- Canada

- /

- Metals and Mining

- /

- TSXV:NILI

Discover 3 Promising TSX Penny Stocks With At Least CA$10M Market Cap

Reviewed by Simply Wall St

As the Canadian market continues to navigate new policies and economic conditions, 2024 ended on a high note with the TSX gaining 18%, reflecting a strong year for investors across various sectors. In this context, penny stocks—though an older term—still represent smaller or less-established companies that can offer significant value when backed by strong financials and growth potential. By focusing on those with robust balance sheets, investors may uncover promising opportunities in these under-the-radar stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.00 | CA$379.39M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$122.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$961.62M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$583.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$15.47M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.45 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.65 | CA$307.33M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alithya Group (TSX:ALYA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alithya Group Inc. offers strategy and digital technology services across Canada, the United States, and Europe, with a market cap of CA$164.89 million.

Operations: The company generates CA$473.43 million in revenue from its Management Consulting Services segment.

Market Cap: CA$164.89M

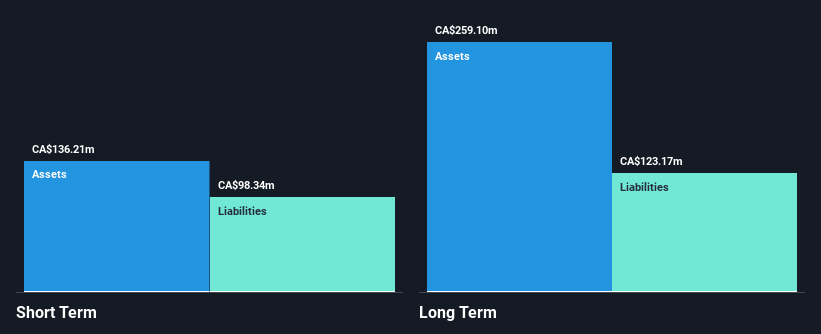

Alithya Group Inc. presents a mixed picture in the penny stock landscape. Despite being unprofitable, it has successfully reduced losses over the past five years and maintains a positive cash flow, ensuring a cash runway exceeding three years. Recent executive changes with the appointment of Nicolas Lavoie as CFO could bolster strategic growth through his experience in acquisitions and financial planning. The company trades at 80% below estimated fair value, offering potential upside relative to peers. However, shareholders have faced dilution recently, and its debt-to-equity ratio has increased significantly over five years, indicating financial leverage concerns.

- Click to explore a detailed breakdown of our findings in Alithya Group's financial health report.

- Examine Alithya Group's earnings growth report to understand how analysts expect it to perform.

Surge Battery Metals (TSXV:NILI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Surge Battery Metals Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in North America with a market cap of CA$61.88 million.

Operations: Surge Battery Metals Inc. currently does not report any revenue segments, as it is in the exploration stage of developing mineral properties in North America.

Market Cap: CA$61.88M

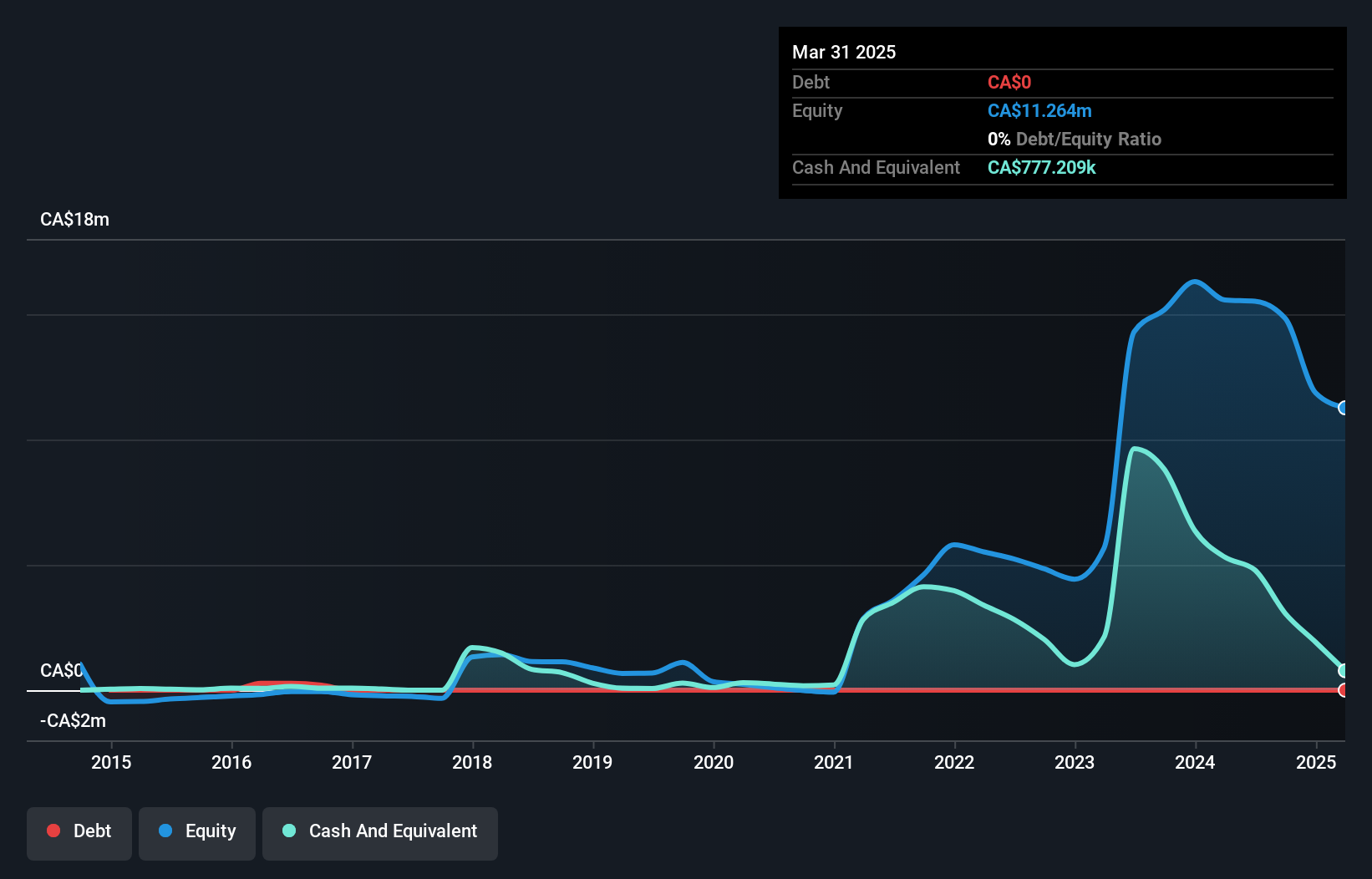

Surge Battery Metals Inc., a pre-revenue exploration stage company with a market cap of CA$61.88 million, is navigating the penny stock domain with strategic advancements in its Nevada North Lithium Project (NNLP). The recent entry of its Exploration Plan into the NEPA public comment phase marks progress toward expanding drilling operations, potentially enhancing mineral extraction insights. Despite being debt-free and having stable volatility, the company faces challenges such as limited cash runway and shareholder dilution over the past year. Continued test work on improving lithium grades presents opportunities for cost reduction in future operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Surge Battery Metals.

- Assess Surge Battery Metals' previous results with our detailed historical performance reports.

RIWI (TSXV:RIWI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RIWI Corp. is a trend-tracking and prediction technology firm operating in the United States, Canada, Europe, and internationally with a market cap of CA$12.60 million.

Operations: The company's revenue is primarily derived from the United States at $2.64 million, followed by Canada with $1.12 million, and Europe contributing $0.32 million.

Market Cap: CA$12.6M

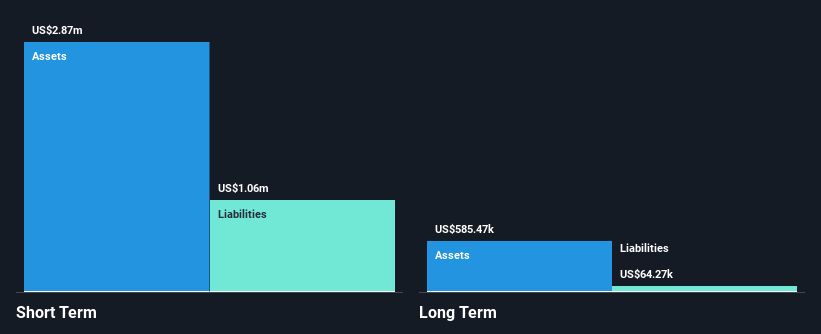

RIWI Corp., with a market cap of CA$12.60 million, operates in the data analytics space and has recently secured a significant contract worth CA$2.65 million over two years, indicating growing client trust. However, the company remains unprofitable with increasing losses over the past five years and reported a net loss of US$0.39 million for Q3 2024. Despite stable weekly volatility compared to most Canadian stocks and being debt-free, RIWI's share price has been highly volatile recently. The firm's seasoned board and sufficient cash runway exceeding three years provide some stability amidst financial challenges.

- Click here to discover the nuances of RIWI with our detailed analytical financial health report.

- Review our historical performance report to gain insights into RIWI's track record.

Key Takeaways

- Explore the 944 names from our TSX Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NILI

Surge Battery Metals

An exploration stage company, acquires, explores, and develops mineral properties in North America.

Moderate with adequate balance sheet.