- Canada

- /

- Renewable Energy

- /

- TSX:RNW

Need To Know: The Consensus Just Cut Its TransAlta Renewables Inc. (TSE:RNW) Estimates For 2023

One thing we could say about the analysts on TransAlta Renewables Inc. (TSE:RNW) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

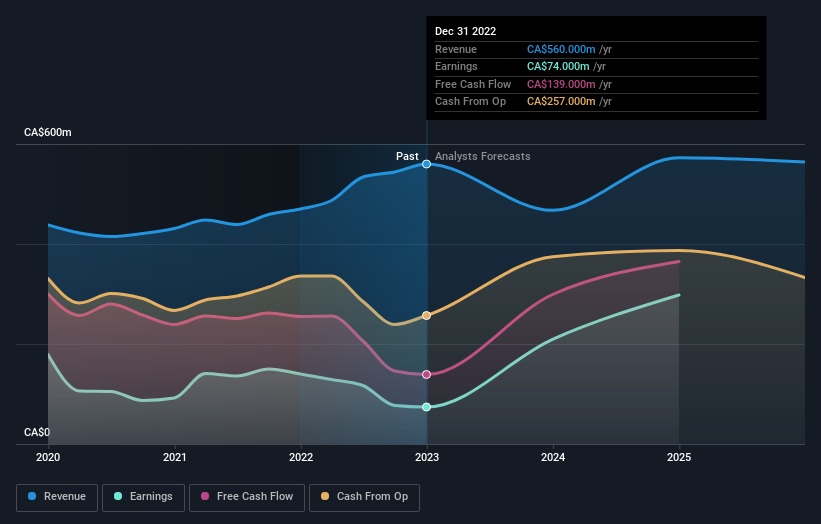

Following the latest downgrade, the current consensus, from the five analysts covering TransAlta Renewables, is for revenues of CA$467m in 2023, which would reflect an uncomfortable 17% reduction in TransAlta Renewables' sales over the past 12 months. Per-share earnings are expected to jump 152% to CA$0.70. Before this latest update, the analysts had been forecasting revenues of CA$532m and earnings per share (EPS) of CA$0.70 in 2023. So there's been a clear change in analyst sentiment in the recent update, with the analysts making a substantial drop in revenues and reconfirming their earnings per share estimates.

See our latest analysis for TransAlta Renewables

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 17% by the end of 2023. This indicates a significant reduction from annual growth of 3.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.7% annually for the foreseeable future. It's pretty clear that TransAlta Renewables' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most obvious conclusion from this consensus update is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that TransAlta Renewables' revenues are expected to grow slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on TransAlta Renewables after today.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with TransAlta Renewables' financials, such as the risk of cutting its dividend. Learn more, and discover the 2 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TransAlta Renewables might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RNW

TransAlta Renewables

TransAlta Renewables Inc. owns, develops, and operates renewable and natural gas power generation facilities and other infrastructure assets in Canada, the United States, and Australia.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026