- Canada

- /

- Oil and Gas

- /

- TSX:GXE

TSX Penny Stocks To Watch: 3 Picks Under CA$200M Market Cap

Reviewed by Simply Wall St

As the Canadian market reflects on a strong 2024, marked by an 18% gain in the TSX and robust performances across sectors, investors are now navigating a landscape of mixed economic signals and policy uncertainties. Amidst this backdrop, smaller companies often referred to as penny stocks continue to attract attention for their potential value and growth opportunities. While the term "penny stocks" may seem outdated, these investments can offer surprising stability when backed by solid financials, making them worth considering for those looking beyond traditional large-cap names.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.04 | CA$379.39M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$122.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.42 | CA$961.62M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$583.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.45 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.66 | CA$307.33M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 945 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

DATA Communications Management (TSX:DCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DATA Communications Management Corp. offers solutions for complex marketing and communication workflows, primarily serving the United States and Canada, with a market cap of CA$118.36 million.

Operations: The company generates revenue from its Printing & Publishing segment, totaling CA$493.70 million.

Market Cap: CA$118.36M

DATA Communications Management Corp. has shown significant financial improvement despite being unprofitable, with a positive shift in shareholder equity and a strong cash runway exceeding three years due to positive free cash flow. Although the company reported a net loss of CA$2.67 million for Q3 2024, this marked an improvement from the previous year's loss of CA$4.19 million, and it achieved net income of CA$2.87 million for the first nine months of 2024 compared to a substantial loss in the prior year. The management team is experienced, but high debt levels remain a concern alongside its negative return on equity.

- Unlock comprehensive insights into our analysis of DATA Communications Management stock in this financial health report.

- Gain insights into DATA Communications Management's future direction by reviewing our growth report.

Gear Energy (TSX:GXE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gear Energy Ltd. is a Canadian exploration and production company focused on acquiring, developing, and managing petroleum and natural gas properties, with a market cap of CA$139.71 million.

Operations: The company generates revenue of CA$131.65 million from its oil and gas exploration and production activities.

