In the current Canadian market landscape, easing monetary policies and a resilient domestic economy have bolstered financials and materials sectors, contributing to robust performance in the TSX. Amidst these favorable conditions, growth companies with high insider ownership stand out as potentially strong contenders for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Canada

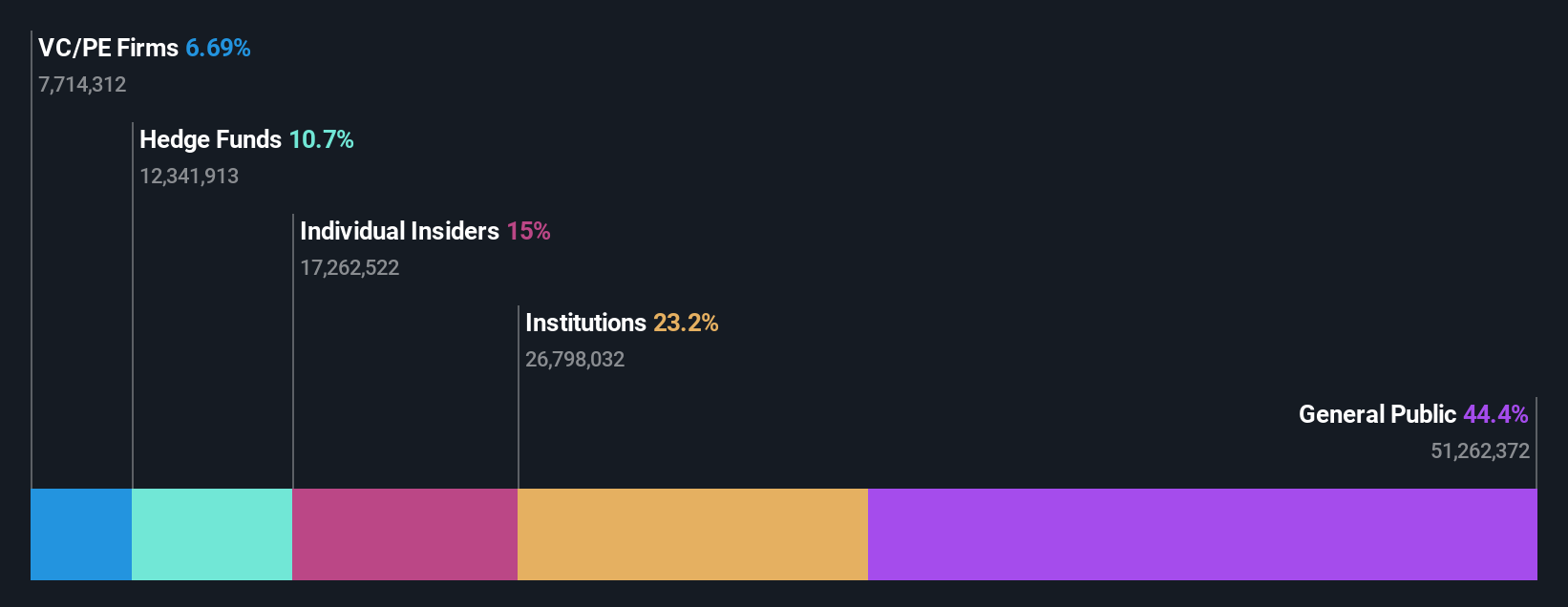

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Allied Gold (TSX:AAUC) | 17.7% | 85.2% |

| Almonty Industries (TSX:AII) | 17.7% | 60.7% |

| Enterprise Group (TSX:E) | 39.8% | 50.5% |

| VersaBank (TSX:VBNK) | 13.2% | 30.4% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 95% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Ivanhoe Mines (TSX:IVN) | 12.5% | 43.2% |

| Profound Medical (TSX:PRN) | 12.2% | 57.4% |

| CHAR Technologies (TSXV:YES) | 10.7% | 58.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Allied Gold Corporation, along with its subsidiaries, engages in the exploration and production of mineral deposits in Africa and has a market cap of CA$1.13 billion.

Operations: The company's revenue is derived from its operations at the Agbaou Mine ($150.18 million), Bonikro Mine ($212.62 million), and Sadiola Mine ($376.41 million).

Insider Ownership: 17.7%

Allied Gold demonstrates characteristics of a growth company with high insider ownership. Insiders have significantly increased their holdings over the past three months, indicating confidence in its future. The company's revenue is forecast to grow at 24.7% annually, outpacing market averages. Despite recent shareholder dilution from a CAD 192.2 million equity offering, Allied Gold's operational expansion at the Sadiola Mine and anticipated profitability within three years bolster its growth potential.

- Unlock comprehensive insights into our analysis of Allied Gold stock in this growth report.

- Our expertly prepared valuation report Allied Gold implies its share price may be lower than expected.

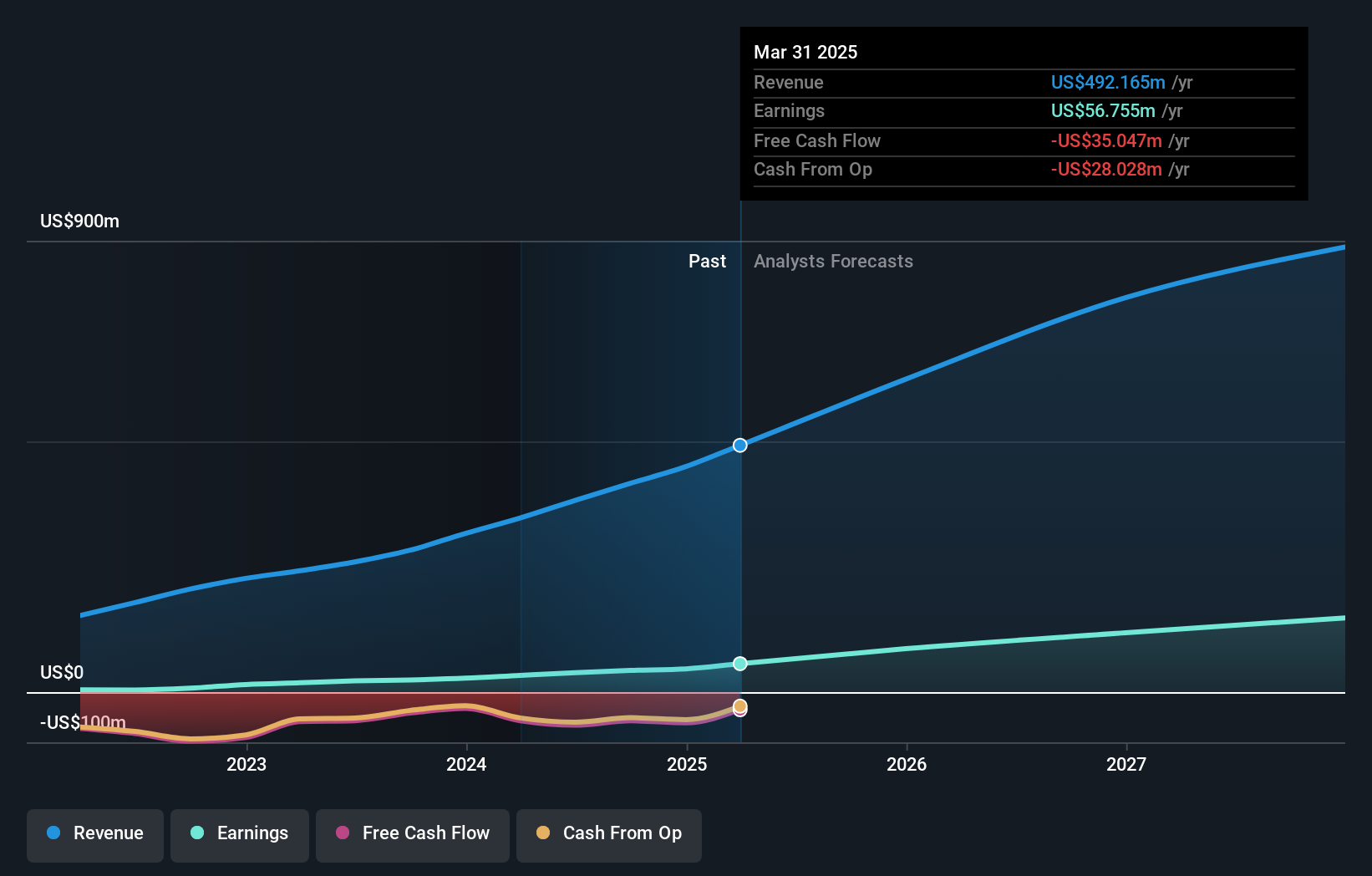

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Propel Holdings Inc. is a financial technology company with a market cap of CA$1.49 billion.

Operations: Propel Holdings Inc. generates revenue of $416.43 million by offering lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 36.9%

Propel Holdings shows potential as a growth company with substantial insider ownership. Despite recent shareholder dilution, its earnings grew by 77.7% over the past year and are expected to continue growing significantly, outpacing the Canadian market. The company recently announced a share repurchase program and increased its dividend by 7%. However, concerns remain about high non-cash earnings and interest payments not being well covered by earnings.

- Click to explore a detailed breakdown of our findings in Propel Holdings' earnings growth report.

- Our expertly prepared valuation report Propel Holdings implies its share price may be too high.

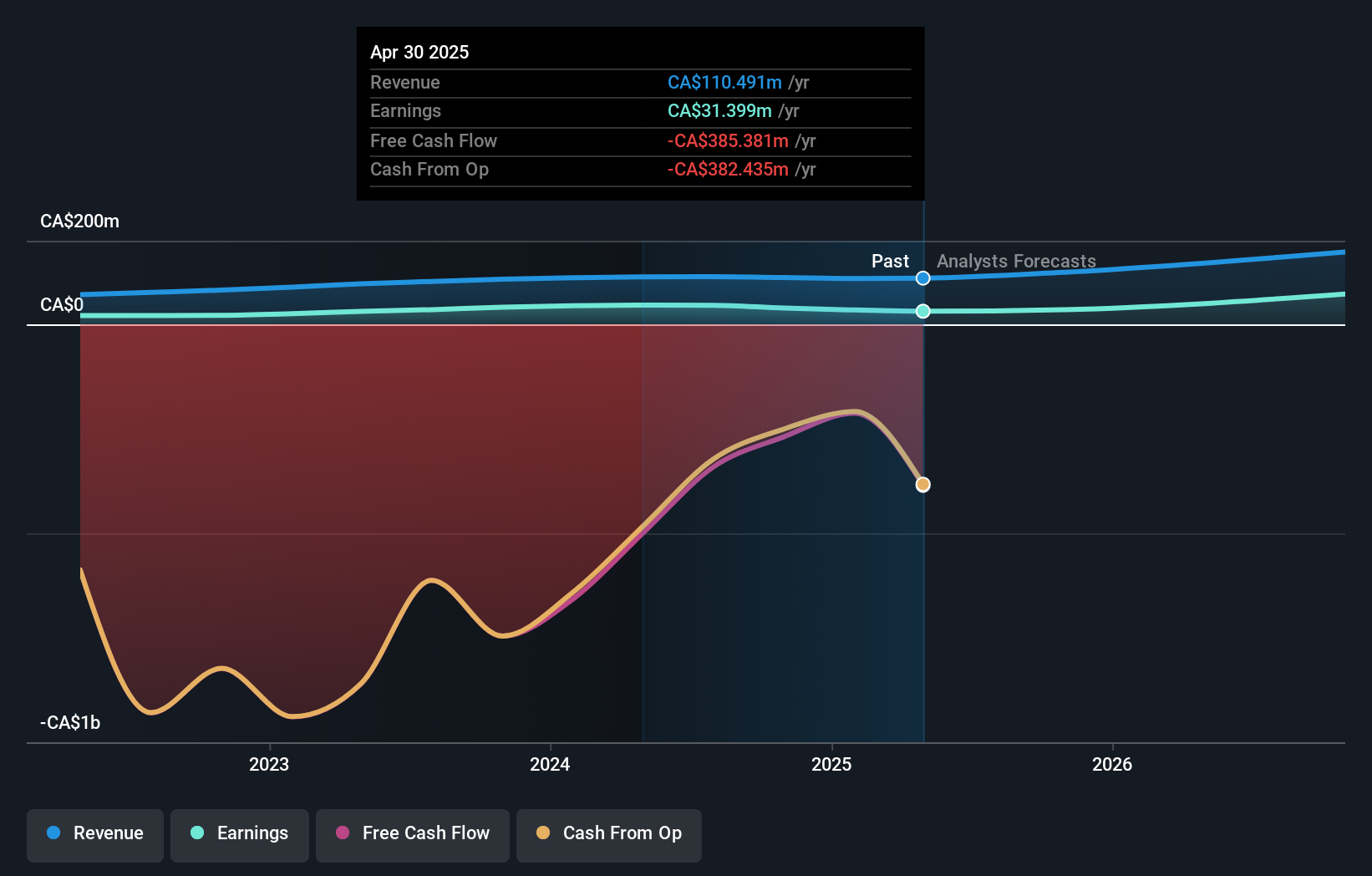

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market capitalization of CA$649.54 million.

Operations: The company's revenue segments include CA$105.16 million from Digital Banking and CA$10.75 million from DRTC, which encompasses cybersecurity services and banking and financial technology development.

Insider Ownership: 13.2%

VersaBank demonstrates growth potential with high insider ownership but faces challenges. Its earnings are forecast to grow significantly at 30.4% annually, surpassing the Canadian market's growth rate. Despite this, recent substantial insider selling raises concerns. Revenue is projected to increase by 22% per year, outpacing the market average of 7.1%. Recent filings for a $200 million shelf registration suggest plans for future capital raising or expansion efforts.

- Dive into the specifics of VersaBank here with our thorough growth forecast report.

- Our valuation report unveils the possibility VersaBank's shares may be trading at a premium.

Taking Advantage

- Reveal the 37 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

Flawless balance sheet with high growth potential.