Discovering TSX Penny Stocks: Hemisphere Energy And Two Others

Reviewed by Simply Wall St

As we look back on 2024, the Canadian market has been buoyed by strong economic growth and rising corporate profits, contributing to an impressive 18% gain for the TSX. In this context of robust performance, investors are increasingly exploring various avenues for potential returns. Penny stocks, often seen as a gateway to discovering smaller or newer companies with growth potential at lower price points, remain relevant in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$3.95 | CA$379.39M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$122.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$961.62M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$583.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$15.47M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.18 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.63 | CA$307.33M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hemisphere Energy Corporation is engaged in the acquisition, exploration, development, and production of petroleum and natural gas interests in Canada with a market cap of CA$178.48 million.

Operations: The company generates revenue of CA$78.57 million from its petroleum and natural gas interests.

Market Cap: CA$178.48M

Hemisphere Energy Corporation, with a market cap of CA$178.48 million, shows strong financial health and operational growth. The company reported increased revenue of CA$60.09 million for the first nine months of 2024, up from CA$49.05 million the previous year, alongside net income growth to CA$25.76 million. Despite no debt burden and a seasoned management team, Hemisphere's earnings are expected to decline by an average of 11.2% annually over the next three years. However, its current price-to-earnings ratio (6.1x) suggests it trades at good value compared to peers in the oil and gas industry.

- Unlock comprehensive insights into our analysis of Hemisphere Energy stock in this financial health report.

- Examine Hemisphere Energy's earnings growth report to understand how analysts expect it to perform.

Quorum Information Technologies (TSXV:QIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quorum Information Technologies Inc. is an information technology company that specializes in the automotive retail sector in Canada and the United States, with a market cap of CA$69.90 million.

Operations: The company's revenue is derived from three segments: Services and One-Time at CA$1.19 million, Software as a Service (SaaS) generating CA$28.67 million, and Business Development Centre (BDC) contributing CA$10.00 million.

Market Cap: CA$69.9M

Quorum Information Technologies Inc., with a market cap of CA$69.90 million, has shown steady financial performance despite challenges in the software industry. Recent earnings for Q3 2024 reveal sales of CA$9.93 million, slightly down from the previous year, yet net income improved to CA$0.79 million from a loss previously. The company maintains a satisfactory net debt to equity ratio of 12.5%, with its debt well covered by operating cash flow at 85%. However, long-term liabilities exceed short-term assets and interest coverage is limited at 2.5 times EBIT, indicating areas needing attention as it explores M&A opportunities in North America.

- Click here and access our complete financial health analysis report to understand the dynamics of Quorum Information Technologies.

- Explore Quorum Information Technologies' analyst forecasts in our growth report.

Thermal Energy International (TSXV:TMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thermal Energy International Inc. develops, engineers, and supplies pollution control products, heat recovery systems, and condensate return solutions across North America, Europe, and internationally with a market cap of CA$34.55 million.

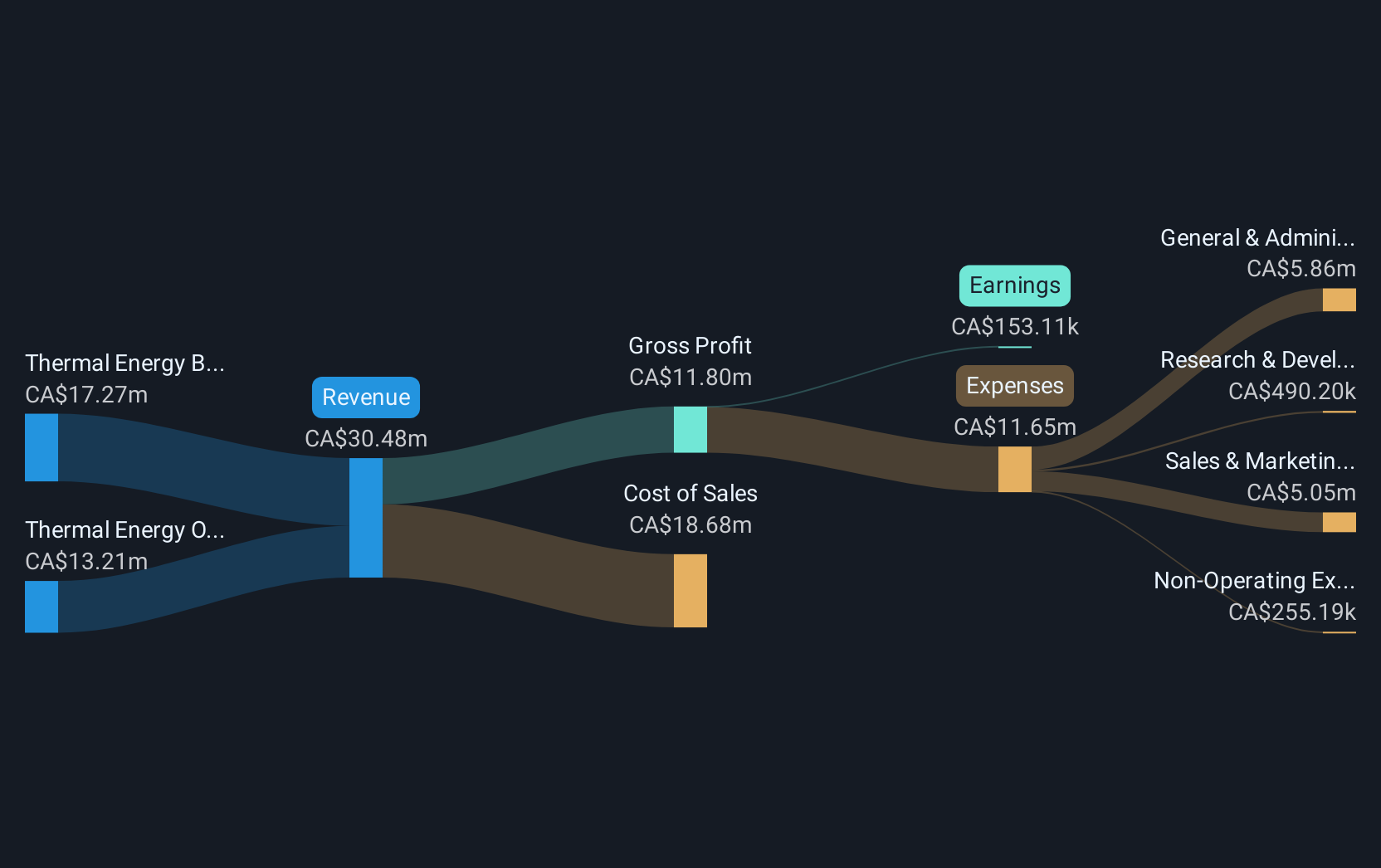

Operations: The company generates revenue from its operations in Ottawa, contributing CA$11.49 million, and Bristol, which accounts for CA$17.67 million.

Market Cap: CA$34.55M

Thermal Energy International Inc., with a market cap of CA$34.55 million, has demonstrated revenue growth, reporting CA$8.47 million in Q1 2025 sales, up from CA$5.18 million the previous year. The company's debt is well-managed with cash exceeding total liabilities and operating cash flow covering debt by 115%. Recent developments include securing a significant heat recovery project worth $1.5 million from a multinational confectionary company, highlighting its capability to attract new clients and contribute to carbon reduction goals. Despite positive earnings growth over five years, recent profit margins have declined compared to last year.

- Click to explore a detailed breakdown of our findings in Thermal Energy International's financial health report.

- Assess Thermal Energy International's future earnings estimates with our detailed growth reports.

Where To Now?

- Navigate through the entire inventory of 944 TSX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermal Energy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TMG

Thermal Energy International

Engages in the development, engineering, and supply of pollution control products, heat recovery systems, and condensate return solutions in North America, Europe, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives