The Canadian market has been navigating a complex landscape marked by fluctuating interest rates and strong economic indicators, with recent bond yield movements drawing significant attention. Amidst these conditions, investors are reminded of the importance of earnings in influencing stock-market directions. Penny stocks, often representing smaller or newer companies, continue to offer intriguing opportunities for growth at lower price points when supported by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.49 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.28 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$123.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$687.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.26 | CA$218.52M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$178.64M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.00 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

ThreeD Capital (CNSX:IDK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ThreeD Capital Inc. is a venture capital firm focusing on seed/startup, early venture, and growth capital opportunistic investments, with a market cap of CA$10.20 million.

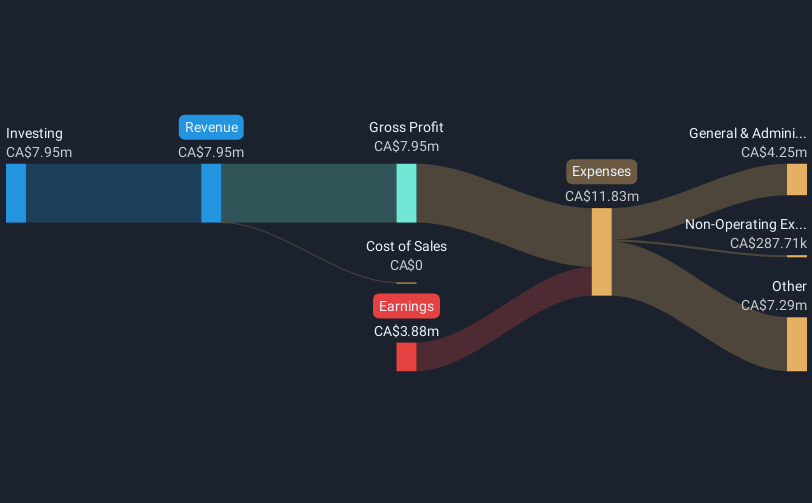

Operations: The firm generates revenue from its investing activities, totaling CA$7.95 million.

Market Cap: CA$10.2M

ThreeD Capital Inc. recently completed a private placement, raising CA$1.96 million by issuing 13,040,000 units at CA$0.15 per unit, with significant insider participation indicating confidence in the firm's prospects. Despite a market cap of CA$10.20 million and revenue generation from investing activities totaling CA$7.95 million last year, the company reported a sharp decline in quarterly revenue to CA$0.12 million and a net loss of CA$1.1 million for Q1 2024 compared to prior profits—a reflection of its volatile financial performance typical among penny stocks. The firm remains debt-free with sufficient cash runway exceeding three years due to positive free cash flow growth.

- Click to explore a detailed breakdown of our findings in ThreeD Capital's financial health report.

- Gain insights into ThreeD Capital's past trends and performance with our report on the company's historical track record.

Intouch Insight (TSXV:INX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intouch Insight Ltd. offers customer experience management products and software solutions across Canada, the United States, and internationally, with a market cap of CA$15.11 million.

Operations: The company generates revenue of CA$30.88 million from its data processing segment.

Market Cap: CA$15.11M

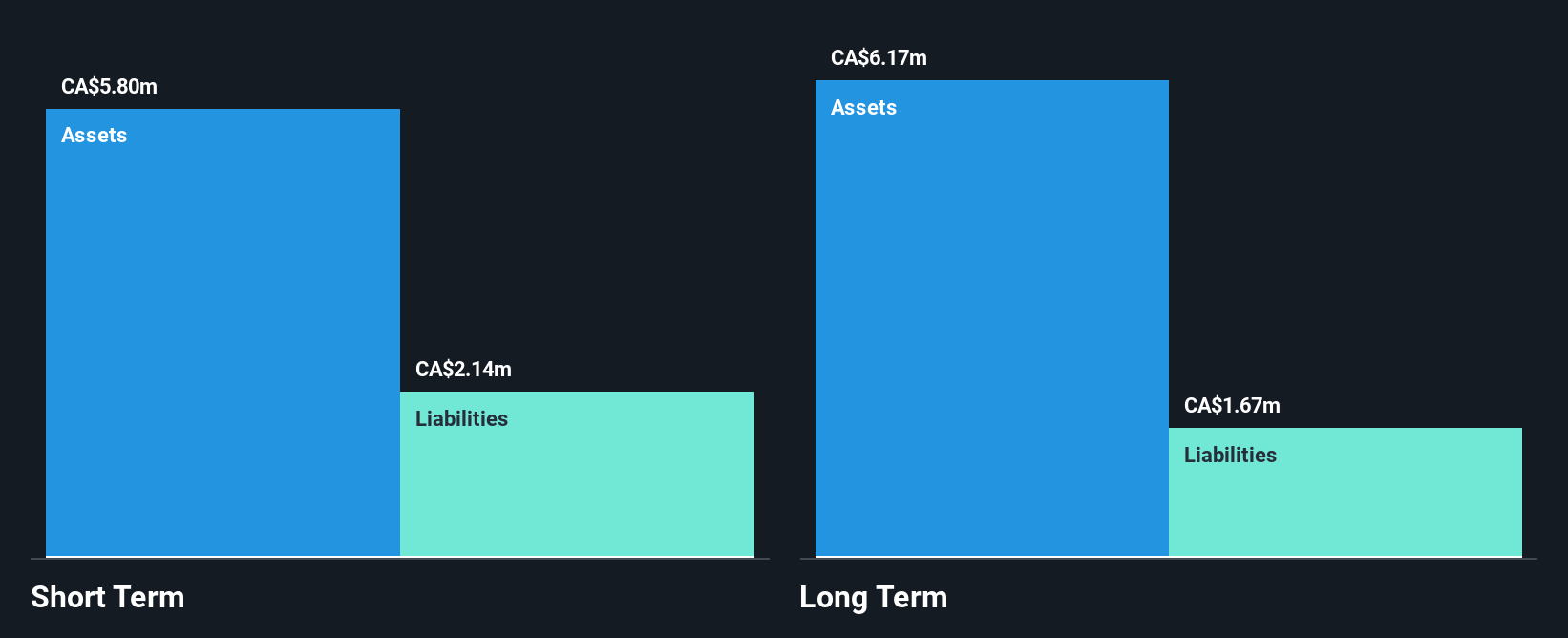

Intouch Insight Ltd. has shown significant earnings growth, with a 213.7% increase over the past year, surpassing industry averages and reflecting accelerated profit growth. The company's revenue reached CA$21.86 million for the first nine months of 2024, up from CA$16.41 million a year ago, demonstrating robust sales performance. Despite this growth, Intouch's return on equity remains low at 8.6%, and interest coverage is below optimal levels at 2.3 times EBIT. However, its debt is well-managed with operating cash flow covering it by 122%, and short-term assets comfortably exceed liabilities, indicating sound financial management amidst share price volatility.

- Unlock comprehensive insights into our analysis of Intouch Insight stock in this financial health report.

- Review our historical performance report to gain insights into Intouch Insight's track record.

Orecap Invest (TSXV:OCI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orecap Invest Corp. focuses on investments in the natural resource sector and has a market cap of CA$14.86 million.

Operations: Orecap Invest Corp. has not reported any revenue segments.

Market Cap: CA$14.86M

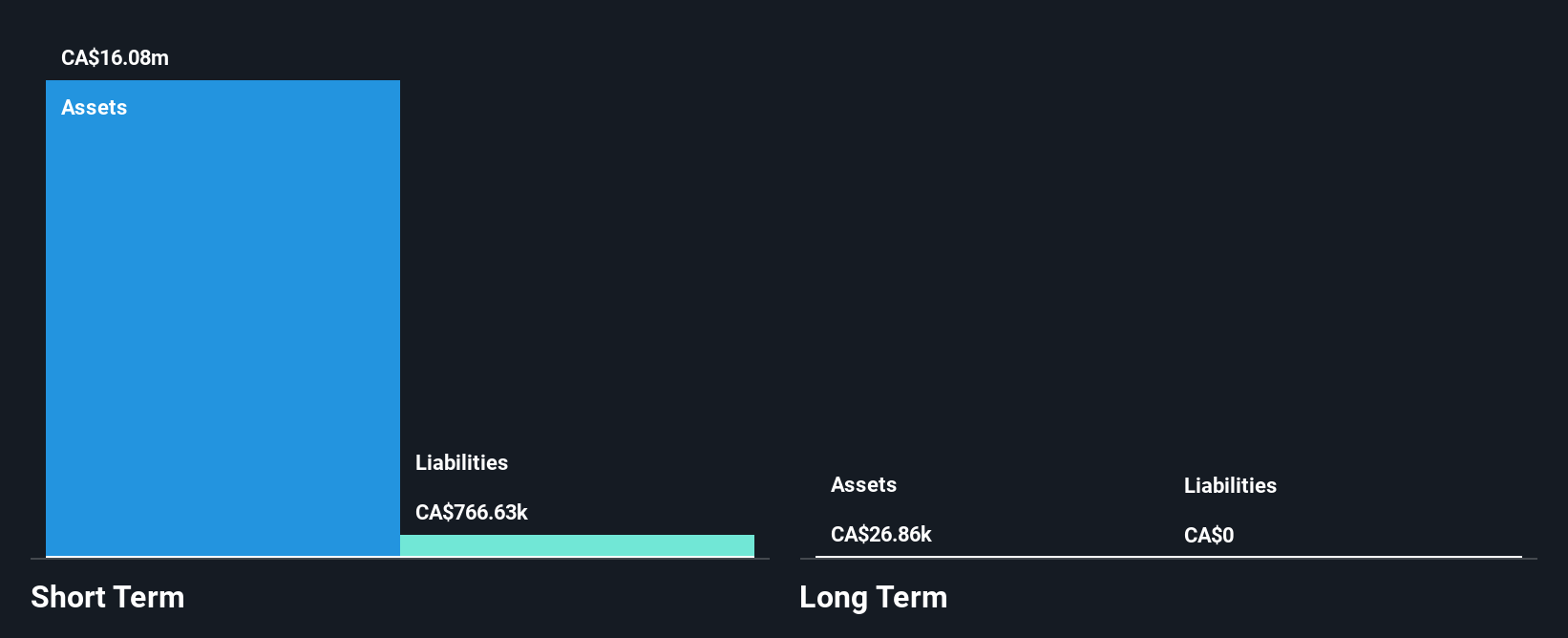

Orecap Invest Corp., with a market cap of CA$14.86 million, is pre-revenue, focusing on investments in the natural resource sector. The company has experienced substantial earnings growth of 1577.4% over the past year, driven by a large one-off gain of CA$11.6 million, although it lacks significant revenue streams. Orecap is debt-free and its short-term assets (CA$19.5M) comfortably cover its liabilities (CA$3.6M), indicating solid financial footing despite high share price volatility and limited revenue generation capacity typical for penny stocks in this sector. Its management and board are seasoned with extensive experience.

- Dive into the specifics of Orecap Invest here with our thorough balance sheet health report.

- Assess Orecap Invest's previous results with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 933 TSX Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:INX

Intouch Insight

Provides customer experience management products and software solutions in Canada, the United States, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)