As global markets navigate a mixed start to the year, with the S&P 500 and Nasdaq Composite closing out another strong year despite recent economic concerns, investors are increasingly focusing on growth companies with substantial insider ownership. In this environment, stocks that combine robust growth potential with high insider stakes can be particularly appealing, as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

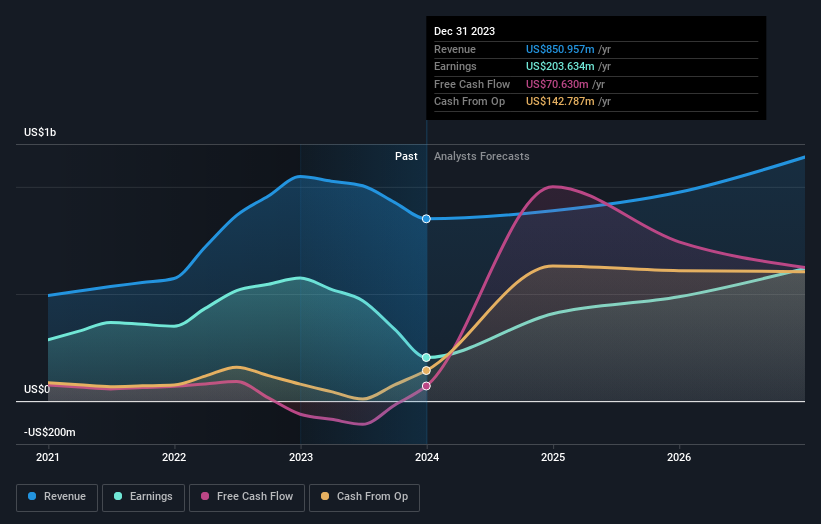

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and internationally with a market cap of HK$50.78 billion.

Operations: The company's revenue segments include Fund Management at $627.98 million and New Economy Development at $113.33 million.

Insider Ownership: 13%

ESR Group is trading at a significant discount to its estimated fair value, with revenue expected to grow 15.8% annually, outpacing the Hong Kong market. However, its return on equity is forecasted to be low in three years. Recently, a consortium agreed to acquire the remaining stake in ESR Group for HK$13 per share or an equivalent share exchange option. The transaction awaits shareholder and court approvals with financing secured through a mix of subscriptions and loans totaling HK$28.4 billion (US$3.6 billion).

- Dive into the specifics of ESR Group here with our thorough growth forecast report.

- The analysis detailed in our ESR Group valuation report hints at an inflated share price compared to its estimated value.

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Skychem Technology Co., Ltd. focuses on the research, development, and manufacturing of electronic materials for the printed circuit board, semiconductor and packaging, and touch screen industries, with a market cap of CN¥6.09 billion.

Operations: The company's revenue segment includes Specialty Chemicals, generating CN¥364.94 million.

Insider Ownership: 32.2%

Guangdong Skychem Technology demonstrates potential for growth, with earnings and revenue forecasted to grow significantly at 39.78% and 31.2% annually, respectively, surpassing the Chinese market averages. Despite a highly volatile share price recently and low future return on equity projections of 12%, its recent stock split may enhance liquidity. The company completed a buyback of shares worth CNY 37.77 million, indicating possible confidence in its valuation amidst no substantial insider trading activity reported recently.

- Get an in-depth perspective on Guangdong Skychem Technology's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Guangdong Skychem Technology shares in the market.

