- Canada

- /

- Metals and Mining

- /

- TSXV:TSG

Discover 3 TSX Penny Stocks With Market Caps Over CA$30M

Reviewed by Simply Wall St

As 2025 begins, the Canadian market stands on a solid foundation following a remarkable year in 2024, with the TSX posting an impressive 18% gain. In this climate of mixed headwinds and tailwinds, investors are keen to identify stocks that combine potential growth with financial stability. Penny stocks, despite their somewhat outdated name, continue to capture interest by offering opportunities in smaller or less-established companies; those with strong financials can present compelling prospects for investors seeking value beyond traditional large-cap investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.00 | CA$379.39M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$122.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$961.62M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$583.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$15.47M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.45 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.65 | CA$307.33M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lara Exploration Ltd. is involved in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile with a market capitalization of CA$69.21 million.

Operations: There are no reported revenue segments for Lara Exploration Ltd.

Market Cap: CA$69.21M

Lara Exploration Ltd., with a market cap of CA$69.21 million, is pre-revenue and currently unprofitable, having increased losses by 6.5% annually over the past five years. Despite this, recent earnings reports show a shift to net income for the third quarter and nine months ending September 2024. The company remains debt-free but faces significant dilution with shares outstanding rising by 7.9% last year. Lara's short-term assets cover its liabilities, yet it has less than a year of cash runway if current cash flow trends persist. Recent developments include an initial resource estimate for its Planalto Copper-Gold Project in Brazil.

- Click here and access our complete financial health analysis report to understand the dynamics of Lara Exploration.

- Learn about Lara Exploration's historical performance here.

Silver Tiger Metals (TSXV:SLVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver Tiger Metals Inc. is involved in the exploration and evaluation of mineral properties in Mexico, with a market cap of CA$92.80 million.

Operations: Silver Tiger Metals Inc. currently does not report any specific revenue segments.

Market Cap: CA$92.8M

Silver Tiger Metals Inc., with a market cap of CA$92.80 million, is pre-revenue and unprofitable, experiencing increased losses over the past five years. The company has no debt but faces shareholder dilution, with shares outstanding growing by 8.2% last year. Short-term assets cover liabilities; however, it has less than a year of cash runway if cash flow trends continue. Recent developments include a Preliminary Feasibility Study for its El Tigre Project in Mexico, highlighting an after-tax NPV of $222 million and plans for further economic assessments in 2025 to explore substantial exploration potential at the site.

- Take a closer look at Silver Tiger Metals' potential here in our financial health report.

- Assess Silver Tiger Metals' future earnings estimates with our detailed growth reports.

TriStar Gold (TSXV:TSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TriStar Gold, Inc. is involved in the acquisition, exploration, and development of precious metal prospects in the Americas with a market cap of CA$37.79 million.

Operations: TriStar Gold, Inc. currently does not report any revenue segments.

Market Cap: CA$37.79M

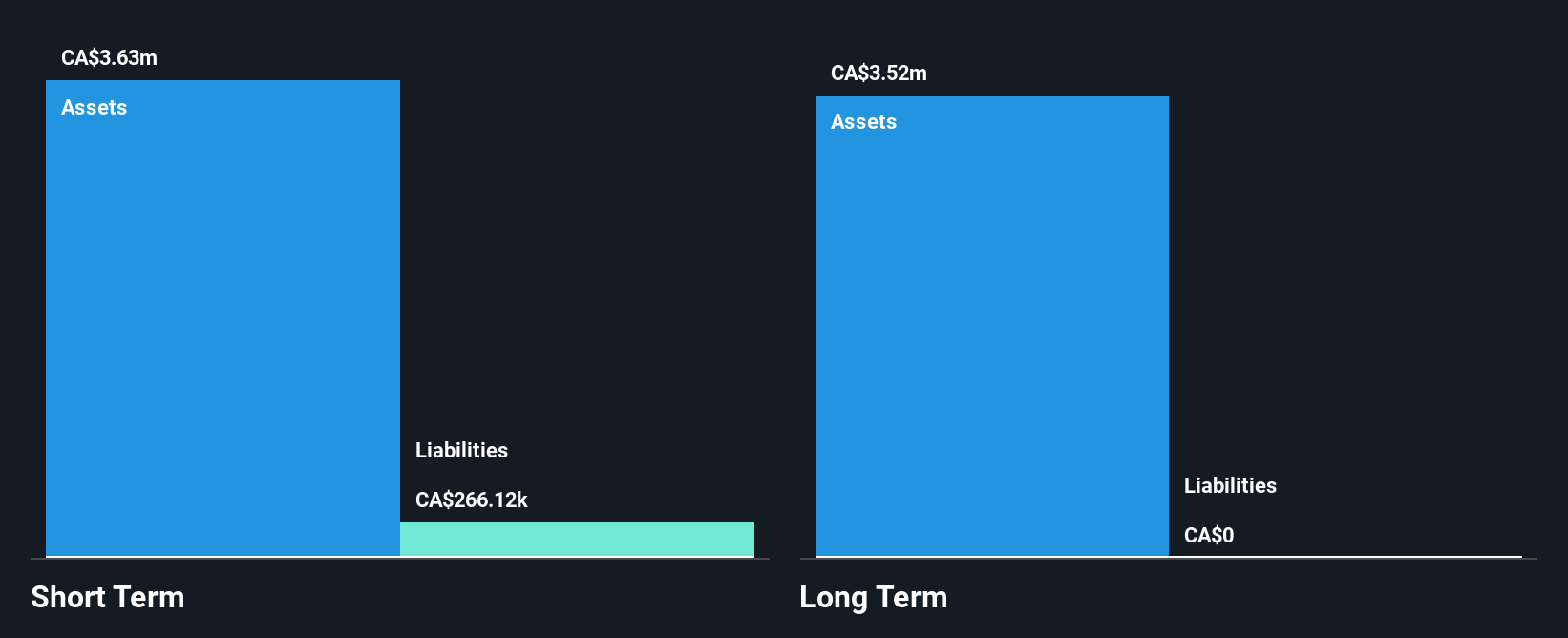

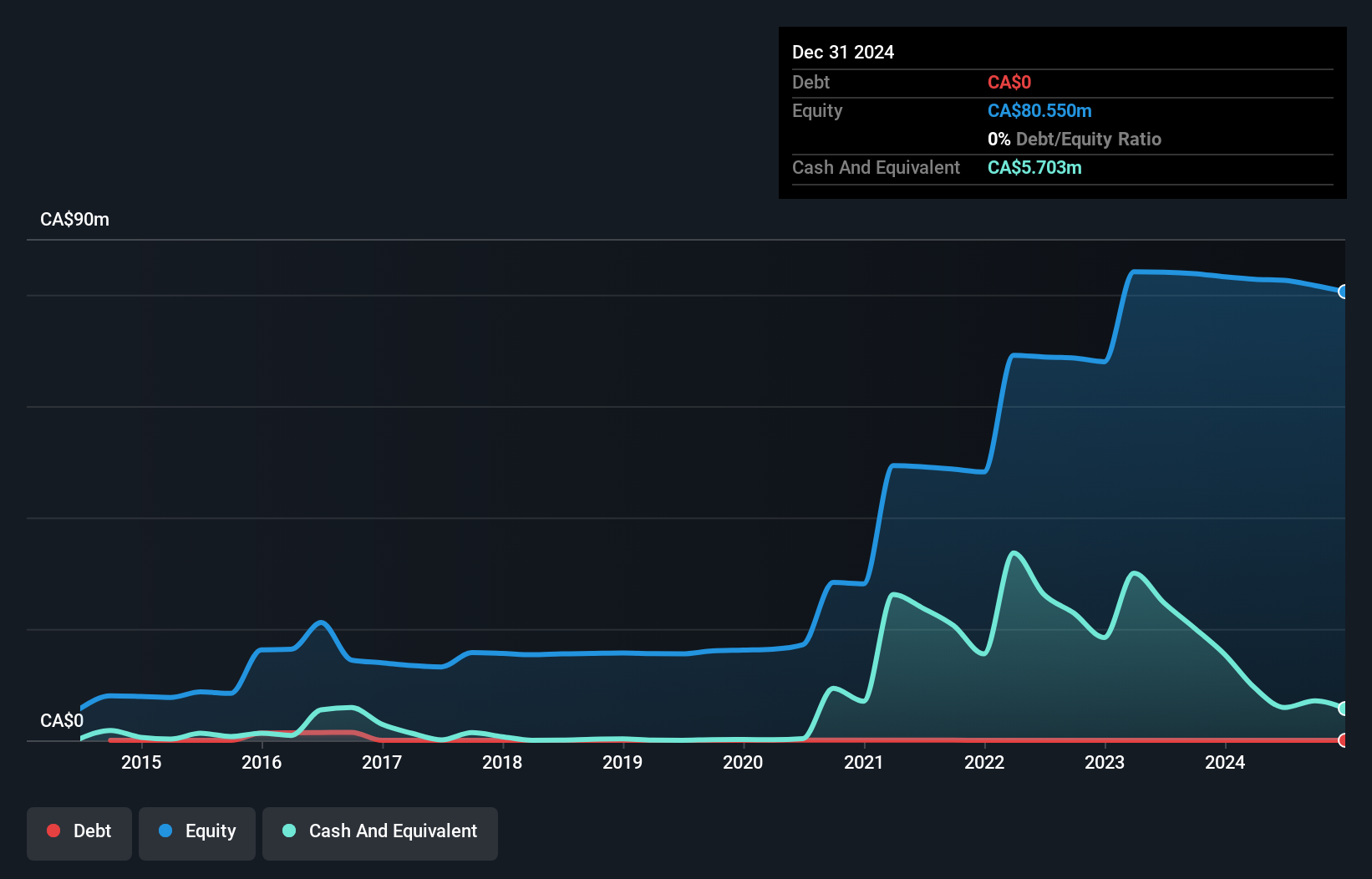

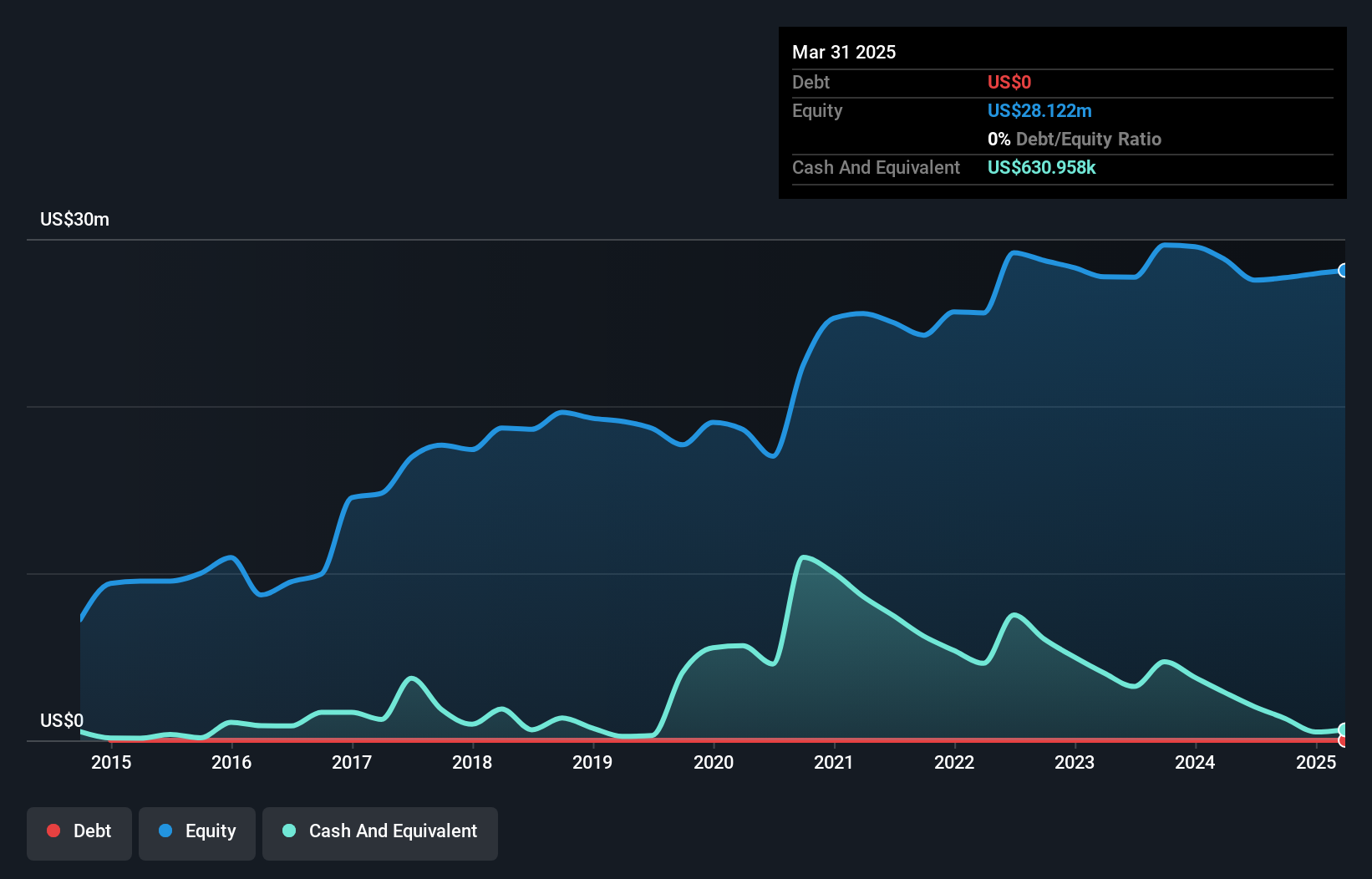

TriStar Gold, Inc., with a market cap of CA$37.79 million, is pre-revenue and unprofitable but maintains a positive cash flow, providing over three years of runway. The company has no debt and its short-term assets exceed both short- and long-term liabilities. Despite stable weekly volatility compared to other Canadian stocks, the share price remains highly volatile in the short term. Recent executive changes include Jessica Van Den Akker as interim CEO during Nick Appleyard's medical leave. The board is experienced with an average tenure of 5.2 years, supporting strategic stability amid ongoing management transitions.

- Click to explore a detailed breakdown of our findings in TriStar Gold's financial health report.

- Review our historical performance report to gain insights into TriStar Gold's track record.

Turning Ideas Into Actions

- Click this link to deep-dive into the 944 companies within our TSX Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriStar Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TSG

TriStar Gold

Engages in the acquisition, exploration, and development of precious metal prospects in the Americas.

Flawless balance sheet low.

Market Insights

Community Narratives