As the Canadian economy navigates through a period of potential volatility influenced by global trade dynamics and monetary policy shifts, investors are increasingly turning their attention to dividend stocks on the TSX for stability. In such an environment, a good dividend stock is often characterized by its ability to provide consistent income and withstand economic fluctuations, making it a compelling choice for those seeking reliable returns amidst uncertainty.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 9.79% | ★★★★★★ |

| SECURE Waste Infrastructure (TSX:SES) | 3.22% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.62% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.85% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.48% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.86% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.57% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.61% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 7.02% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.34% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

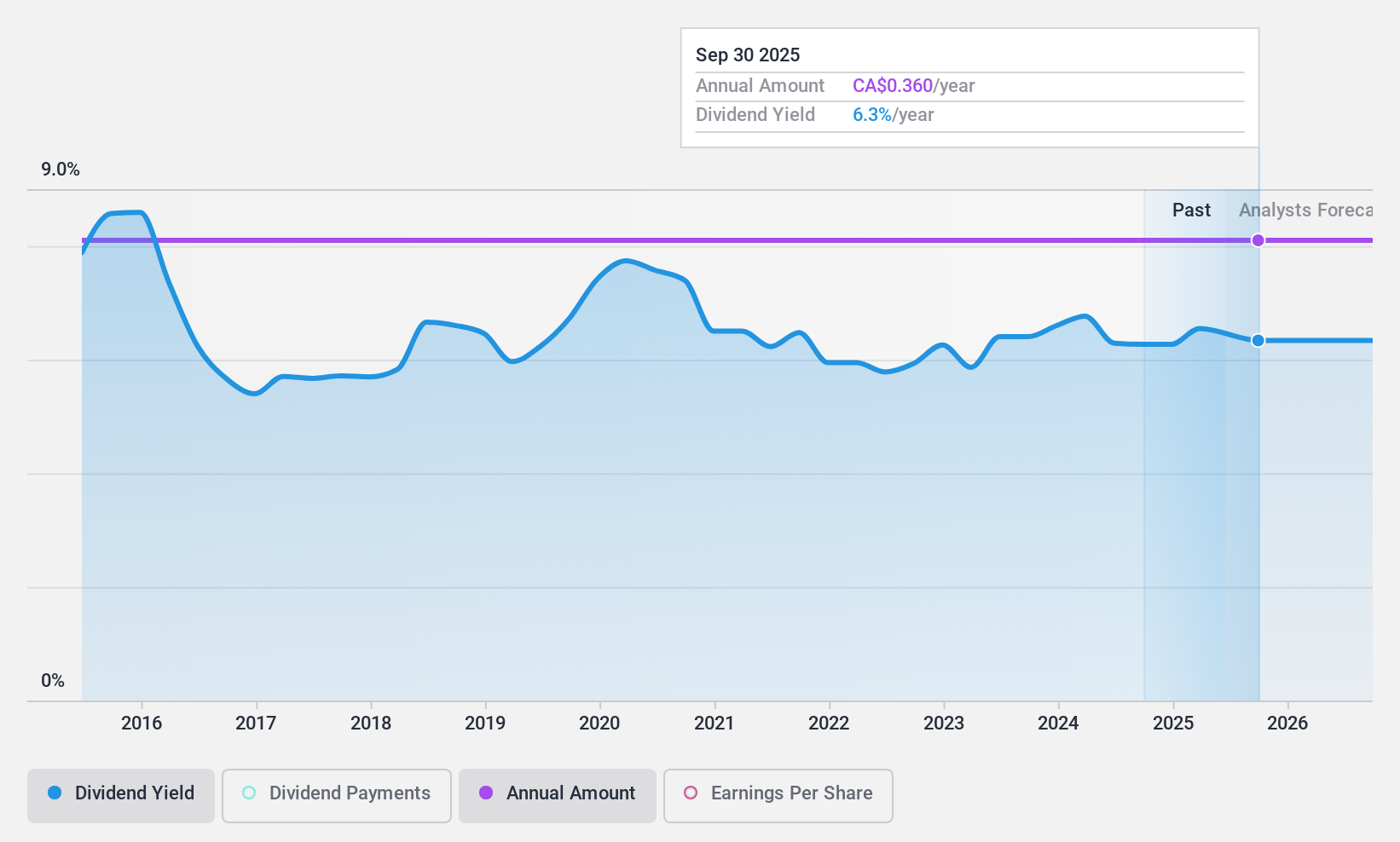

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$793.58 million.

Operations: Evertz Technologies Limited generates revenue primarily from its Television Broadcast Equipment Market, amounting to CA$496.59 million.

Dividend Yield: 7.7%

Evertz Technologies offers a dividend yield in the top 25% of Canadian stocks, with recent quarterly dividends declared at C$0.20 per share. The company's payout ratios indicate that dividends are well-covered by earnings and cash flows, suggesting sustainability despite a historically unstable track record. Recent earnings showed modest growth in net income, reinforcing its capacity to maintain dividend payments. However, past volatility in dividend payments may concern some investors seeking stability.

- Get an in-depth perspective on Evertz Technologies' performance by reading our dividend report here.

- According our valuation report, there's an indication that Evertz Technologies' share price might be on the cheaper side.

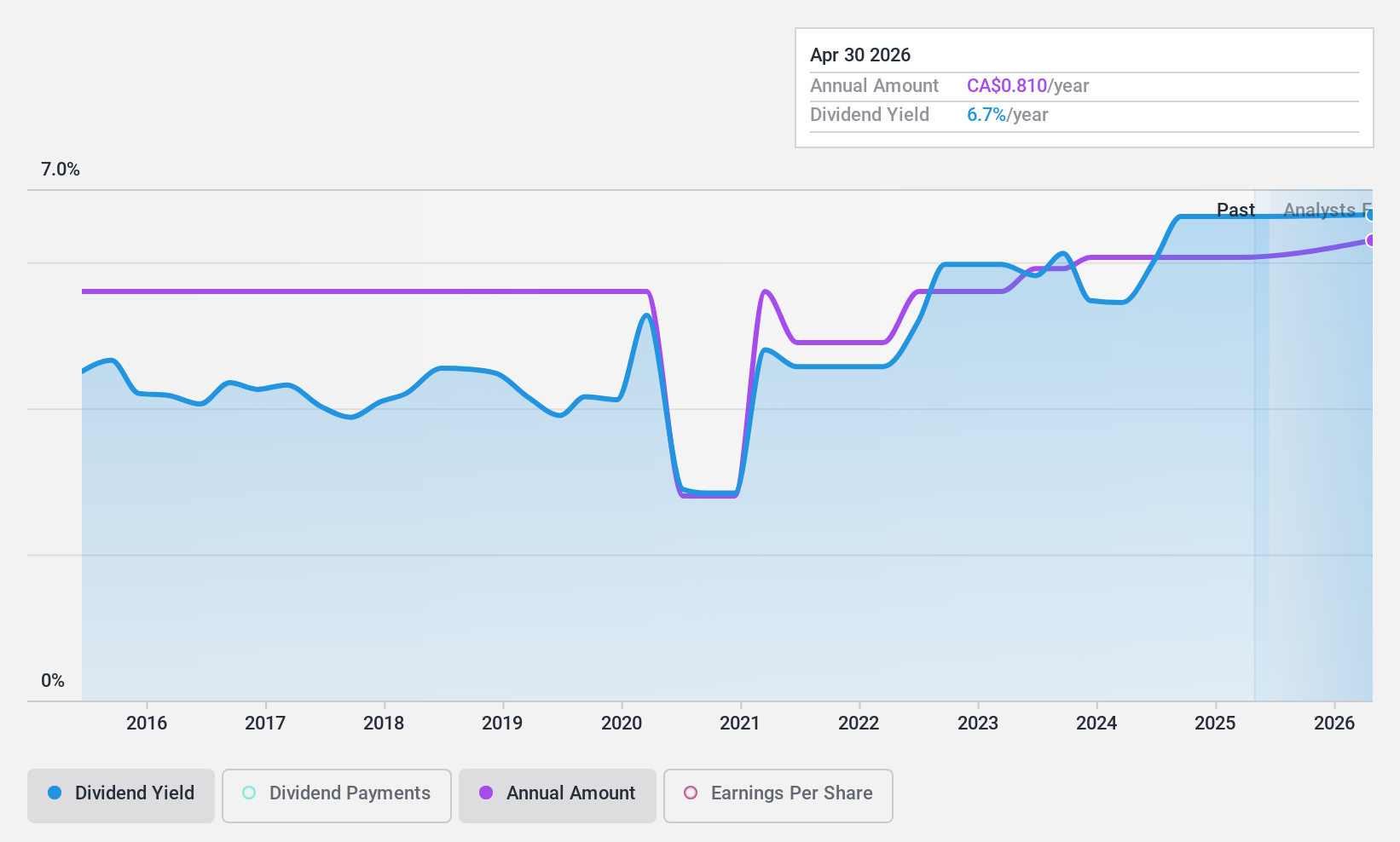

Rogers Sugar (TSX:RSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in the refining, packaging, marketing, and distribution of sugar and maple products across Canada, the United States, Europe, and internationally with a market cap of CA$696.69 million.

Operations: Rogers Sugar Inc.'s revenue is derived from its sugar segment, which accounts for CA$1.03 billion, and maple products segment, contributing CA$241.22 million.

Dividend Yield: 6.7%

Rogers Sugar's dividend yield ranks in the top 25% of Canadian stocks at 6.72%, but its sustainability is questionable as dividends are not covered by free cash flows and have been unreliable over the past decade. The company recently declared a quarterly dividend of C$0.09 per share, despite earnings growth and increased sales in Q1 2025. Recent fixed-income offerings totaling C$175 million may impact financial flexibility, given existing debt challenges.

- Click to explore a detailed breakdown of our findings in Rogers Sugar's dividend report.

- Upon reviewing our latest valuation report, Rogers Sugar's share price might be too pessimistic.

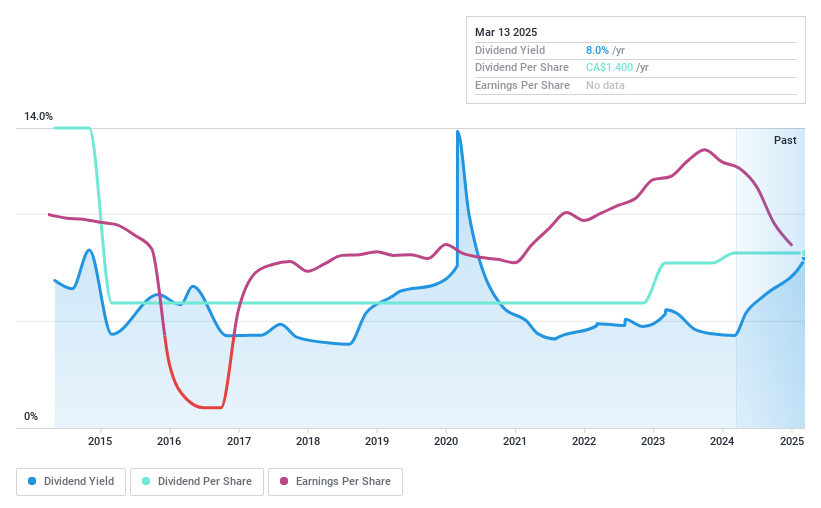

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wajax Corporation offers industrial products and services across Canada, with a market cap of CA$372.49 million.

Operations: Wajax Corporation's revenue from its Wholesale - Machinery & Industrial Equipment segment is CA$2.10 billion.

Dividend Yield: 8.6%

Wajax offers a dividend yield in the top 25% of Canadian stocks at 8.63%, supported by a payout ratio of 71.1% and cash payout ratio of 50.2%. However, dividends have been volatile over the past decade, with recent earnings showing declining net income to C$42.79 million from C$80.99 million last year, raising concerns about sustainability amidst interest coverage issues. The company declared a quarterly dividend of C$0.35 per share for April 2025 payment.

- Click here and access our complete dividend analysis report to understand the dynamics of Wajax.

- The analysis detailed in our Wajax valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 27 Top TSX Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RSI

Rogers Sugar

Engages in refining, packaging, marketing, and distribution of sugar, maple syrup, and related products in Canada, the United States, Europe, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)