- Australia

- /

- Metals and Mining

- /

- ASX:WGX

How Restarting Great Fingall’s High-Grade Mine At Westgold Resources (ASX:WGX) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Westgold Resources has restarted high-grade gold mining at the historic Great Fingall mine in Western Australia, delivering first production from this reef in more than a century and moving the asset from development into production.

- This restart is expected to make Great Fingall a cornerstone source of high-grade ore for Westgold’s Cue processing hub, supporting higher-quality feed alongside existing operations.

- We’ll now examine how bringing Great Fingall’s high-grade ore into production reshapes Westgold’s investment narrative and future production profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Westgold Resources Investment Narrative Recap

To own Westgold, you need to believe it can turn a portfolio of mature and historic WA gold assets into a larger, higher grade, more cash generative business while keeping costs in check. The Great Fingall restart directly supports that story by adding high grade feed to the Cue hub, but it does not remove the near term risk that all in sustaining costs stay elevated and margins remain tight if operating improvements and grade delivery elsewhere fall short.

Against that backdrop, Westgold’s FY2027 and FY2028 guidance, with planned production of about 420 koz and 470 koz respectively at AISC around A$2,450 to A$2,500 per ounce, is the key reference point for how much Great Fingall can contribute to a higher quality production base. This guidance gives investors a concrete yardstick to watch as Great Fingall ramps toward its targeted steady state volumes and as the wider group works to defend margins in the face of rising input costs.

Yet while Great Fingall helps, investors should still be aware of the pressure that persistent cost inflation in labor and energy could place on...

Read the full narrative on Westgold Resources (it's free!)

Westgold Resources' narrative projects A$2.1 billion revenue and A$618.3 million earnings by 2028. This requires 15.0% yearly revenue growth and about A$583.5 million earnings increase from A$34.8 million today.

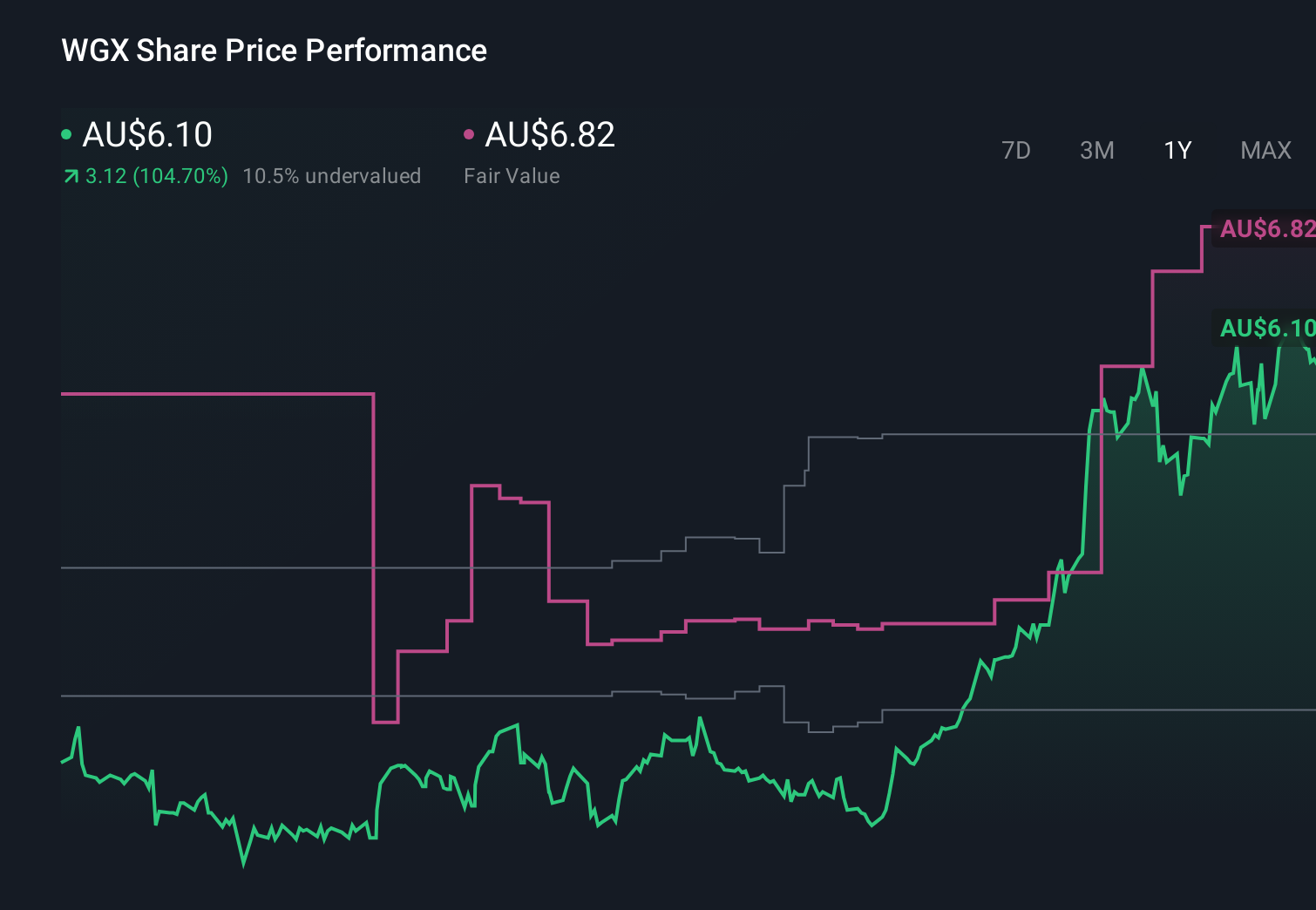

Uncover how Westgold Resources' forecasts yield a A$6.82 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly A$3.60 to A$25.64, showing how far apart individual views can be. Against that wide range, the success or otherwise of Westgold’s cost control and grade delivery at operations like Great Fingall could be a major swing factor in how the company ultimately performs, so it is worth weighing several of these perspectives before forming your own view.

Explore 7 other fair value estimates on Westgold Resources - why the stock might be worth 39% less than the current price!

Build Your Own Westgold Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westgold Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Westgold Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westgold Resources' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGX

Westgold Resources

Engages in the exploration, development, and operation of gold mines in Western Australia.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026