As global markets show resilience with easing core U.S. inflation and robust bank earnings driving major indices higher, small-cap stocks have also been gaining traction. The S&P MidCap 400 and Russell 2000 indices have posted notable gains, reflecting increased investor interest in smaller companies amid cooling inflationary pressures. In this environment, identifying promising small-cap stocks involves looking for those with strong fundamentals and the potential to thrive as economic conditions stabilize.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Beijing ZZNode Technologies (SZSE:003007)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing ZZNode Technologies Co., Ltd. specializes in delivering operation support system software and solutions for information networks and IT infrastructure to telecom operators and large enterprises in China, with a market cap of CN¥2.91 billion.

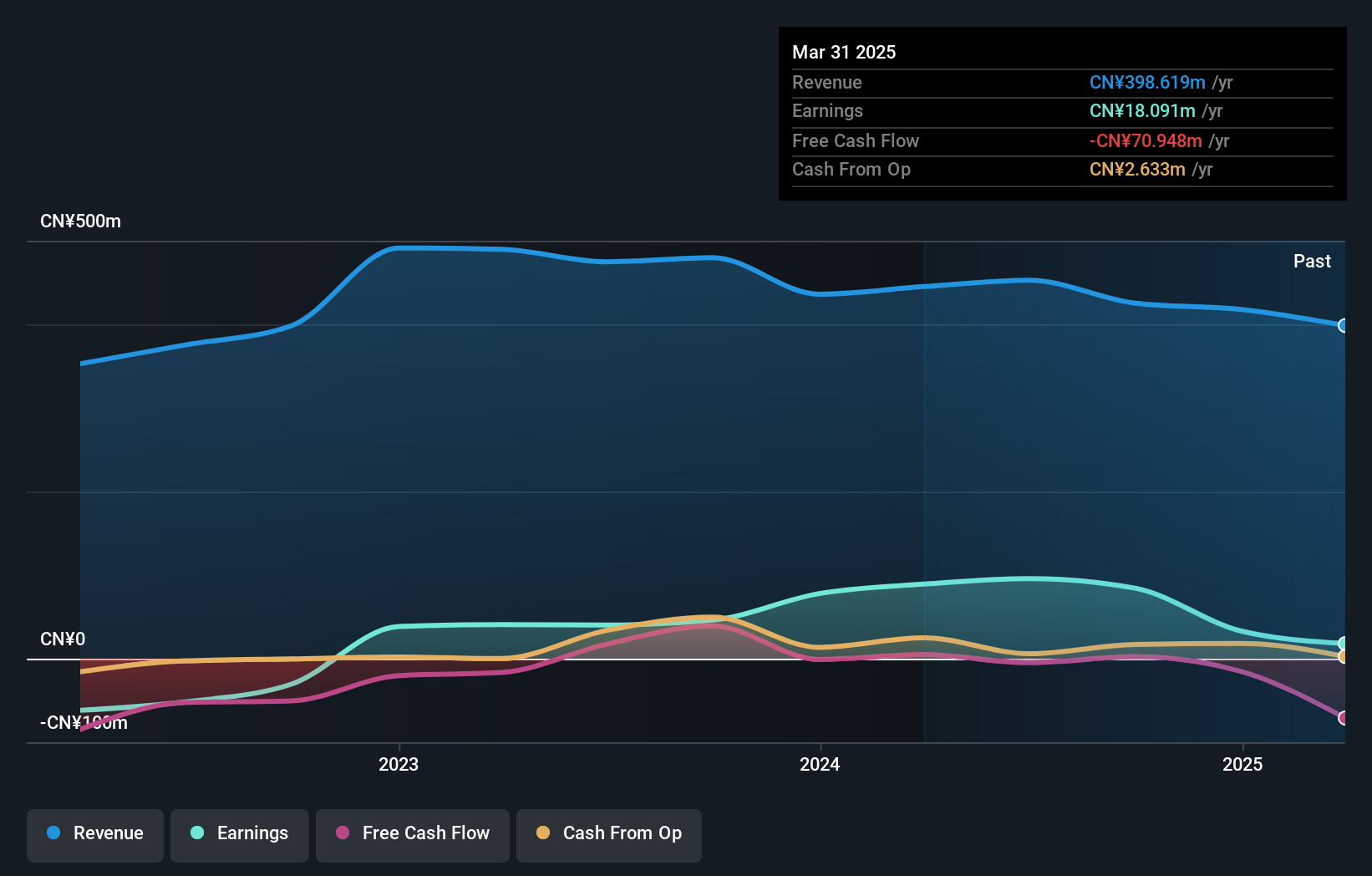

Operations: ZZNode Technologies generates revenue primarily from providing software and solutions for telecom operators and large enterprises. The company's revenue streams are focused on operation support systems within the IT infrastructure sector. Gross profit margin trends have shown variability, reflecting changes in cost structure or pricing strategies over time.

Beijing ZZNode Technologies, a smaller player in the software sector, shows potential with its price-to-earnings ratio at 36x, notably below the industry average of 84x. The company has successfully reduced its debt-to-equity ratio from 0.3% to 0.2% over five years and boasts high-quality earnings. Despite reporting a net loss of CNY 40.71 million for the first nine months of 2024, this figure is an improvement from the previous year's CNY 47.18 million loss. With earnings growth outpacing the industry by a significant margin at 82%, it seems poised for recovery amidst financial challenges and strategic meetings aimed at securing project guarantees.

- Click to explore a detailed breakdown of our findings in Beijing ZZNode Technologies' health report.

Gain insights into Beijing ZZNode Technologies' past trends and performance with our Past report.

XGD (SZSE:300130)

Simply Wall St Value Rating: ★★★★★★

Overview: XGD Inc. is engaged in the research, development, manufacturing, sales, and servicing of payment terminals both in China and internationally, with a market capitalization of approximately CN¥11.58 billion.

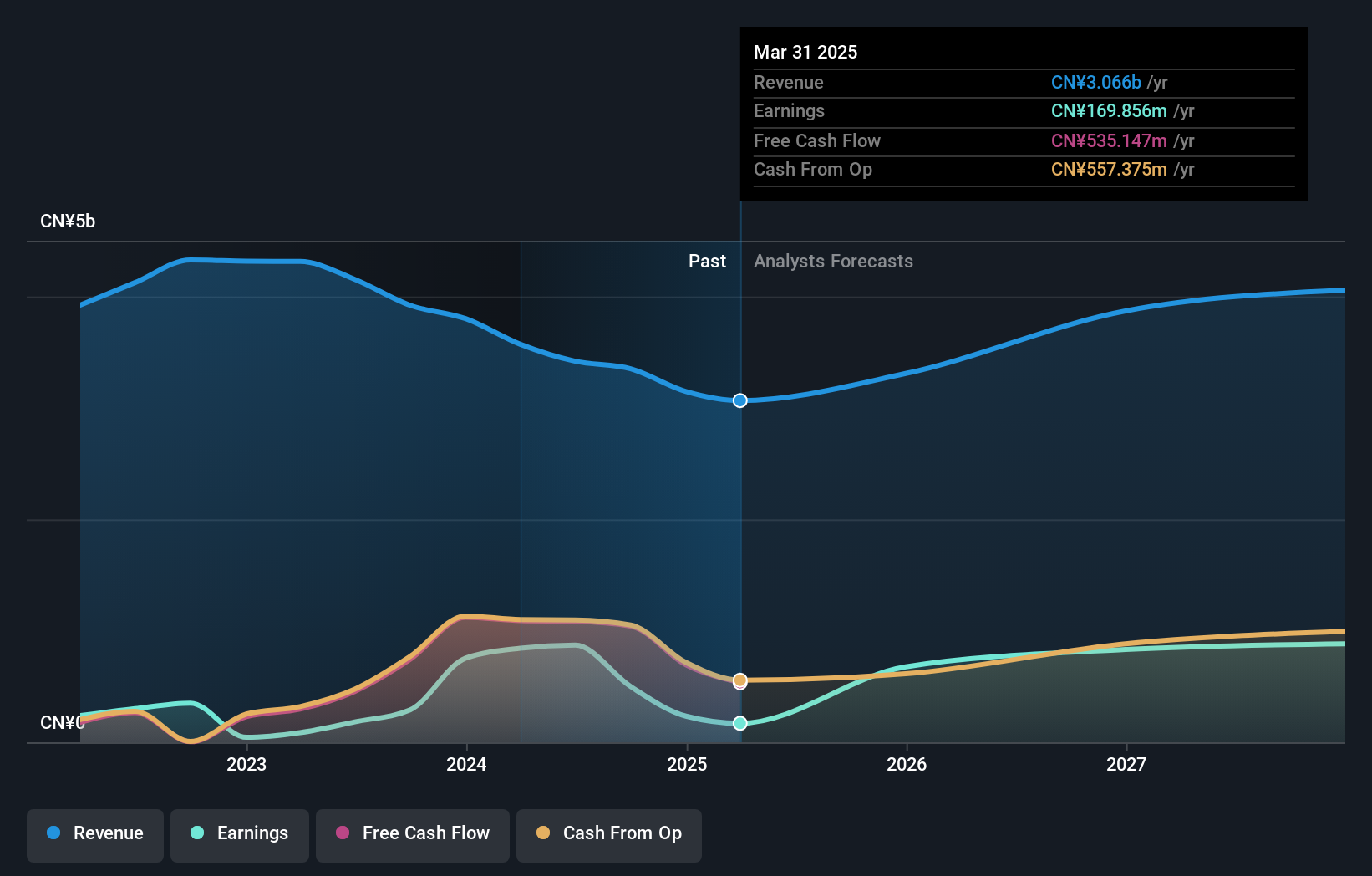

Operations: XGD generates revenue primarily through the sale and servicing of payment terminals, both domestically and internationally. The company's net profit margin has shown a notable trend over recent periods, reflecting its operational efficiency in managing production and sales costs.

XGD, a compact player in the electronics sector, has shown robust growth with its earnings surging by 71.8% over the past year, outpacing the industry average of 2.3%. Trading at 61.3% below its estimated fair value suggests it offers good relative value compared to peers. The company's debt-to-equity ratio improved significantly from 12.5% to 6% over five years, indicating prudent financial management. Despite these strengths, recent reports show a dip in net income to CNY 297 million from CNY 552 million last year and basic earnings per share halved to CNY 0.53, highlighting some challenges ahead for XGD's profitability trajectory.

- Navigate through the intricacies of XGD with our comprehensive health report here.

Gain insights into XGD's historical performance by reviewing our past performance report.

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuburaya Fields Holdings Inc. operates in content-related businesses in Japan and has a market capitalization of approximately ¥112.28 billion.

Operations: The company generates revenue primarily from its PS Business Segment, which accounts for ¥103.77 billion, and the Content & Digital Business Segment, contributing ¥15.92 billion.

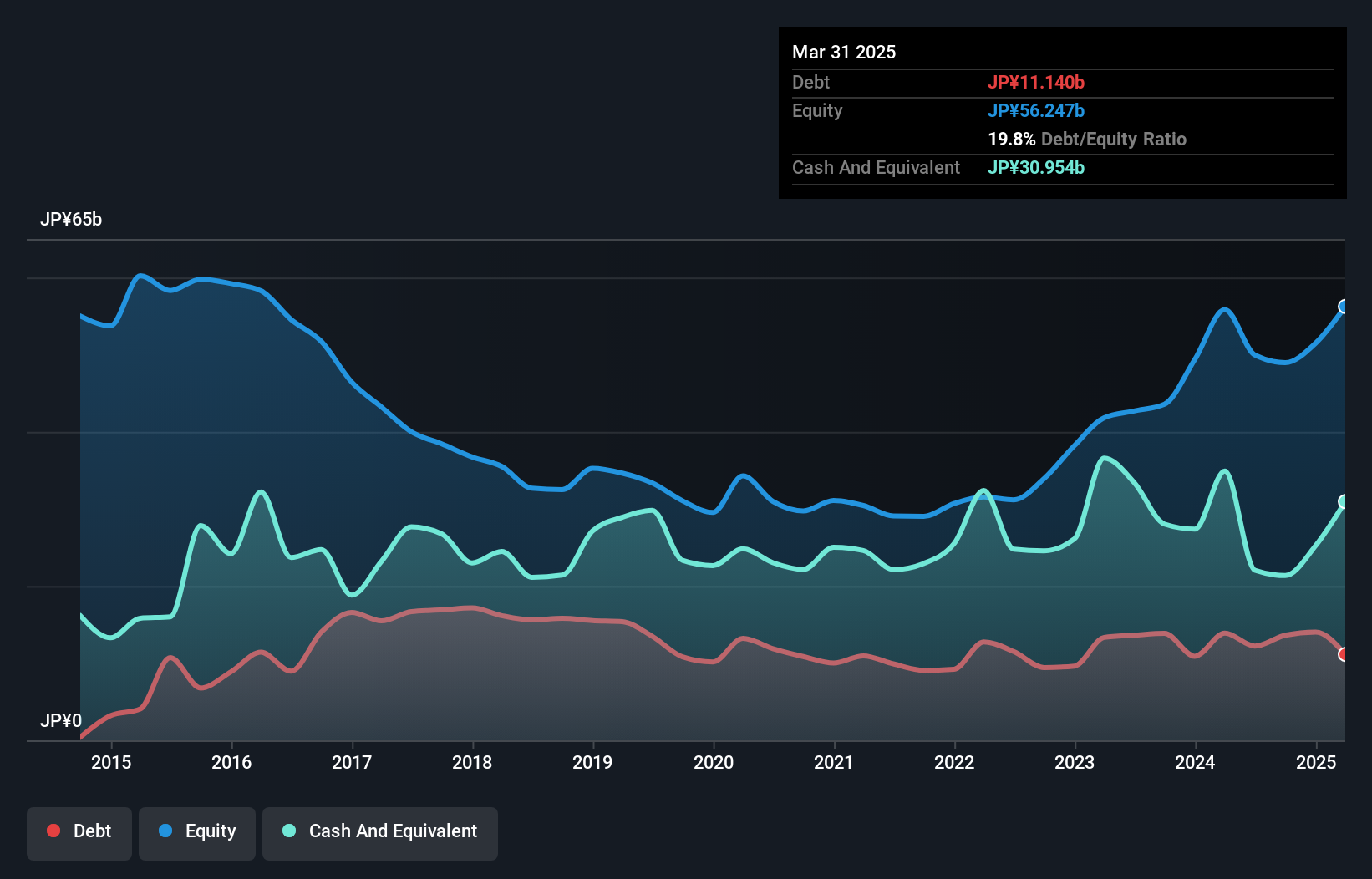

Tsuburaya Fields Holdings stands out with its earnings growth of 4.5% over the past year, surpassing the Leisure industry’s 0.5%. Trading at a substantial discount of 70.3% below estimated fair value, it offers good relative value compared to peers, indicating potential for investors seeking undervalued opportunities. The company is free cash flow positive and has reduced its debt-to-equity ratio from 34.8% to 27.8% in five years, showcasing financial prudence. However, recent share price volatility could be a concern for some investors despite robust interest coverage by EBIT at an impressive 361 times interest payments.

- Delve into the full analysis health report here for a deeper understanding of Tsuburaya Fields Holdings.

Assess Tsuburaya Fields Holdings' past performance with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 4656 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing ZZNode Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003007

Beijing ZZNode Technologies

Provides operation support system software and solutions for the information networks and IT infrastructure to telecom operators and large enterprise in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives