- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

Discovering HeBei Jinniu Chemical IndustryLtd And Two More Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 Index marking a strong two-year stretch despite recent volatility and economic indicators showing both strengths and weaknesses, small-cap stocks continue to capture investor interest. In this dynamic environment, identifying promising small-cap companies like HeBei Jinniu Chemical Industry Ltd., which may offer unique growth opportunities amidst broader market fluctuations, can be key to uncovering potential investment gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Beijing Foyou PharmaLTD | 1.88% | 7.27% | 17.56% | ★★★★★★ |

| Anapass | 7.88% | 5.06% | 41.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 36.20% | 2.98% | 3.98% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

HeBei Jinniu Chemical IndustryLtd (SHSE:600722)

Simply Wall St Value Rating: ★★★★★★

Overview: HeBei Jinniu Chemical Industry Co., Ltd, along with its subsidiaries, is involved in the production and operation of methanol products in China and has a market capitalization of CN¥3.21 billion.

Operations: The company generates revenue primarily from the production and sale of methanol products. It operates within the chemical industry in China, with financial data reflecting a market capitalization of CN¥3.21 billion.

In the realm of under-the-radar stocks, HeBei Jinniu Chemical Industry Ltd. stands out with its robust financial health and promising performance. The company is debt-free, which eliminates concerns over interest coverage and positions it well for future opportunities. Over the past year, earnings grew by 5.6%, surpassing the Chemicals industry's -4.7% performance decline, indicating resilience in a challenging sector. Recent results show net income at CNY 38.96 million for nine months ended September 2024, up from CNY 29.18 million a year ago, reflecting improved profitability despite slightly lower sales of CNY 365.17 million compared to CNY 366.15 million previously.

All Ring Tech (TPEX:6187)

Simply Wall St Value Rating: ★★★★★☆

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market capitalization of NT$37.77 billion.

Operations: All Ring Tech generates revenue primarily from All Ring Technology Co., Ltd. (NT$4.40 billion) and WAN Run Jing Ji Co., Ltd. (NT$684.53 million).

