Top Growth Companies With High Insider Ownership On SIX Swiss Exchange October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Swiss market has remained flat, yet it has shown impressive growth over the past year with a 17% increase and earnings forecasted to grow by 12% annually. In this context of steady expansion, identifying growth companies with significant insider ownership can be crucial as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| LEM Holding (SWX:LEHN) | 29.9% | 20.5% |

| Stadler Rail (SWX:SRAIL) | 14.5% | 24.1% |

| VAT Group (SWX:VACN) | 10.2% | 21.5% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.7% |

| Addex Therapeutics (SWX:ADXN) | 19% | 33.3% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 12.6% |

| Temenos (SWX:TEMN) | 21.8% | 14.4% |

| Partners Group Holding (SWX:PGHN) | 17% | 14.2% |

| Sensirion Holding (SWX:SENS) | 19.9% | 102.7% |

| Kudelski (SWX:KUD) | 37.5% | 121.7% |

Let's take a closer look at a couple of our picks from the screened companies.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market capitalization of CHF1.43 billion.

Operations: The company's revenue segments include providing solutions for measuring electrical parameters across diverse regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

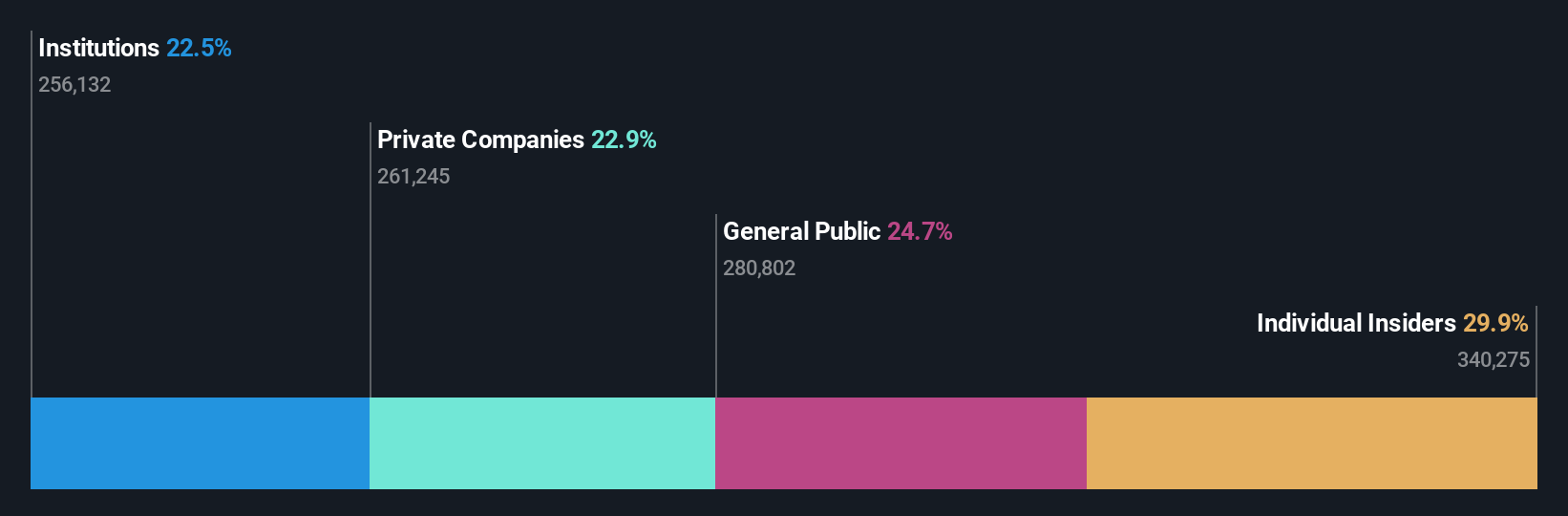

Insider Ownership: 29.9%

Earnings Growth Forecast: 20.5% p.a.

LEM Holding demonstrates potential for growth with earnings forecasted to increase significantly at 20.48% annually, outpacing the Swiss market. Despite trading below estimated fair value and analysts predicting a price rise, recent results show a decline in sales and net income. The company's dividend is not well covered by free cash flow, and it holds high debt levels. However, its Return on Equity is expected to be robust at 29.3% in three years.

- Click to explore a detailed breakdown of our findings in LEM Holding's earnings growth report.

- The valuation report we've compiled suggests that LEM Holding's current price could be quite moderate.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG manufactures and sells trains across Switzerland, Germany, Austria, Europe, the Americas, CIS countries, and internationally with a market cap of CHF2.60 billion.

Operations: Stadler Rail's revenue is primarily derived from its Rolling Stock segment, which generated CHF3.10 billion, followed by the Service & Components segment at CHF789.41 million and the Signalling segment at CHF135.68 million.

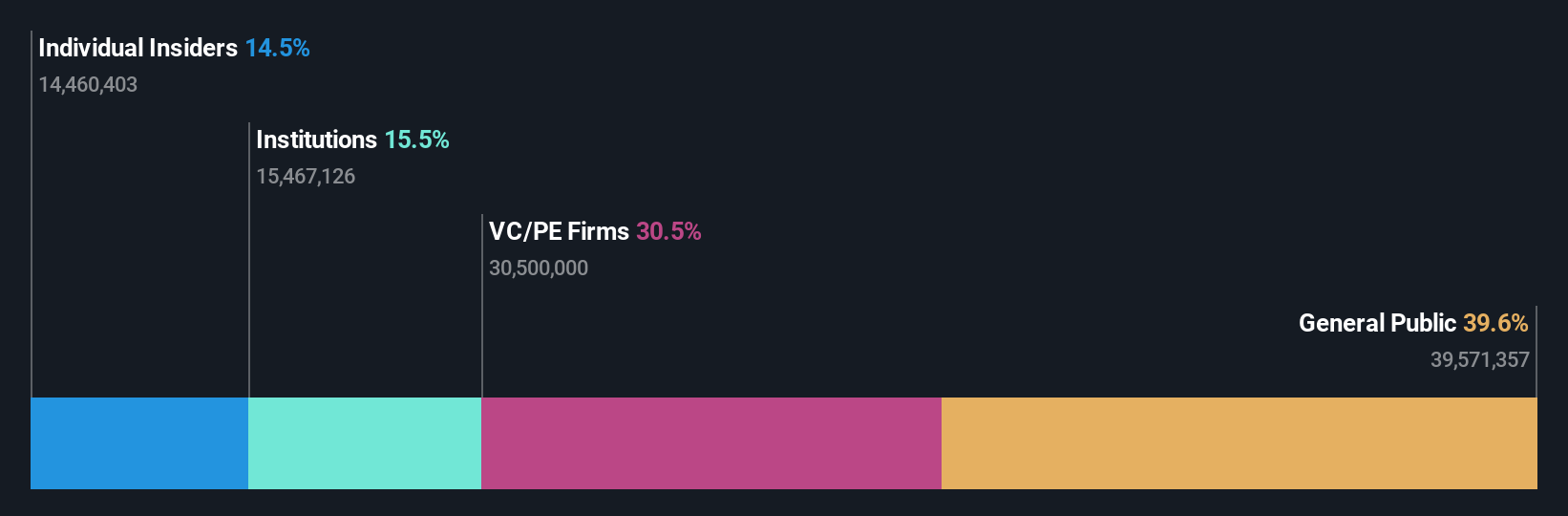

Insider Ownership: 14.5%

Earnings Growth Forecast: 24.1% p.a.

Stadler Rail shows promising growth prospects with earnings expected to grow significantly at 24.05% annually, surpassing the Swiss market's forecast. Despite recent earnings results showing stable sales at CHF 1.29 billion and a slight dip in net income to CHF 23.95 million, the company's revenue growth of 8.9% per year is above the market average. However, its dividend sustainability is questionable as it isn't well covered by free cash flows, though Return on Equity is projected to reach a high level of 21.7%.

- Click here and access our complete growth analysis report to understand the dynamics of Stadler Rail.

- The analysis detailed in our Stadler Rail valuation report hints at an deflated share price compared to its estimated value.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide, with a market cap of CHF4.66 billion.

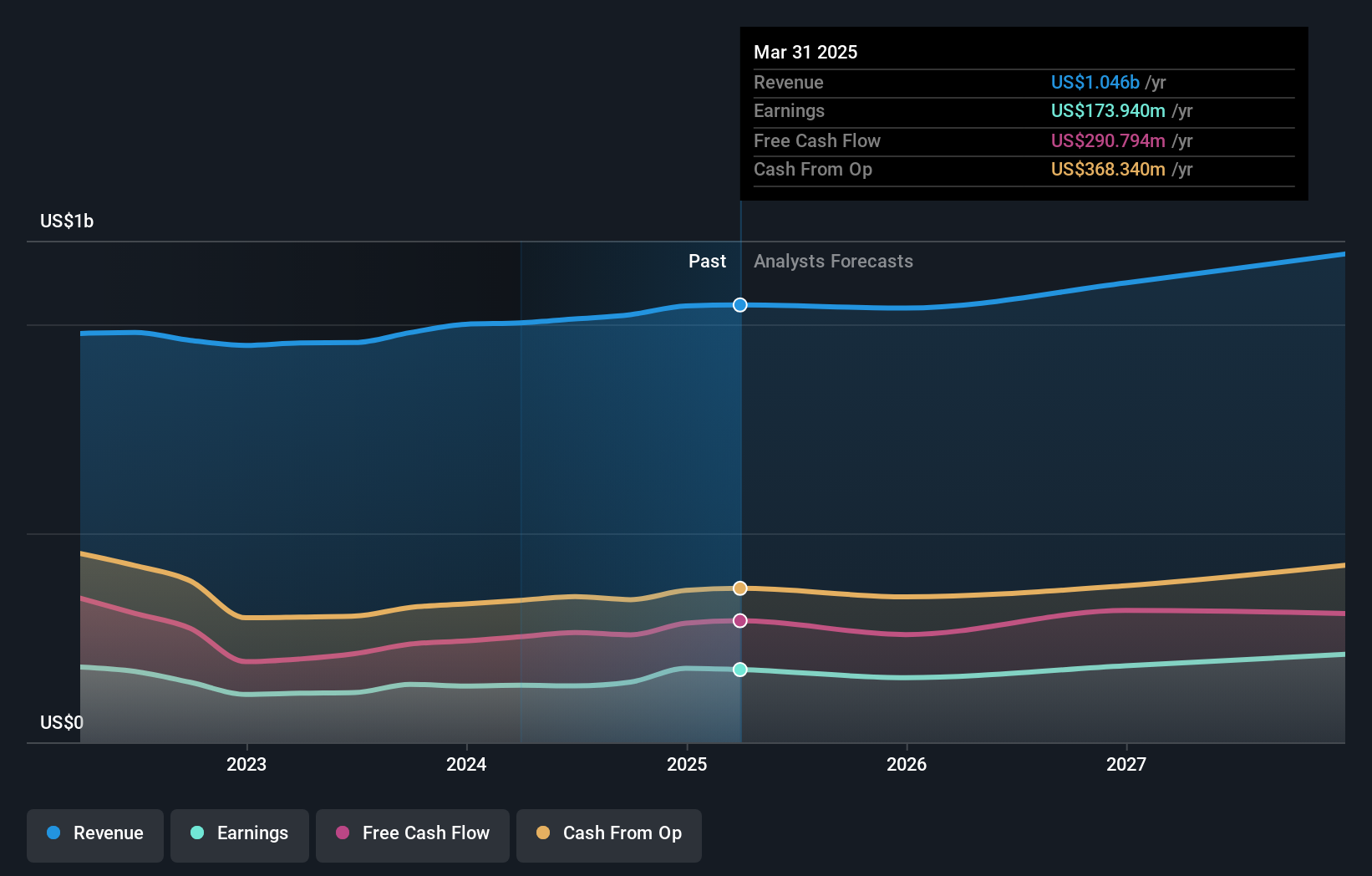

Operations: The company's revenue is derived from two main segments: Product, which accounts for $879.99 million, and Services, contributing $132.98 million.

Insider Ownership: 21.8%

Earnings Growth Forecast: 14.4% p.a.

Temenos demonstrates growth potential with earnings projected to rise by 14.4% annually, outpacing the Swiss market average. Recent executive appointments, including Barb Morgan as Chief Product and Technology Officer, aim to enhance its cloud-based platform and AI-driven solutions. Despite a high debt level, the company trades at 25% below its estimated fair value and completed a CHF 200 million share buyback. Revenue growth is expected at 7.6%, exceeding the market's pace.

- Unlock comprehensive insights into our analysis of Temenos stock in this growth report.

- In light of our recent valuation report, it seems possible that Temenos is trading behind its estimated value.

Summing It All Up

- Unlock our comprehensive list of 14 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEHN

LEM Holding

Provides solutions for measuring electrical parameters in China, Japan, South Korea, India, Southeast Asia, Europe, Middle East, Africa, NAFTA and Latin America.

Undervalued with high growth potential and pays a dividend.