- Australia

- /

- Metals and Mining

- /

- ASX:MIN

ASX Growth Stocks With High Insider Confidence For December 2024

Reviewed by Simply Wall St

As the ASX200 hovers at 8,267 points with a slight decline of 0.35%, investors are closely watching the market dynamics as Chinese stimulus measures have yet to boost sentiment significantly. In this context, identifying growth companies with high insider ownership can be particularly appealing, as such stocks often signal strong internal confidence and potential resilience amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 72.7% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| IperionX (ASX:IPX) | 17.5% | 67.8% |

| Pointerra (ASX:3DP) | 20.8% | 126.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in olive farming and the production and marketing of olive oil across Australia, the United States, and internationally, with a market cap of A$836.04 million.

Operations: The company's revenue is primarily derived from its Australian operations at A$167.53 million and its USA operations at A$69.38 million, with a smaller contribution from Boundary Bend Wellness amounting to A$0.94 million.

Insider Ownership: 18.4%

Earnings Growth Forecast: 22.2% p.a.

Cobram Estate Olives shows potential as a growth company with high insider ownership, despite some challenges. The company's earnings are forecast to grow significantly at 22.2% annually, outpacing the Australian market's 12.5%. However, its revenue growth is expected to be moderate at 13.8% per year and it holds a high level of debt. Recent executive changes include Anabel Godino's appointment as Group CFO, which may impact strategic direction moving forward.

- Take a closer look at Cobram Estate Olives' potential here in our earnings growth report.

- The analysis detailed in our Cobram Estate Olives valuation report hints at an inflated share price compared to its estimated value.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited operates as a mining services company in Australia, Asia, and internationally with a market cap of A$6.98 billion.

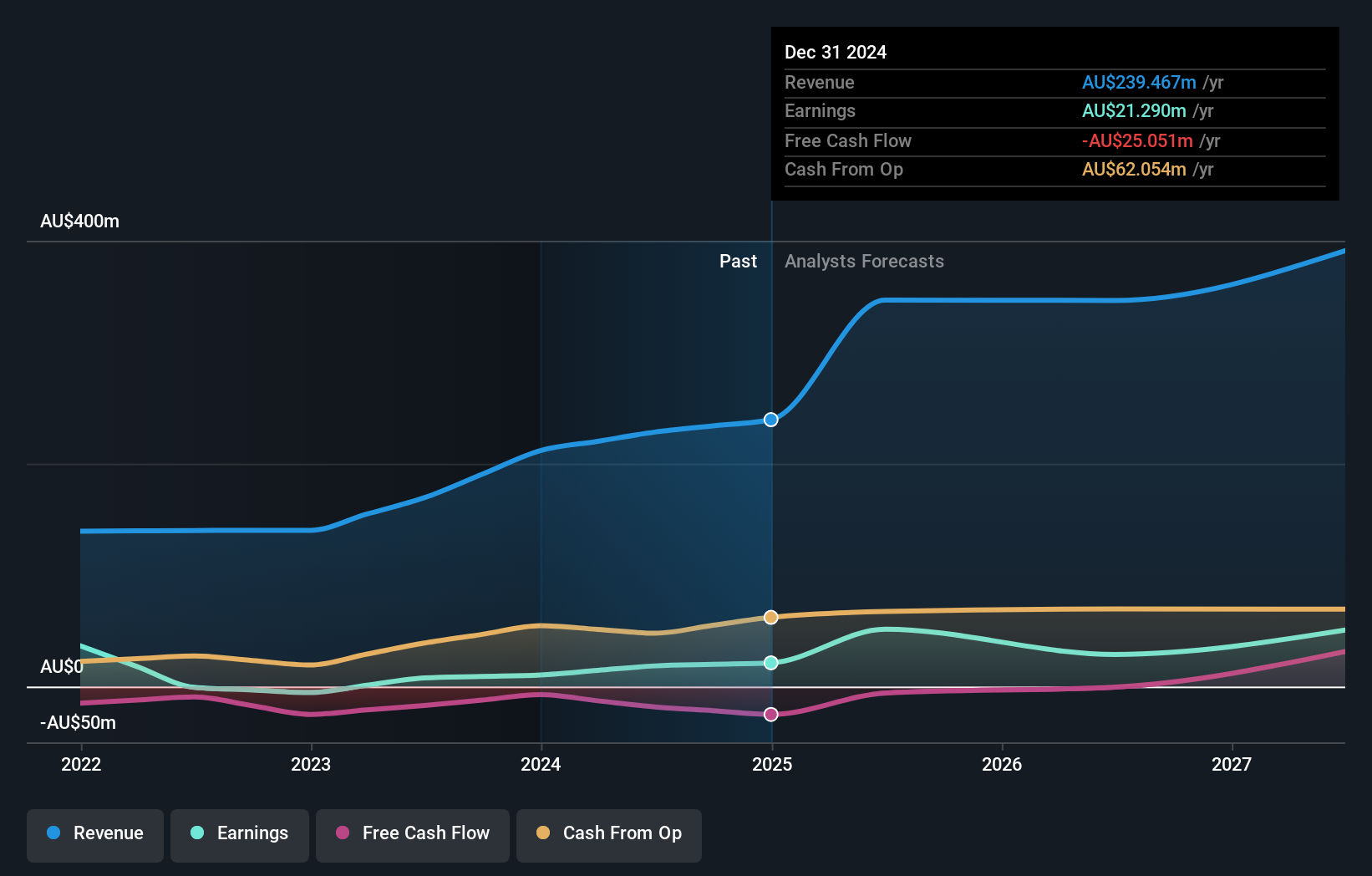

Operations: The company's revenue segments include A$16 million from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, and A$3.38 billion from Mining Services, as well as A$19 million from Other Commodities.

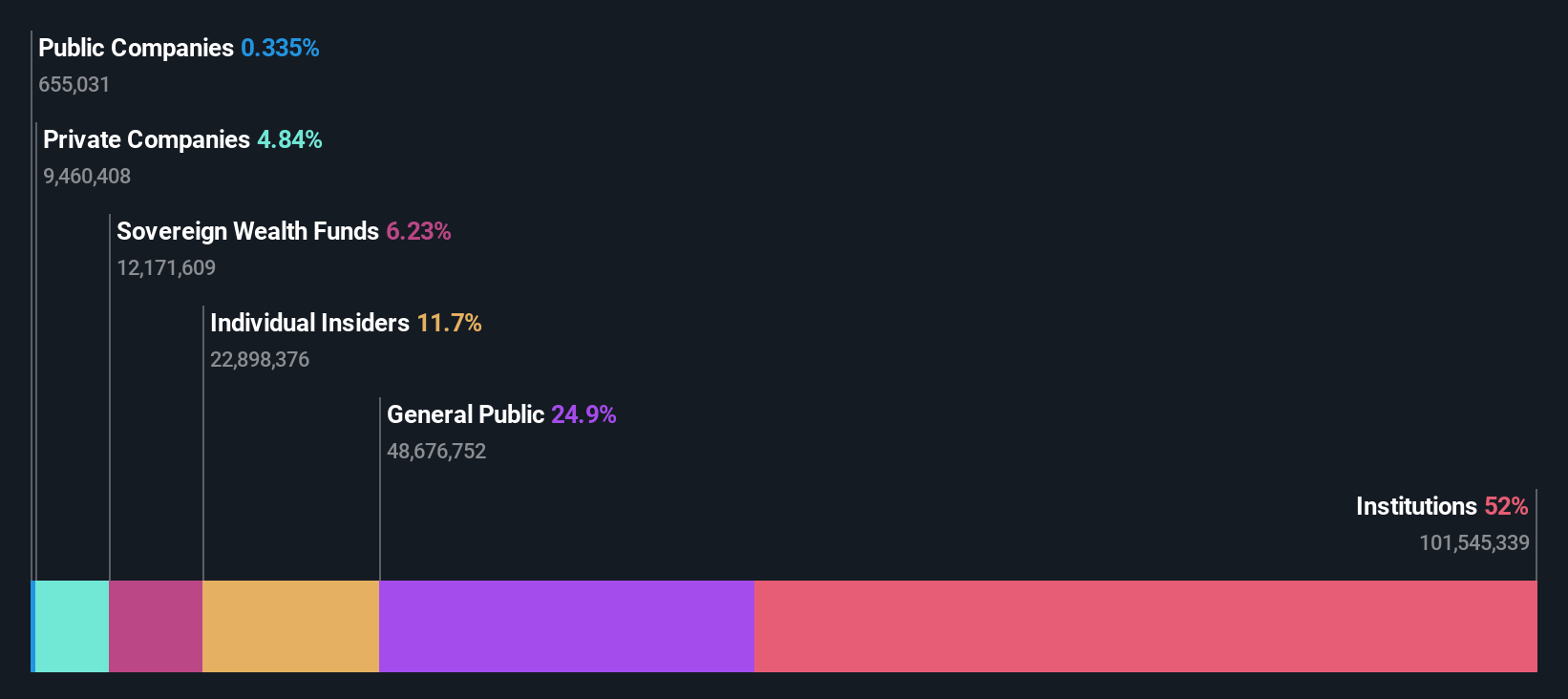

Insider Ownership: 11.7%

Earnings Growth Forecast: 40.6% p.a.

Mineral Resources is positioned for growth with significant insider ownership, though it faces financial constraints due to high net debt of A$4.4 billion and limited borrowing capacity. The company is exploring asset sales, including its Perth Basin holdings, to bolster its balance sheet and fund projects like the Onslow iron ore project. Revenue is expected to grow at 6.4% annually, outpacing the Australian market's average but slower than ideal for rapid expansion. Recent board changes may influence future strategies.

- Dive into the specifics of Mineral Resources here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Mineral Resources shares in the market.

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer of furniture, homewares, and home improvement products in Australia with a market cap of A$1.57 billion.

Operations: The company's revenue is primarily derived from the sale of furniture, homewares, and home improvement products, totaling A$497.84 million.

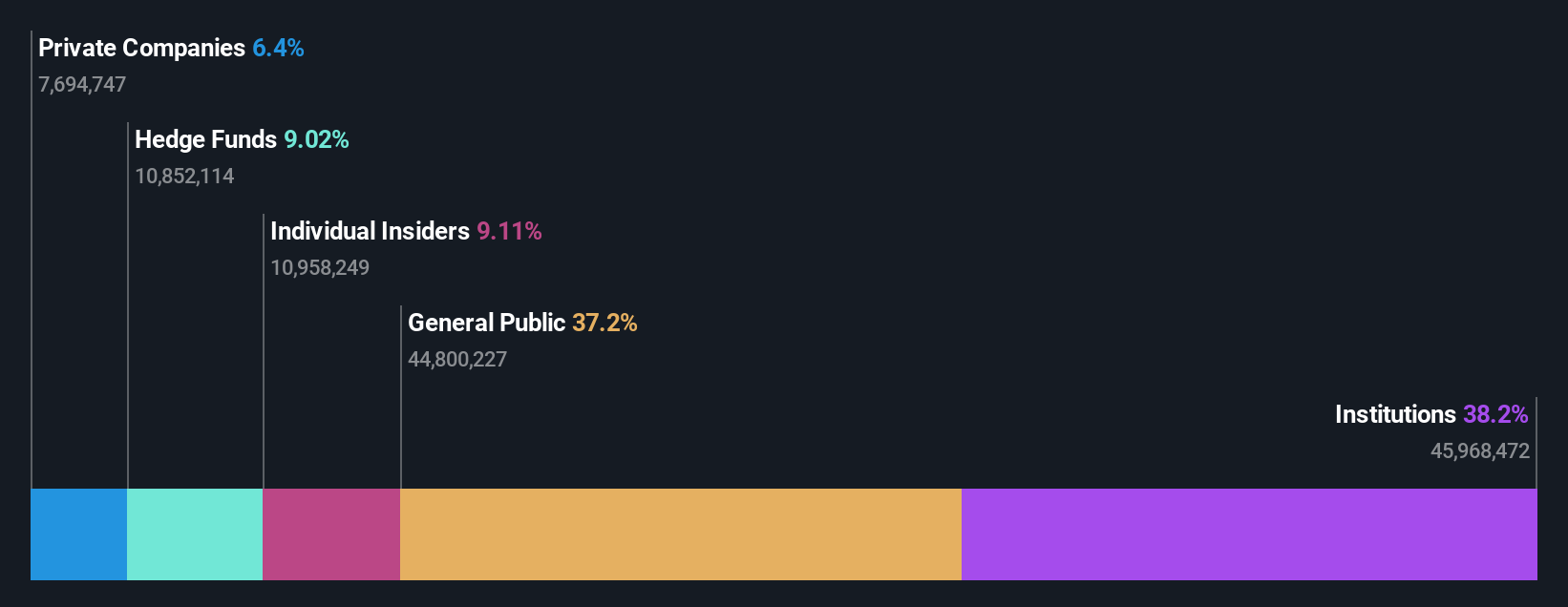

Insider Ownership: 13.1%

Earnings Growth Forecast: 40.2% p.a.

Temple & Webster Group is poised for growth with strong insider ownership and no substantial insider selling in recent months. The company anticipates revenue growth of 15.8% annually, surpassing the Australian market average, while earnings are expected to grow significantly at 40.2% per year. Despite a decline in profit margins from last year, the stock trades slightly below its estimated fair value. Upcoming Q1 2025 results may provide further insights into performance trends.

- Click to explore a detailed breakdown of our findings in Temple & Webster Group's earnings growth report.

- According our valuation report, there's an indication that Temple & Webster Group's share price might be on the expensive side.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 93 Fast Growing ASX Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

Reasonable growth potential low.