- Canada

- /

- Consumer Finance

- /

- TSX:GSY

3 TSX Growth Companies With Up To 25% Insider Ownership

Reviewed by Simply Wall St

In light of recent economic uncertainties and market volatility, the Canadian stock market has demonstrated resilience, with large-cap stocks reaching new all-time highs. As investors navigate these conditions, focusing on growth companies with significant insider ownership can be a strategic approach, as it often indicates confidence from those closest to the company's operations and potential for long-term success.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 33% |

| Robex Resources (TSXV:RBX) | 25.6% | 147.4% |

| Almonty Industries (TSX:AII) | 11.6% | 55.8% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Aritzia (TSX:ATZ) | 17.5% | 22.4% |

| Stingray Group (TSX:RAY.A) | 25.7% | 79.7% |

| Discovery Silver (TSX:DSV) | 17.5% | 49.4% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Allied Gold (TSX:AAUC) | 16% | 76% |

| Tenaz Energy (TSX:TNZ) | 10.4% | 151.2% |

Here's a peek at a few of the choices from the screener.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

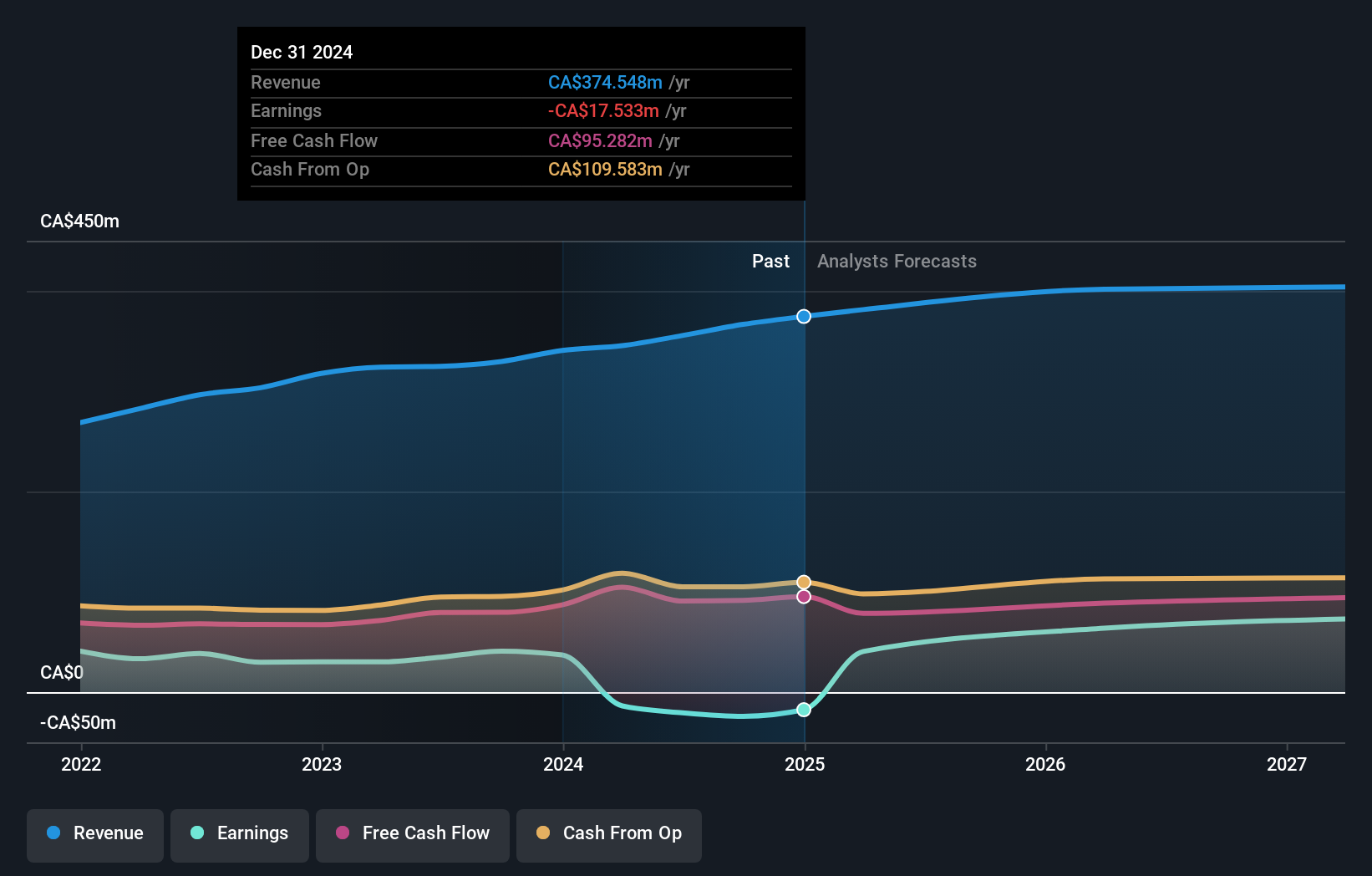

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$2.43 billion.

