discount To Fair Value: 36.9%

SNGN Romgaz is trading at 36.9% below its estimated fair value and is considered highly undervalued based on discounted cash flow analysis, with a current price of RON5.19 against a fair value estimate of RON8.22. The company's earnings are forecast to grow at 7.65% annually, outpacing the Romanian market's growth rate, while recent operational results show increased hydrocarbon and electricity production despite slightly lower sales figures compared to the previous year.

- Insights from our recent growth report point to a promising forecast for SNGN Romgaz's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of SNGN Romgaz.

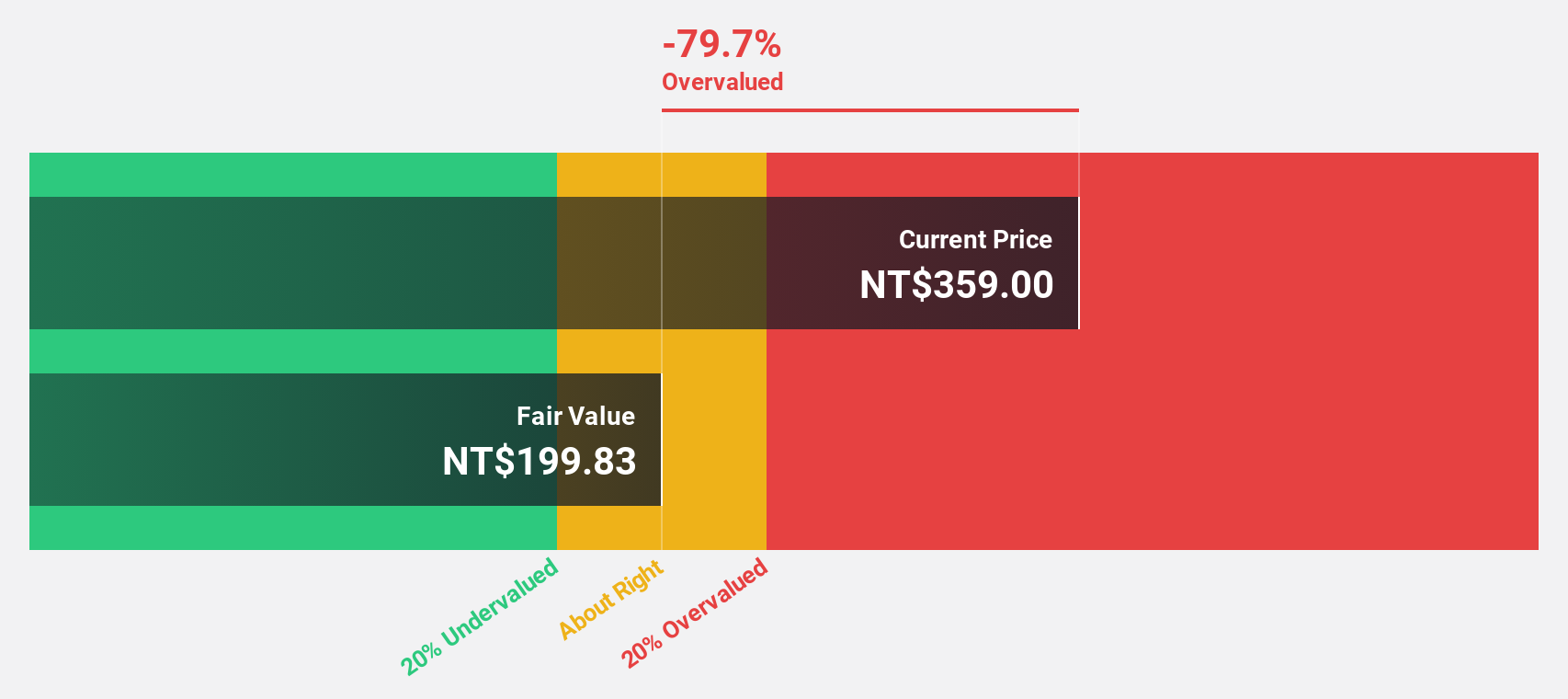

All Ring Tech (TPEX:6187)

Overview: All Ring Tech Co., Ltd. designs, manufactures, and assembles automation machines in Taiwan and China, with a market cap of NT$37.77 billion.

Operations: The company's revenue segments include NT$684.53 million from WAN Run Jing Ji Co., Ltd. and NT$4.40 billion from All Ring Technology Co., Ltd.

Estimated Discount To Fair Value: 45.2%

All Ring Tech is trading at NT$411.5, significantly below its estimated fair value of NT$750.7, highlighting its undervaluation based on discounted cash flow analysis. The company reported substantial earnings growth with net income reaching TWD 452.23 million for Q3 2024, up from TWD 28.76 million a year ago. Future earnings are projected to grow over 26% annually, surpassing the Taiwan market's average growth rate despite recent share price volatility and past shareholder dilution.