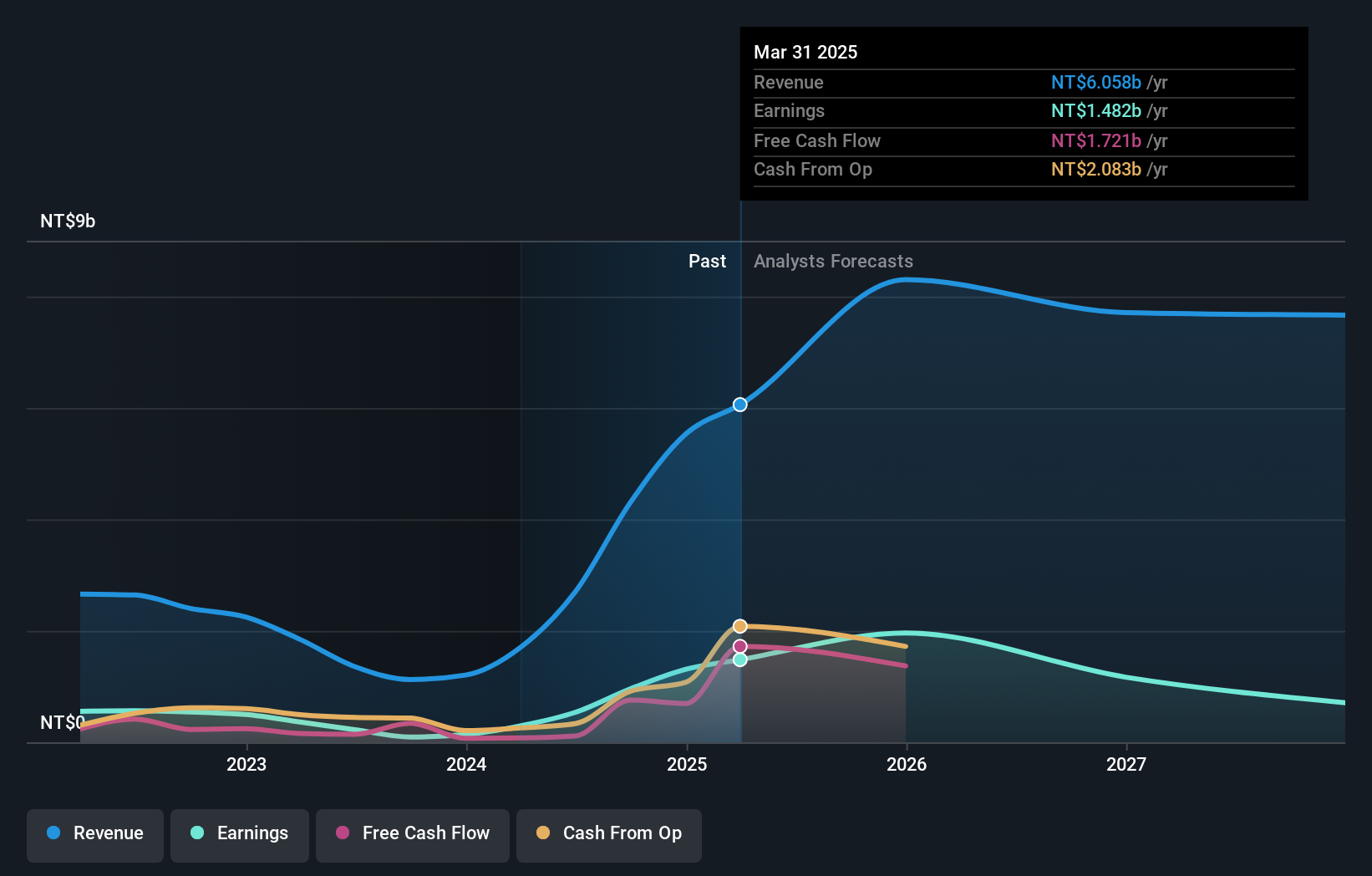

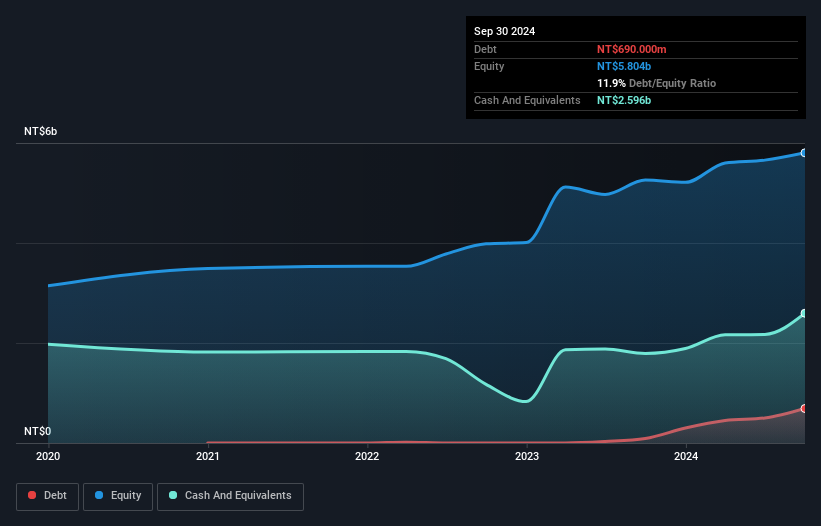

All Ring Tech, a smaller player in the tech industry, has showcased impressive growth with earnings surging 906% over the past year, far outpacing the electronic sector's average. The company reported third-quarter sales of TWD 1.94 billion and net income of TWD 452 million, reflecting significant improvement from last year's figures. Despite a volatile share price recently, All Ring Tech is trading at an attractive valuation—45% below its estimated fair value. With high-quality earnings and more cash than debt, it remains well-positioned financially while actively engaging in industry events to boost visibility and future prospects.

- Dive into the specifics of All Ring Tech here with our thorough health report.

Explore historical data to track All Ring Tech's performance over time in our Past section.

Arizon RFID Technology (Cayman) (TWSE:6863)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arizon RFID Technology (Cayman) Co., Ltd., along with its subsidiaries, is involved in the design, development, manufacturing, and trading of radio-frequency identification systems across Taiwan, China, and international markets with a market cap of NT$17.71 billion.

Operations: Arizon's primary revenue stream comes from its wireless communications equipment segment, generating NT$4.09 billion.

Arizon RFID Technology (Cayman) has shown impressive growth, with earnings soaring 83.9% over the past year, outpacing the Communications industry. Their recent quarterly report highlights sales of TWD 1,149.94 million and net income of TWD 171.09 million, both significantly higher than last year's figures. The company boasts a favorable price-to-earnings ratio of 25.4x compared to the industry average of 32.8x, suggesting potential value for investors. Despite a highly volatile share price recently and negative levered free cash flow in recent quarters (-TWD 393.96 million as of September), Arizon's profitability and strong cash position offer a promising outlook for future performance within its niche market segment.

- Unlock comprehensive insights into our analysis of Arizon RFID Technology (Cayman) stock in this health report.

Understand Arizon RFID Technology (Cayman)'s track record by examining our Past report.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4665 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives