- Switzerland

- /

- Software

- /

- SWX:TEMN

June 2024 Spotlight On Three Growth Companies With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

Amidst a fluctuating session, the Switzerland market demonstrated resilience, closing slightly higher as select stocks managed to support gains despite broader declines. The SMI's modest uptick reflects a cautious optimism in the market environment. In such conditions, companies with high insider ownership can be particularly appealing, as significant internal stakeholding often aligns with robust long-term confidence in the company's growth trajectory.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.3% |

| Kudelski (SWX:KUD) | 37.6% | 106.5% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.3% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Here we highlight a subset of our preferred stocks from the screener.

Gurit Holding (SWX:GURN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gurit Holding AG specializes in developing, manufacturing, marketing, and selling advanced composite materials, composite tooling equipment, and kitting services globally, with a market capitalization of CHF 294.14 million.

Operations: Gurit Holding AG generates revenue from three primary segments: Composite Materials at CHF 307.09 million, Marine and Industrial at CHF 101.63 million, and Manufacturing Solutions at CHF 51.29 million.

Insider Ownership: 30.2%

Gurit Holding, a Swiss company with high insider ownership, is trading at CHF 52% below its estimated fair value, signaling potential undervaluation. Despite a volatile share price recently, analysts predict a substantial 34.7% increase in stock price. The firm's earnings are expected to surge by 35.08% annually over the next three years, outpacing the broader Swiss market's growth rate significantly. However, its revenue growth at 4% per year lags behind the market average of 4.4%. Gurit also carries a high level of debt which could be a concern for risk-averse investors.

- Unlock comprehensive insights into our analysis of Gurit Holding stock in this growth report.

- The valuation report we've compiled suggests that Gurit Holding's current price could be quite moderate.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and institutional clients with a market capitalization of CHF 4.16 billion.

Operations: The company generates revenue through two primary segments: Leveraged Forex, which brought in CHF 101.09 million, and Securities Trading, contributing CHF 429.78 million.

Insider Ownership: 11.4%

Swissquote Group Holding Ltd, a Swiss growth company with high insider ownership, has shown promising financial trends. Recently, the firm reported a substantial increase in net income to CHF 217.63 million for the full year ended December 31, 2023. Looking forward, earnings are forecasted to grow by 14.3% annually, outpacing the Swiss market's average of 8.3%. Additionally, its revenue is expected to grow at 10.6% per year—also above the market trend of 4.4%. Despite these positives, its revenue growth does not meet the high-growth benchmark of over 20% per year.

- Click to explore a detailed breakdown of our findings in Swissquote Group Holding's earnings growth report.

- According our valuation report, there's an indication that Swissquote Group Holding's share price might be on the expensive side.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems, serving banks and financial institutions worldwide, with a market capitalization of approximately CHF 4.28 billion.

Operations: The company generates revenue from the development, marketing, and sale of banking software systems globally.

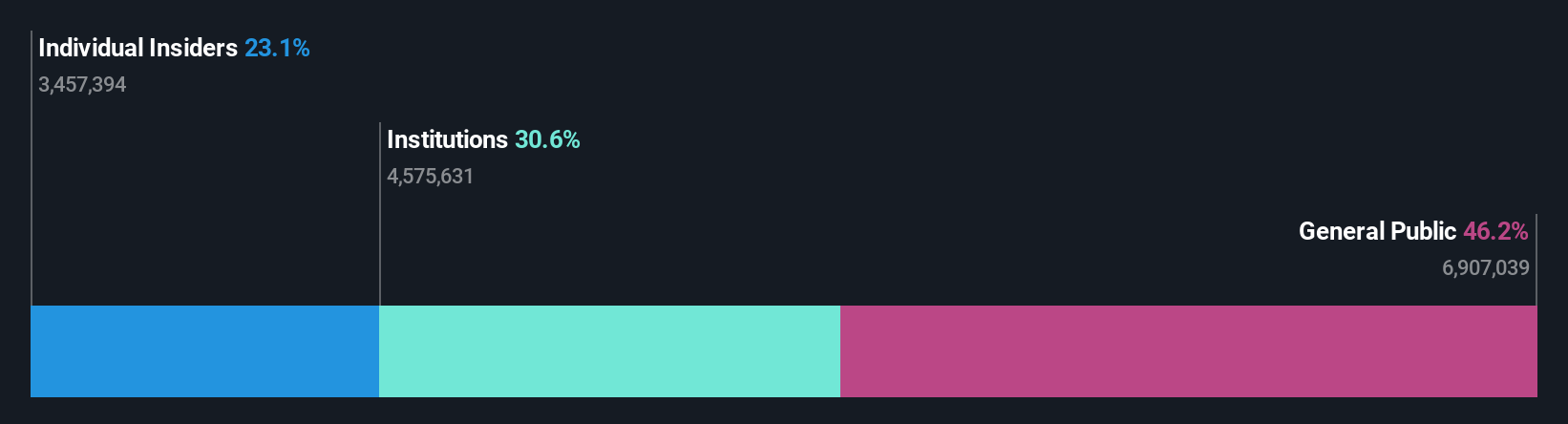

Insider Ownership: 17.4%

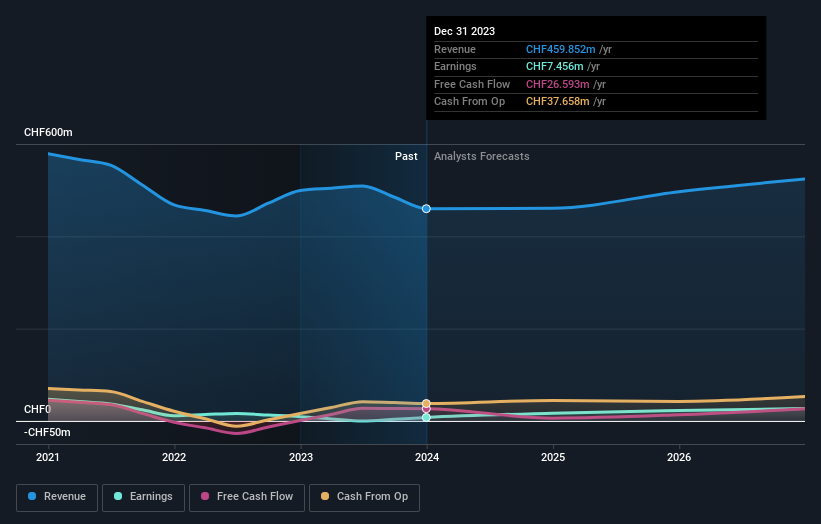

Temenos, a Swiss-based growth company with significant insider ownership, is forecasted to see its earnings grow by 14.7% annually, outstripping the Swiss market's 8.3%. Despite trading at a substantial discount to its estimated fair value and offering a stable dividend yield of 1.98%, it carries high debt levels and exhibits share price volatility. Recent advancements include enhancing the efficiency of its cloud-native banking platform on Microsoft Azure, significantly reducing carbon emissions while improving transaction handling capabilities.

- Click here and access our complete growth analysis report to understand the dynamics of Temenos.

- The analysis detailed in our Temenos valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Explore the 16 names from our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial services institutions.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion