As global markets navigate a mix of profit-taking and economic uncertainties, with the S&P 500 Index achieving its best two-year stretch in decades despite recent fluctuations, investors are increasingly focused on stability and income generation. In this context, dividend stocks yielding 4.3% present an attractive option for those seeking steady returns amidst mixed market signals and economic forecasts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 2015 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

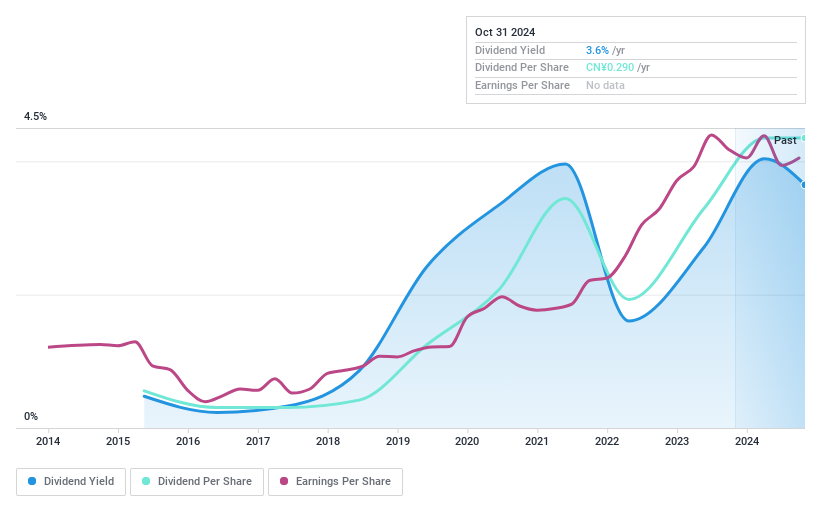

JDM JingDaMachine (Ningbo)Ltd (SHSE:603088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JDM JingDaMachine (Ningbo) Co. Ltd specializes in the production and sale of precision stamping parts both domestically in China and internationally, with a market cap of CN¥3.84 billion.

Operations: JDM JingDaMachine (Ningbo) Ltd generates its revenue primarily from Metal Forming Machine Tool Manufacturing, amounting to CN¥783.71 million.

Dividend Yield: 3.4%

JDM JingDaMachine's dividend yield of 3.38% ranks in the top 25% of the CN market, but its dividends have been volatile and unreliable over the past decade, with a high cash payout ratio of 97%, indicating poor coverage by free cash flows. Despite a favorable price-to-earnings ratio (23.3x) compared to the CN market (33.6x), and earnings growth potential, its dividend sustainability remains questionable amidst recent earnings stability challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of JDM JingDaMachine (Ningbo)Ltd.

- Our valuation report here indicates JDM JingDaMachine (Ningbo)Ltd may be overvalued.

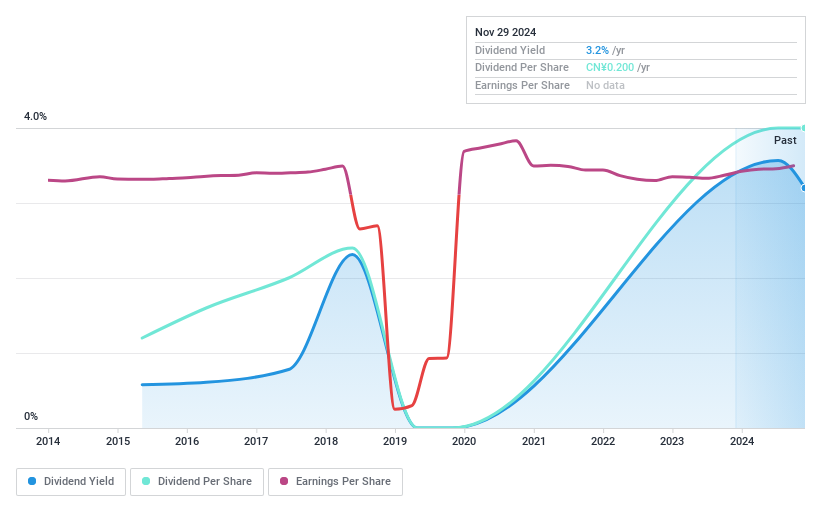

Nanjing Kangni Mechanical & ElectricalLtd (SHSE:603111)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nanjing Kangni Mechanical & Electrical Co., Ltd specializes in the research, development, manufacture, sale, and maintenance of railway vehicle door systems and has a market cap of CN¥5.21 billion.

Operations: Nanjing Kangni Mechanical & Electrical Co., Ltd generates its revenue primarily through the development, production, and servicing of railway vehicle door systems.

Dividend Yield: 3.4%

Nanjing Kangni Mechanical & Electrical's dividend yield of 3.41% is among the top 25% in the CN market, yet its dividends have been volatile and unreliable over the past decade, with a high cash payout ratio of 233.8%, indicating inadequate coverage by free cash flows. Despite earnings growth and a low price-to-earnings ratio (12.8x) compared to the CN market (33.6x), dividend sustainability is questionable due to inconsistent historical payments and coverage issues.

- Navigate through the intricacies of Nanjing Kangni Mechanical & ElectricalLtd with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Nanjing Kangni Mechanical & ElectricalLtd is priced higher than what may be justified by its financials.

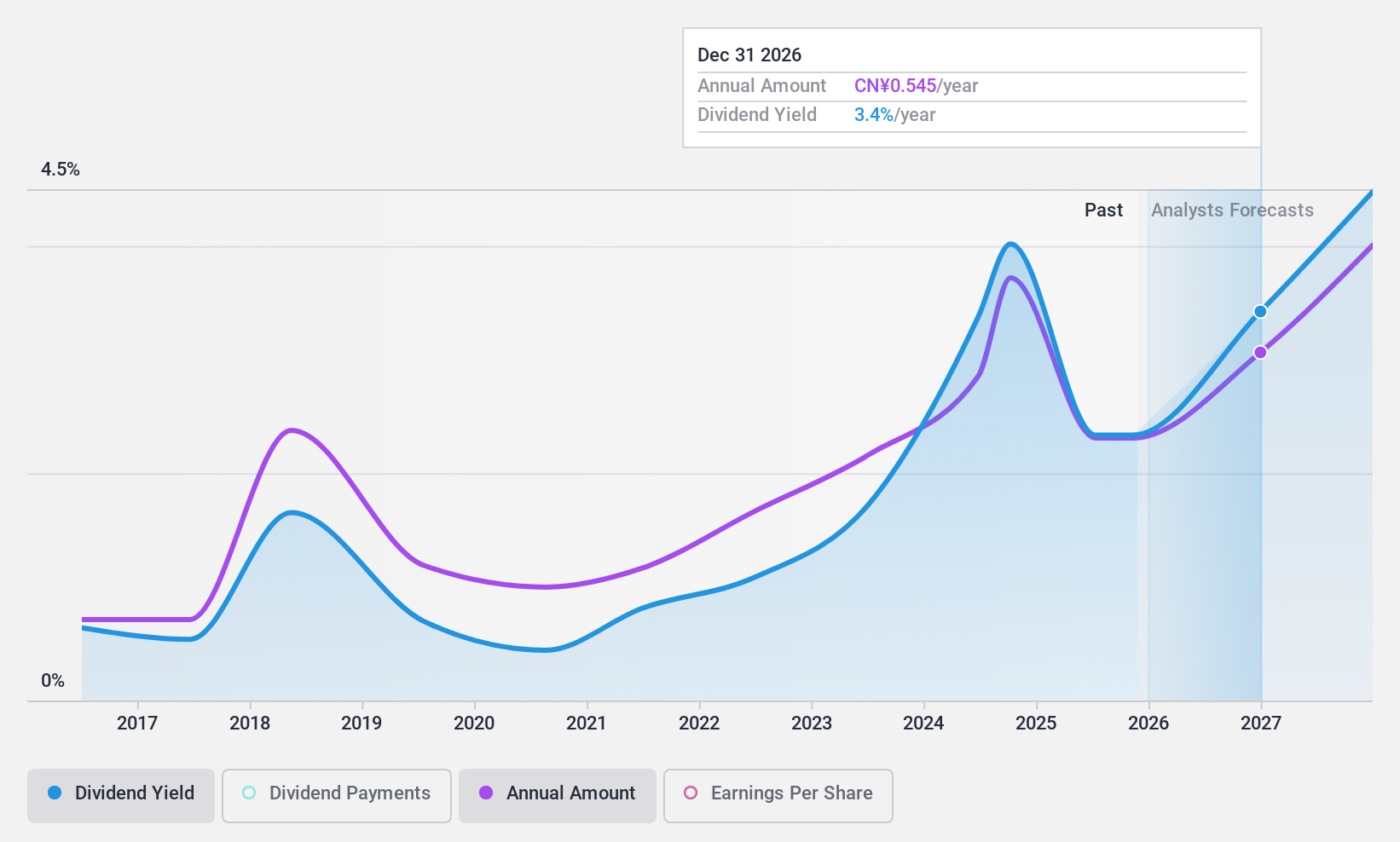

LBX Pharmacy Chain (SHSE:603883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LBX Pharmacy Chain Joint Stock Company operates a pharmacy store chain in China with a market cap of CN¥11.92 billion.

Operations: LBX Pharmacy Chain Joint Stock Company's revenue segments are not provided in the text.

Dividend Yield: 4.3%

LBX Pharmacy Chain's dividend yield of 4.31% ranks in the top 25% of CN market payers, yet its dividends have been volatile and unreliable over the past nine years. Despite trading at a significant discount to its estimated fair value, concerns arise from its unstable dividend track record. However, with a low cash payout ratio of 27.1%, dividends are well covered by cash flows, while earnings coverage is adequate with a payout ratio of 75.3%.

- Take a closer look at LBX Pharmacy Chain's potential here in our dividend report.

- Our valuation report here indicates LBX Pharmacy Chain may be undervalued.

Turning Ideas Into Actions

- Discover the full array of 2015 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603088

JDM JingDaMachine (Ningbo)Ltd

Produces and sells precision stamping parts in China and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.