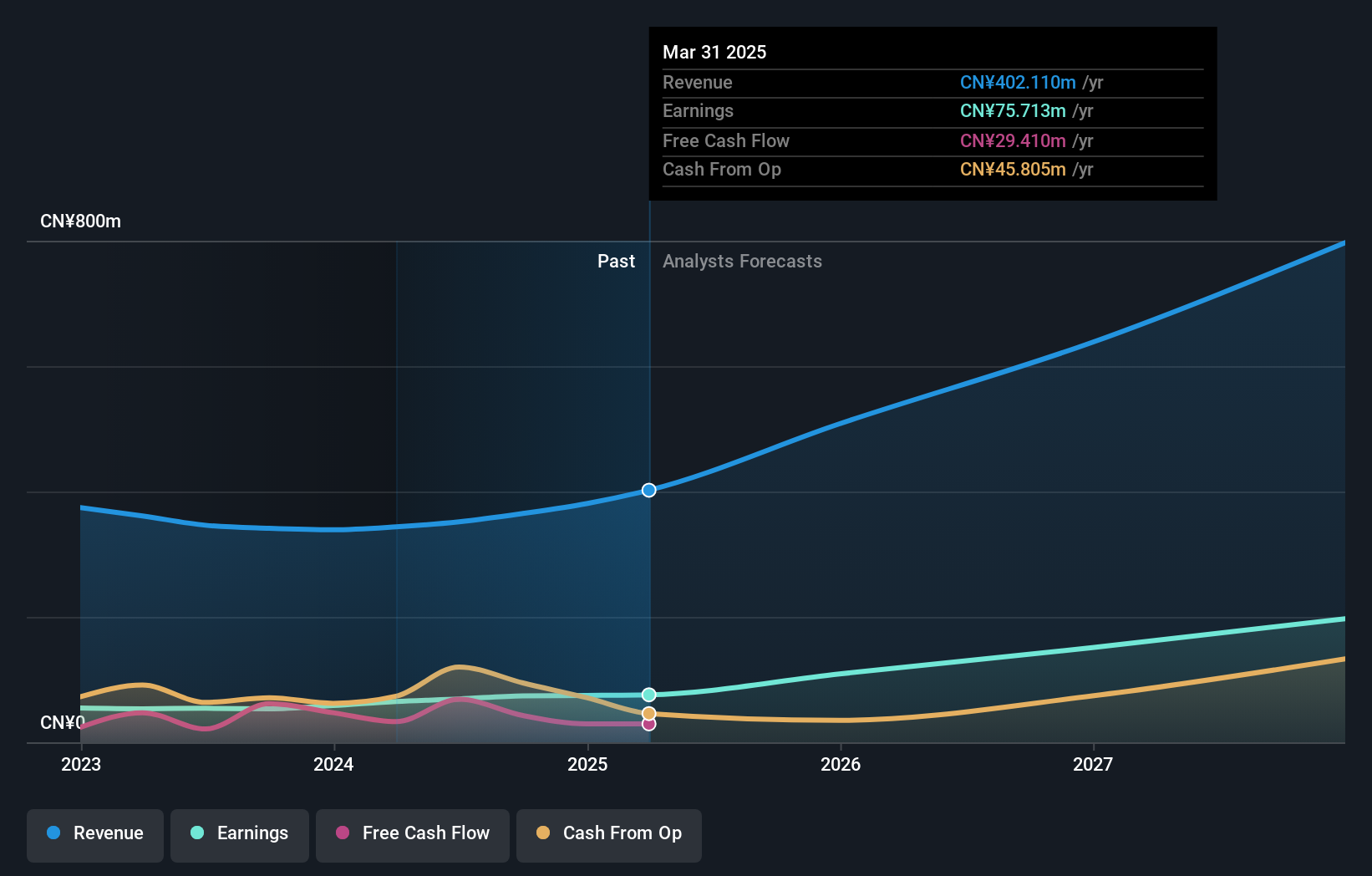

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a provider of IT services and solutions, with a market cap of CN¥49.62 billion.

Operations: The company's revenue is derived from its IT services and solutions offerings.

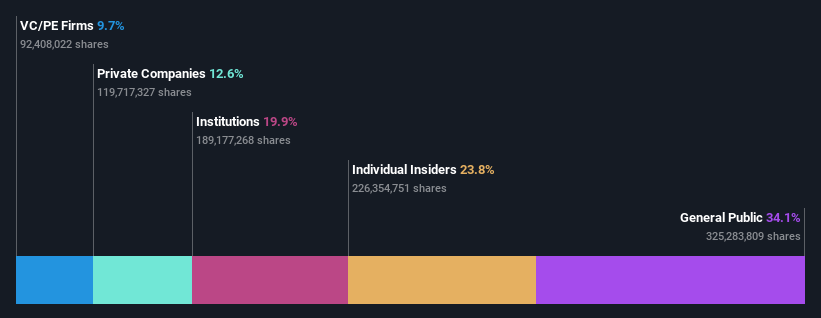

Insider Ownership: 23.8%

iSoftStone Information Technology is experiencing significant earnings growth, forecasted at 39.3% annually, outpacing the Chinese market's average. Despite a volatile share price and declining profit margins from 3.7% to 1%, it trades at a good relative value compared to peers. Recent earnings reveal increased revenue of CNY 22.21 billion but decreased net income of CNY 75.94 million year-over-year, with no substantial insider trading activity reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of iSoftStone Information Technology (Group).

- Our expertly prepared valuation report iSoftStone Information Technology (Group) implies its share price may be lower than expected.

Seize The Opportunity

- Get an in-depth perspective on all 1483 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if iSoftStone Information Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301236

iSoftStone Information Technology (Group)

iSoftStone Information Technology (Group) Co., Ltd.

Excellent balance sheet with reasonable growth potential.