As global markets experience a boost from cooling inflation and robust bank earnings, investors are increasingly focused on identifying promising opportunities within the equity landscape. In this environment, growth companies with high insider ownership can be particularly appealing, as significant insider stakes often indicate confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's uncover some gems from our specialized screener.

Hunan Zhongke Electric (SZSE:300035)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Zhongke Electric Co., Ltd. manufactures electromagnetic metallurgy products in China and has a market cap of CN¥10.06 billion.

Operations: Hunan Zhongke Electric Co., Ltd. generates its revenue primarily from manufacturing electromagnetic metallurgy products in China.

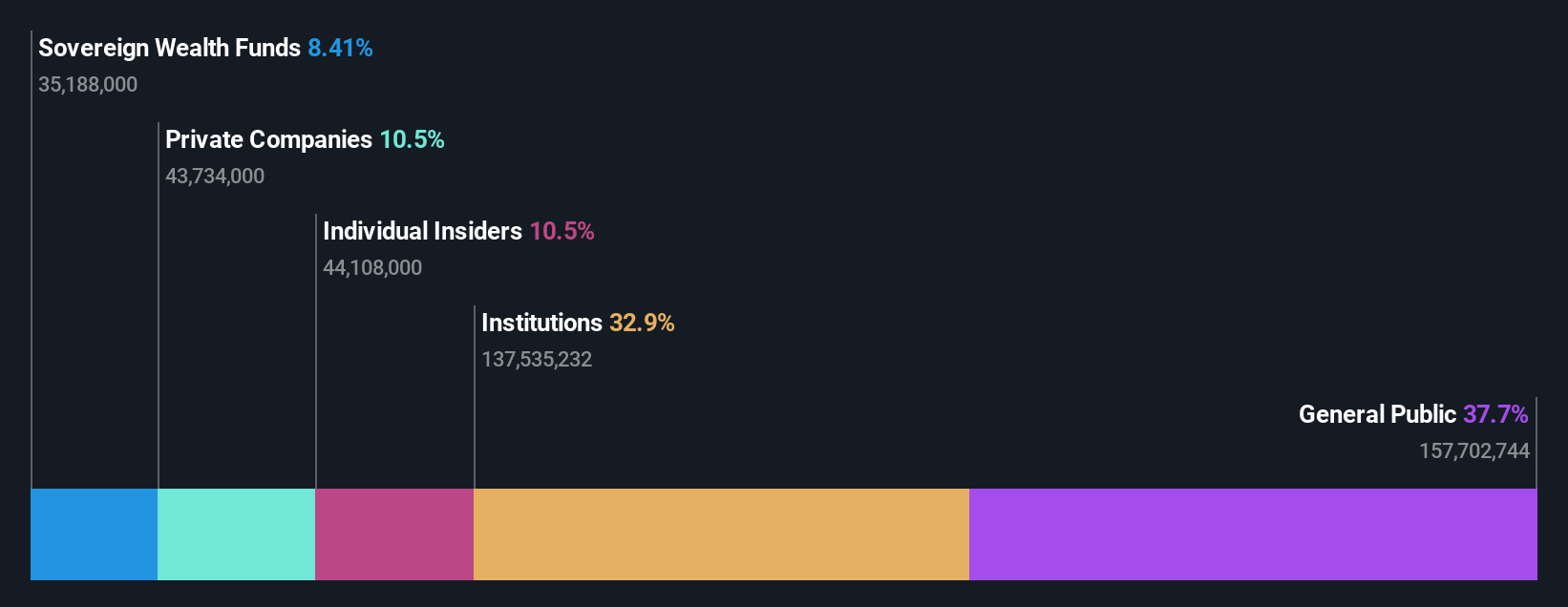

Insider Ownership: 20.1%

Revenue Growth Forecast: 23.5% p.a.

Hunan Zhongke Electric is experiencing robust growth, with revenue forecasted to increase by 23.5% annually, outpacing the Chinese market's 13.4%. Earnings are expected to grow significantly at 49.2% per year, surpassing the market's 25.1%. The company became profitable this year but has an unstable dividend track record and debt not well covered by operating cash flow. Recent earnings showed a net income of CNY 183.57 million compared to a previous loss, indicating financial improvement.

- Delve into the full analysis future growth report here for a deeper understanding of Hunan Zhongke Electric.

- The valuation report we've compiled suggests that Hunan Zhongke Electric's current price could be inflated.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. provides geographic information system (GIS) and geospatial intelligence software products and services both in China and internationally, with a market cap of CN¥7.88 billion.

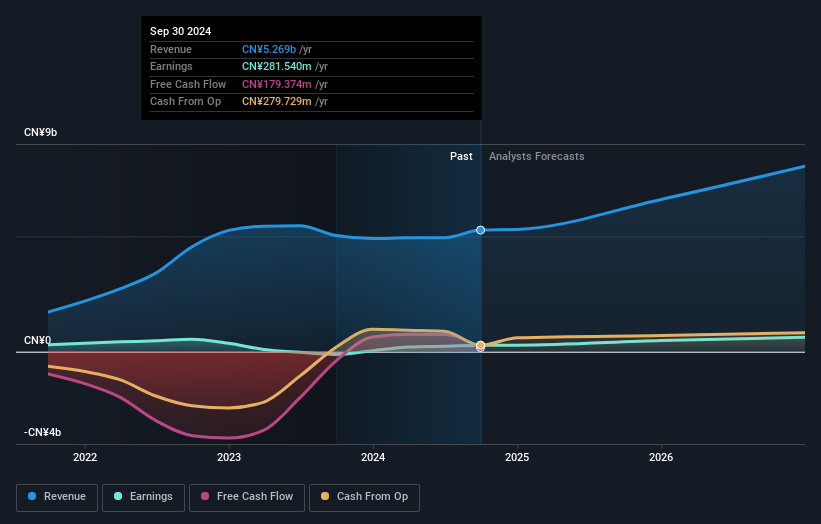

Operations: Revenue Segments (in millions of CN¥): null

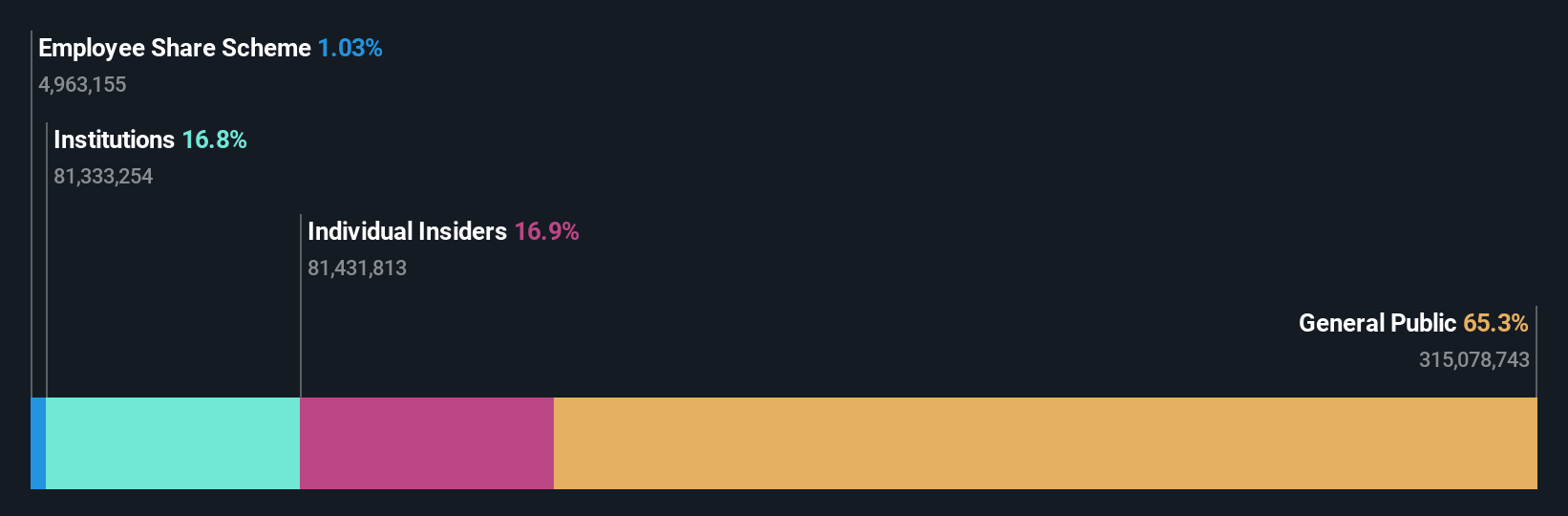

Insider Ownership: 17%

Revenue Growth Forecast: 24.4% p.a.

Beijing SuperMap Software is poised for significant growth, with revenue expected to increase by 24.4% annually, surpassing the Chinese market's 13.4%. Earnings are forecasted to grow at a substantial rate of 54.2% per year, though recent results show a decline in net income to CNY 26.31 million from CNY 135.44 million last year. While trading at good value compared to peers, its dividend yield of 0.61% is not well covered by earnings or cash flow.

- Unlock comprehensive insights into our analysis of Beijing SuperMap Software stock in this growth report.

- Our expertly prepared valuation report Beijing SuperMap Software implies its share price may be lower than expected.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is involved in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of ¥1.38 trillion.

Operations: Revenue Segments (in millions of ¥): Home video games: ¥75,000, Online games: ¥25,000, Mobile games: ¥10,000, Arcade games: ¥5,000. Capcom generates revenue primarily from home video games at ¥75 billion followed by online games at ¥25 billion and mobile and arcade games contributing smaller portions.

Insider Ownership: 10.6%

Revenue Growth Forecast: 10.2% p.a.

Capcom's growth outlook shows revenue is expected to rise by 10.2% annually, outpacing Japan's market average of 4.3%, while earnings are projected to grow at 15.6% per year, exceeding the national benchmark of 8%. Despite no recent insider trading activity, its high forecasted return on equity of 20% in three years suggests strong potential for value creation. However, revenue and earnings growth rates remain below significant thresholds for rapid expansion expectations.

- Take a closer look at Capcom's potential here in our earnings growth report.

- According our valuation report, there's an indication that Capcom's share price might be on the expensive side.

Next Steps

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1462 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SuperMap Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300036

Beijing SuperMap Software

Offers geographic information system (GIS) and geospatial intelligence software products and services in China and internationally.

High growth potential with adequate balance sheet.