In the current Canadian market landscape, investors are navigating a complex environment influenced by shifting expectations around interest rate policies and productivity trends, particularly in light of global economic developments. As these macroeconomic factors unfold, identifying growth companies with strong insider ownership can be a prudent strategy, as such ownership often indicates confidence in the company's long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 16.8% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| First National Financial (TSX:FN) | 38.4% | 20.2% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Medicenna Therapeutics (TSX:MDNA) | 15.3% | 57.2% |

| Allied Gold (TSX:AAUC) | 17.7% | 74.4% |

| Vext Science (CNSX:VEXT) | 21.6% | 111.1% |

Let's explore several standout options from the results in the screener.

First National Financial (TSX:FN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: First National Financial Corporation, with a market cap of CA$2.46 billion, operates in Canada where it originates, underwrites, and services commercial and residential mortgages through its subsidiaries.

Operations: Revenue Segments (in millions of CA$): The company generates revenue through the origination, underwriting, and servicing of commercial and residential mortgages in Canada.

Insider Ownership: 38.4%

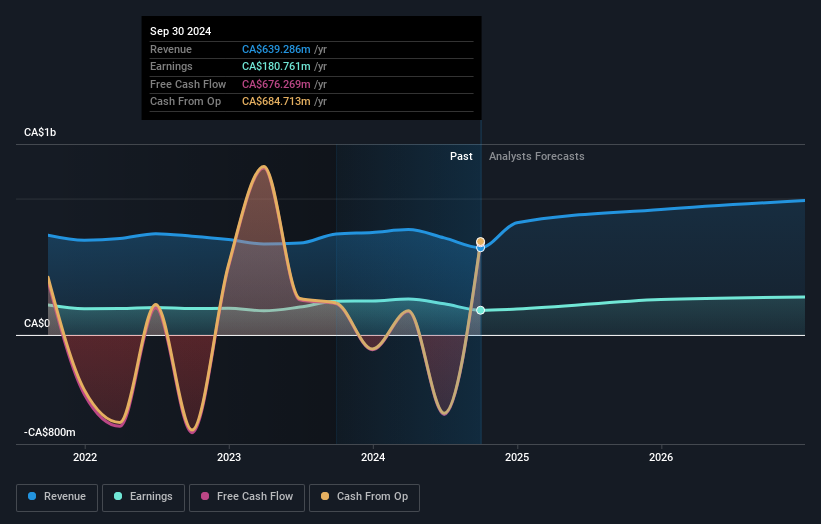

First National Financial shows strong growth potential with expected annual earnings growth of 20.2%, surpassing the Canadian market's forecast. The company's Return on Equity is projected to be high at 35.9% within three years, indicating efficient management and profitability. Insider confidence is evident, with substantial insider buying in the past three months, and no significant selling recorded. Despite a recent decline in quarterly net income to C$36.41 million, First National continues to enhance shareholder value through regular dividend increases and a special dividend announcement.

- Click here and access our complete growth analysis report to understand the dynamics of First National Financial.

- The valuation report we've compiled suggests that First National Financial's current price could be quite moderate.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a music, media, and technology company operating worldwide with a market cap of CA$480.71 million.

Operations: The company's revenue is derived from two main segments: Radio, generating CA$154.41 million, and Broadcasting and Commercial Music, contributing CA$201.10 million.

Insider Ownership: 25.8%

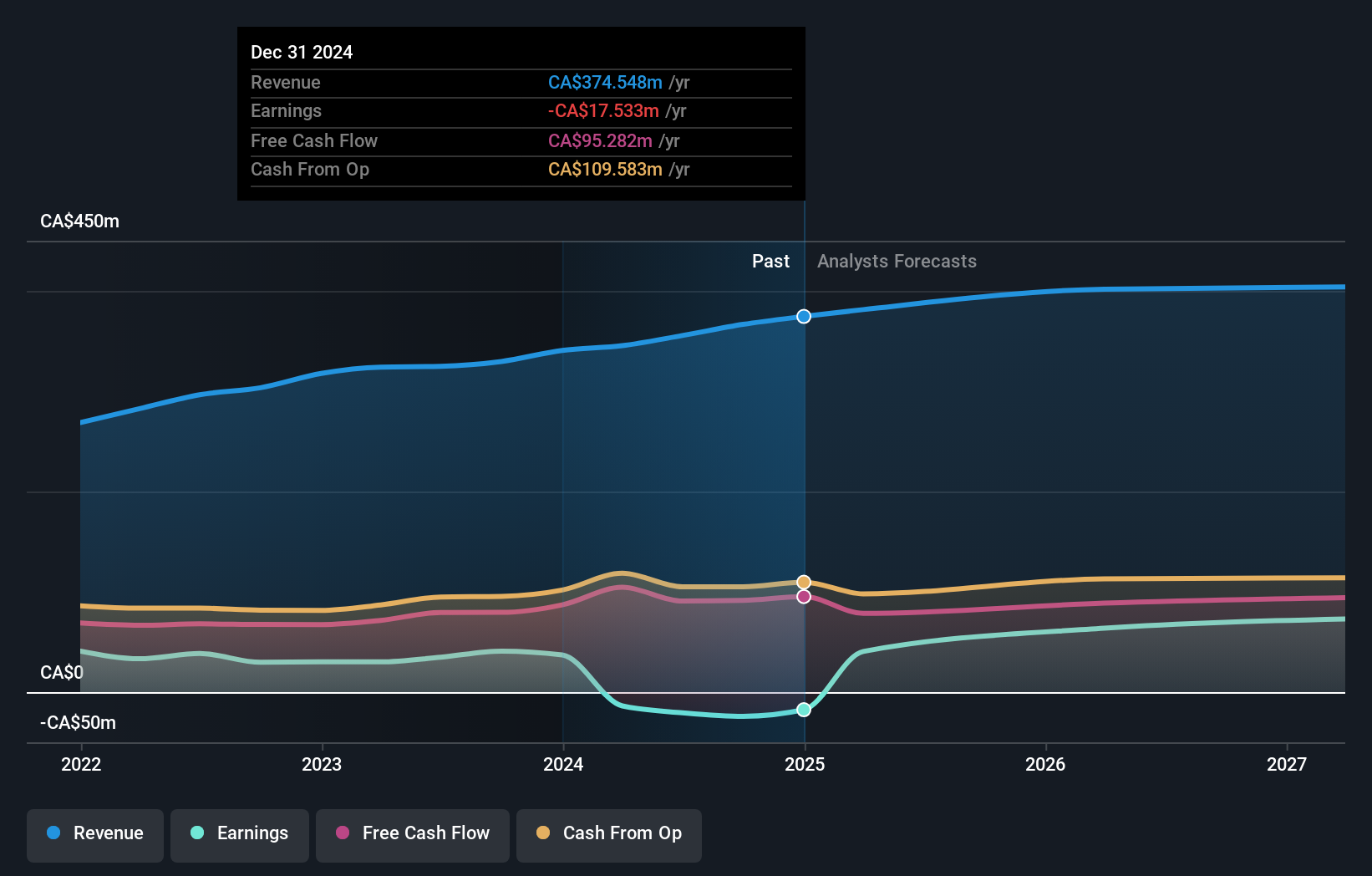

Stingray Group is leveraging its high insider ownership to drive growth through strategic initiatives like the launch of the Stingray Karaoke app on VIZIO and integration into Ford vehicles. Despite a recent drop in net income, analysts expect profitability within three years, with a projected 69.4% annual earnings growth rate. The company has initiated a share repurchase program, reflecting confidence in its undervalued stock trading at 67.7% below fair value estimates, though revenue growth lags behind market expectations.

- Get an in-depth perspective on Stingray Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Stingray Group's share price might be too pessimistic.

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$536.20 million.

Operations: The company's revenue segments include CA$105.16 million from digital banking and CA$10.75 million from DRTC, which encompasses cybersecurity services and banking and financial technology development.

Insider Ownership: 13.3%

VersaBank's high insider ownership aligns with its growth trajectory, as evidenced by forecasted revenue and earnings growth rates of 22% and 30.4% annually, respectively, surpassing the Canadian market. Despite a recent dip in quarterly net income to C$9.71 million, the bank's stock trades at a significant discount to fair value estimates. Recent substantial insider share purchases indicate confidence in its long-term potential amidst a competitive financial landscape.

- Navigate through the intricacies of VersaBank with our comprehensive analyst estimates report here.

- Our valuation report here indicates VersaBank may be undervalued.

Turning Ideas Into Actions

- Embark on your investment journey to our 38 Fast Growing TSX Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company worldwide.

Reasonable growth potential and fair value.