- Switzerland

- /

- Tech Hardware

- /

- SWX:LOGN

What Do Logitech’s Recent Gains Signal for Investors in 2025?

Reviewed by Bailey Pemberton

If you have been following Logitech International or are considering adding it to your portfolio, you are not alone in wondering what comes next for this long-standing tech player. Logitech’s stock recently closed at $86.02, and although the past month brought a modest pullback of -2.8%, the year-to-date gain stands strong at 14.8%. If you widen the lens, the stock is up an impressive 102.7% over the last three years, a testament to market confidence as Logitech adapts to shifting workplace and gamer habits worldwide.

Much of Logitech's performance can be traced to broader industry trends, such as the persistent demand for hybrid work hardware and elevated consumer interest in PC peripherals. While the moves are not always dramatic—recent weeks showed just a 1.5% uptick—investors continue to treat the company as a consistent, if at times cautious, growth story. Notably, Logitech currently earns a value score of 5 out of 6, meaning it is deemed undervalued on five key fronts measured by common valuation methods. This is the kind of setup that grabs attention from bargain hunters and long-term growth investors alike.

But what exactly does this value score mean for you, and how do various valuation techniques stack up when sizing up Logitech’s true potential? In the next section, we will break down these valuation checks, and later on, share an even more insightful approach to determining whether the stock deserves a spot in your portfolio.

Approach 1: Logitech International Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future free cash flows and then discounting those figures back to today, considering the time value of money. For Logitech International, this means taking what it currently generates in cash, forecasting its growth, and translating those numbers into a present-day valuation.

The company's latest reported Free Cash Flow (FCF) sits at $722.2 million. Analyst estimates project steady growth over the next five years, with FCF expected to reach $845.4 million by 2028. Beyond that, further projections extrapolated by Simply Wall St foresee continued, albeit slower, expansion in annual cash generation, with 10-year estimates reaching $960.9 million (discounted to $593.3 million using current models).

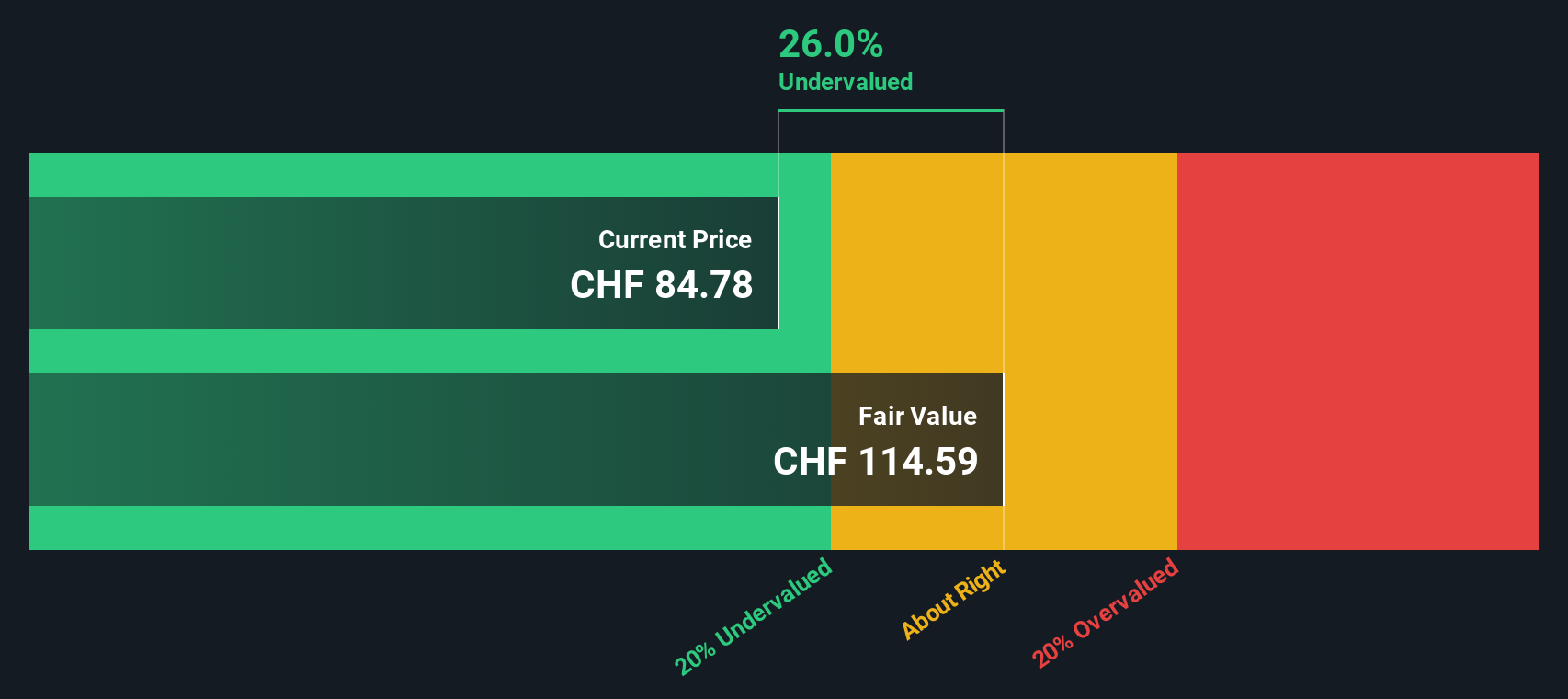

When all those future cash flows are added up and brought back to today's dollars, the DCF method assigns Logitech an intrinsic value of $114.09 per share. With the current share price at $86.02, this means the stock is trading at a 24.6% discount to its calculated fair value. In short, the DCF analysis points to Logitech as a meaningful bargain at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Logitech International is undervalued by 24.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Logitech International Price vs Earnings

For profitable companies like Logitech International, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It provides a clear snapshot of how much investors are willing to pay for each dollar of earnings. A lower PE might signal undervaluation, while a higher ratio could mean the stock is seen as having strong growth prospects.

What is considered a “normal” or “fair” PE ratio depends heavily on expectations for future growth and the level of risk investors associate with the company. High-growth, low-risk companies tend to attract higher PE ratios, while slower-growing or riskier firms see lower ones. This context helps investors assess whether a stock’s valuation is justified by its business outlook.

Currently, Logitech trades at a PE of 23.8x, just above the broader tech industry average of 23.6x and below the average of its peer group, which stands at 27.7x. To add more nuance, Simply Wall St calculates a proprietary “Fair Ratio” for Logitech at 29.2x. This Fair Ratio reflects an optimal multiple for the company, tuned to its earnings growth potential, profit margins, industry context, market cap, and unique risk factors. Unlike a plain peer or industry average comparison, this tailored metric offers a more comprehensive view by considering the specific strengths and challenges facing Logitech at this stage.

When comparing the current PE of 23.8x to the Fair Ratio of 29.2x, Logitech appears undervalued relative to what its fundamentals suggest is reasonable for investors to pay.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Logitech International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter and more dynamic way to invest that goes well beyond traditional metrics. A Narrative connects the story you believe about a company (your expectations about Logitech’s future growth, margins, and risks) with a set of financial forecasts and, ultimately, your own fair value estimate.

Narratives make investing more approachable by allowing you to summarize your perspective about Logitech, tie it directly to the numbers that matter, and see your personal fair value versus today’s price. On Simply Wall St’s platform, Narratives can be easily crafted and explored right on the Community page, used by millions of investors worldwide.

They help you decide whether Logitech is a buy or sell, because when the fair value from your Narrative is above the market price, that may signal an opportunity if your assumptions prove correct. Since Narratives update dynamically with every relevant news headline or earnings report, your analysis stays fresh and actionable.

For instance, some investors might build a Narrative for Logitech around continued growth in gaming and remote work, estimating a fair value of $111.66 per share. Others, more cautious about competition and changing trends, see only $61.42 as reasonable. This demonstrates just how personal and adaptable investing can be.

Do you think there's more to the story for Logitech International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LOGN

Logitech International

Through its subsidiaries, designs, manufactures, and markets software-enabled hardware solutions that connect people to working, creating, and gaming worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)