Shareholders May Be A Little Conservative With Tessenderlo Group NV's (EBR:TESB) CEO Compensation For Now

Under the guidance of CEO Luc Tack, Tessenderlo Group NV (EBR:TESB) has performed reasonably well recently. As shareholders go into the upcoming AGM on 11 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Tessenderlo Group

How Does Total Compensation For Luc Tack Compare With Other Companies In The Industry?

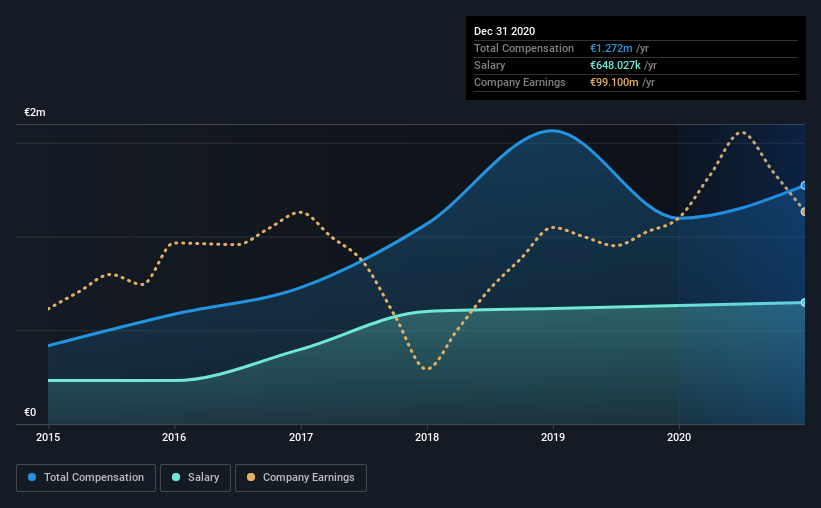

According to our data, Tessenderlo Group NV has a market capitalization of €1.5b, and paid its CEO total annual compensation worth €1.3m over the year to December 2020. That's a notable increase of 16% on last year. In particular, the salary of €648.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from €831m to €2.7b, the reported median CEO total compensation was €1.3m. From this we gather that Luc Tack is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €648k | €632k | 51% |

| Other | €624k | €465k | 49% |

| Total Compensation | €1.3m | €1.1m | 100% |

Talking in terms of the broader industry, salary and other compensation roughly make up 50% each, of the total compensation. Tessenderlo Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Tessenderlo Group NV's Growth Numbers

Tessenderlo Group NV has seen its earnings per share (EPS) increase by 57% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Tessenderlo Group NV Been A Good Investment?

With a total shareholder return of 5.0% over three years, Tessenderlo Group NV has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Tessenderlo Group that you should be aware of before investing.

Important note: Tessenderlo Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Tessenderlo Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tessenderlo Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:TESB

Tessenderlo Group

Engages in the agriculture, valorizing bio-residuals, machinery, mechanical engineering, electronics, energy, and industrial solution businesses worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026