- China

- /

- Basic Materials

- /

- SZSE:002671

Yueyang Forest & Paper And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing out a strong year despite recent volatility and economic indicators showing varied performances across regions, investors are seeking new opportunities beyond the usual blue-chip names. Penny stocks, though often perceived as relics of past market trends, remain a relevant investment area for those willing to explore smaller or newer companies with potential for significant returns. In this article, we examine three penny stocks that demonstrate balance sheet resilience and offer intriguing growth prospects in today's evolving market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.66B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.13B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.984 | £747.6M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.57 | HK$40.74B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £471.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.43 | £182.11M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.47 | £66.18M | ★★★★☆☆ |

Click here to see the full list of 5,845 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Yueyang Forest & Paper (SHSE:600963)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yueyang Forest & Paper Co., Ltd. manufactures and sells cultural, industrial, and packaging paper products with a market cap of CN¥8.12 billion.

Operations: The company generates revenue of CN¥7.18 billion from its operations in China.

Market Cap: CN¥8.12B

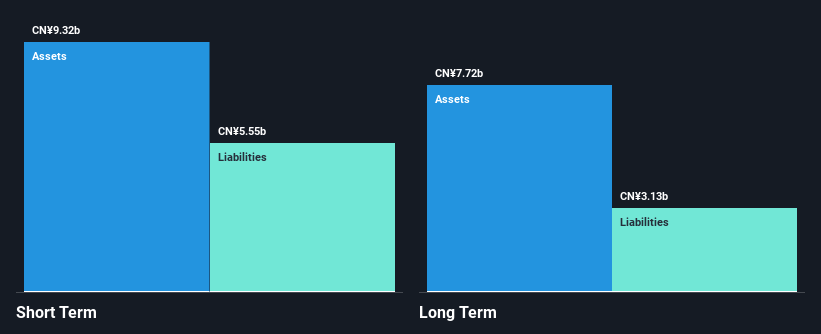

Yueyang Forest & Paper faces challenges with profitability, reporting a net loss of CN¥94.99 million for the first nine months of 2024, a downturn from the previous year's profit. Despite this, it trades at a significant discount to its estimated fair value and maintains stable weekly volatility. The company's debt is high but manageable with operating cash flow covering 20.7% of it, and short-term assets exceed both short- and long-term liabilities, indicating sufficient liquidity. Management is experienced with an average tenure of 5.5 years, providing stability amid financial restructuring efforts.

- Unlock comprehensive insights into our analysis of Yueyang Forest & Paper stock in this financial health report.

- Examine Yueyang Forest & Paper's earnings growth report to understand how analysts expect it to perform.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and supplies material handling equipment for the non-ferrous metallurgy and port terminals industries in China and internationally, with a market cap of CN¥4.46 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.46B

Zhuzhou Tianqiao Crane Co., Ltd. has demonstrated significant earnings growth, with a very large increase of 6332.4% over the past year, although it has faced a decline of 14.7% annually over five years. The company trades at a substantial discount to its estimated fair value and maintains high-quality earnings despite low return on equity at 2.2%. It possesses more cash than debt, and its short-term assets comfortably cover both short- and long-term liabilities, ensuring liquidity stability. Recent bylaw amendments reflect active governance adjustments as part of ongoing corporate restructuring efforts.

- Navigate through the intricacies of Zhuzhou Tianqiao Crane with our comprehensive balance sheet health report here.

- Explore historical data to track Zhuzhou Tianqiao Crane's performance over time in our past results report.

Shandong Longquan Pipe IndustryLtd (SZSE:002671)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Longquan Pipe Industry Co., Ltd specializes in the production, sale, installation, and service of prestressed concrete cylinder pipes and metal pipe fittings in China, with a market cap of CN¥2.50 billion.

Operations: The company's revenue primarily comes from its operations in China, totaling CN¥1.20 billion.

Market Cap: CN¥2.5B

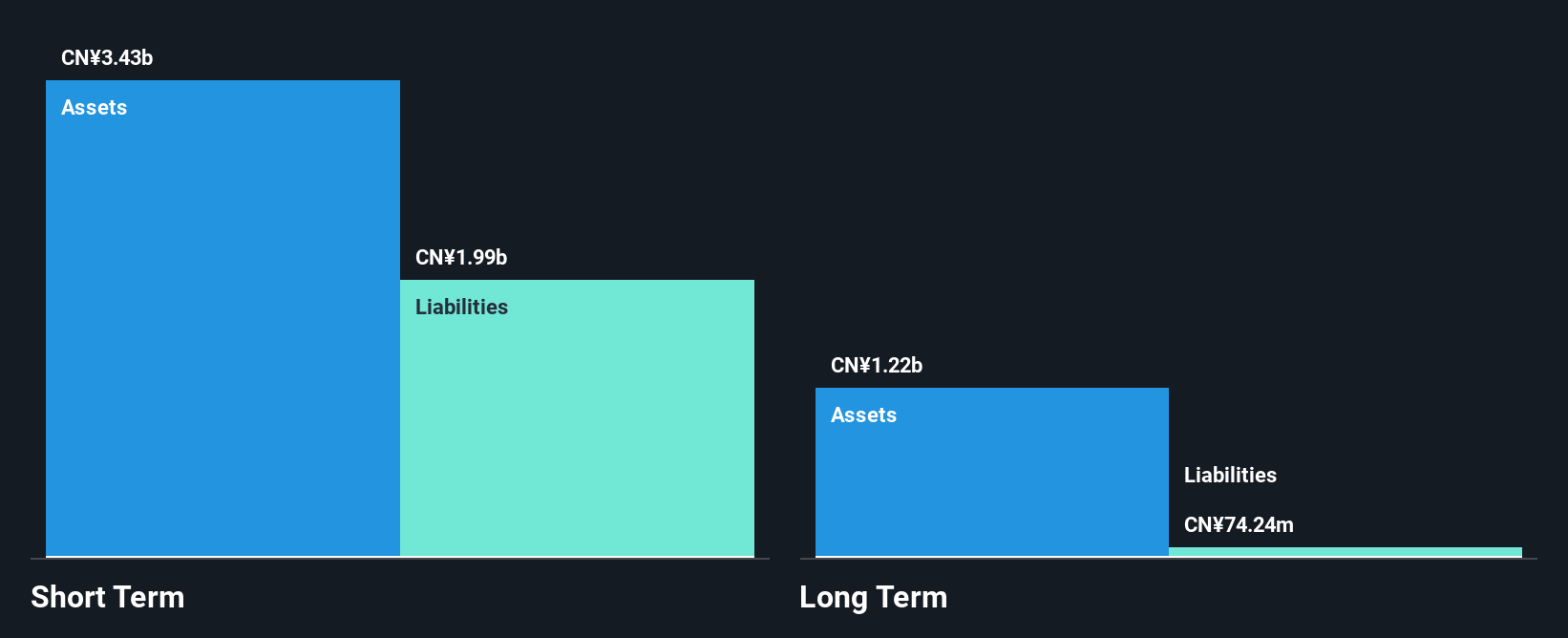

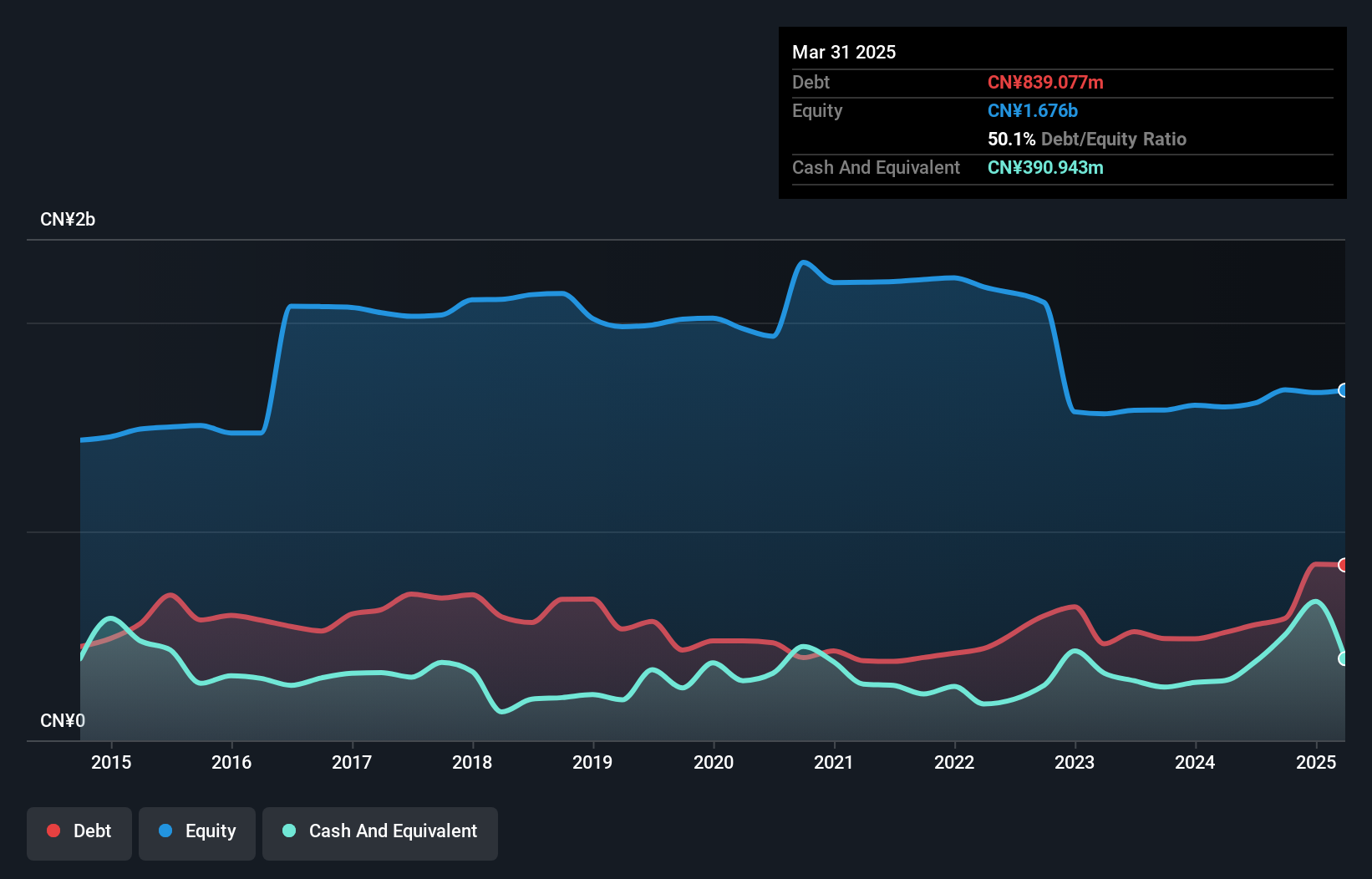

Shandong Longquan Pipe Industry Co., Ltd has achieved profitability recently, with earnings for the first nine months of 2024 reaching CN¥79.43 million, a significant increase from the previous year. The company's Price-to-Earnings ratio of 23.8x is below the market average, suggesting potential value. Its financial stability is supported by satisfactory net debt to equity and well-covered interest payments by EBIT. However, operating cash flow coverage of debt remains low at 13%. A share repurchase program aims to enhance employee incentives and promote long-term growth, funded internally with a cap of CN¥18 million over three months.

- Click to explore a detailed breakdown of our findings in Shandong Longquan Pipe IndustryLtd's financial health report.

- Examine Shandong Longquan Pipe IndustryLtd's past performance report to understand how it has performed in prior years.

Key Takeaways

- Click this link to deep-dive into the 5,845 companies within our Penny Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002671

Shandong Longquan Pipe IndustryLtd

Engages in the production, sale, installation, and service of prestressed concrete cylinder pipes and metal pipe fittings in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives