3 Growth Companies With High Insider Ownership And 17% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly vigilant about the potential for growth amidst fluctuating indices and economic indicators. Despite recent contractions in manufacturing data and revised GDP forecasts, sectors with robust insider ownership often attract attention due to their perceived alignment of interests between management and shareholders. In this context, identifying companies that not only demonstrate significant revenue growth but also have high insider ownership can be an appealing strategy for those seeking resilient investment opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG is involved in the global development, production, sale, and servicing of sensor systems, modules, and components with a market capitalization of CHF869.65 million.

Operations: The company's revenue segment consists solely of sensor systems, modules, and components, generating CHF237.91 million.

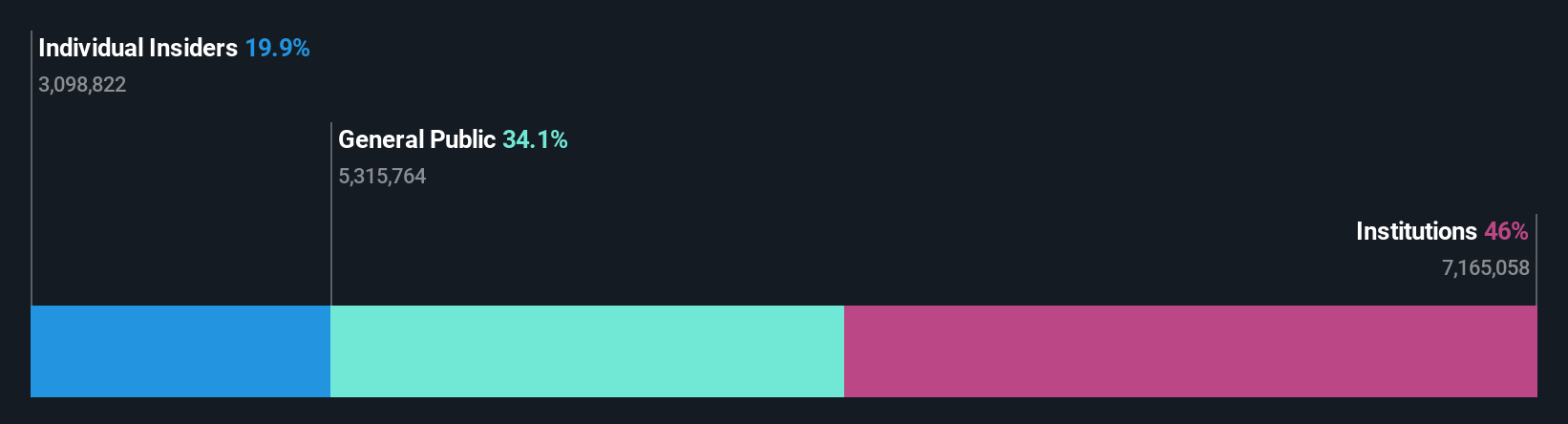

Insider Ownership: 19.9%

Revenue Growth Forecast: 12.9% p.a.

Sensirion Holding demonstrates potential as a growth company with high insider ownership, with revenue expected to grow 12.9% annually, outpacing the Swiss market's 4.2%. Despite its volatile share price recently, it trades at 68.4% below fair value estimates and is anticipated to become profitable within three years. Analysts agree on a potential stock price increase of 44.6%, although its forecasted return on equity remains modest at 12.3%.

- Click here to discover the nuances of Sensirion Holding with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Sensirion Holding shares in the market.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market capitalization of approximately ¥318.19 billion.

Operations: The company's revenue segments are comprised of HR Tech, generating ¥66.61 billion, and Incubation, contributing ¥2.10 billion.

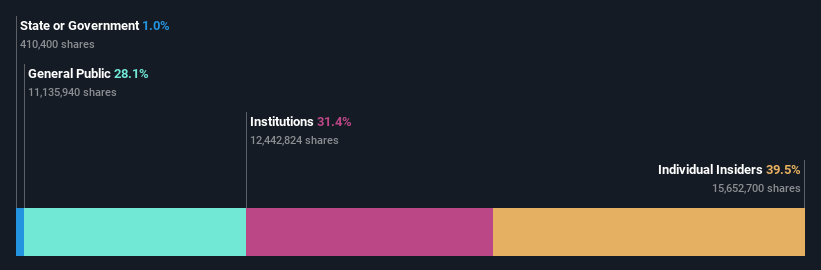

Insider Ownership: 39.2%

Revenue Growth Forecast: 12.1% p.a.

Visional shows promise with earnings having grown 24.5% last year and forecasted to grow 13.88% annually, outpacing the Japanese market's growth rate of 7.8%. It trades at a significant discount, 53% below fair value estimates, and analysts predict a potential stock price rise of 20.6%. Revenue is expected to increase by 12.1% annually, faster than the market's average growth rate of 4.2%, although slower than some high-growth peers.

- Click here and access our complete growth analysis report to understand the dynamics of Visional.

- Our expertly prepared valuation report Visional implies its share price may be lower than expected.

Kinik (TWSE:1560)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kinik Company operates in the production and sale of abrasives, cutting tools, and reclaimed wafers both in Taiwan and internationally, with a market cap of NT$42.28 billion.

Operations: The company's revenue is derived from two main segments: the Electronics Sector, contributing NT$3.39 billion, and the Traditional Sectors, also accounting for NT$3.39 billion.

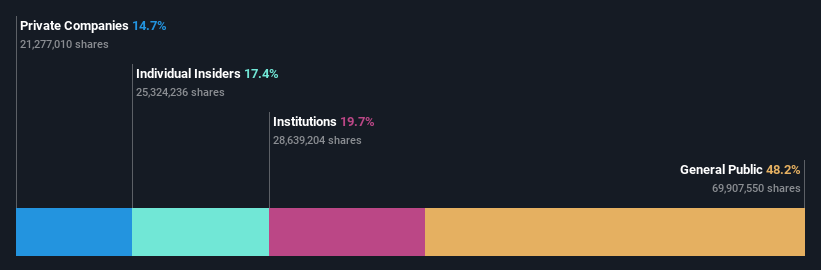

Insider Ownership: 15.9%

Revenue Growth Forecast: 17.7% p.a.

Kinik is trading 64.3% below its estimated fair value, with analysts anticipating a 28.9% stock price rise. Although revenue growth is forecasted at 17.7%, slower than the high-growth benchmark, it surpasses the TW market's 12.2%. Earnings are expected to grow significantly at 35.4%, well above market averages, supported by a strong return on equity projection of 25.5%. Recent earnings show steady sales growth but slight net income decline year-over-year for Q3 2024.

- Dive into the specifics of Kinik here with our thorough growth forecast report.

- Our valuation report here indicates Kinik may be undervalued.

Where To Now?

- Navigate through the entire inventory of 1500 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.