- In light of our recent growth report, it seems possible that All Ring Tech's financial performance will exceed current levels.

- Take a closer look at All Ring Tech's balance sheet health here in our report.

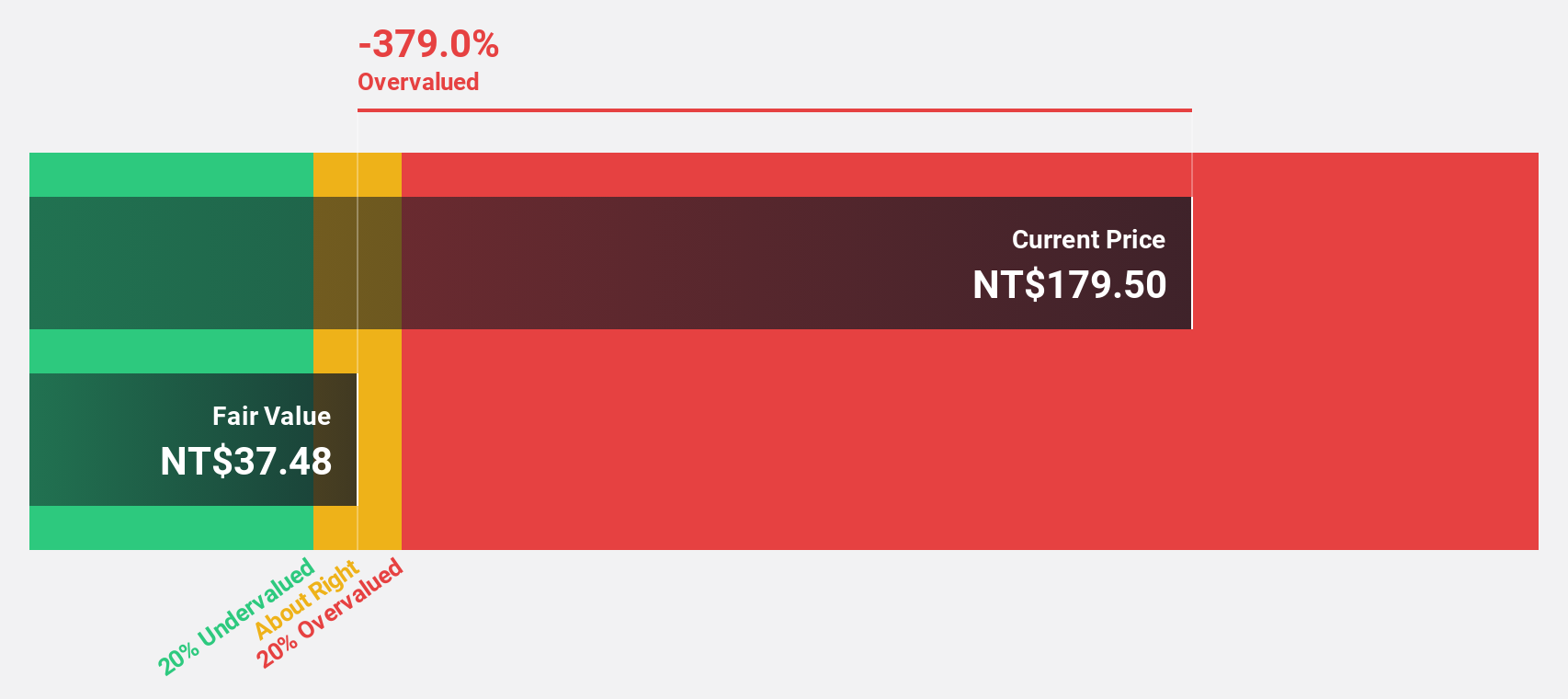

Shihlin Electric & Engineering (TWSE:1503)

Overview: Shihlin Electric & Engineering Corp. engages in the manufacturing and sale of heavy electrical equipment, electrical machinery, and automotive equipment across Taiwan, Mainland China, Vietnam, and international markets, with a market cap of NT$99.77 billion.

Operations: The company's revenue segments include NT$23.12 billion from Power Distribution, NT$5.96 billion from Vehicle Parts, and NT$3.44 billion from Automation Equipment and Spare Parts Department.

Estimated Discount To Fair Value: 44.2%

Shihlin Electric & Engineering is trading at NT$194.5, well below its estimated fair value of NT$348.85, showing significant undervaluation based on discounted cash flow analysis. Recent earnings reports indicate solid performance with Q3 2024 net income rising to TWD 702.4 million from TWD 669.38 million a year ago and revenue increasing to TWD 8,062.44 million from TWD 7,700.43 million. Earnings are forecasted to grow substantially at over 34% annually, outpacing the Taiwan market average growth rate.

- The analysis detailed in our Shihlin Electric & Engineering growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Shihlin Electric & Engineering.

Summing It All Up

- Get an in-depth perspective on all 894 Undervalued Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives