- China

- /

- Semiconductors

- /

- SHSE:603160

Shenzhen Goodix Technology Co., Ltd. (SHSE:603160) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Those holding Shenzhen Goodix Technology Co., Ltd. (SHSE:603160) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

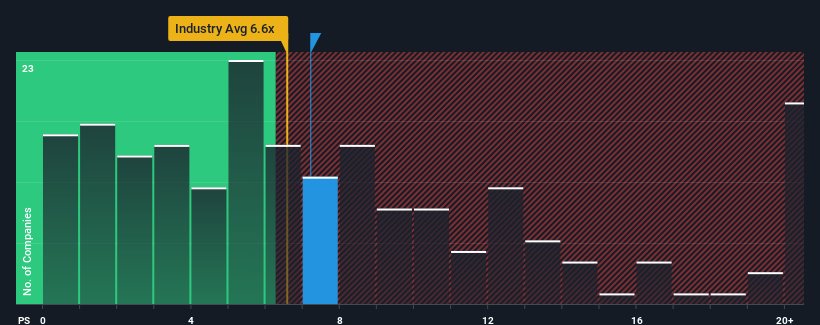

Even after such a large jump in price, it's still not a stretch to say that Shenzhen Goodix Technology's price-to-sales (or "P/S") ratio of 7.2x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in China, where the median P/S ratio is around 6.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Shenzhen Goodix Technology

How Has Shenzhen Goodix Technology Performed Recently?

Shenzhen Goodix Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Goodix Technology.Is There Some Revenue Growth Forecasted For Shenzhen Goodix Technology?

The only time you'd be comfortable seeing a P/S like Shenzhen Goodix Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 41% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 20,706% growth forecast for the broader industry.

With this in mind, we find it intriguing that Shenzhen Goodix Technology's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Shenzhen Goodix Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Shenzhen Goodix Technology's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Shenzhen Goodix Technology with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Shenzhen Goodix Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603160

Shenzhen Goodix Technology

Operates as an integrated solution provider for applications based on integrated circuit (IC) design and software development in China and internationally.

Excellent balance sheet with moderate growth potential.