Exploring 3 Undervalued Small Caps In Global Backed By Insider Activity

Reviewed by Simply Wall St

As global markets continue to react to economic data and rate cut speculations, small-cap stocks have been gaining attention, with the Russell 2000 Index notably outperforming larger indices like the S&P 500. This environment of potential interest rate adjustments and mixed inflation signals presents an intriguing backdrop for exploring small-cap opportunities, where insider activity can often provide additional insights into a company's potential.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 20.96% | ★★★★★☆ |

| Lion Rock Group | 5.2x | 0.4x | 49.23% | ★★★★☆☆ |

| Hemisphere Energy | 5.8x | 2.2x | 11.14% | ★★★★☆☆ |

| East West Banking | 3.3x | 0.8x | 15.68% | ★★★★☆☆ |

| BWP Trust | 9.7x | 12.6x | 17.90% | ★★★★☆☆ |

| Sagicor Financial | 7.3x | 0.4x | -76.72% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 12.9x | 6.7x | 15.96% | ★★★★☆☆ |

| CVS Group | 45.4x | 1.3x | 37.66% | ★★★★☆☆ |

| A.G. BARR | 19.2x | 1.8x | 46.79% | ★★★☆☆☆ |

| Far East Orchard | 9.7x | 3.1x | 16.00% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

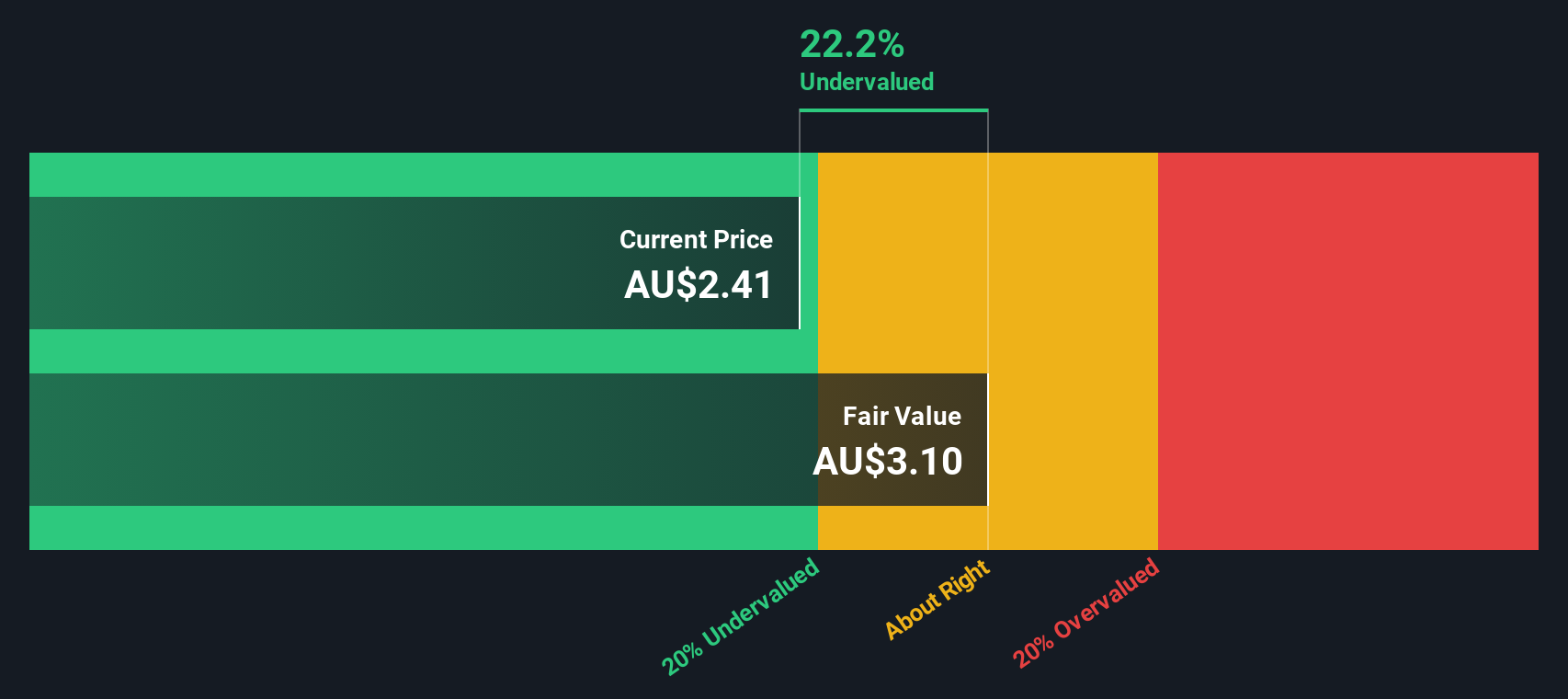

Growthpoint Properties Australia (ASX:GOZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Growthpoint Properties Australia focuses on owning and managing a diversified portfolio of office and industrial properties, with a market capitalization of A$3.05 billion.

Operations: Growthpoint Properties Australia's revenue is primarily derived from its office and industrial segments, generating A$210 million and A$101 million, respectively. The company's net income margin has shown significant variability, reaching a high of 2.48% in December 2021 before declining into negative territory by the end of 2024. Operating expenses have increased over time, with the most recent figure at A$39.9 million as of June 2025.

PE: -14.9x

Growthpoint Properties Australia, a smaller company in its sector, reported a net loss of A$124.6 million for the year ending June 2025, improving from A$298.2 million the previous year. Despite revenue dipping slightly to A$331.3 million from A$332.4 million, insider confidence is evident with share purchases occurring recently. However, reliance on external borrowing presents financial risks as interest payments are not well covered by earnings. The CFO transition signals potential strategic shifts ahead for Growthpoint's next growth phase.

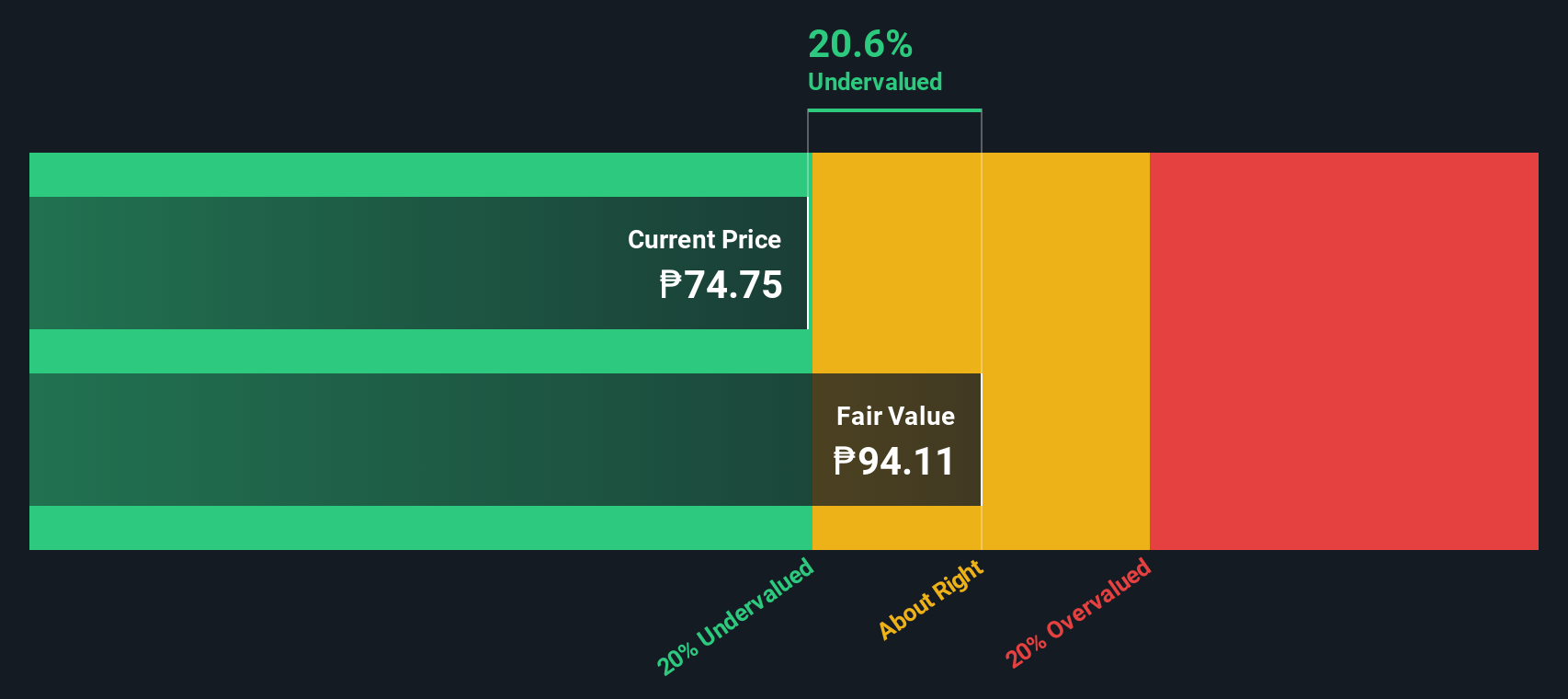

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank is a Philippine-based commercial bank that provides a range of financial services including deposit products, loans, and investment banking, with a market capitalization of approximately ₱26.68 billion.

Operations: AUB's revenue model primarily involves generating income through its core banking operations, with a notable focus on maintaining high gross profit margins, which have consistently remained above 98%. The company's cost structure includes operating expenses that are largely driven by general and administrative costs. Over recent periods, net income margins have shown an upward trend, reaching over 50% in the latest quarter.

PE: 5.6x

Asia United Bank, a smaller player in the banking sector, recently showcased insider confidence with share purchases in early 2025. Their net interest income for Q2 2025 rose to PHP 4.48 billion from PHP 4.22 billion year-on-year, reflecting steady growth. Despite a dividend decrease to PHP 2 per share split into two tranches, the bank's earnings per share improved slightly over the previous year. Leadership changes include Manuel R. Bengson joining as Senior VP of Treasury Group in July 2025, bringing extensive treasury experience and strategic insight to bolster operations further.

- Unlock comprehensive insights into our analysis of Asia United Bank stock in this valuation report.

Assess Asia United Bank's past performance with our detailed historical performance reports.

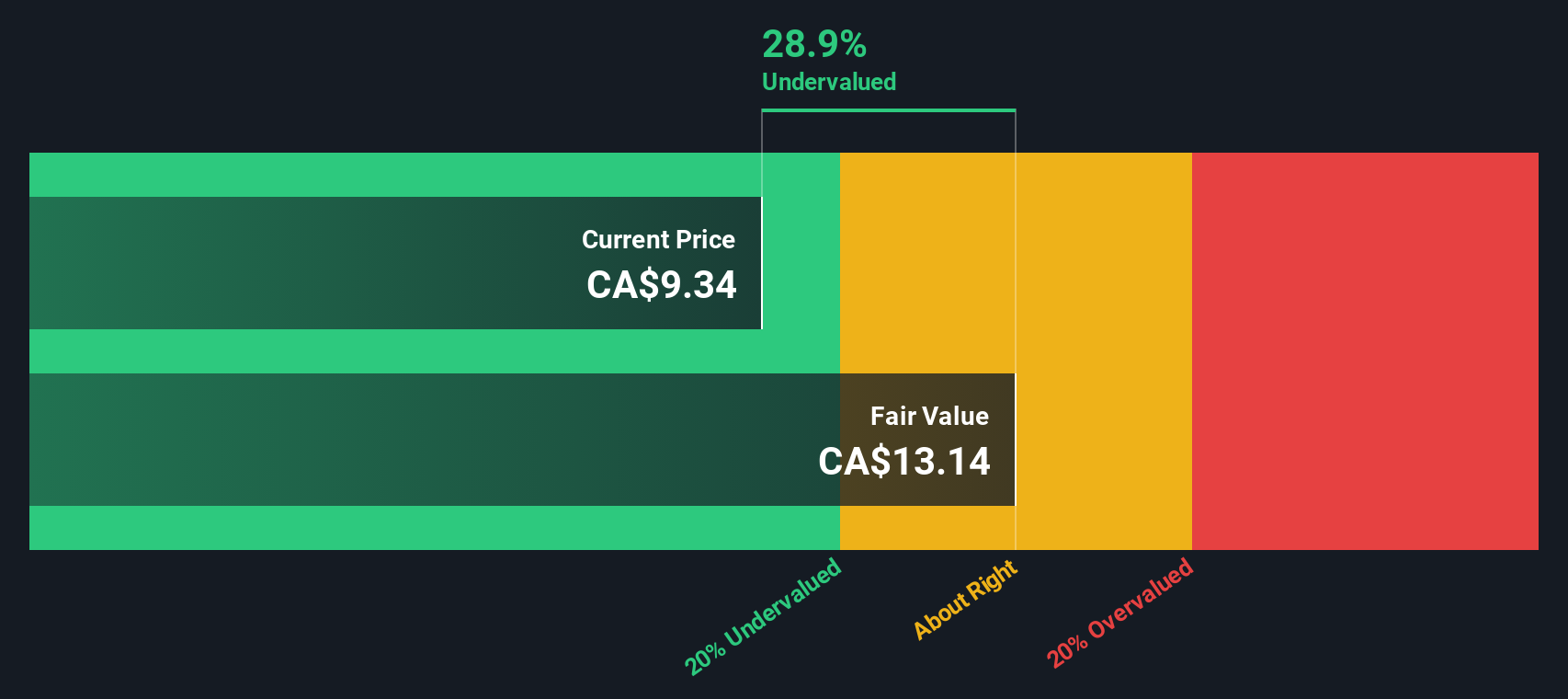

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aris Mining is a company engaged in gold mining operations, primarily focusing on its Marmato and Segovia projects, with a market cap of approximately $1.2 billion.

Operations: The company's revenue primarily stems from its Segovia and Marmato operations, with Segovia contributing significantly more. Over recent periods, the gross profit margin has shown a notable trend, reaching 46.99% by mid-2025. Operating expenses and non-operating expenses have varied, impacting net income margins across different quarters.

PE: 276.6x

Aris Mining, a dynamic player in the gold mining sector, recently reported Q2 2025 earnings with sales of US$203.46 million, up from US$117.19 million the previous year. Despite this revenue growth, they faced a net loss of US$16.9 million compared to last year's profit of US$5.71 million. The company is advancing its operations at Marmato and Segovia with strategic expansions and partnerships aimed at boosting production capacity and formalizing artisanal mining activities in Colombia, potentially enhancing future output and stability.

- Click here and access our complete valuation analysis report to understand the dynamics of Aris Mining.

Gain insights into Aris Mining's past trends and performance with our Past report.

Key Takeaways

- Access the full spectrum of 97 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GOZ

Growthpoint Properties Australia

Our vision is to create sustainable value in everything we do, by being the forward-thinking, trusted partner of choice.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)