- Canada

- /

- Trade Distributors

- /

- TSX:FTT

Is Now The Time To Put Finning International (TSE:FTT) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Finning International (TSE:FTT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Finning International with the means to add long-term value to shareholders.

Check out our latest analysis for Finning International

Finning International's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Finning International's EPS has grown 31% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

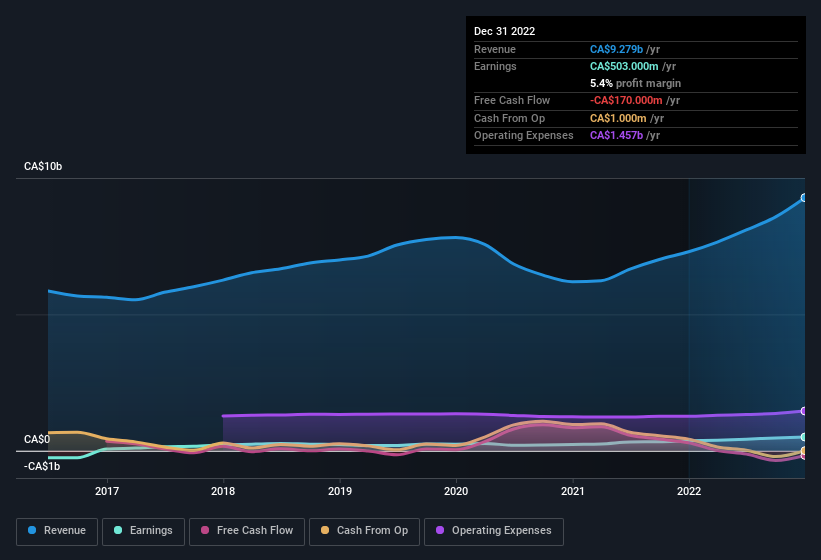

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Finning International maintained stable EBIT margins over the last year, all while growing revenue 27% to CA$9.3b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Finning International?

Are Finning International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Even though some insiders sold down their holdings, their actions speak louder than words with CA$716k more invested than sold by people who know they company best. This overall confidence in the company at current the valuation signals their optimism. We also note that it was the Independent Chairman of the Board, Harold Kvisle, who made the biggest single acquisition, paying CA$164k for shares at about CA$32.80 each.

It's commendable to see that insiders have been buying shares in Finning International, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Finning International, with market caps between CA$2.7b and CA$8.7b, is around CA$4.6m.

Finning International offered total compensation worth CA$2.5m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Finning International Deserve A Spot On Your Watchlist?

You can't deny that Finning International has grown its earnings per share at a very impressive rate. That's attractive. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. All in all, this stock is worth the time to delve deeper into the details. We don't want to rain on the parade too much, but we did also find 2 warning signs for Finning International (1 is potentially serious!) that you need to be mindful of.

The good news is that Finning International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FTT

Finning International

Sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, the United Kingdom, Argentina, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives