- Canada

- /

- Paper and Forestry Products

- /

- TSX:ADN

Top TSX Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is poised with both opportunities and uncertainties, following a remarkable 18% gain in the TSX last year. In this environment of potential policy shifts and economic growth, dividend stocks stand out as attractive options for investors seeking stability and income amidst evolving market dynamics.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.01% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.57% | ★★★★★★ |

| Olympia Financial Group (TSX:OLY) | 6.64% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.06% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.11% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.54% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.22% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.92% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.98% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Acadian Timber Corp. is a supplier of primary forest products operating in Eastern Canada and the Northeastern United States, with a market cap of CA$313.74 million.

Operations: Acadian Timber Corp.'s revenue is primarily derived from its New Brunswick Timberlands segment at CA$76.88 million and Maine Timberlands segment at CA$18.31 million.

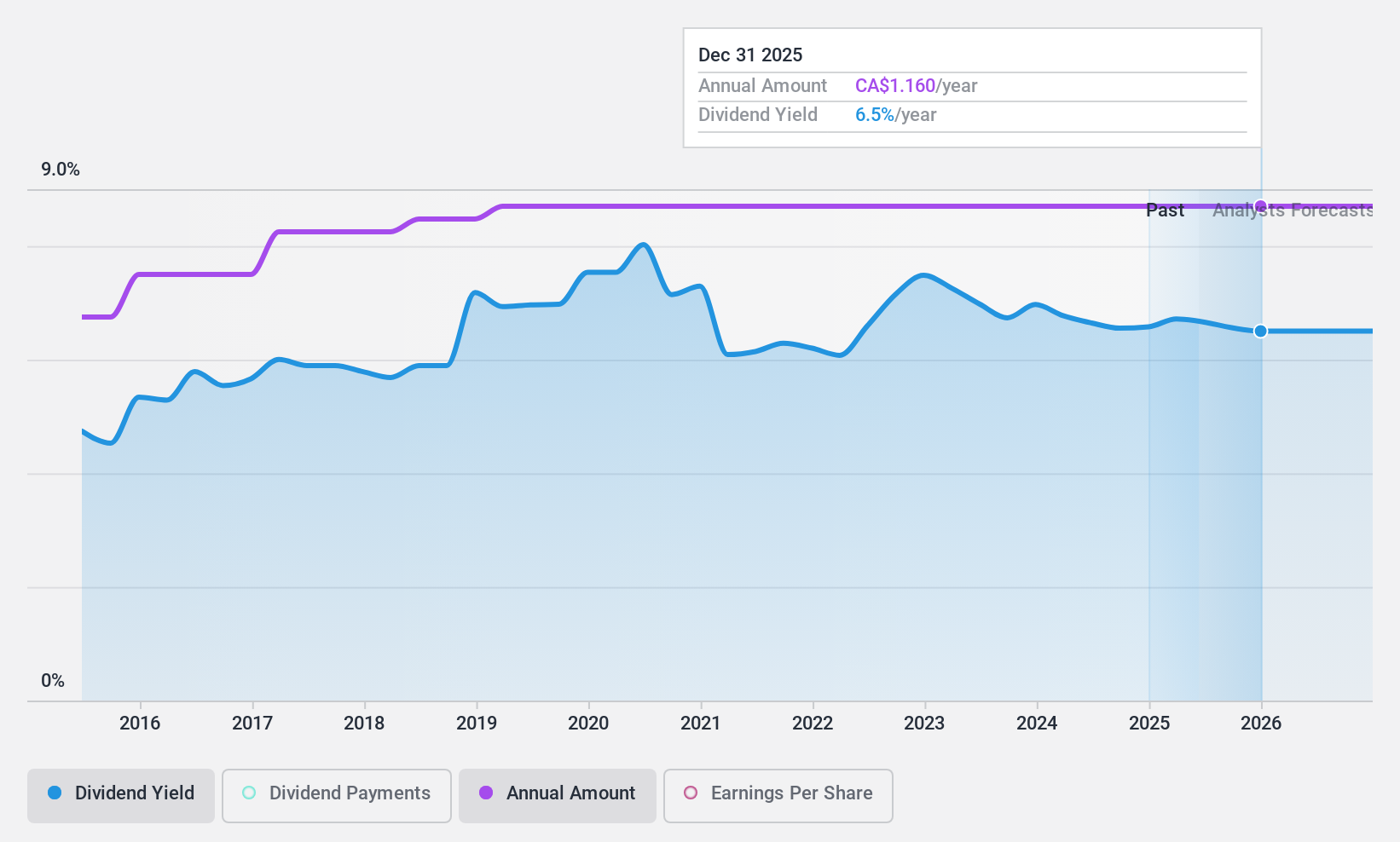

Dividend Yield: 6.6%

Acadian Timber offers a high and reliable dividend yield of 6.57%, ranking in the top 25% among Canadian dividend payers. The company has maintained stable dividends over the past decade, with payments covered by both earnings (72.8% payout ratio) and cash flows (84.5% cash payout ratio). Despite a recent decline in profit margins to 23.2%, Acadian continues to affirm its $0.29 per share dividend, demonstrating commitment to shareholder returns amidst fluctuating earnings performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Acadian Timber.

- Our expertly prepared valuation report Acadian Timber implies its share price may be too high.

Leon's Furniture (TSX:LNF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, with a market cap of CA$1.80 billion, operates as a retailer of home furnishings, mattresses, appliances, and electronics across Canada through its subsidiaries.

Operations: The company's revenue primarily comes from the sale of home furnishings, mattresses, appliances, and electronics, totaling CA$2.52 billion.

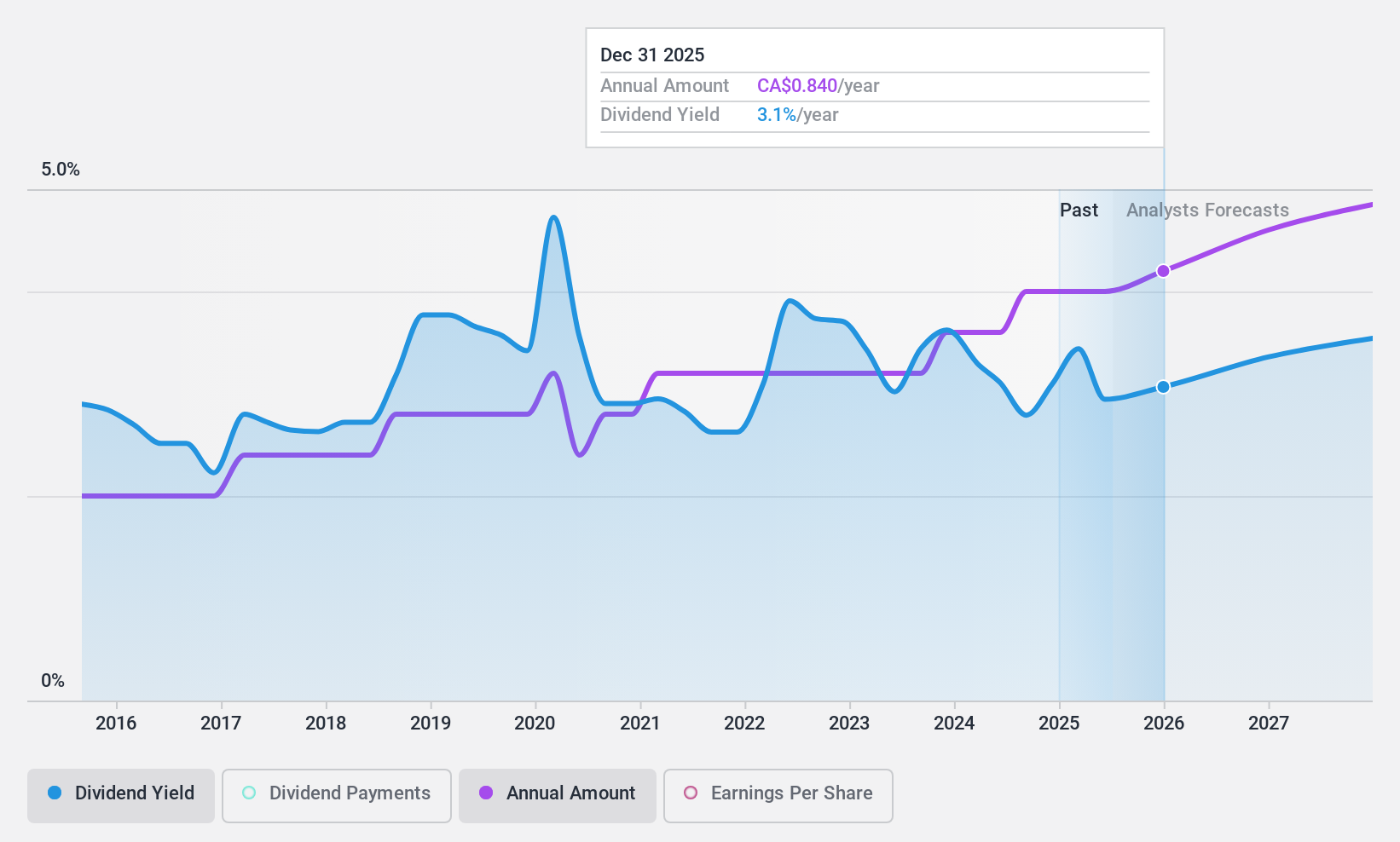

Dividend Yield: 3.1%

Leon's Furniture's dividend yield of 3.07% is modest compared to top Canadian payers, but its dividends are well covered by earnings (38.2% payout ratio) and cash flows (23.7% cash payout ratio). Despite an unstable dividend history over the past decade, recent affirmations indicate continued payouts with a declared $0.20 CAD per share for January 2025. The stock trades at a significant discount to estimated fair value, suggesting potential value opportunities despite recent earnings declines.

- Navigate through the intricacies of Leon's Furniture with our comprehensive dividend report here.

- Our expertly prepared valuation report Leon's Furniture implies its share price may be lower than expected.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$260.32 million, operates in Canada as a non-deposit taking trust company through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Health (CA$10.26 million), Corporate (CA$0.11 million), Exempt Edge (EE) (CA$1.44 million), Investment Account Services (IAS) (CA$79.36 million), Currency and Global Payments (CGP) (CA$7.15 million), and Corporate and Shareholder Services (CSS) (CA$4.04 million).

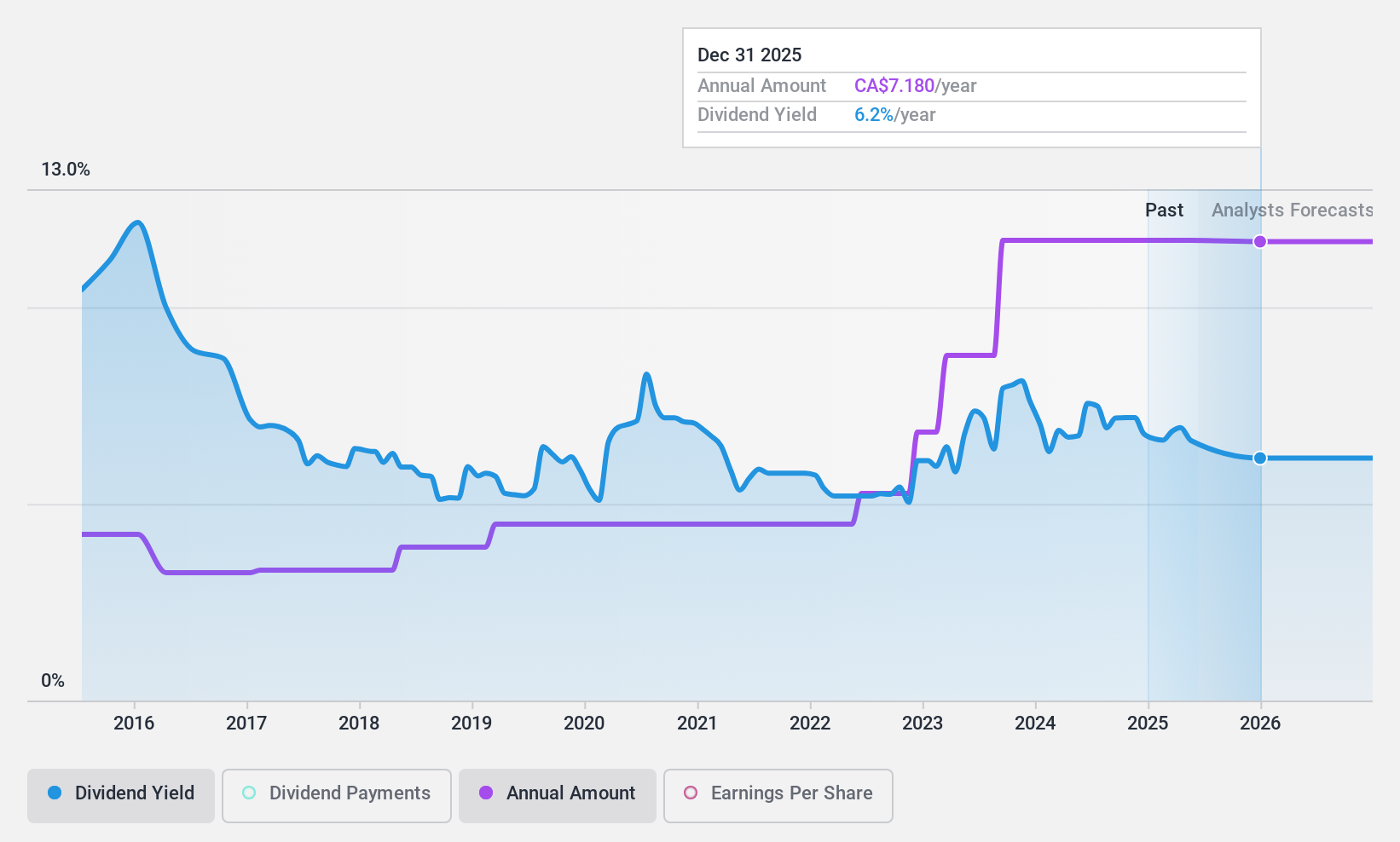

Dividend Yield: 6.6%

Olympia Financial Group's dividend yield of 6.64% ranks in the top 25% of Canadian payers, with dividends well covered by earnings (70.9% payout ratio) and cash flows (74.9%). Despite a volatile dividend history over the past decade, recent affirmations confirm consistent monthly payouts of $0.60 CAD per share through January 2025. However, significant insider selling and forecasted earnings decline pose potential concerns for investors seeking stable income growth.

- Dive into the specifics of Olympia Financial Group here with our thorough dividend report.

- Our valuation report here indicates Olympia Financial Group may be undervalued.

Turning Ideas Into Actions

- Navigate through the entire inventory of 28 Top TSX Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ADN

Acadian Timber

Supplies primary forest products in Eastern Canada and the Northeastern United States.

6 star dividend payer with adequate balance sheet.