January 2025's Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a period of optimism fueled by easing inflation and strong earnings reports, particularly in the U.S. where major stock indexes have rebounded significantly. With value stocks outperforming growth shares and central banks cautiously navigating interest rate policies, investors are keenly eyeing opportunities to identify stocks trading below their fair value. In such an environment, a good stock is often characterized by solid fundamentals and potential for growth that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.31 | 49.7% |

| Fudo Tetra (TSE:1813) | ¥2150.00 | ¥4294.32 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥10.72 | CN¥21.42 | 49.9% |

| Stille (OM:STIL) | SEK228.00 | SEK453.79 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.54 | €5.06 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5851.00 | ¥11653.40 | 49.8% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.10 | CN¥18.17 | 49.9% |

| Equifax (NYSE:EFX) | US$268.88 | US$535.98 | 49.8% |

| BATM Advanced Communications (LSE:BVC) | £0.19 | £0.38 | 49.8% |

| RXO (NYSE:RXO) | US$26.19 | US$52.36 | 50% |

We're going to check out a few of the best picks from our screener tool.

Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707)

Overview: Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on biochemical products, with a market cap of CN¥21.28 billion.

Operations: Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd.'s revenue segments primarily comprise its operations in the pharmaceutical industry, focusing on biochemical products.

Estimated Discount To Fair Value: 48.9%

Nanjing King-Friend Biochemical Pharmaceutical Ltd. trades at CN¥13.48, significantly below its estimated fair value of CN¥26.38, indicating it is undervalued based on cash flows. Despite a decline in recent earnings, with net income dropping to CN¥605.78 million from CN¥839.31 million year-over-year, the company's revenue is forecast to grow 25.5% annually, outpacing market growth and supporting future profitability within three years according to analyst consensus estimates.

- Upon reviewing our latest growth report, Nanjing King-Friend Biochemical PharmaceuticalLtd's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nanjing King-Friend Biochemical PharmaceuticalLtd with our comprehensive financial health report here.

Shenzhen Yinghe Technology (SZSE:300457)

Overview: Shenzhen Yinghe Technology Co., Ltd focuses on the R&D, production, and sale of lithium-ion battery automation equipment in China, with a market cap of CN¥11.69 billion.

Operations: Shenzhen Yinghe Technology Co., Ltd generates its revenue from the development, manufacturing, and distribution of automation equipment for lithium-ion batteries in China.

Estimated Discount To Fair Value: 49.5%

Shenzhen Yinghe Technology trades at CN¥18.8, well below its estimated fair value of CN¥37.25, suggesting significant undervaluation based on cash flows. Recent earnings showed a slight decline with net income at CN¥495.79 million compared to the previous year's CNY 510.75 million, yet revenue and earnings are forecasted to grow significantly above market rates annually. The company announced a share buyback program worth up to CNY 200 million, enhancing shareholder value potential.

- Our comprehensive growth report raises the possibility that Shenzhen Yinghe Technology is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Yinghe Technology.

Zhejiang Tianyu Pharmaceutical (SZSE:300702)

Overview: Zhejiang Tianyu Pharmaceutical Co., Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical intermediates and APIs both in China and internationally, with a market cap of CN¥5.87 billion.

Operations: Zhejiang Tianyu Pharmaceutical Co., Ltd. generates revenue through its activities in pharmaceutical intermediates and active pharmaceutical ingredients (APIs) across domestic and international markets.

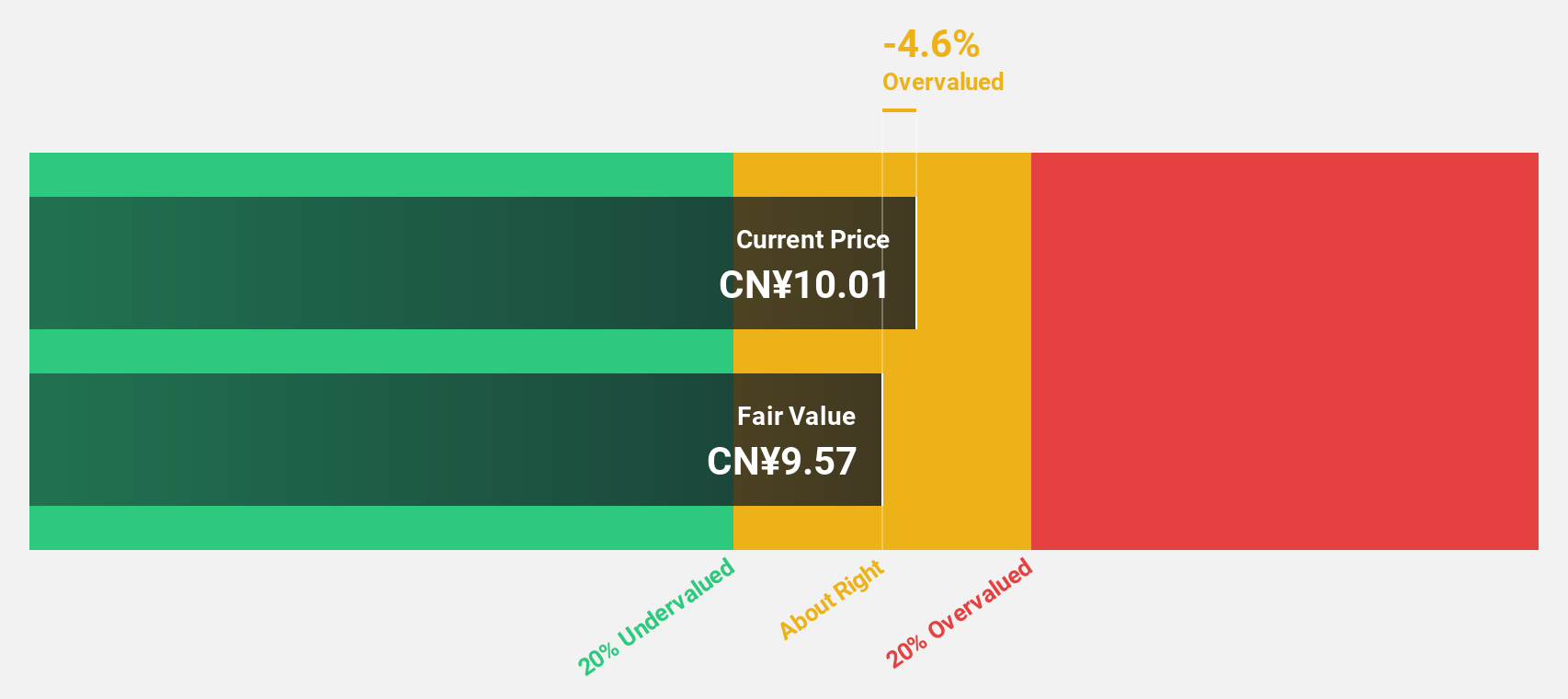

Estimated Discount To Fair Value: 49.6%

Zhejiang Tianyu Pharmaceutical trades at CN¥17.25, significantly below its estimated fair value of CN¥34.21, indicating undervaluation based on cash flows. The company became profitable this year and reported nine-month sales of CNY 1.93 billion, up from CNY 1.86 billion last year, with net income rising to CN¥85.11 million from CN¥68.8 million. Earnings are expected to grow substantially faster than both revenue and the market average over the next three years despite low forecasted return on equity.

- The analysis detailed in our Zhejiang Tianyu Pharmaceutical growth report hints at robust future financial performance.

- Get an in-depth perspective on Zhejiang Tianyu Pharmaceutical's balance sheet by reading our health report here.

Key Takeaways

- Discover the full array of 872 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

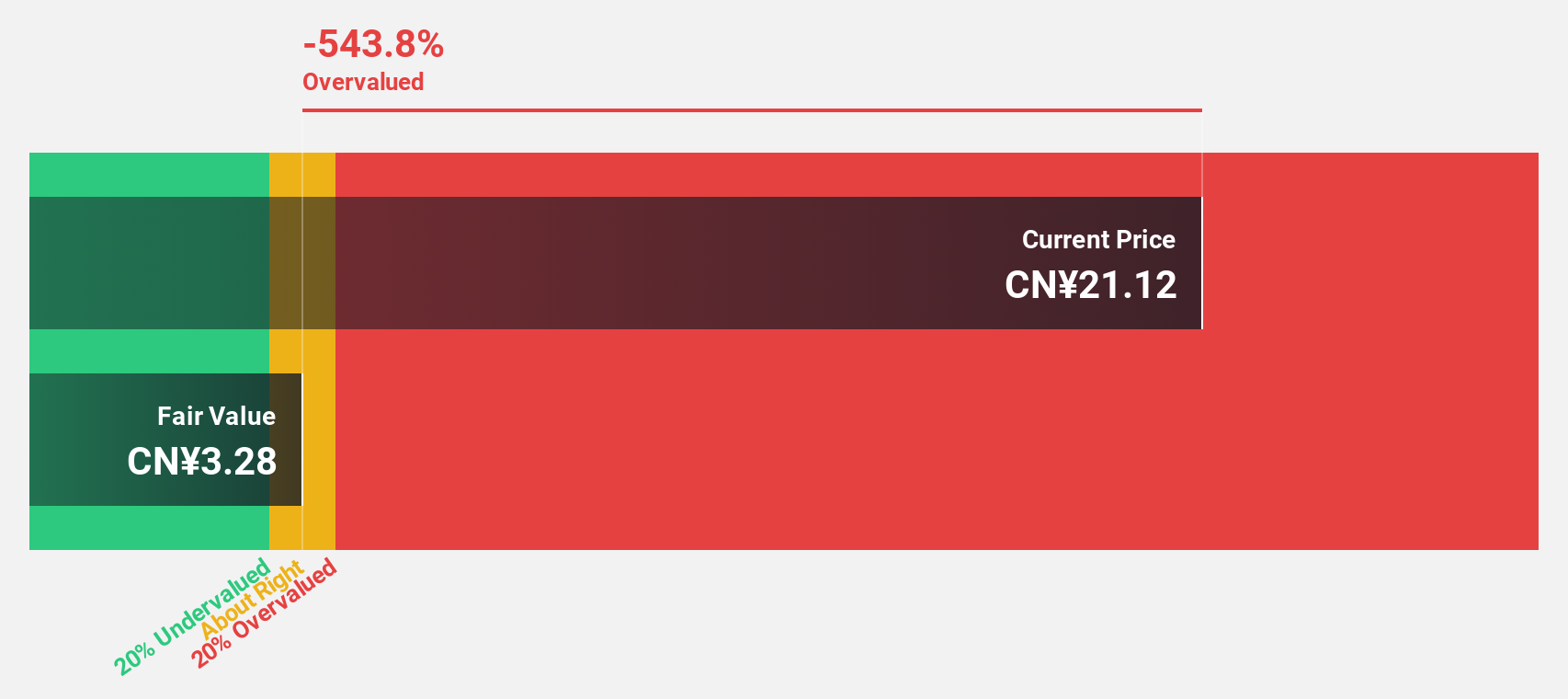

Discover if Zhejiang Tianyu Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300702

Zhejiang Tianyu Pharmaceutical

Engages in the research, development, manufacture, and sale of pharmaceutical intermediates and APIs in China and internationally.

Reasonable growth potential with adequate balance sheet.