- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

3 TSX Stocks Trading At Up To 30.6% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

In the last week, the Canadian market has been flat, but it is up 13% over the past year with earnings expected to grow by 15% per annum over the next few years. In this promising environment, identifying undervalued stocks can be a strategic way to capitalize on potential growth while minimizing risk.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$189.67 | CA$359.49 | 47.2% |

| Computer Modelling Group (TSX:CMG) | CA$12.74 | CA$22.26 | 42.8% |

| Alvopetro Energy (TSXV:ALV) | CA$5.04 | CA$9.04 | 44.3% |

| Kinaxis (TSX:KXS) | CA$147.32 | CA$279.82 | 47.4% |

| Obsidian Energy (TSX:OBE) | CA$9.26 | CA$18.22 | 49.2% |

| Africa Oil (TSX:AOI) | CA$2.06 | CA$3.69 | 44.1% |

| Calibre Mining (TSX:CXB) | CA$2.28 | CA$4.54 | 49.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| NFI Group (TSX:NFI) | CA$19.31 | CA$37.69 | 48.8% |

| NanoXplore (TSX:GRA) | CA$2.25 | CA$4.19 | 46.3% |

Underneath we present a selection of stocks filtered out by our screen.

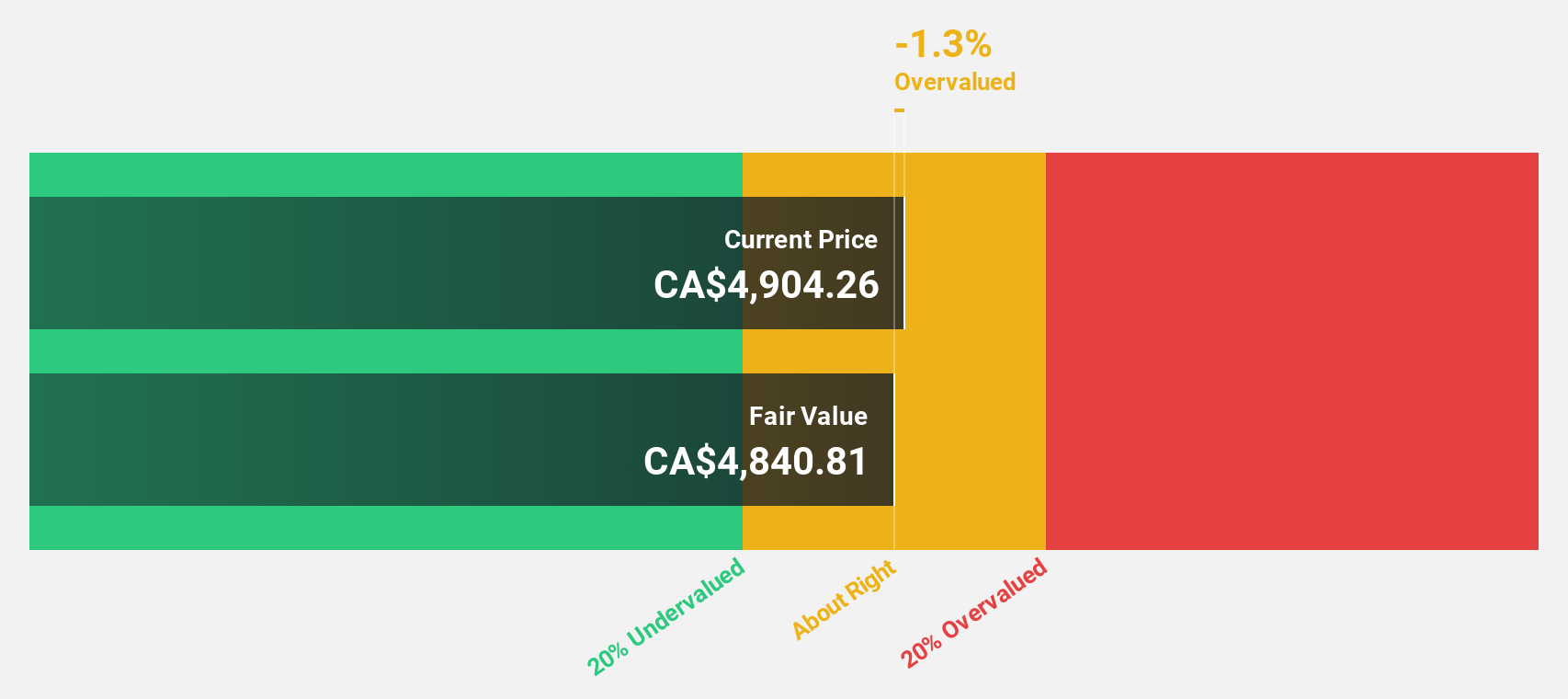

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.26 billion.

Operations: Revenue from the Software & Programming segment totaled $9.27 billion.

Estimated Discount To Fair Value: 20.6%

Constellation Software Inc. is trading at CA$4400.69, significantly below its estimated fair value of CA$5540.97, suggesting it may be undervalued based on cash flows. Recent earnings reports show strong growth with Q2 revenue at US$2.47 billion and net income of US$177 million, reflecting a substantial increase from the previous year. Despite high debt levels, its projected annual profit growth of 23.6% outpaces the Canadian market's 15.4%, highlighting significant potential for investors focused on cash flow valuation metrics.

- Our growth report here indicates Constellation Software may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Constellation Software stock in this financial health report.

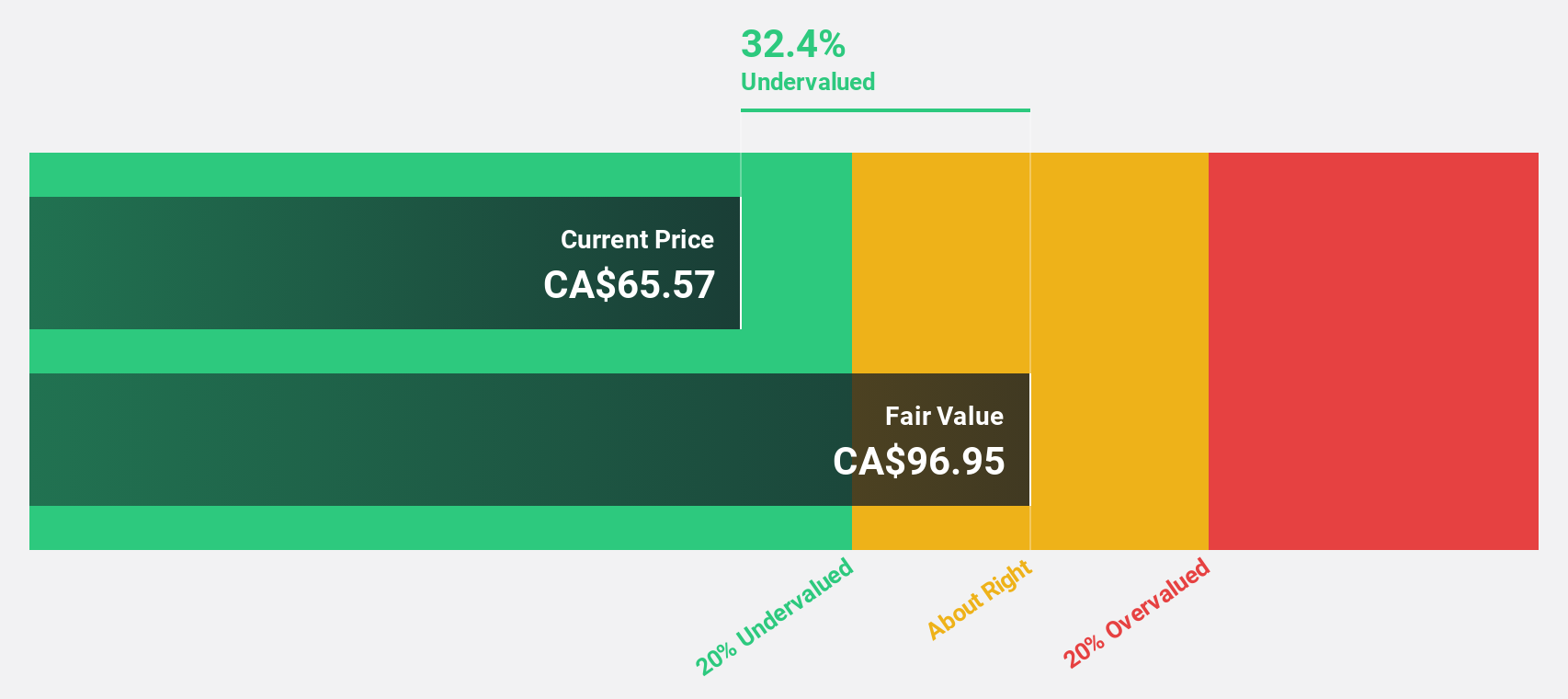

GFL Environmental (TSX:GFL)

Overview: GFL Environmental Inc. provides non-hazardous solid waste management and environmental services in Canada and the United States, with a market cap of CA$21.99 billion.

Operations: The company's revenue segments include CA$4.79 billion from Solid Waste in the USA, CA$2.16 billion from Solid Waste in Canada, and CA$1.67 billion from Environmental Services.

Estimated Discount To Fair Value: 30.6%

GFL Environmental Inc. is trading at CA$58.4, significantly below its estimated fair value of CA$84.1, indicating it may be undervalued based on cash flows. The company reported Q2 2024 revenue of CA$2.06 billion, up from CA$1.94 billion a year ago, but posted a net loss of CA$471.2 million compared to net income last year due to higher expenses and divestitures. Despite recent losses, GFL's revenue is forecasted to grow annually by 7.1%, outpacing the Canadian market's 6.9%.

- The analysis detailed in our GFL Environmental growth report hints at robust future financial performance.

- Dive into the specifics of GFL Environmental here with our thorough financial health report.

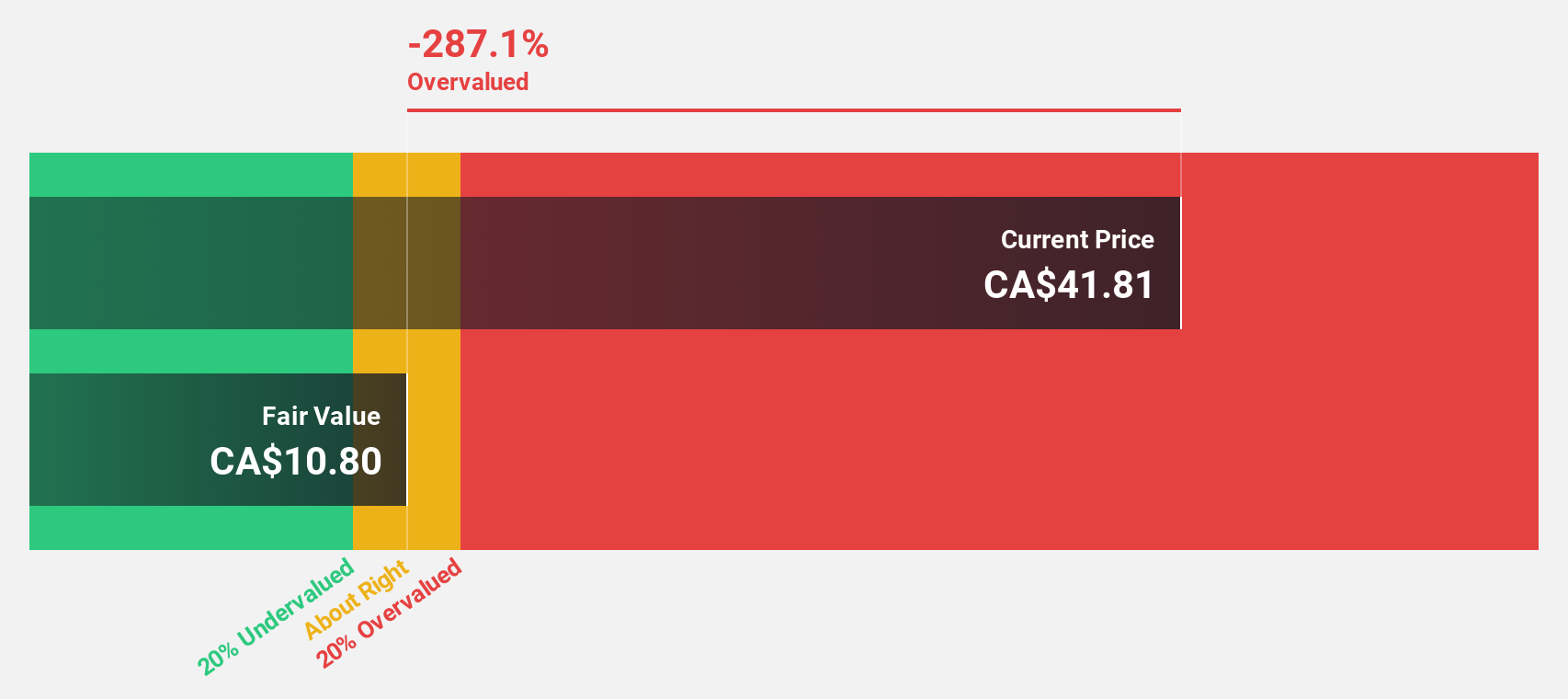

MDA Space (TSX:MDA)

Overview: MDA Space Ltd. designs, manufactures, and services space robotics, satellite systems and components, and intelligence systems globally with a market cap of CA$1.90 billion.

Operations: MDA Space Ltd.'s revenue segments include Geointelligence, Robotics & Space Operations, and Satellite Systems, totaling CA$860.80 million.

Estimated Discount To Fair Value: 17%

MDA Space Ltd. reported Q2 2024 sales of CA$242 million, up from CA$196 million a year ago, with net income rising to CA$11 million from CA$9.9 million. The company expects robust revenue growth, forecasting between $1.02 billion and $1.06 billion for 2024, driven by substantial contracts like the Canadarm3 program worth $1 billion. Trading at CA$15.85, below its estimated fair value of CA$19.09, MDA's earnings are forecasted to grow significantly at 50% annually over the next three years.

- Upon reviewing our latest growth report, MDA Space's projected financial performance appears quite optimistic.

- Take a closer look at MDA Space's balance sheet health here in our report.

Taking Advantage

- Discover the full array of 30 Undervalued TSX Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives