- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

UBS (SWX:UBSG): Does Strong Performance Reflect Fair Value?

Reviewed by Simply Wall St

Most Popular Narrative: Fairly Valued

The prevailing analyst narrative sees UBS Group as fairly valued at current prices. This outlook is driven by expectations of solid earnings and revenue growth, balanced against evolving sector challenges.

Significant investment in digital infrastructure, AI-powered client solutions, and operational automation (for example, the rollout of in-house AI assistant and expanded Microsoft Copilot access) is expected to increase differentiation, expand UBS's scalable client base, and lower expense ratios over time. These factors may further boost operating margins and profitability.

Curious what justifies UBS Group's current price? The analyst consensus is betting on accelerated growth, operational transformation, and financial targets that would change how investors see the bank's future. Want to understand which bold performance projections and industry shifts drive this valuation? There is more to the story, and the numbers behind it may surprise you.

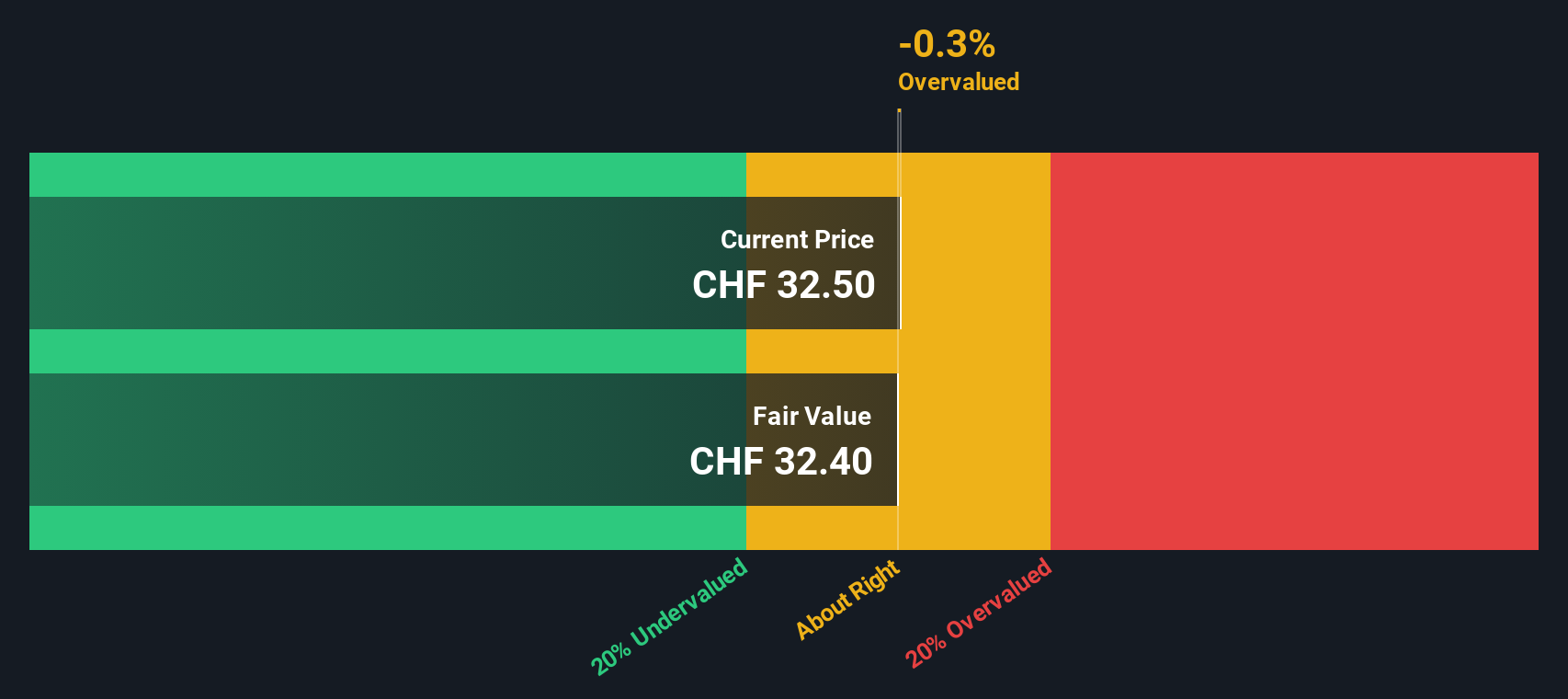

Result: Fair Value of CHF32.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened regulatory requirements or setbacks in integrating Credit Suisse could quickly weigh on UBS's profitability and challenge its current valuation assumptions.

Find out about the key risks to this UBS Group narrative.Another View: Discounted Cash Flow Model

Taking a different approach, our SWS DCF model paints a less optimistic picture and suggests that UBS Group may actually be trading a bit above its intrinsic value. Could the market be too confident?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UBS Group Narrative

If these perspectives do not quite fit your view, or you want to investigate key numbers for yourself, you can craft a personalized UBS Group narrative in just minutes. Do it your way

A great starting point for your UBS Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never wait for the crowd. Broaden your watchlist with fresh stock ideas tailored to today’s biggest trends and tomorrow’s best opportunities.

- Supercharge your search for untapped tech leaders by scanning AI-powered companies at the forefront of innovation using AI penny stocks.

- Boost your income strategy and spot reliable payouts by checking out companies offering dividend stocks with yields > 3%.

- Capitalize on hidden bargains and future market movers by identifying undervalued stocks based on cash flows ready to grow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)