Market Cap: CA$139.71M

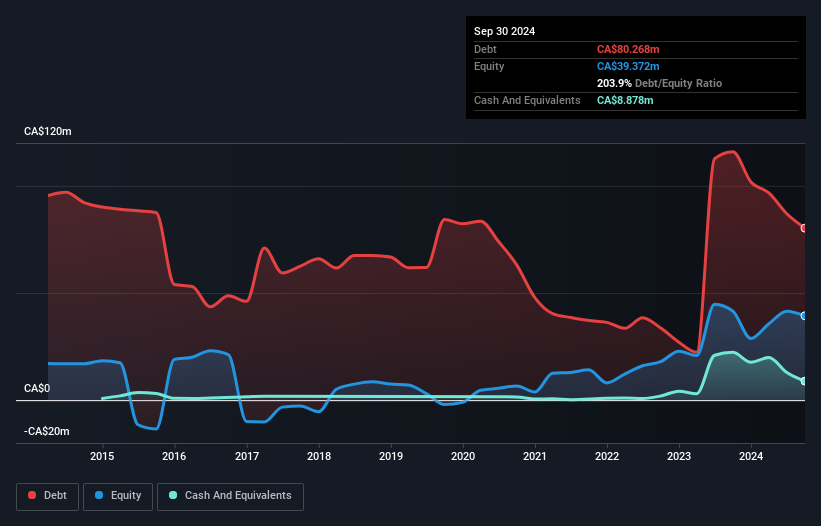

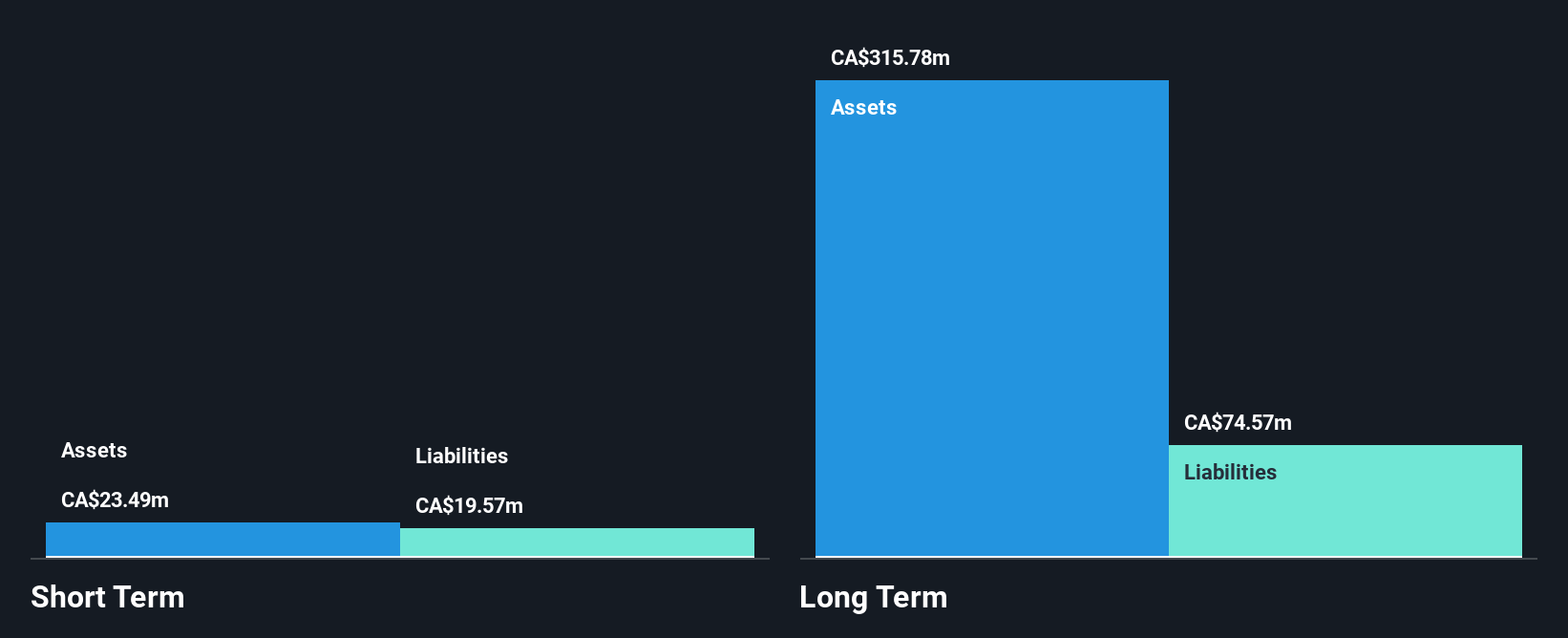

Gear Energy Ltd. is navigating a transformative phase with its acquisition by Cenovus Energy Inc., valued at approximately CA$160 million, expected to close in early February 2025. The company has demonstrated financial resilience, reporting net income of CA$19.29 million for the first nine months of 2024, despite a decline in profit margins from 33% to 9.3%. While its debt-to-equity ratio has significantly improved over five years, short-term assets do not cover long-term liabilities. The seasoned management team and board bring stability amid fluctuating earnings and production guidance adjustments for fiscal year 2025.

- Get an in-depth perspective on Gear Energy's performance by reading our balance sheet health report here.

- Evaluate Gear Energy's prospects by accessing our earnings growth report.

Theralase Technologies (TSXV:TLT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Theralase Technologies Inc. is a clinical stage pharmaceutical company focused on developing light activated photo dynamic compounds and drug formulations for treating cancers, bacteria, and viruses, with a market cap of CA$71.86 million.

Operations: The company generates its revenue primarily from its Device segment, which reported CA$0.99 million.

Market Cap: CA$71.86M

Theralase Technologies Inc. is navigating its clinical-stage development with a focus on innovative bladder cancer treatments, despite being pre-revenue with sales under CA$1 million. The company recently expanded its clinical study sites in North America, enhancing its Phase II trials for BCG-Unresponsive NMIBC CIS. Interim results show promising efficacy and safety, meeting international guidelines and suggesting potential as an alternative to radical cystectomy if approved by the FDA. However, financial challenges persist with high volatility in share price and limited cash runway despite recent capital raises through private placements.

- Click here to discover the nuances of Theralase Technologies with our detailed analytical financial health report.

- Assess Theralase Technologies' future earnings estimates with our detailed growth reports.

Taking Advantage

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 942 more companies for you to explore.Click here to unveil our expertly curated list of 945 TSX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GXE

Gear Energy

An exploration and production company, engages in the acquiring, developing, and holding of interests in petroleum and natural gas properties and assets in Canada.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives