- China

- /

- Aerospace & Defense

- /

- SHSE:688132

3 Growth Companies With Insider Ownership Up To 39%

Reviewed by Simply Wall St

As global markets experience a rebound, buoyed by easing U.S. core inflation and strong bank earnings, investors are increasingly optimistic about the potential for rate cuts later in the year. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Here we highlight a subset of our preferred stocks from the screener.

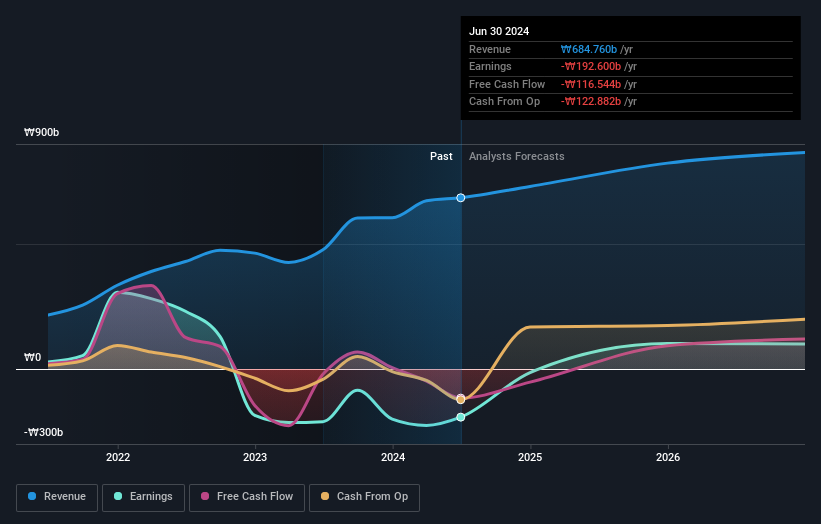

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wemade Co., Ltd. develops and publishes games in South Korea and internationally, with a market cap of ₩1.29 trillion.

Operations: The company's revenue is primarily derived from its gaming business, which generated ₩663.58 billion.

Insider Ownership: 39.7%

Wemade Ltd. is trading below analyst price targets, suggesting potential upside. Despite a recent dip in Q3 sales to KRW 214,361 million from KRW 235,544 million the previous year, net income slightly improved to KRW 41,937 million. The company is forecasted for significant earnings growth at 117.74% annually and expects profitability within three years. Revenue growth of 12.2% per year outpaces the Korean market average of 9.4%.

- Click here to discover the nuances of WemadeLtd with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that WemadeLtd is trading behind its estimated value.

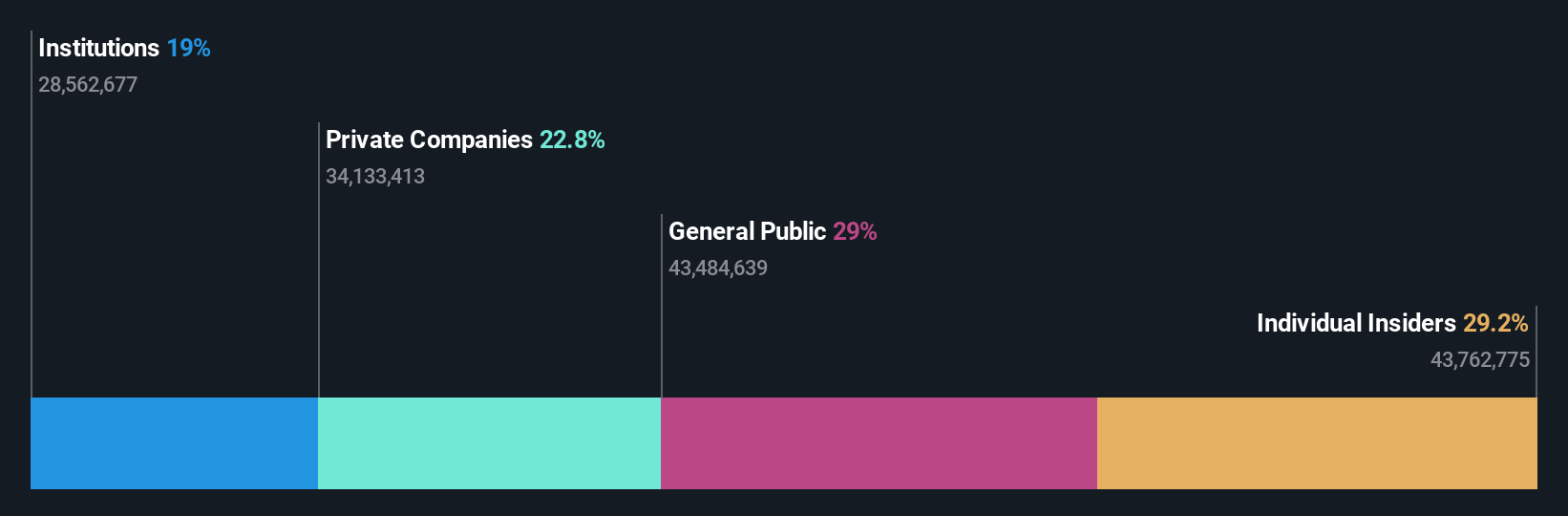

Bangyan Technology (SHSE:688132)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bangyan Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of information communication and security equipment for China's military industry and has a market cap of approximately CN¥2.55 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling CN¥271.49 million.

Insider Ownership: 29.2%

Bangyan Technology's recent private placement aims to bolster growth, with shares restricted from transfer for six months post-issuance. Despite a net loss of CNY 0.93 million for the first nine months of 2024, revenue surged to CNY 254.1 million from CNY 163.3 million year-on-year. The company is forecasted for robust annual revenue growth of 46%, surpassing market averages, and anticipates profitability within three years despite current share price volatility.

- Delve into the full analysis future growth report here for a deeper understanding of Bangyan Technology.

- Our valuation report here indicates Bangyan Technology may be overvalued.

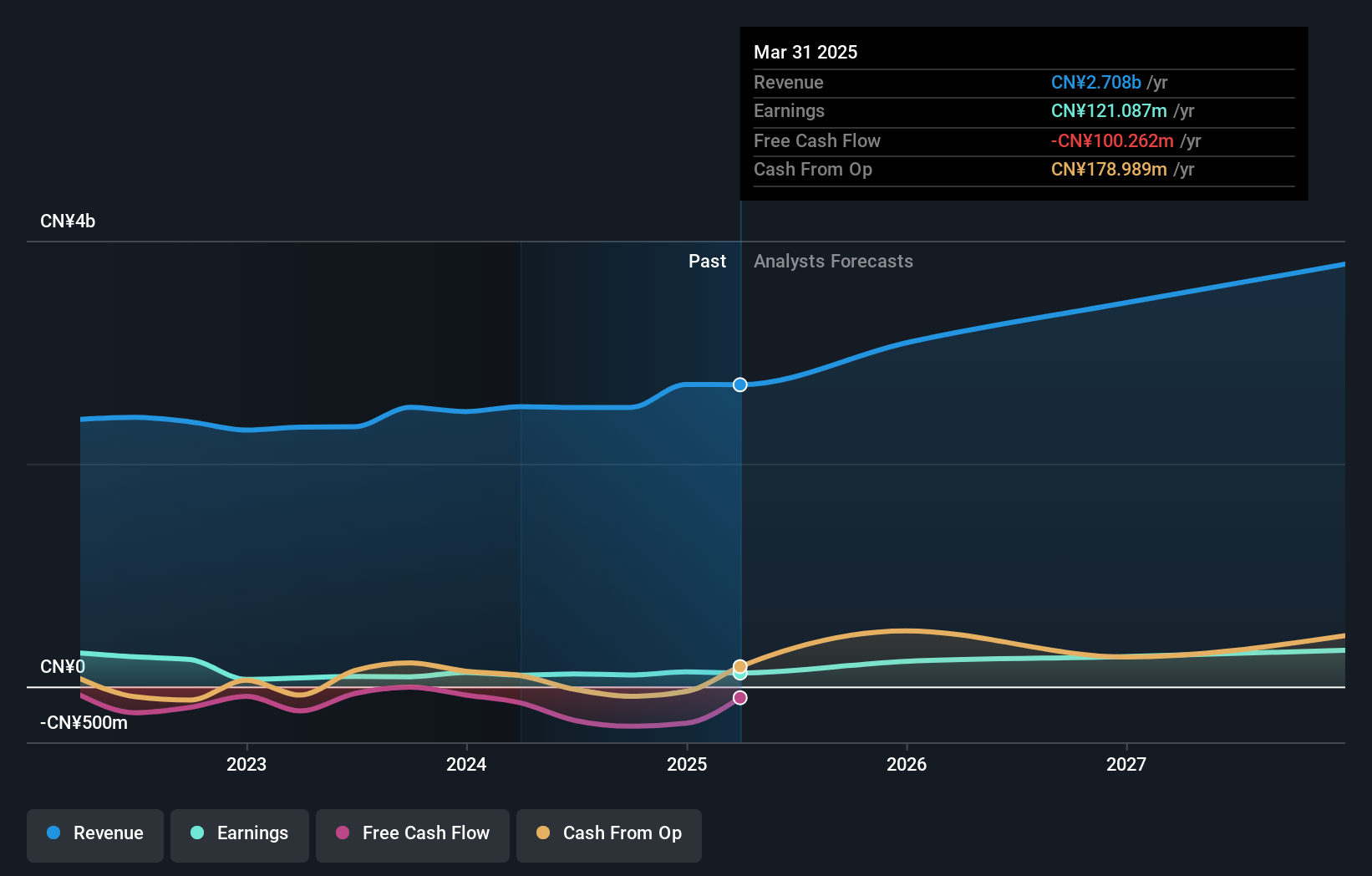

Longhua Technology GroupLtd (SZSE:300263)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Longhua Technology Group Co., Ltd. manufactures and sells heat transfer and energy-saving equipment in China, with a market cap of CN¥6.25 billion.

Operations: The company's revenue is primarily derived from its heat transfer and energy-saving equipment operations in China.

Insider Ownership: 22.4%

Longhua Technology Group's recent earnings report shows a modest increase in revenue to CNY 1.93 billion, despite a decline in net income. The company's earnings are forecasted to grow significantly at 43.8% annually, outpacing the Chinese market average, although revenue growth is expected to be slower than 20%. A special shareholders meeting is scheduled for early January 2025 to discuss a new restricted stock incentive plan and future shareholder returns, highlighting potential strategic shifts.

- Click here and access our complete growth analysis report to understand the dynamics of Longhua Technology GroupLtd.

- According our valuation report, there's an indication that Longhua Technology GroupLtd's share price might be on the expensive side.

Taking Advantage

- Discover the full array of 1462 Fast Growing Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bangyan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688132

Bangyan Technology

Engages in the research, development, manufacture, sale, and service of information communication and security equipment for the military industry in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives