- Canada

- /

- Entertainment

- /

- TSX:CGX

3 TSX Stocks Estimated To Be Up To 48.4% Below Intrinsic Value

Reviewed by Simply Wall St

As the Canadian market navigates a period of sideways consolidation, investors are considering strategies to fortify their portfolios against potential volatility and uncertainty. In this environment, identifying undervalued stocks on the TSX can be an effective way to capitalize on price swings while maintaining diversification, as these investments may offer substantial intrinsic value relative to their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Peyto Exploration & Development (TSX:PEY) | CA$15.36 | CA$28.88 | 46.8% |

| Docebo (TSX:DCBO) | CA$45.53 | CA$85.51 | 46.8% |

| Decisive Dividend (TSXV:DE) | CA$6.10 | CA$11.31 | 46.1% |

| VersaBank (TSX:VBNK) | CA$15.05 | CA$29.17 | 48.4% |

| Major Drilling Group International (TSX:MDI) | CA$7.78 | CA$14.71 | 47.1% |

| Groupe Dynamite (TSX:GRGD) | CA$14.83 | CA$27.64 | 46.3% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.78 | CA$3.30 | 46% |

| Quisitive Technology Solutions (TSXV:QUIS) | CA$0.56 | CA$1.04 | 46.2% |

| Thinkific Labs (TSX:THNC) | CA$3.18 | CA$6.34 | 49.9% |

| GURU Organic Energy (TSX:GURU) | CA$1.68 | CA$3.12 | 46.2% |

We'll examine a selection from our screener results.

Cineplex (TSX:CGX)

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$650.75 million.

Operations: Cineplex generates revenue through three main segments: Media (CA$133.80 million), Location-Based Entertainment (CA$128.62 million), and Film Entertainment and Content (CA$1.07 billion).

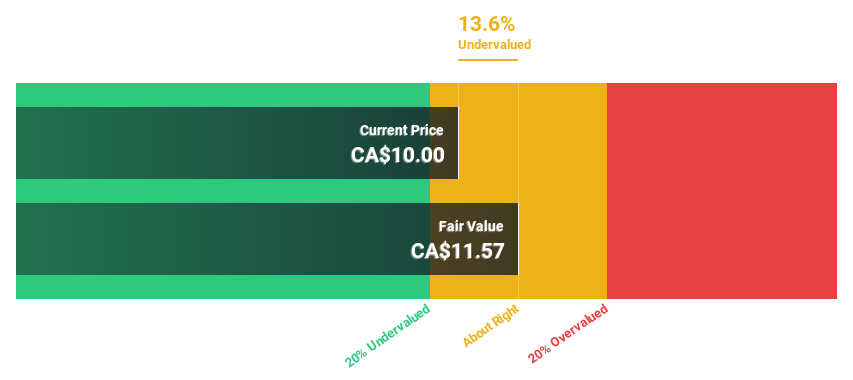

Estimated Discount To Fair Value: 12.8%

Cineplex is trading at CA$10.09, slightly below its fair value estimate of CA$11.57, indicating potential undervaluation based on discounted cash flows. Despite recent financial challenges with a net loss of CA$37.68 million for 2024, analysts expect profitability within three years and forecast earnings growth of over 89% annually. Recent expansions like Playdium and The Rec Room aim to boost revenue streams amidst a competitive market landscape, enhancing long-term cash flow prospects.

- According our earnings growth report, there's an indication that Cineplex might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Cineplex.

Converge Technology Solutions (TSX:CTS)

Overview: Converge Technology Solutions Corp. offers software-enabled IT and cloud solutions across the United States and Canada, with a market cap of CA$1.03 billion.

Operations: Converge Technology Solutions Corp. generates revenue from several regions, including CA$246.82 million from the UK, CA$281.78 million from Germany, and CA$2.05 billion from North America, along with CA$9.33 million from Portage SaaS Solutions.

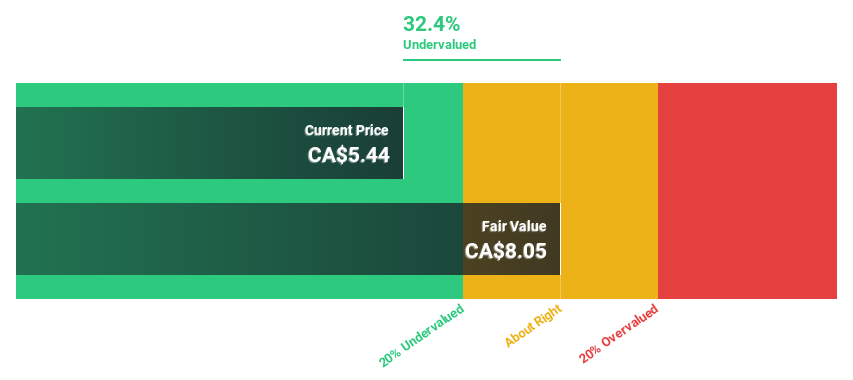

Estimated Discount To Fair Value: 31.1%

Converge Technology Solutions, trading at CA$5.45, is undervalued compared to its estimated fair value of CA$7.91, with a significant discount exceeding 20%. Despite reporting a net loss of CA$177.71 million in 2024 and slower revenue growth than the Canadian market, profitability is anticipated within three years. The recent acquisition by H.I.G. Capital values Converge at approximately CA$1.3 billion and may impact future public trading status and cash flow dynamics positively post-integration.

- Our earnings growth report unveils the potential for significant increases in Converge Technology Solutions' future results.

- Take a closer look at Converge Technology Solutions' balance sheet health here in our report.

VersaBank (TSX:VBNK)

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$486.05 million.

Operations: VersaBank generates revenue through its diverse array of banking products and services across Canada and the United States.

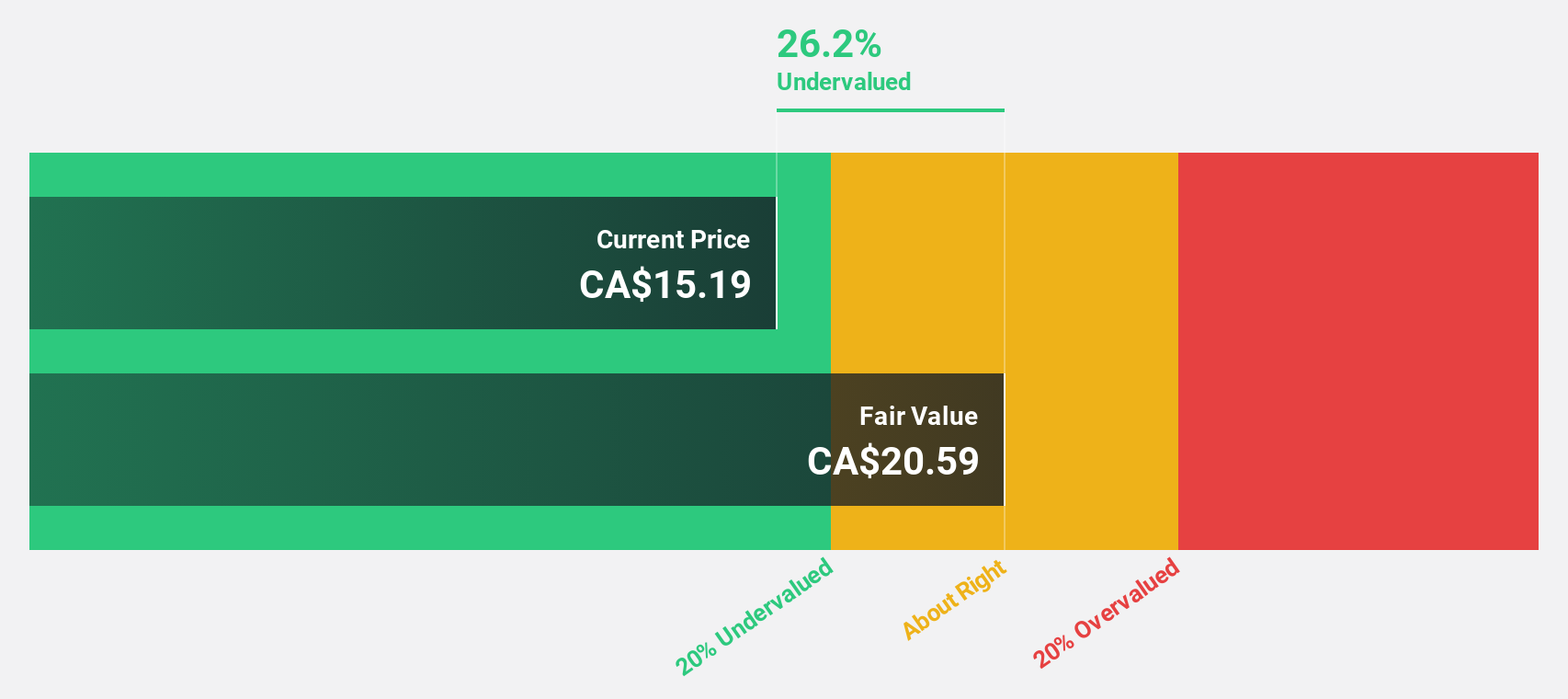

Estimated Discount To Fair Value: 48.4%

VersaBank is trading at CA$15.05, significantly below its estimated fair value of CA$29.17, indicating a substantial discount. Despite a recent decline in net income to CA$8.14 million for Q1 2025, the bank's revenue and earnings are forecasted to grow faster than the Canadian market, with expected annual profit growth of over 55%. However, past shareholder dilution and reduced earnings per share may temper enthusiasm despite positive future projections.

- In light of our recent growth report, it seems possible that VersaBank's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of VersaBank stock in this financial health report.

Taking Advantage

- Access the full spectrum of 25 Undervalued TSX Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGX

Cineplex

Operates as an entertainment and media company in Canada and internationally.

Undervalued with reasonable growth potential.