Operations: The company generates revenue from its Easyhome segment, contributing CA$150.86 million, and its Easyfinancial segment, which accounts for CA$1.41 billion.

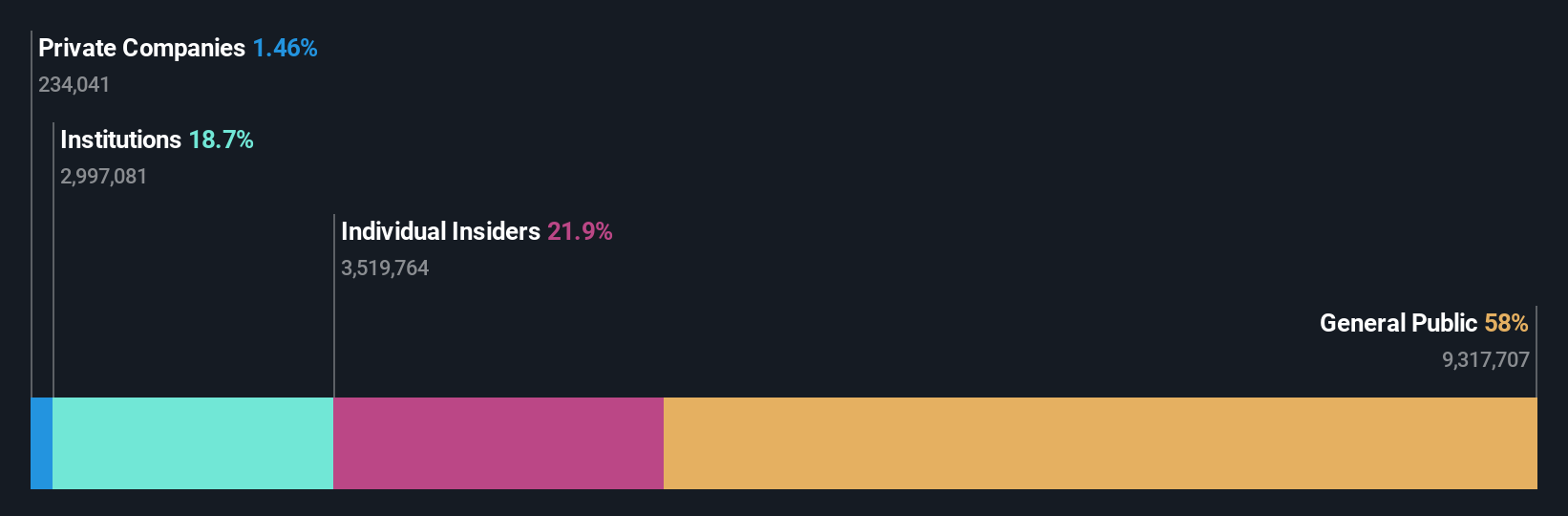

Insider Ownership: 21.9%

goeasy demonstrates strong growth potential with forecasted revenue growth of 29.9% annually, outpacing the Canadian market. Insider ownership is high, with recent substantial insider buying indicating confidence in its prospects. Despite a challenging Q1 2025 with net income declining to C$39.4 million from C$58.94 million a year ago, the company maintains a strategic focus on expansion and operational efficiency under new CEO Dan Rees, aiming to scale its loan portfolio significantly by 2027.

- Get an in-depth perspective on goeasy's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, goeasy's share price might be too pessimistic.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market cap of CA$591.96 million.

Operations: The company's revenue is primarily derived from its Broadcasting and Commercial Music segment at CA$243.37 million, followed by its Radio segment at CA$131.18 million.

Insider Ownership: 25.7%

Stingray Group's growth prospects are bolstered by its forecasted earnings increase of 79.71% annually, despite slower revenue growth of 4.5% per year compared to the Canadian market. The company is expected to become profitable within three years, surpassing average market growth rates. Although trading at a significant discount to estimated fair value and with a high debt level, insider ownership remains substantial without recent insider trading activity. Recent presentations at international conferences highlight its strategic outreach efforts.

- Delve into the full analysis future growth report here for a deeper understanding of Stingray Group.

- The valuation report we've compiled suggests that Stingray Group's current price could be quite moderate.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★★☆

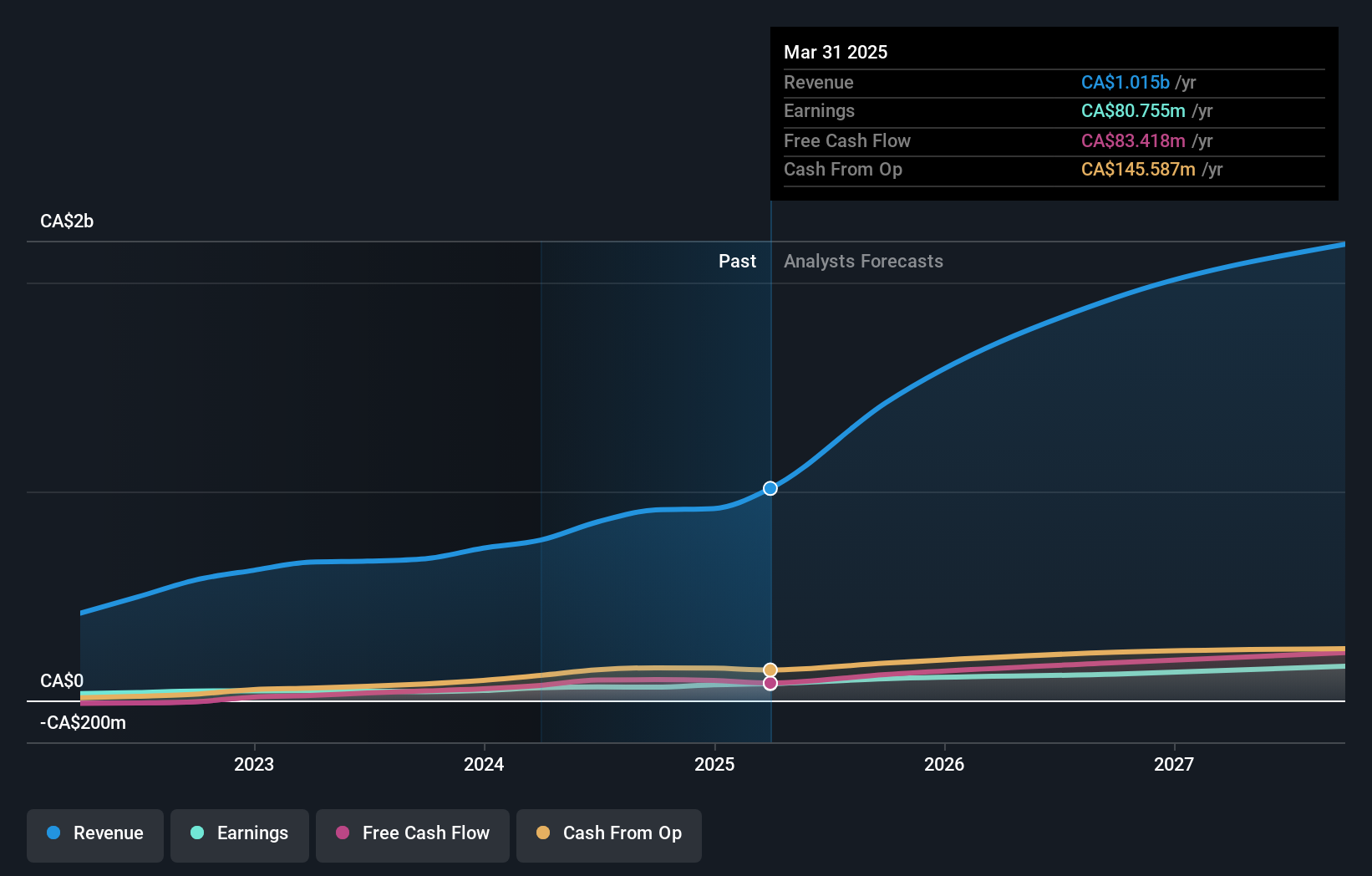

Overview: TerraVest Industries Inc. is a manufacturer and seller of goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$3.32 billion.

Operations: The company's revenue is primarily derived from its HVAC and Containment Equipment segment at CA$363 million, followed by Compressed Gas Equipment at CA$336.15 million, Service at CA$216.52 million, and Processing Equipment at CA$104.18 million.

Insider Ownership: 21%

TerraVest Industries demonstrates strong growth potential, with earnings forecasted to rise 22.8% annually, outpacing the Canadian market. Recent earnings reports show substantial revenue and net income increases, reinforcing its growth trajectory. Despite trading significantly below estimated fair value and a debt position not well-covered by operating cash flow, insider ownership remains high without recent trading activity. The CAD 240.45 million follow-on equity offering could support further expansion efforts in line with its ambitious growth forecasts.

- Take a closer look at TerraVest Industries' potential here in our earnings growth report.

- The analysis detailed in our TerraVest Industries valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Discover the full array of 42 Fast Growing TSX Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade goeasy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives