- Canada

- /

- Metals and Mining

- /

- TSX:LGO

Largo (TSX:LGO) Is Down 22.4% After Rapid Equity Raises and Institutional Backing - What's Changed

Reviewed by Sasha Jovanovic

- In recent days, Largo Inc. announced a follow-on equity offering of $17.40 million and a private placement totaling $6 million, both involving common shares at a price of $1.22 per share with institutional participation.

- This rapid succession of capital raises is significant as it signals increased emphasis on strengthening Largo’s balance sheet and funding future projects.

- We'll explore how the back-to-back equity offerings and institutional backing could influence Largo's investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Largo's Investment Narrative?

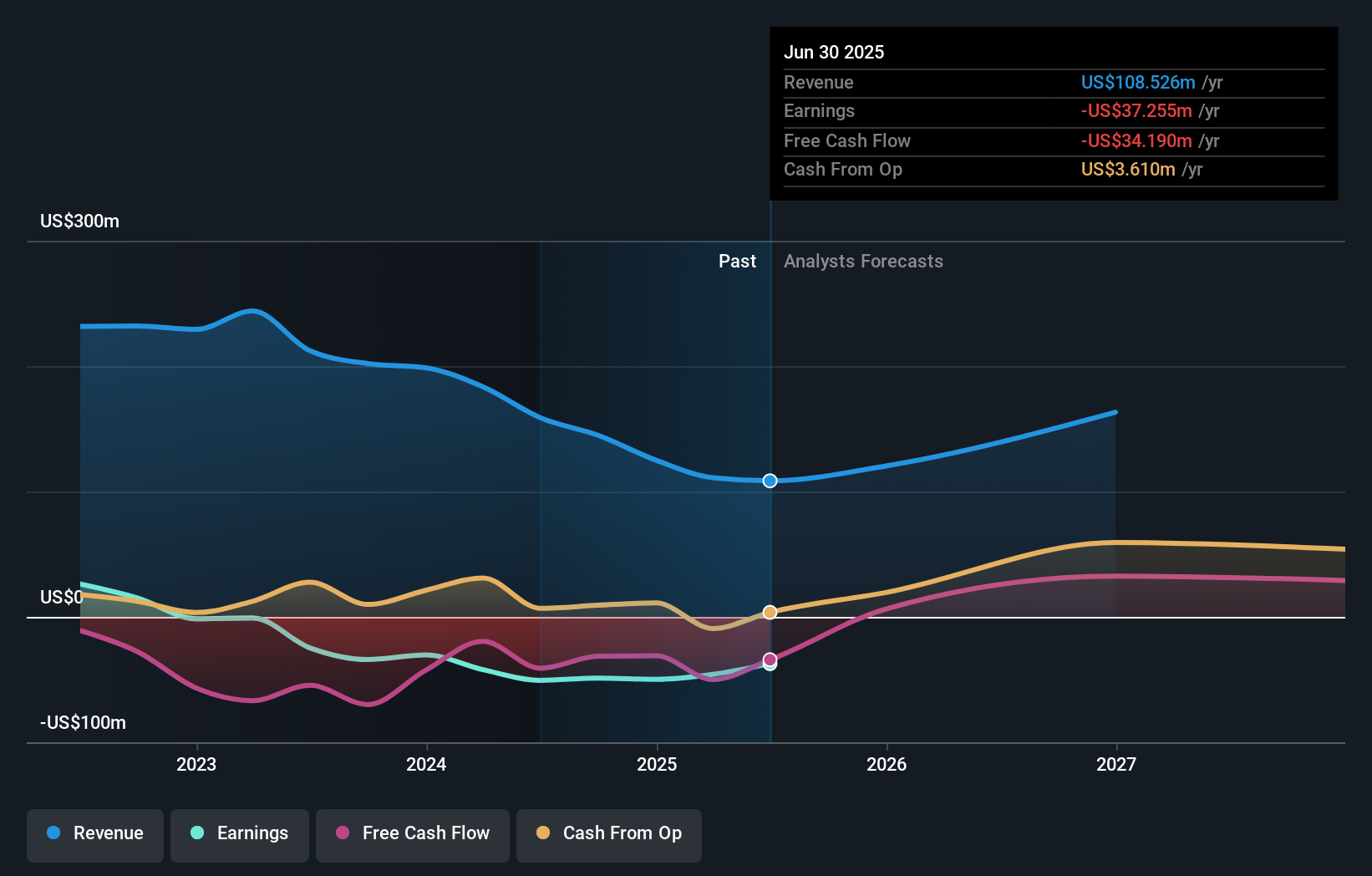

Largo’s recent double-barreled equity offerings, raising over US$23 million at a marked discount, arrived at a pivotal moment for the business, given its streak of quarterly losses and a share price that’s fallen considerably this year. The added capital ticks an urgent box: strengthening the balance sheet as loan deferrals and covenant deadlines loom. It could also alter the company’s biggest near-term catalyst, which was previously tied to securing enough funds to meet debt requirements and avoid liquidity strains. Now, with institutional backing signaling confidence, there’s greater clarity the company can focus on operational improvements and strategic initiatives. However, the flipside is increased shareholder dilution at a low price, raising the bar for future production growth and margin recovery. For shareholders, the balance between financial stability and long-term profitability feels more immediate than ever. But the risk of continued dilution, especially at current price levels, remains critically important for investors to watch.

Despite retreating, Largo's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Largo - why the stock might be worth over 4x more than the current price!

Build Your Own Largo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Largo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Largo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Largo's overall financial health at a glance.

No Opportunity In Largo?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LGO

Largo

Engages in the development and sale of vanadium-based energy storage systems in Canada.

Undervalued with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026