- Canada

- /

- Metals and Mining

- /

- TSX:OGC

TSX's September 2024 Stock Picks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

The Canadian market has been flat in the last week but has risen 13% over the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this context, identifying undervalued stocks that have strong growth potential can be a strategic move for investors looking to capitalize on future gains.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.72 | CA$22.18 | 47.2% |

| AtkinsRéalis Group (TSX:ATRL) | CA$49.82 | CA$76.21 | 34.6% |

| Kinaxis (TSX:KXS) | CA$151.95 | CA$283.44 | 46.4% |

| Calian Group (TSX:CGY) | CA$44.45 | CA$72.78 | 38.9% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.54 | CA$10.60 | 38.3% |

| Endeavour Mining (TSX:EDV) | CA$28.86 | CA$51.50 | 44% |

| NanoXplore (TSX:GRA) | CA$2.27 | CA$4.21 | 46.1% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

| Boyd Group Services (TSX:BYD) | CA$218.98 | CA$341.89 | 36% |

Let's explore several standout options from the results in the screener.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, with a market cap of CA$7.06 billion, operates as a gold mining company in West Africa through its subsidiaries.

Operations: Endeavour Mining plc generates revenue from its Houndé Mine ($612.70 million), Sabodala Massawa Mine ($509.60 million), Mana Mine Burkina Faso ($308.40 million), and Ity Mine Côte D’Ivoire ($708.10 million).

Estimated Discount To Fair Value: 44%

Endeavour Mining is trading at CA$28.86, significantly below its estimated fair value of CA$51.5. The company has a forecasted revenue growth rate of 11.3% per year, outpacing the Canadian market's 6.8%. Analysts expect earnings to grow by 55.86% annually, and the stock is projected to become profitable within three years. Recent settlements and asset divestments have strengthened its cash position with an additional $60 million in payments and royalty agreements on gold sales from Wahgnion mine.

- The analysis detailed in our Endeavour Mining growth report hints at robust future financial performance.

- Dive into the specifics of Endeavour Mining here with our thorough financial health report.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$21.71 billion.

Operations: Ivanhoe Mines Ltd. generates revenue primarily through the mining, development, and exploration of minerals and precious metals in Africa.

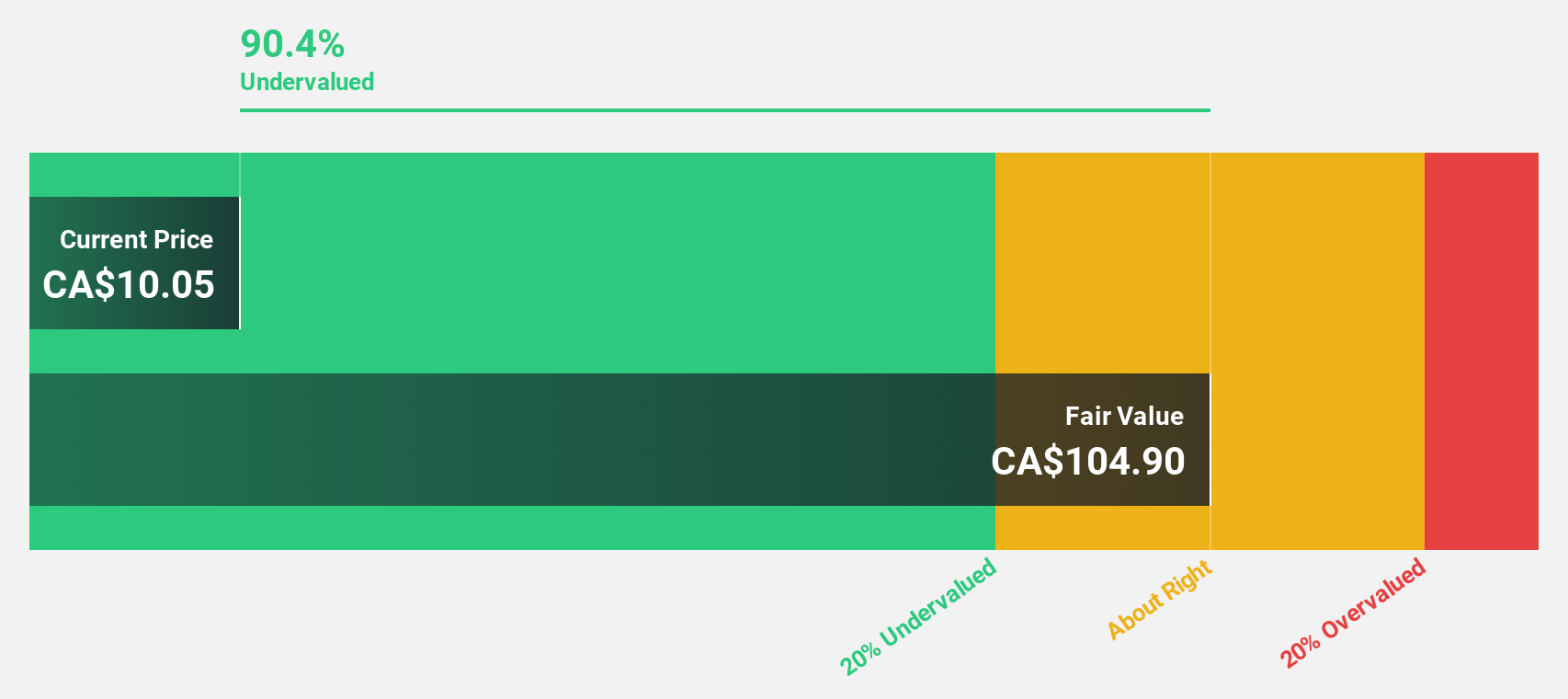

Estimated Discount To Fair Value: 33.3%

Ivanhoe Mines is trading at CA$16.09, well below its estimated fair value of CA$24.11, indicating it may be undervalued based on cash flows. The company has significant growth potential with earnings forecasted to grow 71.6% annually and revenue expected to increase by 83% per year, both outpacing the Canadian market averages. Recent milestones include a record monthly production of 40,347 tonnes of copper at the Kamoa-Kakula Copper Complex and a new MOU with Zambia's Ministry of Mines for exploration activities.

- According our earnings growth report, there's an indication that Ivanhoe Mines might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Ivanhoe Mines.

OceanaGold (TSX:OGC)

Overview: OceanaGold Corporation is a gold and copper producer involved in the exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand, with a market cap of CA$2.46 billion.

Operations: OceanaGold generates $1.00 billion in revenue from its Metals & Mining - Gold & Other Precious Metals segment.

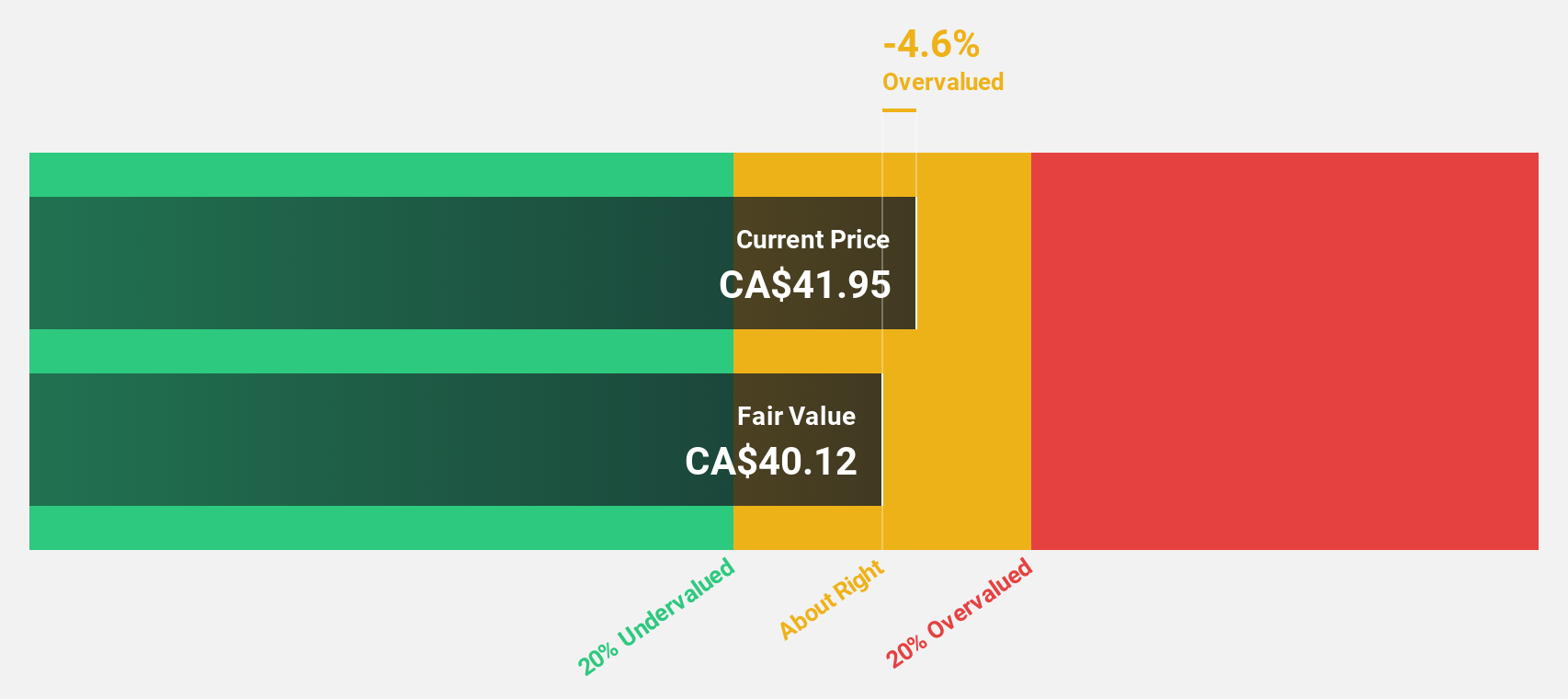

Estimated Discount To Fair Value: 32.8%

OceanaGold is trading at CA$3.48, significantly below its estimated fair value of CA$5.18, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow 61.5% annually, outpacing the Canadian market average of 15.2%. Recent exploration results at Wharekirauponga (WKP) in New Zealand show promising high-grade mineralization, supporting future revenue growth and adding potential value to its asset base despite current lower profit margins and production figures compared to last year.

- In light of our recent growth report, it seems possible that OceanaGold's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of OceanaGold stock in this financial health report.

Seize The Opportunity

- Access the full spectrum of 27 Undervalued TSX Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OGC

OceanaGold

A gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand.

Flawless balance sheet and undervalued.